Gold Prices Bearish Correction Expected Amid Sub-$2,300 Hold

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Gold (XAU/USD) fell for the second week in a row, with prices staying just over the critical $2,300 level.

Market volatility remained relatively low following key developments, particularly the Federal Reserve’s monetary policy statement and the US employment report released on Friday. Despite these causes, gold prices have struggled to maintain momentum.

Key Market Drivers

- Fed Chair Jerome Powell’s dovish position, which suggests a likely rate drop and a pause in future hikes, has lowered bond yields. Despite this hopeful forecast, gold prices did not rise as expected.

- U.S. Employment Data: The U.S. jobs data showed a worsening economy, with nonfarm payrolls increasing by 175K in April compared to 315K in March, and the unemployment rate rising to 3.9%. Despite these signals, which support FOMC softening views, gold prices continued to fall.

- Economic Fundamentals and Inflation: Although the US economy is showing signs of weakness and the Federal Reserve is hinting at relaxing monetary policy, inflation concerns and hawkish comments from some Fed officials have reduced gold’s appeal as a safe haven.

Technical Analysis

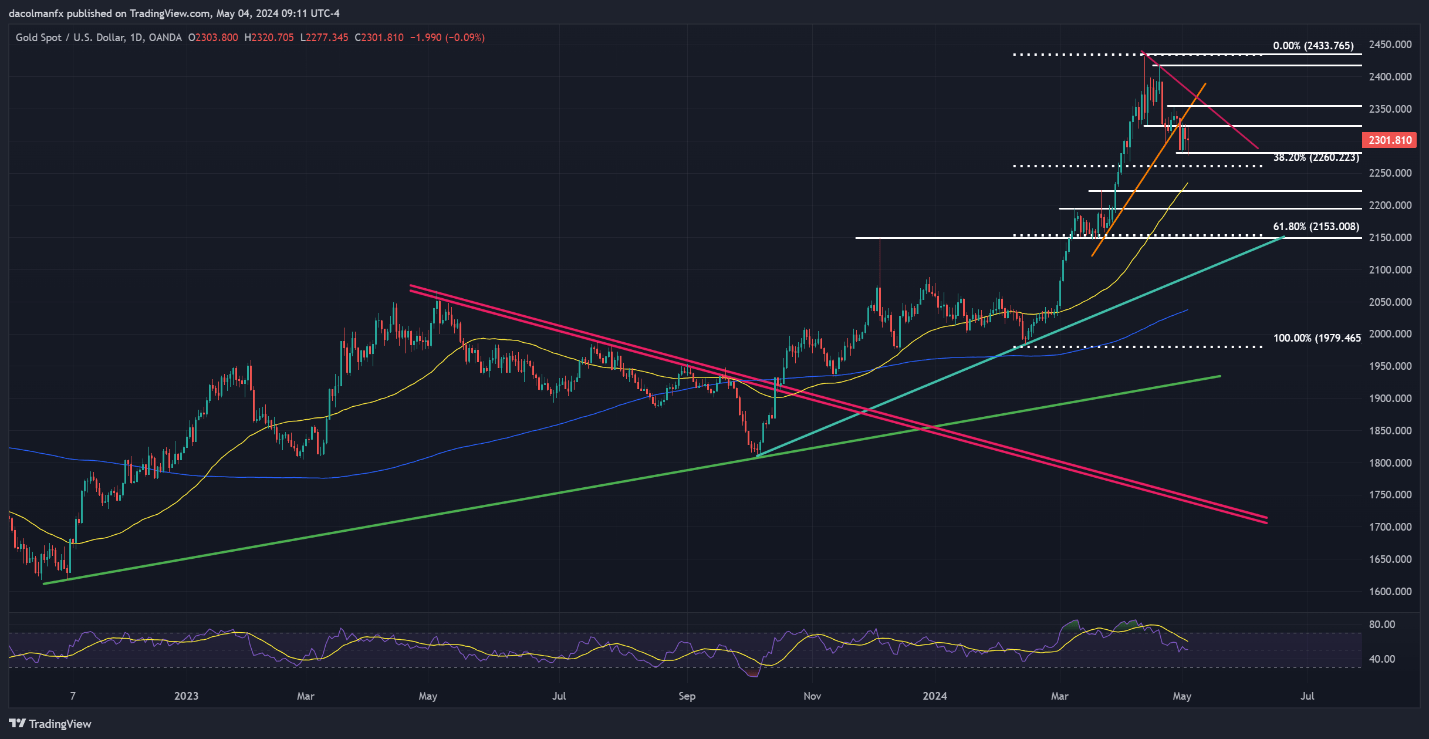

Gold prices fell to their lowest level in nearly a month, but they remained supported above $2,280. Bulls must protect this level; a breach could push prices toward the crucial Fibonacci level at $2,260, eventually testing the 50-day simple moving average at $2,235.

A positive reversal from current levels will face resistance at $2,325 and subsequently $2,355. If gold breaks through these obstacles, it might climb to $2,375, a short-term declining trendline from recent highs.

Upcoming Catalysts and Events

The US economic calendar remains quiet, which may keep volatility under control. The April Consumer Price Index (CPI), which is slated for May 15, could spark market activity if the data exceeds forecasts.

Furthermore, the Michigan Consumer Sentiment Index for May will provide information about consumer confidence.

Final Thoughts

Gold prices remain sensitive as economic data and Fed policy continue to influence market sentiment.

Despite a dovish change in monetary policy expectations and deteriorating US economic data, the hawkish stance of some Fed members, along with a risk-on trading environment, has weakened gold’s appeal as a safe haven asset.

Traders should keep a tight eye on gold’s technical levels for more directional clues in the coming weeks, while also assessing the potential impact of significant economic data. A price below $2,300 may indicate a further bearish decline unless crucial support levels stay firm.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.