GBP/USD Retreats as Bulls Pause: Key Levels To Watch

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Pound Retreats Against US Dollar

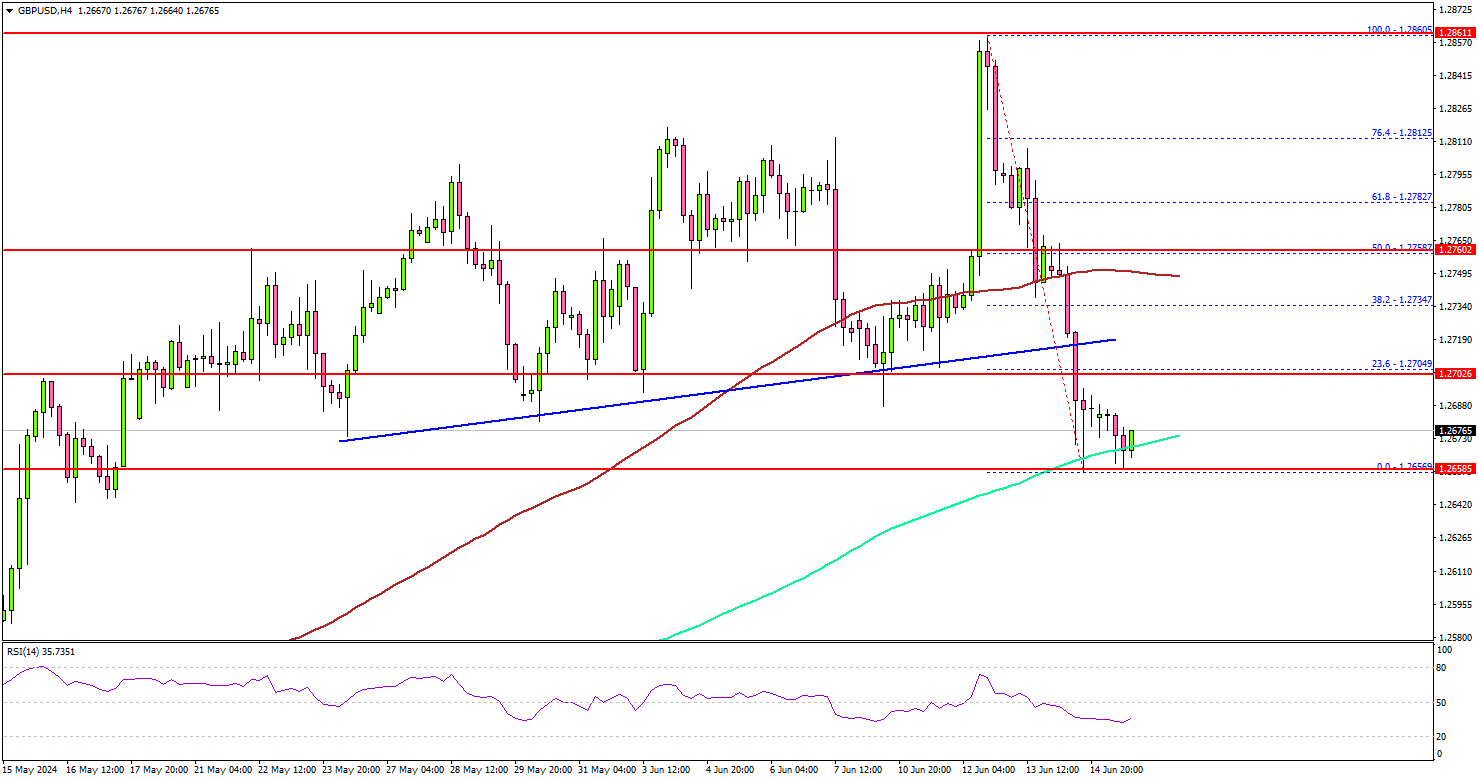

The British Pound peaked around 1.2860 and began a fresh decline against the US Dollar. GBP/USD fell below the 1.2800 and 1.2740 support levels, moving into a short-term bearish zone.

On the 4-hour chart, the pair broke below a key bullish trend line with support at 1.2720. The bears managed to push the pair below the 100 simple moving average (SMA) (red, 4-hour), and it tested the 200 SMA (green, 4-hour).

A low formed at 1.2655, and the pair is now consolidating its losses. If the pair starts to increase again, it might face resistance near the 23.6% Fibonacci retracement level of the downward move from the 1.2860 swing high to the 1.2655 low.

The first major resistance is near the 1.2740 level. A clear move above this resistance might push it toward the 1.2780 level. Further gains could drive it towards the 1.2860 level in the near term.

If the pair fails to rise, it might dip again. Immediate support is near the 1.2655 level, with the next major support around the 1.2620 zone. A break and close below the 1.2620 support could open the doors for a larger decline, potentially targeting the 1.2550 level.

In comparison, EUR/USD found support near the 1.0665 zone and may aim for a recovery wave in the near term.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.