Gold’s Steady Ascent: Eyes on Global Manufacturing Data Amid Neutral Forecast

By Daniel M.

April 1, 2024 • Fact checked by Dumb Little Man

Gold Sets New Record Amid Global Economic Shifts

Gold’s price has achieved a remarkable milestone, surpassing the $2,200 per ounce barrier and setting a new record in the first quarter.

This spike is mostly due to market confidence about a probable dovish shift in monetary policy by important central banks around the world, following aggressive rate hikes in recent years.

Despite this rally, the outlook for gold seems neutral, with future moves mainly driven by global economic indices, geopolitical concerns, and central bank policies.

Market Dynamics and Central Bank Influence

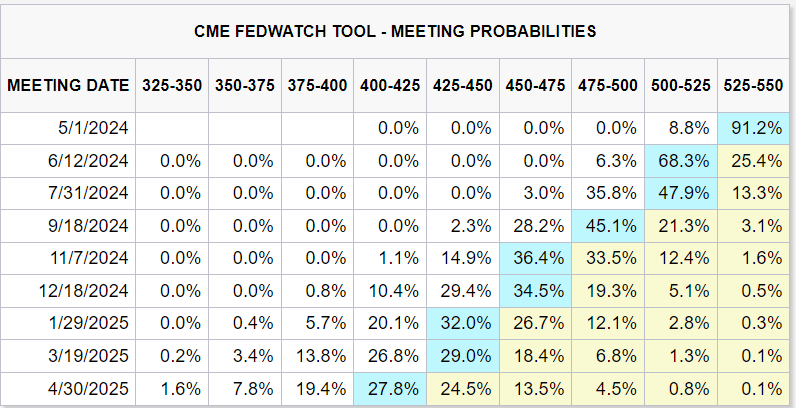

Investors remain cautious, expecting the Federal Reserve to ease by around 75 basis points in 2024. Any shift towards a hawkish approach due to persistent inflation could cause volatility in gold prices.

Gold gains from lower Treasury yields and a weaker US currency, which occur when the Fed decreases borrowing costs. Aside from monetary policy, geopolitical conflicts, like the recent Russia-Ukraine war, provide a geopolitical premium to gold.

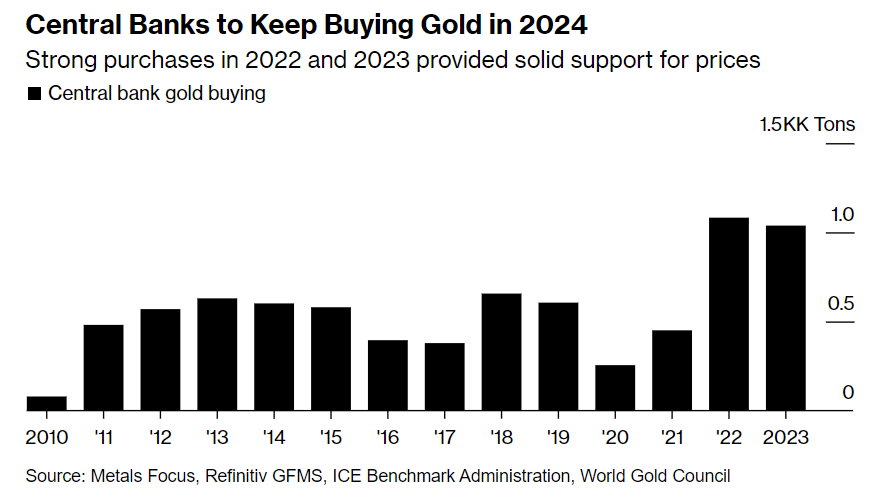

Furthermore, major physical purchases by central banks, such as the Central Bank of Turkey and the People’s Bank of China, highlight gold’s appeal as a safe-haven asset.

These purchases, motivated by a desire for diversification and concerns about US supremacy, have persisted at an unprecedented rate, implying a strong demand backdrop for gold.

Global Economic Indicators and Gold’s Outlook

The forecast for gold in the second quarter remains neutral, with potential for consolidation following recent advances. However, investors should pay special attention to economic data releases, central bank comments, and geopolitical developments.

Notably, the U.S. presidential election later this year may cause volatility, while it is not considered to be a big market driver in the near term.

Recent developments, such as the Federal Reserve’s interest rate policy, heightened tensions in the Middle East, and optimistic economic data from China, have all contributed to gold’s rise to all-time highs of about $2,250 per troy ounce.

The anticipation of a more accommodative monetary policy across major economies, along with geopolitical upheaval and signs of revival in China’s economy, strengthens gold’s position as a preferred safe-haven investment.

Final Thoughts

Looking ahead, traders will keep a careful eye on future economic measures, such as China’s Caixin Manufacturing PMI and the US ISM Manufacturing PMI, for more clues regarding gold’s trajectory.

While the near-term prognosis is cautious and neutral, the fundamental causes underpinning gold’s value—from central bank demand to geopolitical risks—indicate that it will remain a major component of global financial markets.

Gold’s future outlook will most certainly be influenced by a complex interplay of economic policies, geopolitical happenings, and market sentiment, making it a valuable asset for both traders and investors.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.