How To Have A Growth Mindset About Money

By Brian Wallace

January 10, 2024 • Fact checked by Dumb Little Man

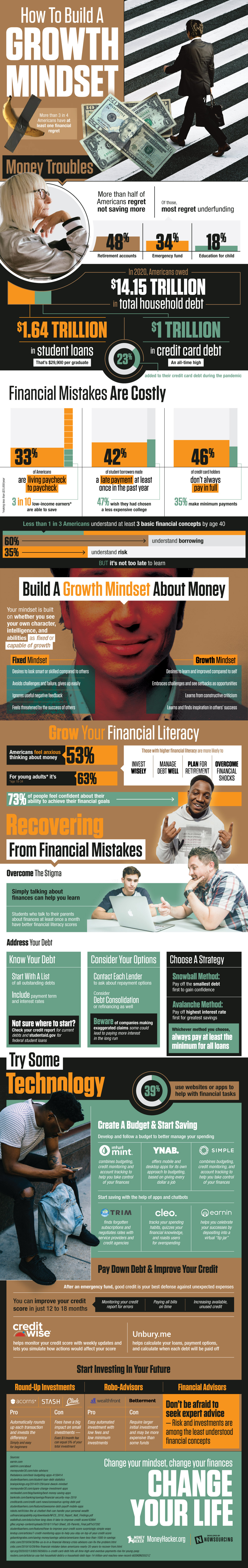

More than 75% of Americans have at least one financial regret, and is it any wonder? We’re taught from a young age that talking about money is taboo, and the result is that throughout most of adulthood we have no actual idea how to deal with our finances. People are stuck living paycheck to paycheck, not saving enough for retirement and emergencies, and the result is always catastrophic. Debt continues to grow, and we rely on credit cards to get us through the tough times. But what if there were a better way to handle our finances and make small changes that will add up in the long run? If you can apply a growth mindset to your finances, you might find yourself in a better financial situation sooner than you think.

Money Troubles Abound

With our economy in a free fall, there has never been a more relevant time to talk about money troubles. Whether you’ve lost a job or you’re just unsure of the future, the way you spend and save now could impact your life for years to come.

As of this year, American consumers owed more than $14.15 trillion in household debt. This is everything from mortgages to credit card balances to student loan balances, and it adds up quickly. In student loan debt alone, Americans owe more than $1.64 trillion. Credit card debt has skyrocketed to an all-time high of $1 trillion. Americans just aren’t prepared for everyday life.

Part of the problem is that wages have stagnated while the cost of living has ballooned out of control. For decades raises have barely kept up with inflation, while the cost of living has overshot normal wages by a significant amount.

Most Americans have decided that college is the only way to beat the system, but that often leaves them with a crippling debt load they later find they can’t afford as they try to juggle paying rising rents, minimum student loan payments, and healthcare premiums. This, in turn, has sent an entire generation back to their parents’ basements to try to regroup, which further exacerbates the economic situation. For those who are unfortunate enough to have any sort of medical needs, making ends meet is just not a financial possibility in many cases.

Currently, a third of Americans are living paycheck to paycheck, while even three in every ten low-wage earners are able to save at least some of their money but don’t. Student loan borrowers often find themselves regretting choosing a more expensive college than they needed, and 42% make at least one late payment a year. 35% of credit card users only pay the minimum amount instead of paying the full balance every cycle.

Applying A Growth Mindset To Your Finances

Most people apply a fixed mindset to their financial situation – they feel they are helpless to change it, that they know all there is to know about their finances, and that challenges can only lead to failure or financial ruin. When you instead start to apply a growth mindset to your financial situation you realize there’s a lot you don’t know about finances and that you have plenty of room to learn and grow. Setbacks become opportunities for growth.

Financial mistakes and problems happen, and it’s your responsibility to learn from them and do better next time. Start by listing all your debts and their corresponding interest rates. There are a couple of things you can do here. The snowball method is probably the easiest – start by concentrating on paying off the smallest debt first. Keep paying minimum payments on all your debts so you don’t go into default, but find extra money each month to go toward your smallest debt. Once that one is out of the way, apply all that money to your next smallest debt until it is paid off, and keep going from there. Before long you will be debt-free and have the ability to focus your attention on other aspects of your financial life.

There are tons of apps out there that can help you keep track of your finances and expenses and make cuts wherever you can. Saving is also going to be a major component of your financial strategy, as emergency savings prevent you from having to go into debt in the first place.

Learn more about having a financial growth mindset from the infographic below.

Source: Money Hacker

Brian Wallace

Brian Wallace is the Founder and President of NowSourcing, an industry leading infographic design agency based in Louisville, KY and Cincinnati, OH which works with companies that range from startups to Fortune 500s. Brian also runs #LinkedInLocal events nationwide, and hosts the Next Action Podcast. Brian has been named a Google Small Business Advisor for 2016-present and joined the SXSW Advisory Board in 2019.