GDX Vs. GDXJ: Which Is Better?

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

VanEck Junior Gold Miners ETF (GDXJ) and VanEck Gold Miners ETF (GDX) are essential tools for investors looking to profit from the gold and silver mining industries. GDX provide exposure to large-cap gold miners, which has a portfolio that is dominated by leaders in the industry with a sizable market capitalization.

As an alternative, GDXJ focuses on junior and mid-tier miners and offers a special combination of risk and potential for large profits.

The question is, which one of these two are better?

GDX

GDX, listed under the NYSEARCA, is a leading ETF for large-cap gold miners, with a market capitalization of $11 billion. It primarily includes major companies such as Newmont (NEM) with a 13% holding, Barrick (GOLD) at 9%, and Agnico Eagle (AEM) constituting 8%.

These top three assets form 30% of the ETF’s composition, indicating their significant impact on its performance. Notably, 64% of the fund is concentrated in its top 10 holdings, including royalty companies like Wheaton Precious Metals (WPM), Franco-Nevada (FNV), and Royal Gold (RGLD), which is viewed unfavorably due to their potentially lower performance compared to more leveraged producers. GDX offers a 1.8% dividend yield, adding to its appeal.

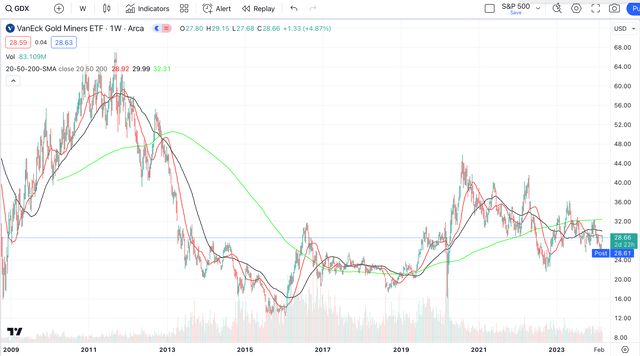

Historical data reveal significant fluctuations: from a peak of $66.90 in September 2011 to a low of $13.16 in January 2016, followed by a recovery to $31.79 in August 2016. The period from 2016 to 2020 showed tight trading ranges, with recent performance showing a potential for a 35% to 100% bounce in the next gold run, considering the patterns observed in 2016 and 2020. Currently, GDX trades at $29.15, requiring a 130% increase to reach a new all-time high.

GDXJ

GDXJ, targeting mid-tier gold miners, contrasts with GDX by focusing on a broader range of companies, including large caps, with a portfolio of 93 stocks and a market capitalization of $3.8 billion. The top five companies, including Pan American Silver (PAAS) and Kinross Gold (KGC), make up 44% of the fund’s assets.

The inclusion of significant silver producers and a .8% dividend yield are notable benefits. Historical performance indicates extreme volatility but also significant rebound potential, with the price needing a 423% return to reach its all-time high.

Final Thoughts

The analysis favors GDXJ over GDX for investors seeking exposure to gold and silver mining sectors. GDXJ not only offers a diversified portfolio but also holds the potential for higher returns, evidenced by its past performance and the possibility of reaching new all-time highs.

The emphasis on including silver miners provides additional leverage compared to GDX, making GDXJ a more attractive option for those bullish on gold and silver in the long term.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.