Gold Price Performance Overview

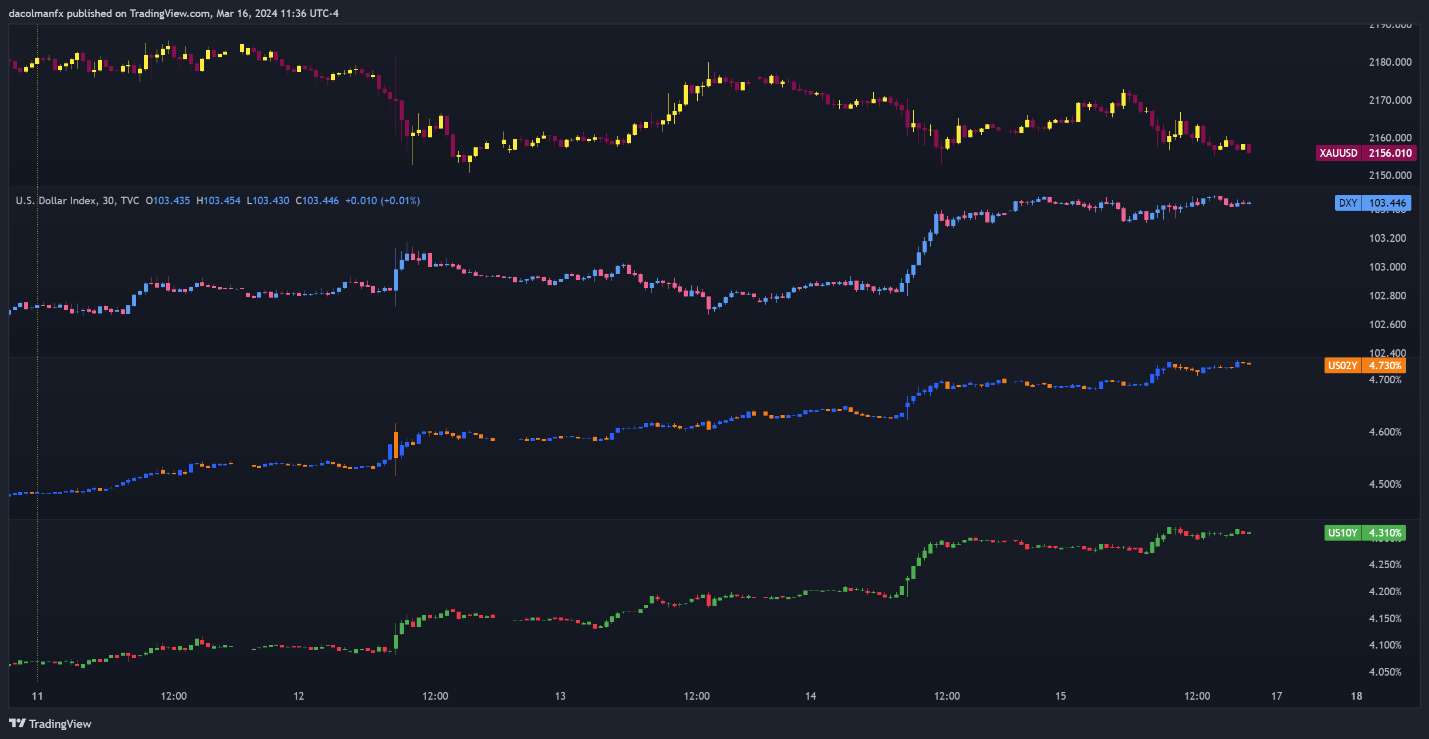

This week saw a slight retreat in the price of gold (XAU/USD), down approximately 1.05% to $2,155. Rebounding U.S. Treasury yields and a rising US dollar are attributed to the decline.

Despite this, there is still a strong bullish trend in gold, as evidenced by the 5.5% rise in March that sent it to new all-time highs.

Expectations of a rate decrease by the Federal Reserve drove this rise, which intensified when Fed Chair Jerome Powell’s comments to Congress hinted at a potential shift toward a less restrictive stance.

Inflation and Federal Reserve’s Stance

Disappointing consumer pricing data in recent sessions has caused a narrative change, suggesting that the disinflation progress may be stagnating or perhaps reversing.

Given the increasing inflation risks shown by recent PPI and CPI data, traders may expect the Fed to adopt a more hawkish stance, indicating a delay in easing policy and fewer rate decreases than initially anticipated.

New guidelines and forecasts are also eagerly awaited for the Fed’s March decision, which is scheduled on Wednesday. The Fed’s forecast of 75 basis points of easing this year is consistent with current market pricing.

However, any indications of fewer reductions could raise bond rates and the US currency, which would negatively affect the price of gold.

Technical Analysis and Future Movement

Gold prices remained above the $2,150 support level throughout the week. To prevent additional selling pressure, the bulls need to protect this area.

If there are any pullbacks, they should be targeted around $2,085, while keeping a close eye on the critical level of $2,065. On the other hand, if the market experiences a bullish resurgence, it may face a challenge in surpassing the recent peak of $2,195. There could be additional resistance near the $2,205 mark.

Influence of US and Chinese Economic Indicators

U.S. inflation data has helped maintain expectations for Fed rate cuts, as market participants closely monitor upcoming FOMC decisions. If inflation remains high, the Fed may choose to hold off on easing until there is stronger evidence of inflation reduction.

Furthermore, weak consumer sentiment and steady inflation expectations, coupled with modest improvements in industrial production, are contributing factors. China’s focus on proactive fiscal policy and potential monetary easing measures, such as reduced bank reserves, may have a positive impact on gold prices.

Given China’s status as a major gold consumer, the country’s economic recovery and stimulus measures play an important role. Anticipated Chinese Retail Sales and Industrial Production data, coupled with the Fed’s interest rate decision, will play an essential role in shaping the trajectory of gold’s price.

Final Thoughts

In the face of Chinese economic data, gold traders remain on edge as they navigate the complexities of U.S. inflation data and the Federal Reserve’s impending choices.

The course of gold’s price in the coming days will surely be shaped by the delicate balance that exists between expectations for interest rates, inflation, and global economic policy.

Gold’s volatility is highlighted by its appeal as a safe-haven asset and its vulnerability to interest rate fluctuations as the market awaits these significant events.