Dollar down, Gold up

In recent trading dynamics, gold and silver have diverged on their own courses against the backdrop of a weaker dollar. Gold prices have moved higher, tracking the currency’s minor decline, and the holiday-shortened trading week has begun with cautious optimism.

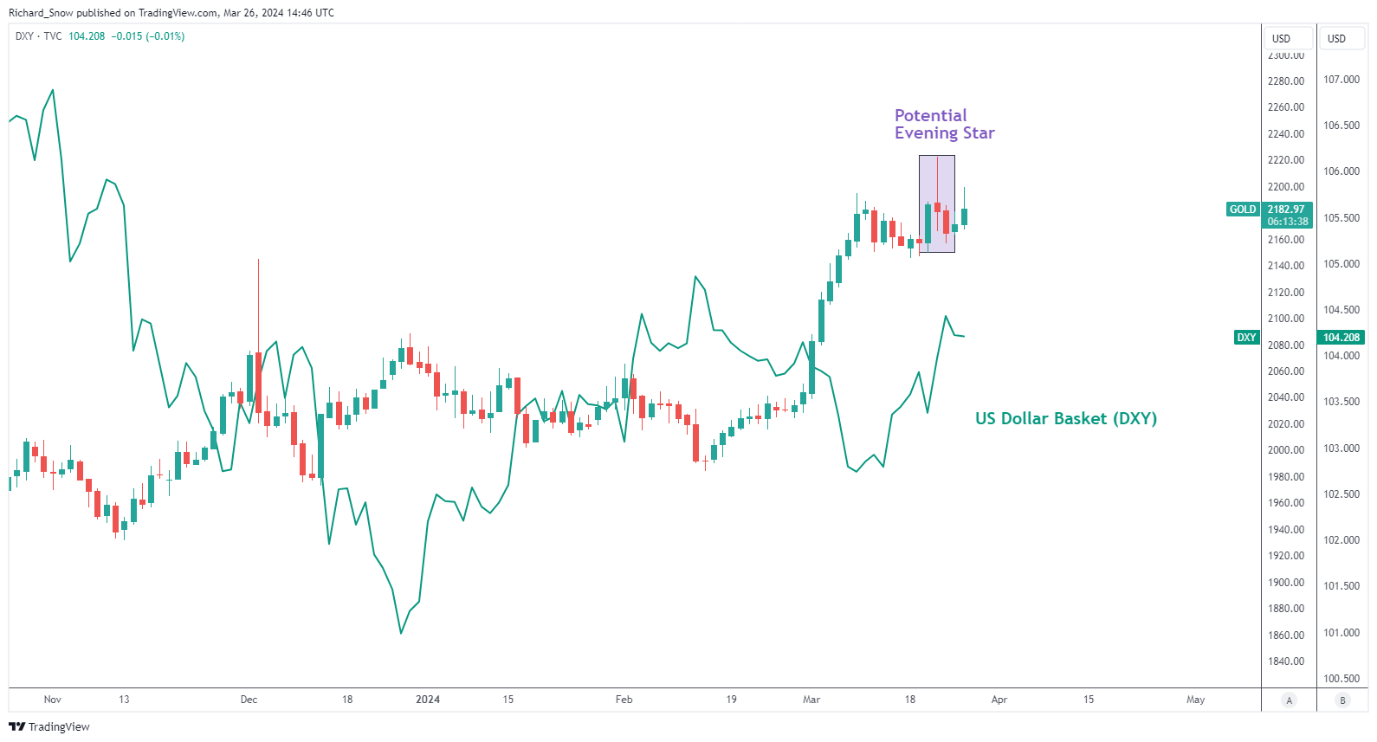

Last week’s trading revealed an odd evening star pattern in gold price movements, a normally negative indication that appeared at the uptrend’s height. Despite its rarity, this pattern, which is distinguished by a much higher wick in the middle ‘doji’ candle, remains consistent with technical criteria.

The fluctuation in the dollar’s strength appears as a cooldown from the previous week’s volatility, which saw a drop post the Federal Open Market Committee (FOMC) meeting, followed by a sharp rebound.

The anticipation for incoming inflation data on Friday positions it as the week’s pivotal event, potentially stirring significant market movements amidst the expected lower liquidity due to bank holidays in the UK and the US.

Daily Gold Chart Compared with the US Dollar Basket (DXY)

Gold Retest Prior to 2024 All-Time High

Gold’s price endurance is visible as it strives to reach its previous all-time high in 2024, testing the recent top of roughly $2222 following a close above $2195. This test of bullish momentum may indicate the need for further catalysts to maintain the higher trend, with $2146 identified as a significant support level for the week.

Traders are cautioned to expect heightened volatility on Friday, depending on the outcome of the inflation report.

If bears want to regain control this week, $2146 is the appropriate level of support. To summarize, Friday may bring increased volatility if we see a surprise in the report due to lesser liquidity.

Gold (XAU/USD) Daily Chart

Silver found a barrier and continued to drip lower

Conversely, silver encounters resistance, persistently trailing lower after failing to breach the $26.10 threshold, a robust cap since mid-2023. The slide below key Fibonacci retracement levels underscores the metal’s struggle, with immediate downside interests potentially leading to $22.35.

The bearish momentum faces a test at $24.55, a level that previously capped its ascent, indicating a critical juncture for silver’s price trajectory.

Silver Weekly Chart

The daily chart shows an immediate test for bearish momentum at $24.55, which has previously acted to limit rising potential.

Silver Daily Chart

Final Thoughts

For traders, the price difference between gold and silver provides a complicated environment, accentuated by the dollar’s movements and future economic data releases. The expectation of Friday’s inflation report has the potential to cause considerable swings, especially given the threat of restricted market liquidity.

As a result, navigating the precious metals market requires a strategic strategy that takes into account support and resistance levels, as well as macroeconomic data.