During hours of market open, the Gap and Go strategy is one of the most effective day trade techniques out there.

When done correctly, you may even conclude your trading day in no more than half an hour in the market.

Today, we will show you how to efficiently identify and work your way around the Gap and Go strategy like other successful day traders.

Gap And Go Strategy: Here We Go!

Advantages of Gap and Go strategy

When you look at the advantages of the Gap and Go strategy, it is clear why people prefer this over previous day trading techniques to handle their stocks in the financial market.

Since you will have access to pre-made scans, it helps in the effortless identification of the best market open trading setups. As a result, you should have profitable returns.

Other than that, you can also opt for the standard scans with a basic brokerage account. These will also be quite beneficial for your trading day in the stock market.

Considering all the factors, it is clear that the Gap and Go strategy holds quite the potential of tackling price movement. And more importantly, it should result in positive returns in the market opens.

Disadvantages of Gap and Go Strategy

Like every other trading strategy out there, the Gap and Go strategy also comes with its drawbacks.

Since the open market can have huge stock gaps, it could result in high volatility price action. Consequently, there will be uncertainty while trading stocks.

As there is a possibility of adverse effects on the price movement, you will manually need to find out the cause of the stock gaps.

Nevertheless, you may take this with a grain of salt because every trader out there in the stocks market prefers different market open trading strategies.

And understandably so, some of you will find that the Gap and Go strategy works the best for you.

What is the concept behind the Gap and Go trading strategy?

The disparity between the previous day trading market’s current share price and today’s starting price is known as an overnight gap.

The current trading day’s pre-market high stocks price fluctuation is part of the most common scan rationale.

However, it does not include the last day’s after-market stock price movements.

Being early is advantageous with the strategy of Gap and Go since it ensures that you have thorough preparation when the market is open. The secret to winning here is flawless preparedness.

It’s critical to keep an eye on the price fluctuation on the official market open.

In the next section, we will explain everything to you in detail.

CLICK HERE TO READ MORE ABOUT GAP AND GO STRATEGY

Identification and trade of Gap and Go through Trade-Ideas.

How To Set up the Gap and Go Strategy Pre-market Scanners?

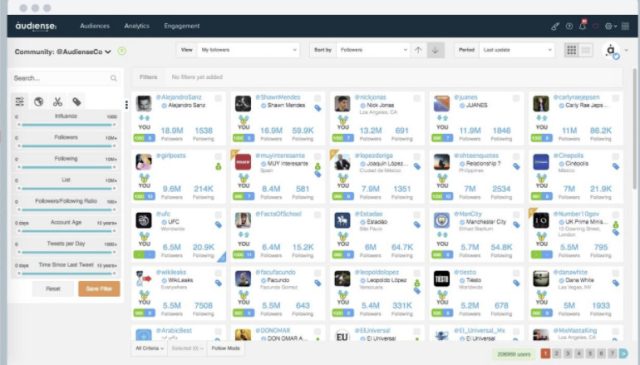

Before anything else, make sure you have a subscription with Trade Ideas. It is necessary because this service helps in identifying the price movement in the market open.

Since Trade Ideas has many promotional codes available, you should go for the paid version.

Furthermore, this will be considerably beneficial for dealing with the stock markets in the long run as you can quickly identify the Gap and Go strategy.

Thanks to the app’s technical analysis, you will effortlessly spot a beneficial trading setup that could result in positive market returns.

To set up the price pattern scanner, open the pro version of Trade Ideas and log in with your email account.

Afterward, go to the “Trade The Gap” channel and customize the column settings according to your needs. Feel free to add as many columns as you want.

However, keep in mind that the most important ones out of these are Today’s Trading Volume, Price, Gap $, and Gap percentage.

After setting up the Gap and Go scanner, Trade-Ideas displays a graph with the price movement and gaps.

Trade Ideas’ free version

If you feel like paying up for Trade Ideas Pro is too much, you can join their free trading room that is active between Monday and Friday.

After subscribing for informational purposes, it will provide you with pre-market intelligence to get ahead of the market.

Turning the tables on the trade market

As we have already mentioned earlier, Trade-Ideas will make your trading days so much more effortless.

You may customize your Gap and Go strategy scanner as you like, keep track of price movement, and filter the scan tables whenever you want.

As a result, you will become aware of the patterns of pre-market volume and turn the tables on the other markets.

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

Importance of Gap and Go method

Many of the larger stock exchange firms are already active for stock trading within pre-market times. The trading volume is often low at this period.

However, there are certain outliers, such as the initial pre-market hours following an earnings report.

Engaging at the market open or afterward, but not before the market open, is crucial when trading the strategy of the Gap and Go strategy.

The time spent during the pre-market hours is for the sole purpose of keeping an eye on the price movement.

What is the Reason Behind This?

The difference in price between that of the initial trading period and the last second of the preceding trading day inside the regular trading period defines the gap.

While looking at the pre-market, there is usually a significant disparity. But after the opening of the markets, the gap disappears.

It makes no difference what the pre-market volume is throughout the pre-market trading hours. However, during the market open, things start to move much quicker.

Due to this reason, a top-notch stocks market scanner, such as Trade Ideas, is essential. Manually monitoring innumerable stocks each day isn’t only challenging but is also nearly impossible to do.

What type of strategy is Gap and Go?

If there is a huge gap in the market, we should always aim for a lengthier trade, which includes the purchase of the stocks.

But if there is a minimum gap in the markets, we will always opt for a relatively shorter trade, which means that it would be advisable to sell stocks that you don’t even have at the current time.

Having said that about the gaps and their trade strategies, we expect the stock’s overnight surge to continue.

So it is safe to say that Gap and Go is a continuation approach and not the other way around.

CLICK HERE TO READ MORE ABOUT GAP AND GO STRATEGY

Significance of stock gaps’ fluctuations while the market opens

News about earnings releases and business news is the most typical cause of a gap on particular shares, but broad market news can affect the whole trade.

While searching for a “Gap and Go” trade strategy with a gap-direction continuing surge, you must first understand why the gap exists. Moreover, keep your hands away from buying and selling orders if there is solely broad market information or an unclear strategy.

To determine whether the news has sufficient strength to sustain the trade price movement, you must first understand the strategy of the Gap and Go method. Always keep in mind that it’s all really about supply and demand.

And before trade prices shift directions, you must try and avoid being the last one in line.

Also, keep in mind that news drives mass movement, not the technological installations themselves. The day traders that are unaware of this only trade a dull breakout or collapse.

However, if there is no information to back it up, the increase will be short-lived, or the shares may continue sideways.

The crucial aspect is that trading price movements should have backing from reliable news. With influential internet financial news sources, finding trade information is straightforward.

The majority of other news sources provide delayed content, which is useless for trading in real-time. The news always precedes the Gap & Go price change, not the other way around.

Day trade with the Gap and Go method.

Trading the Gap and Go strategy is a relatively simple process. To begin, you must determine the time of the creation of the gap. For doing so, we suggest using market scanners to locate the most active stocks.

Finding answers for the gapping-up

The next step is to figure out what’s causing the gap.

When there is a significant gap, it should ideally have an explanation. A wider gap, for example, might indicate that the price action is due to a company’s poor profits.

While you’re at it, attempt to figure out how much money the financial asset is worth. When a large trade volume follows the gap, it usually proceeds in the same direction.

How To Work Your Way Through Additional Scanner Settings

As you may already know, there are various beneficial scanner settings out there. As a result, you may use them to reduce the number of possible candidates.

First of all, you should try filtering the minimum gap down or gap up. An ideal setting would be +/-4% like Ross Cameron, the owner of Warrior Trading.

Additionally, you may also filter for the present day’s minimal trade volumes. Higher volume equates to reduced spread, slipping, and more notable fills. Fortunately, these are all desirable outcomes.

Finally, consider including a price and spread filter to ensure that you don’t buy stocks with unsatisfactory trade implementations.

Final Thoughts

Due to how frequently it arises and how simple it is to implement, the Gap and Go strategy is the most significant in the financial sector.

But if you want to take full advantage of this strategy, make sure you have a subscription to Trade Ideas for the key to successful day trading!