Gold Prices Sink Amid Rising US Treasury Yields

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Economic Performance and Inflation

The strong performance of the US economy and continuing inflationary pressures suggest that the Federal Reserve may keep its restrictive policy stance for longer than expected.

This scenario, defined by increasing interest rates, may limit gold’s near-term upward potential, providing risk aversion remains low.

Upcoming Economic Indicators

Looking ahead, the economic calendar will be rather quiet until late next week. The release of the core PCE index, the Fed’s preferred inflation metric, will be critical.

This data should be monitored by traders to gain insight into consumer price movements. A hot report could raise interest rate expectations, weighing on precious metals prices.

Technical Analysis: Key Levels

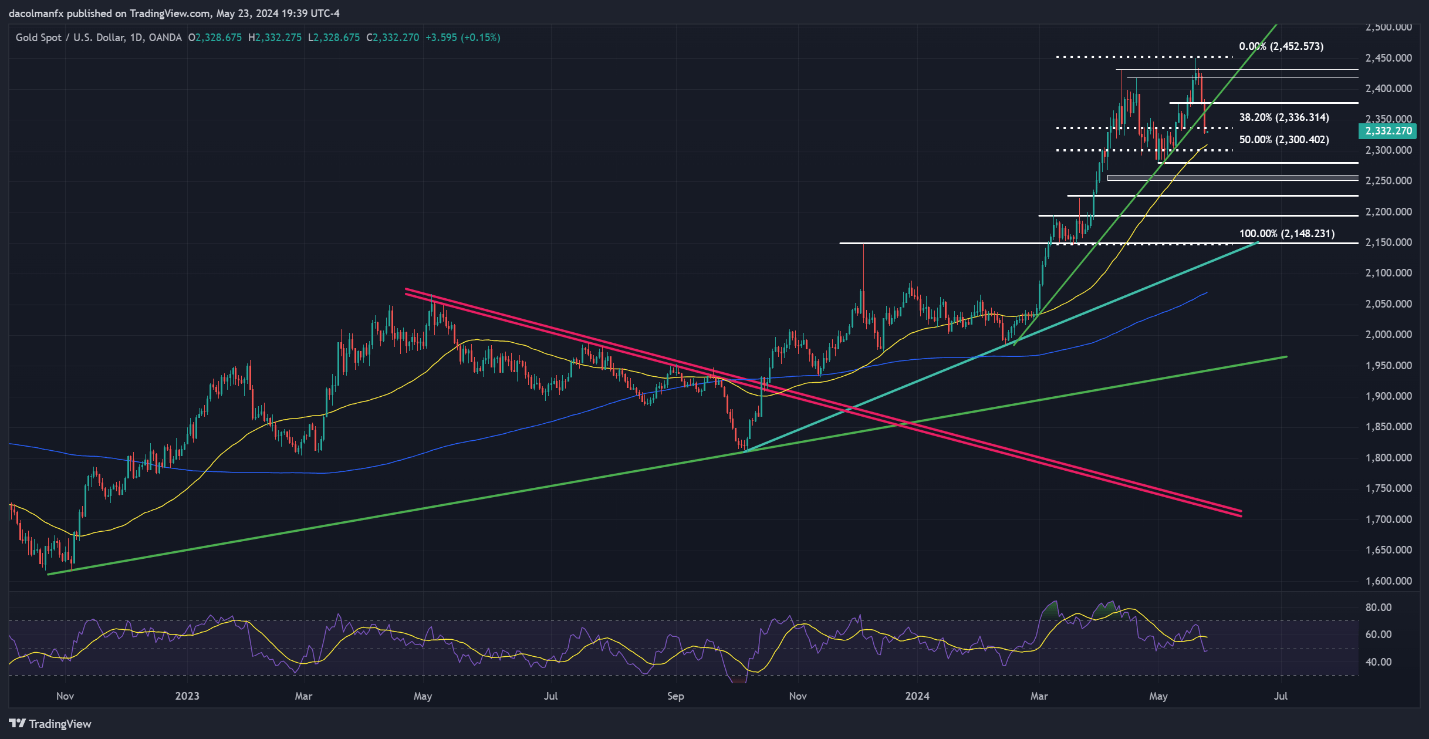

In terms of technical analysis, XAU/USD fell for the third straight session on Thursday. It broke through an important trendline at $2,360 and the 38.2% Fibonacci retracement of the 2023 rise at $2,335.

If losses continue, the next line of defense will be the 50-day simple moving average of $2,310, followed by $2,300 and $2,280.

In the event of a positive turn, overhead resistance is at $2,365, followed by $2,375. Overcoming these difficulties may motivate purchasers to aim for $2,420. Further strength might lead to a rally toward $2,430, with a possible retest of the all-time high of around $2,450.

Market Reactions and Data Impact

Gold prices fell for the third day in a row on Thursday, reaching a one-week low. The fall came after U.S. economic statistics pushed up Treasury yields and strengthened the currency.

This event has decreased expectations for a Federal Reserve rate cut, with investors expecting only 27 basis points of lowering by the end of 2025.

XAU/USD is now trading at $2,332, down 1.90% from its recent high of $2,383.

US Economic Data

S&P Global‘s final assessment of the U.S. Manufacturing, Services, and Composite PMIs for May indicated a quicker rate of business activity. In addition, the US Bureau of Labor Statistics announced that jobless claims were lower than projected, indicating labor market strength.

These data points bolstered the US dollar, with the US Dollar Index (DXY) climbing 0.18% to above 105.00.

Furthermore, the Federal Reserve’s minutes suggested that some officials were willing to hike interest rates if inflation merited it, providing a headwind for the non-yielding metal.

US Economic Data

Despite the impact of US statistics, developing market central bank purchases gave some support for gold. According to the World Gold Council, central banks have added almost 2,200 tons of gold since the third quarter of 2022, owing to Western sanctions against Russia.

Daily Digest: Market Movers

The rise in U.S. Treasury yields weighed on gold prices, with the 10-year Treasury note yield rising five basis points to 4.477%. This rise created a headwind for the precious metal.

Initial unemployment claims in the United States hit 215,000 for the week ending May 18, lower than the expected 220,000 and the prior week’s number of 223,000.

S&P Global’s latest U.S. PMI numbers for May showed improvement across the board, with the Manufacturing PMI climbing to 50.9 and the Services PMI rising to 54.8. The composite PMI also increased to 54.4, above expectations.

The FOMC minutes expressed doubt regarding the extent of policy restrictions, emphasizing that achieving sustained 2% inflation may take longer than expected. According to data from the Chicago Board of Trade, investors expect the Fed to ease by 27 basis points before the end of the year.

Final Thoughts

The gold market is currently being driven by a combination of positive US economic data, rising Treasury yields, and central bank purchases.

While the short-term outlook appears bearish, key support levels and upcoming economic indicators may play an important role in determining the direction of gold prices. Traders should remain watchful and attentively monitor the developments.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.