Hong Kong Spot ETF Approval Rumors Spark Bitcoin and Ethereum Rally

By Daniel M.

April 16, 2024 • Fact checked by Dumb Little Man

Bitcoin and Ethereum Prices Surge on ETF Approval Speculations

Bitcoin and Ethereum are rising in early European trading, with reports claiming that the Hong Kong Securities and Exchange Commission (SEC) has approved various spot BTC and ETH exchange-traded funds (ETFs).

Although no formal confirmation has been issued, China Asset Management (HK) Ltd hinted at permission in an announcement on its website.

Bitcoin Halving Event and Market Sentiment

While the market is buzzing with excitement about the supposed ETF approvals, traders are also keeping a careful eye on the upcoming Bitcoin halving event on Saturday, April 20th.

With only 683 blocks left to mine before the event, excitement, and speculation are strong.

Weekend Turmoil Spurs Crypto Sell-off

The Bitcoin market experienced tremendous volatility over the weekend as a result of Iran’s retaliatory strikes on Israeli targets. The resulting uncertainty sparked a sell-off, with Bitcoin falling to $60.6k and Ethereum reaching a low of $2,845.

Prices have been rebounding, although recovering from weekend losses may take some time.

Technical Outlook for Bitcoin and Ethereum

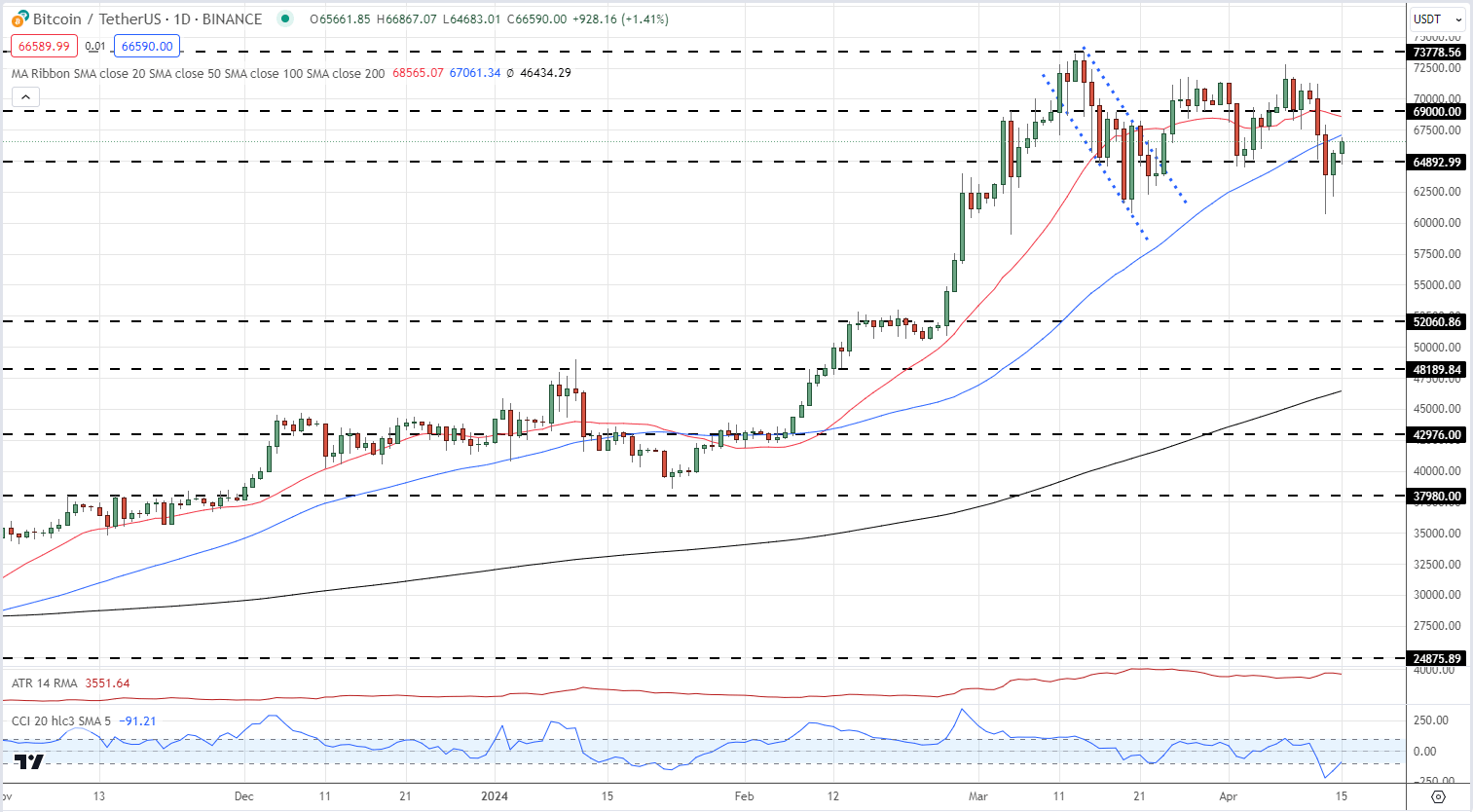

Bitcoin’s recent drop below significant moving averages for the first time since January highlights the necessity for a strong recovery above them, as well as reclaiming the $69k support level, to clear the way for a new attempt at the mid-March all-time high.

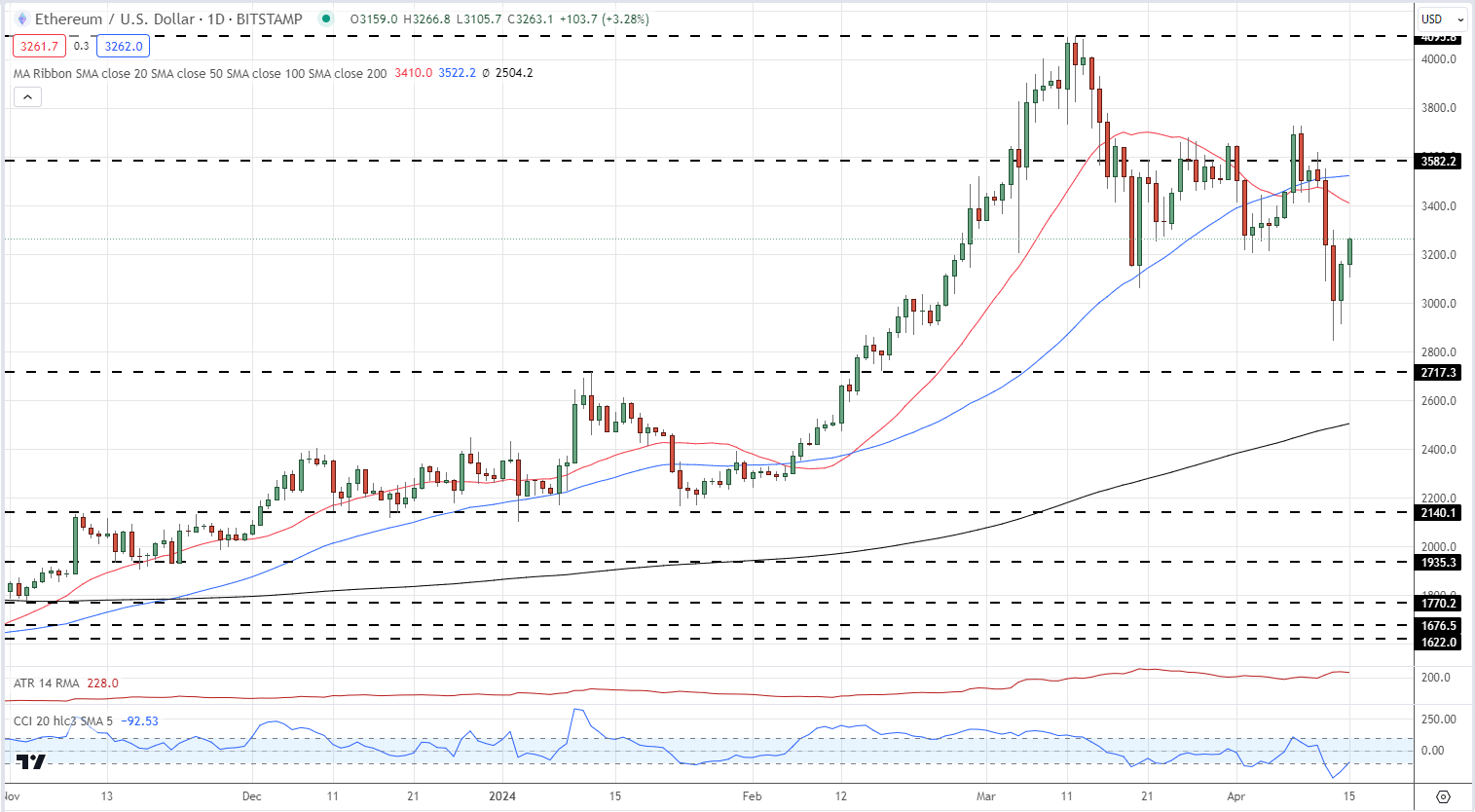

Meanwhile, Ethereum is aiming to surpass its previous low and reach $3,582, with further resistance at $3,728.

Hong Kong Leads in Approving Bitcoin and Ethereum ETFs

Hong Kong has emerged as a forerunner in permitting trading of Bitcoin and Ethereum cash ETFs, outperforming the US SEC’s regulatory processes.

Leading financial institutions such as China Asset Management and Bosera Capital have received approval to introduce these revolutionary products, which will allow investors to buy cryptocurrency shares directly with cash.

Mainland China’s Regulatory Landscape

Despite Hong Kong’s accomplishments, mainland China’s strict crypto rules make it difficult for Chinese investors to access these ETFs.

Regulatory constraints now preclude mainland funds from investing in cryptocurrency-linked goods, highlighting the gap in crypto rules between Hong Kong and the mainland.

Hong Kong Monetary Authority’s Digital Currency Initiatives

Since July of last year, the Hong Kong Monetary Authority (HKMA) has actively advocated for the establishment of digital currencies as a mainstream medium of exchange.

Mainstream banks such as HSBC and Standard Chartered are helping regulated cryptocurrency regulators gain access to banking services, highlighting Hong Kong’s commitment to digital innovation.

Final Thoughts

Unconfirmed reports of spot BTC and ETH ETF approvals in Hong Kong have sparked a large increase in cryptocurrency values, with Bitcoin and Ethereum leading the way.

While regulatory barriers exist, Hong Kong’s proactive approach to digital assets creates a persuasive precedent for global markets, implying a wider acceptance of cryptocurrencies in mainstream finance.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.