Gold Prices Pause Before Fed; USD/JPY Fakeout

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

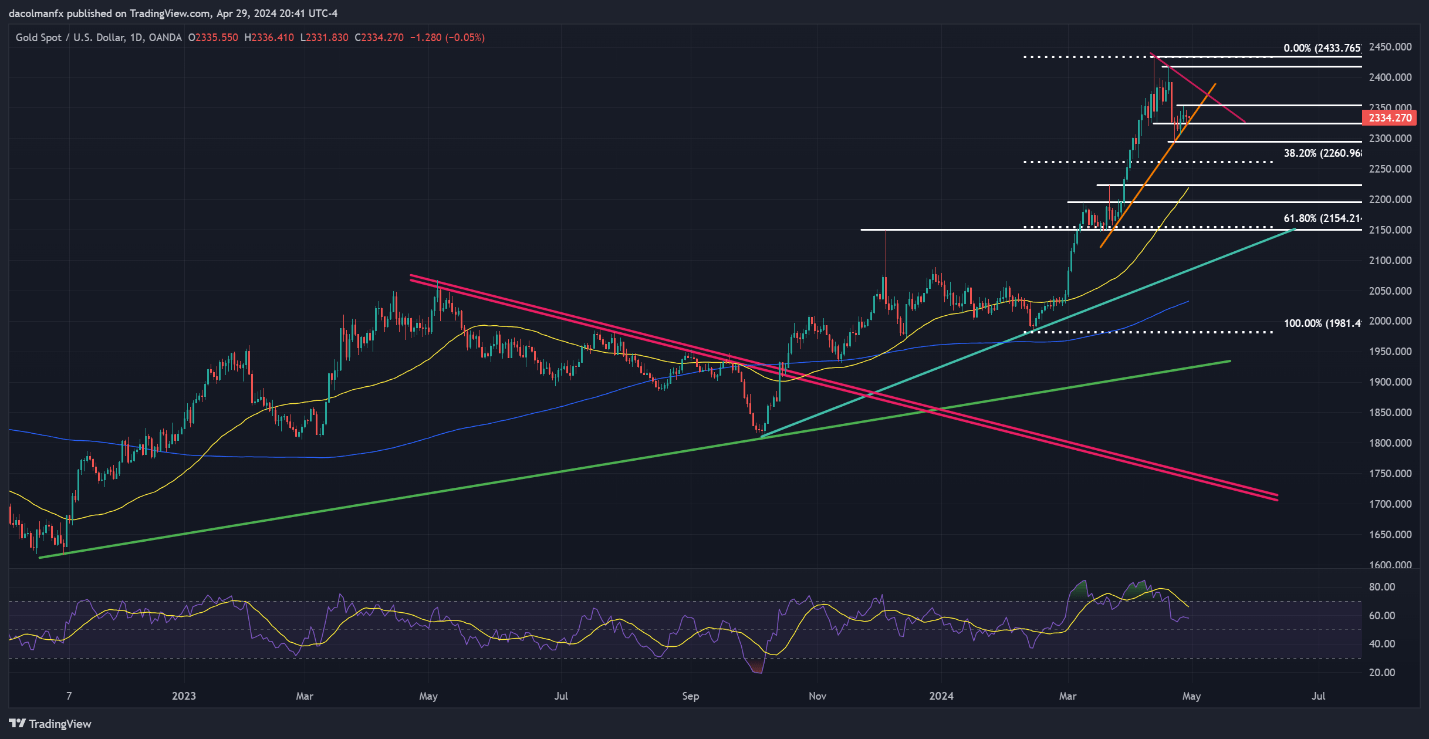

Gold prices experienced a slight decline on Monday, as anticipation builds ahead of key events later in the week, notably the FOMC monetary policy announcement and U.S. employment data release. This caution among traders could limit volatility until Wednesday afternoon, awaiting the U.S. central bank’s guidance. Trendline support at $2,320 might stabilize the market, resisting a further downturn. However, a breach of this level could invite bearish pressure towards $2,295, potentially leading to a retreat to $2,260. Conversely, a bullish rebound may encounter resistance at $2,355 and $2,395, with a breakout targeting $2,420.

USD/JPY Analysis

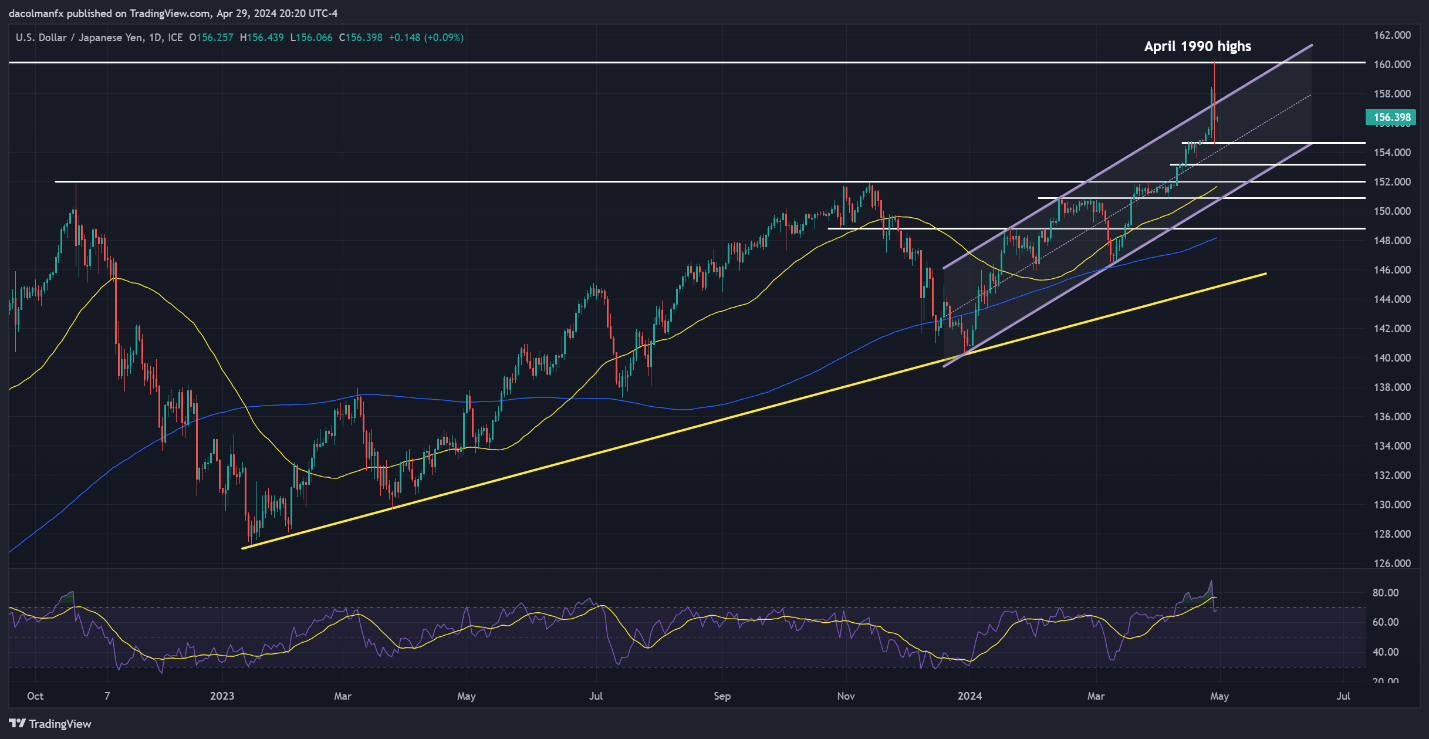

USD/JPY surged to new highs last week, but Monday saw a swift reversal, possibly indicating a fakeout. Uncertainty lingers regarding the cause of this bearish turn, with speculation suggesting Japanese government intervention. This, coupled with waning upward pressure, may lead to a temporary pullback, with support levels at 154.65, 153.20, and possibly 152.00. Alternatively, a decisive breach of 157.00 could reignite bullish momentum, aiming for a retest of 160.00.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.