Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

One key requirement for traders arises from a constant need to keep up to date with analytical needs and tools. Moving averages for a significant portion of most indicators for market analysis.

So in that light, we’ll expound more about the Hull moving average. Other than just a moving average, the HMA has a specific problem that it helps resolve in average trading strategies.

Our plan is to dig deeper into the whole concept to add value to you as a trader. Therefore, the plan is to seek insights from an expert in the field. Deliberately we‘ve reached out to Ezekiel Chew – a trader, market analyst, and trainer with 20 years of experience in trading.

Ezekiel will help expound what the Hull moving average is. Plus, an explanation of the specific issue it helps with. There are a few pints on the similarity it has with other common MA’s or moving averages.

One key section dedicates efforts to the calculation of the Hull moving average. And to set you on the right footing, there’s a critical discussion on the right settings for HMA. And lastly, before the conclusion and FAQ sections, are the pros/cons of the HMA

What is Hull Moving Average?

The HMA or Hull Moving Average is a trend indicator whose purpose is to show the direction of a trend.

HMA suits traders who ride on strategies that require very high-quality information (eliminates lag altogether). And on most occasions, the traders narrow down to assets with narrow margins and price volatility.

Hull Moving Average combines weighted moving averages or WMAs. In other words, the HMA indicator puts more emphasis on the most recent price changes and, of course, less emphasis on older price points in time.

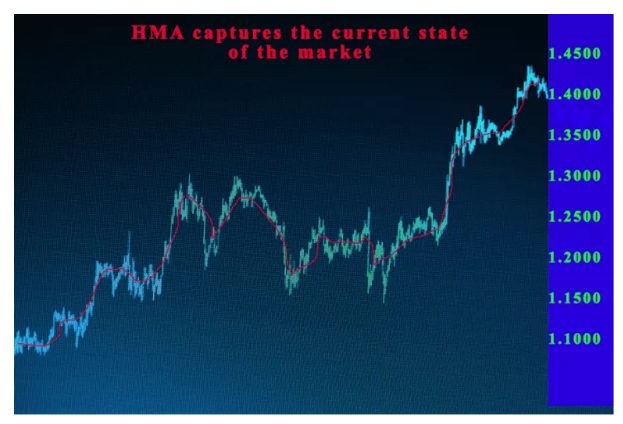

Therefore, with HMA, market analysts ride on moving averages that are a combination of more dynamic and smooth. HMA is, therefore, a comprehensive moving average indicator tool. It helps as a directional trend indicator for picking out the trend that is dominating a market. A good number of traders rely on the HMA indicator to gain more precise insights regarding signals for market entry plus exit.

Precisely, the Hull moving average picks a name from the developer – Alan Hull. Hull combines experiences in trading, mathematics, and Information Technology. He rolled out the directional trend indicator in 2005.

Hull claims that as a technical indicator, the HMA eliminates lags while concurrently improving the smoothing across timeframes.

To date, the Hull Moving average indicator helps both swing and position traders apply it to complement other indicators or confirm trading signals. Of course, this works best after an in-depth analysis of markets.

Technically, experts say there’s nothing so special about the Hull Moving Average. It comprises moving averages with variations in the weighting applications for each. Overall, it remains a very robust technical indicator.

Does HMA Solve the Lag Problem?

Absolutely, the Hull Moving Average helps solve the lagging menace with most short-term moving averages.

By eliminating the lag, HMA is more responsive to price escalations with a more effective smoothing effect. One advantage of HMA is combining the lag with the enhanced smoothing effect concurrently.

Here are three ways in which HMA greatly reduces lag:

- WMA or weighted moving averages by default phase out lag via allocation of additional weighting to the most recent prices.

- HMA also deploys an extra model to further lower the effects of lags. It works by further splitting WAMs into two and deliberately putting more weight on the latest one.

- The last focus is to enhance the smoothing effect by paying more attention to WMA’s within shorter timeframes. The select few timeframes are taken as square root plus placing more emphasis on the latest price points.

From the appearance, HMA achieves a thoroughly enhance moving average line – which stays far, much closer to the candlesticks than normal SMAs.

Expert analysts recommend the application of HMA to spot turning points for prices – it’s more precise at generating entry and exit signals. On a very contrasting note, the HMA is not applicable for the generation of signals for crossovers. The key reason is that crossovers rely heavily on lags.

How Similar is HMA to other Traditional Moving Averages?

Hull Moving Averages have lots of similarities in comparison to other moving averages. The key difference lies in the interpretation.

Specifically, the HMA records a faster response to price fluctuations. On that note, it tends to help confirm signals more precisely. Also, by smoothing and weighting, HMA helps cut down on the noise and irrelevant trends with prices.

In better words, HMA helps focus on the main trends while giving signals of change much earlier. Of all other categories of moving average indicators, HMA is the most efficient.

On a note of comparison, HMA also allows market analysts to make adjustments regarding the period you need to focus on. So, you can adjust it to look far into the price histories as part of the market conditions.

How to Calculate the Hull Moving Average HMA?

The Hull Moving average calculation arises from two components of moving averages or WMA’s of pries. Essentially, the second set of WMA’s is required to eliminate or flatten the escalations sets of raw moving averages.

The formula to arrive at the Hull Moving average comprises three portions:

Firstly, it starts with the estimation of the two-price points. And this primarily arises from picking from a pre-defined number of bars or periods. Plus, the set number of periods is taken as half of the initial set of periods.

Secondly is calculating the raw HMA or raw hull moving average. Next is the position that steadies the raw HMA or simply obtaining the square roots of the scores within the predefined periods.

Thirdly, it’s dividing the outcome or number by two. Or better, getting the square roots, which potentially gives out results of numbers with decimals. Or fractions – not whole.

Next, when the results do not appear as whole numbers, the alternative is to round them off to the nearest whole numbers – it helps with counting and tabulating the cumulative WMAs.

Looking at the inputs and efforts required to arrive at the HMA scores or line, it can be very tedious or even far wildly inaccurate when done manually. The sweet portion is that you must not calculate the hull moving average HMA manually. Trading platforms provide it as part of the custom tools of their software.

Weighted Moving Averages

In the context of the HMA, a Weighted Moving Average -WMA comes out as a tweak of the EMA’s whose power rides on the most recent information.

One key aspect of the Weighted moving averages is the flexibility to come up and help analysts make custom adjustments. More so when it comes to the choice of the number of periods to include in the scope of analysis.

However, the simple departure between WMA’s and the HMA arises with the smoothing effect. It’s the correct smoothing that cuts out the irrelevant trends to leave a way for the main trends alone.

Right Settings of Hull Moving Average Indicator

The HMA, like other technical indicators, is vastly helpful when set up in the correct parameters. So one of the correct settings to get right with the HMA indicator is adjusting to a correct period of timeframe.

By default, HMA indicators capture 14 days. So the flexibility allows you to capture the best applicable period for analysis.

You may ask, which is the best period for your case? And the best way is to approach it practically. Beauty is that you can test a strategy risk-free with the use of demo- or dummy accounts. More important also, keep records of the test runs. Later, do an in-depth analysis of your results.

One other critical question arises; how many days are best to do adequate runs? And experts say you can take as low as 25 days. However, to capture more sample data, flex the days to 25 or double. But the longer, the better.

HMA and Simple Moving Average Discussed

SMA or Simple Moving Average forms the basis of technical analysis. Other than being the easiest of all the forms of moving averages, it helps signal the main trends within specific timeframes.

The worst downside with SMA is the challenge with the highest appearance of lags. And the attempt to expand the scope in periods only tends to increase the lagging effect.

As part of minimizing the effect of the lag, Alan Hull developed the HMA. HMA is amazingly powerful as an indicator that has more precision on the prices. In appearance, HMA is more leveled and traces prices more sharply than SMA.

Pros and Cons of HMA Indicator and Trading Strategy

The HMA, other than being a trend indicator, brings in more advantages. First, it’s easily applicable like most indicators. And reducing the lag gives more potential to traders to get more timely yet precise signals.

Secondly, most brokers incorporate HMA as a freely available indicator on most trading software. So, it’s easy to lay hands on it.

Thirdly, financial and CFD markets move very fast. That brings in high volatility, and the low predictability requires technical analysis and training strategies that bring more helpful and precise analysis.

On the drawbacks, phasing out lags is counterproductive for strategies that target MA crossovers to generate signals.

Best Forex Trading Course

Ezekiel Chew is a successful forex trader who understands technical analysis and its underlying principles. For several years, he has been an industry expert, speaker at important industry events, and a sought-after trainer. He has trained bank traders, professional traders, corporate finance players, and retail traders as well.

From his 20 years of experience in trading the financial markets, he created the ‘one core program’ which can be obtained from the Asia Forex Mentor website. The trading course teaches some proprietary trading strategies which he developed based on statistical and mathematical probability principles. You do not need any prior knowledge of trading or experience as the course teaches from the scratch, so it is suitable for beginners.

Best Forex Brokers

Conclusion: Hull Moving Average

The Hull Moving Average or HMA indicator was developed by Alan Hull in 2005. HMA removes the lag effect prevalent with SMA’s and EMA’s.

HMA uses a smoothing effect to eliminate lags and overall produce more trend precise indicator lines.

The computation formula is complex, but brokers allow it as part of the trading software they provide to analysts.

Other than the 14-period hull moving average strategy, it’s flexible to accommodate other periods as traders deem fit.

Hull Moving Average FAQs

Is Hull Moving Average Strategy Good?

Yes, when you compare with other moving averages, HMA is more responsive and helps with the faster and timely spotting of opportunities.

The HMA achieves that by removing the lag effect on MAs. The indicator line is more precise and flatter within the candlesticks.

What is a good moving average?

By default, most Ma indicators capture a 14-day period, the hull moving average HMA inclusive. But, market analysts are free to adjust the periods either upward or downwards. The best avenue to arrive at what periods work best is using practical trading strategy tests.

Ideally, capturing 15 days is okay. Yet, more time-frame periods are better, like 25 or 50 days. And all that can be done risk-free by use of demo accounts.