The recent re-pricing of US interest rate decreases has weighed on gold and silver, lowering demand for these previously high-flying commodities.

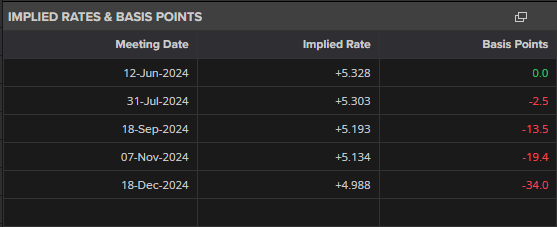

Current market estimates imply that the first 25 basis point US rate decrease is now completely priced for the December meeting, albeit the November meeting is still possible.

Recent solid US economic data has given the Federal Reserve more freedom to keep interest rates higher as it combats persistent inflation.

Gold Analysis

Gold, which hit a multi-decade high on May 20th, has since fallen by more than $100/oz due to persistent concern about increased interest rates and strong economic indicators. High short-term US Treasury yields continue to put downward pressure on gold and silver.

Unless the next PCE data shocks on the downside, both metals may find difficulties in rising higher. In the event of further losses, gold is projected to find initial support near $2,280/oz.

Retail trader data shows that 63.97% of traders are net-long gold, with a long-to-short position ratio of 1.78 to 1.

The number of net-long traders is up 3.95% from yesterday and 36.52% from last week, while the number of net-short traders is up 6.68% from yesterday but down 20.68% from the previous week.

This contrarian viewpoint implies that gold prices may continue to decrease, given the current sentiment and recent positioning adjustments.

According to Saxo Bank’s technical analyst Kim Cramer Larsson, gold appears to be rebounding from the shaded area of the Ichimoku Cloud, between the 0.618 and 0.786 retracement levels, with minimal support around $2,326.

A further drop to the 0.786 retracement at $2,314 is possible before a comeback. If gold breaks above $2,385 per ounce, the previous uptrend is expected to resume, with a goal of $2,500.

However, a close below $2,277 would indicate a downturn. Larsson observes that the RSI indicates a possible end to the uptrend, but that a closing above the 60 levels and the upper falling trendline would signify another positive push in gold.

Silver Analysis

Silver has outperformed gold over the last month, with the silver/gold spread rising to highs not seen since mid-November 2021. A break and open above the mid-October 2021 high might push this spread higher.

Silver recently broke through the $30/oz barrier, achieving its highest point in over a decade, with short-term support at $29.80/oz.

According to Larsson, spot silver has rebounded from the 0.382 Fibonacci retracement at $30 per ounce and is expected to resume its upward trajectory. The daily RSI remains bullish with no divergence, indicating that silver could rise above $32.52.

On the weekly chart, if silver exceeds $32.52, there is no significant resistance until $34.40-$35.40. A breach below $30 might result in a pullback to the 0.618 retracement level at $28.50.

Current Prices

Gold prices remain stable, with spot gold last trading at $2,351.37 per ounce, up 0.74% for the period. Silver continues to dominate the metals complex, with spot silver trading at $31.522 per ounce, up nearly 4% on the day.

Final Thoughts

The performance of gold and silver is still directly linked to US economic statistics and Federal Reserve actions. While gold is under pressure from higher interest rates, silver continues to show strength and outperform.

To successfully navigate the volatility in these precious metals markets, traders should monitor critical support and resistance levels, as well as economic factors such as PCE data.