Gold prices plunged this week after briefly hitting an all-time high on Monday. They sank more than 3%, settling slightly below the $2,335 mark. The selloff was driven by a rally in short-term Treasury yields following hawkish Fed minutes and better-than-expected U.S. PMI data.

The data showed business activity in the services sector accelerated to its strongest pace in over two years in May. This indicates the economy is holding up well and can tolerate higher interest rates for longer.

With inflationary pressures proving stickier than initially anticipated, and the prospects of central bank easing pared back due to economic resilience, U.S. Treasury yields may move higher in the near term, especially on the front end of the curve.

This could keep the U.S. dollar biased upwards, preventing bullion from making another attempt at fresh records heading into the end of the month.

While gold’s very near-term outlook appears neutral to slightly bearish, this view will need reassessment late in the upcoming week. This is when fresh core personal consumption expenditures (PCE) price data, the Fed’s preferred inflation measure, is released.

Consensus estimates indicate that the underlying PCE deflator advanced 0.3% in April, bringing the annual reading down to 2.7% from 2.8% previously. This small step in the right direction is welcome news for policymakers.

For gold to reverse course and resume its upward trend, bulls need the core PCE report to surprise to the downside. Such an outcome could reignite optimism that the disinflationary trend, which began in late 2023 but stalled earlier this year, is back on track.

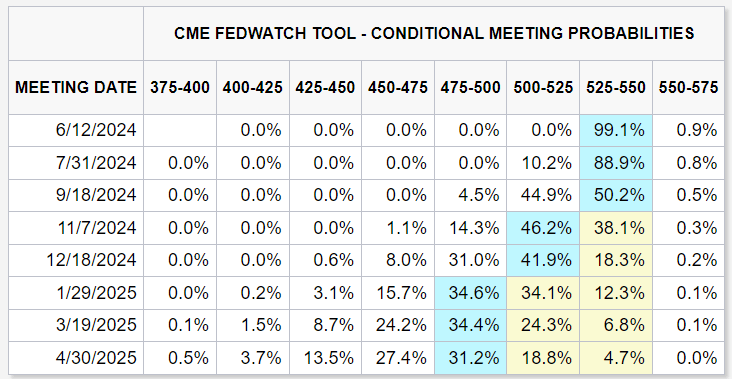

This could strengthen the argument for the Federal Reserve to start dialing back on policy restraint early in the fall. Currently, there is about a 45% chance of a 25-bps rate cut occurring at the September FOMC meeting.

FOMC Meeting Probabilities

In the event of red-hot inflation numbers that top Wall Street’s forecasts, interest rate expectations are likely to drift higher. Traders might push out the timing of the first rate cut to November or December.

This could boost yields and the greenback, fostering a hostile environment for precious metals. Higher yields typically reduce the appeal of non-interest-bearing assets like gold and silver. Additionally, a stronger dollar increases their cost for overseas buyers, suppressing demand.

Gold Price Technical Analysis

Gold (XAU/USD) plummeted this week, slipping below a key trendline at $2,360 and the 38.2% Fibonacci retracement of the 2025 advance at $2,335. With bearish momentum seemingly accelerating, sellers could soon target the 50-day SMA at $2,310.

On further weakness, the focus will be on the psychological $2,300 threshold, followed by $2,280, May’s swing low.

In case of a market rebound, resistance could manifest near the $2,375 zone. Surmounting this technical ceiling could prove challenging. Yet, a breakout could encourage buyers to target $2,420.

Additional gains beyond this point could set the stage for a rally towards $2,430, with the all-time high at $2,450 being the next noteworthy bullish target.