Gold Surged to a New All-time High After The Fed Reaffirmed Its Rate Cut View

By Daniel M.

March 21, 2024 • Fact checked by Dumb Little Man

Gold hits a record high as the Federal Reserve confirms interest rate cuts

Gold prices have climbed to historic highs following the Federal Reserve’s most recent monetary policy announcement. Despite changes in inflation and economic forecasts, the central bank’s decision to stick to its plan of three interest rate cuts this year has lifted gold significantly.

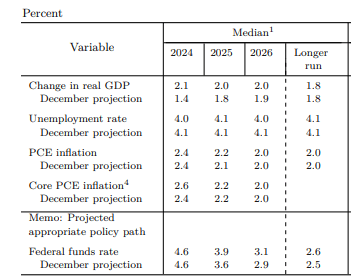

The Federal Reserve’s Summary of Economic Projections for March 2024 highlighted various modifications, including a minimal increase in the long-term federal funds rate from 2.5% to 2.6%. This change proposes revisiting the ‘neutral rate,’ which balances economic progress without being overly stimulative or restrictive.

Fed Summary of Economic Projections, March 2024

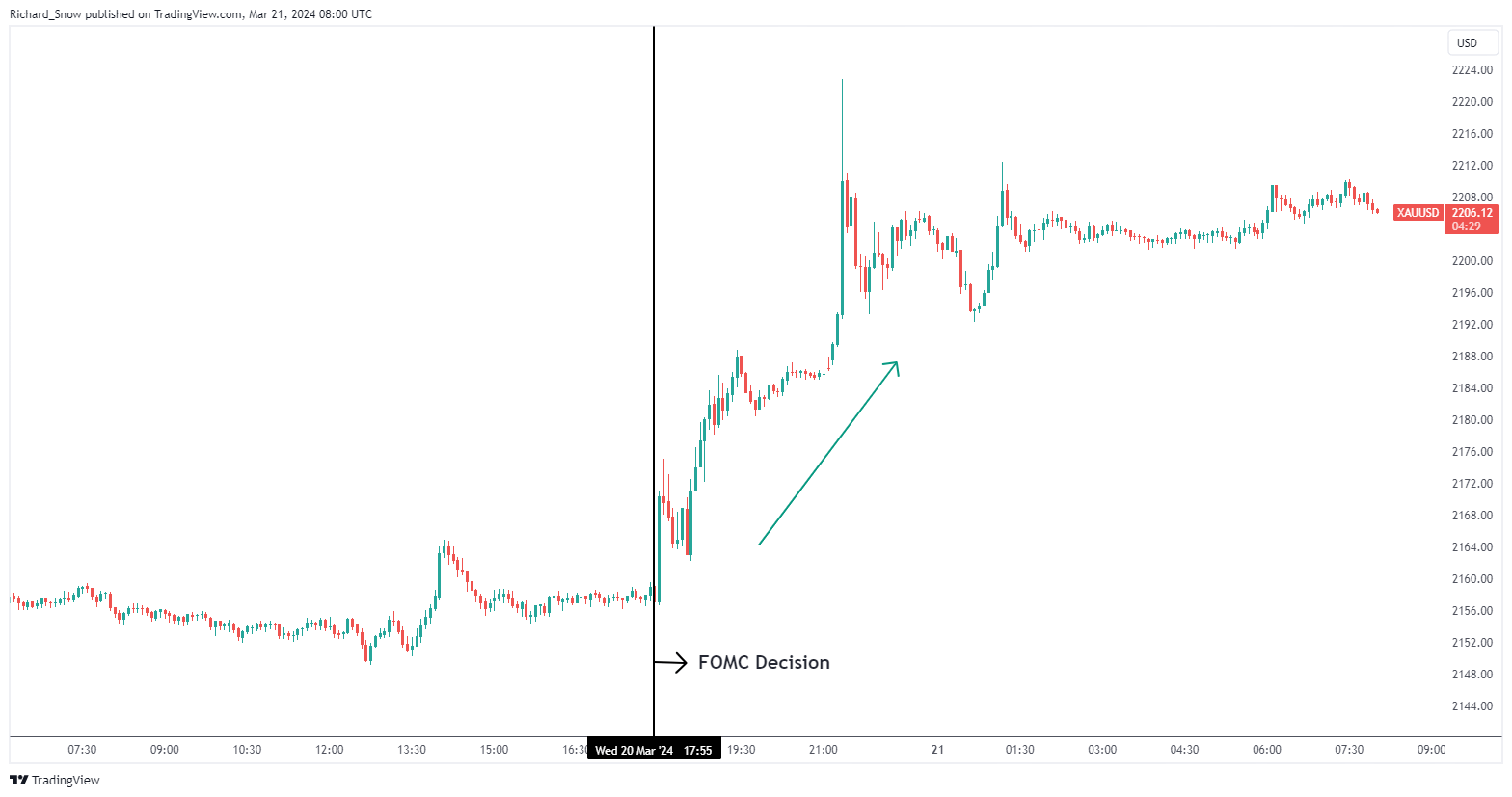

Prior to the Fed’s statement, the discussion centered on whether the central bank would revise its rate-cutting forecast in light of recent strong economic statistics and higher inflation figures. However, the Fed’s confirmation of its December predictions triggered a dovish market reaction, weakening the currency and lowering short-term yields like the 2-year Treasury yield. This market dynamic provided ideal conditions for gold to attain a new all-time high.

Gold Soars to New All-Time High

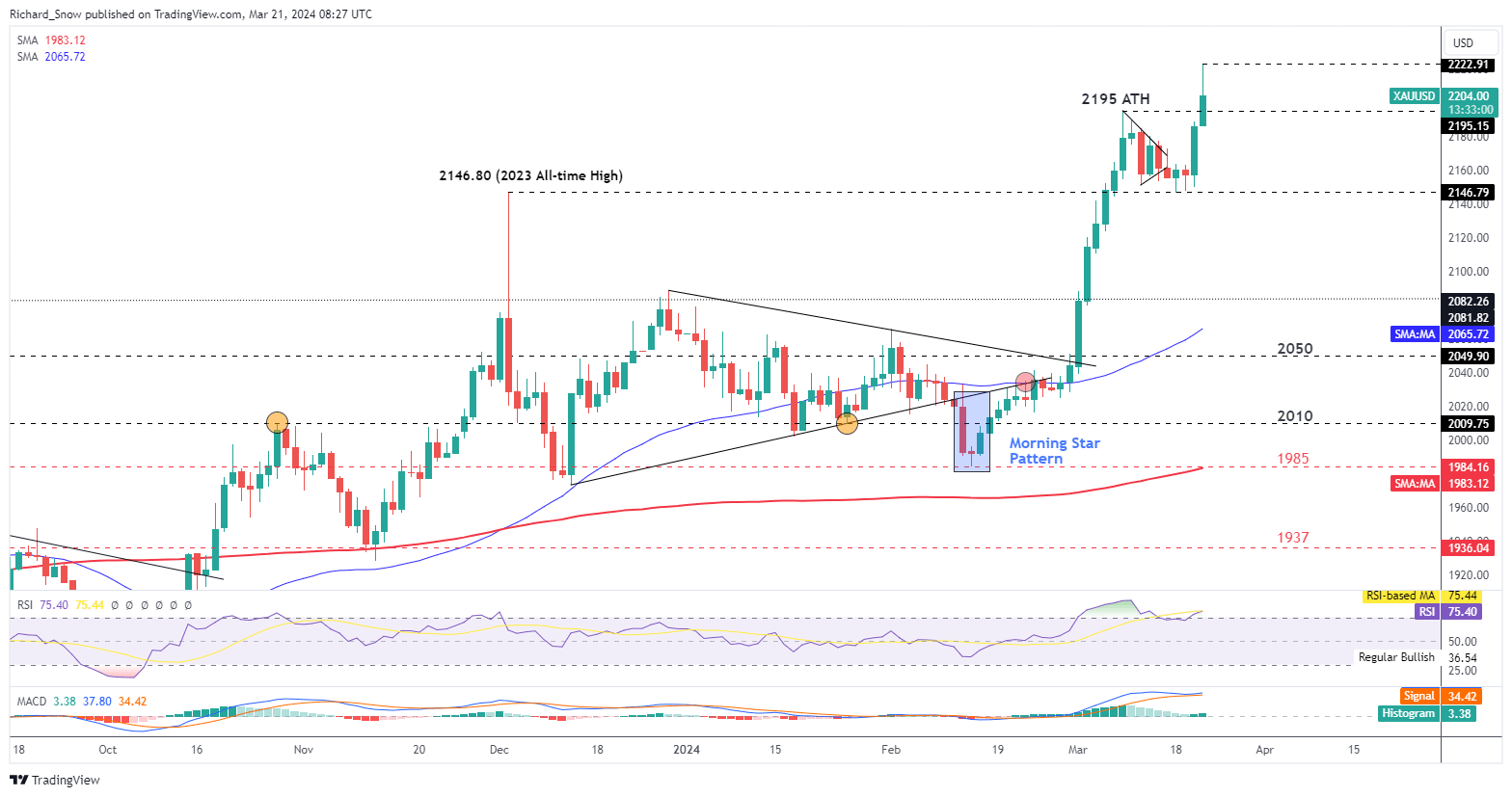

Gold’s rally continues following the FOMC meeting. Following Wednesday’s Federal Open Market Committee (FOMC) meeting, gold prices have continued to rise, establishing a new high. The precious metal’s price consolidated above the previous all-time high of $2146.80, reaching over $2222. This rise was expected if gold prices held above the previous high, indicating strong momentum in the gold market.

Daily Gold (XAU/USD) Chart

The rise in gold prices is also aided by rising central bank purchases, particularly from China. Despite the prospect of a temporary decline due to recent large action and a probable dollar recovery, gold’s support remains solid near $2146. This development demonstrates the precious metal’s enduring appeal as a safe-haven asset in an uncertain economic environment.

Final Thoughts

Investors and dealers must continuously monitor these developments, particularly the impact of Federal Reserve policy on gold prices. The combination of dovish Federal Reserve estimates and strong demand for gold points to a continued bullish trend for the precious metal, creating a lucrative opportunity for investors.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.