Instant Funding Review with Rankings 2025 By Dumb Little Man

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Instant Funding as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Prop firms give traders access to a variety of financial tools and use pooled cash to increase earnings. By fostering a trading environment that prioritizes long-term success and providing its traders with educational support, Instant Funding distinguishes out in this context. Simple policies, aggressive pricing, and excellent risk and compliance systems are how the company sets itself apart.

Using a combination of expert analysis and real user feedback, this review will examine Instant Funding‘s user experience and operational performance. Readers will obtain a comprehensive understanding of Instant Funding’s advantages and disadvantages as a proprietary trading company by mixing professional insights with first-hand trader experiences.

What is Instant Funding?

Dedicated to the long-term growth of the industry and the development of traders, Instant Funding is a contemporary proprietary trading firm and training provider. Transparency, honesty, and high operational standards are valued highly by the company. It aims to change industry standards through a strategy of transparent regulations, aggressive pricing, and effective risk management.

Instant Funding adheres to the highest operational standards frequently found in regulated organizations, even though it is not required to be regulated. To guarantee compliance in every aspect of business, including trade handling, risk management, and customer relations, the firm works with legal experts in the US and the UK.

Instant Funding extends an invitation to anyone to become part of its expansion as a team member or affiliate partner. Being a customer-first and compliance-oriented company, it distinguishes itself as a pioneer in the proprietary trading industry. Everyone engaged stands to gain a great deal from the company’s commitment to developing a strong and long-lasting business strategy.

Pros and Cons of Instant Funding

Pros

- Variety of funding options

- Flexible trading periods

- Potential 90% profit split

- Intuitive user interface

- Advanced technology

- Lenient trading rules

- Services available in over 180 countries

- Transparent information for informed decision-making

- Responsive customer support

Cons

- Higher pricing model

- Unverified funding claims

- New market player

- Limited third-party feedback

- Limited diversification opportunities

Safety and Security of Instant Funding

Instant Funding offers its customers simulated accounts only. These accounts use simulated market inputs to create trading conditions, therefore ensuring that all trading activities occur in a virtual setting.

Instant Funding does not engage customers in actual market trading. Instead, in order to better its own trading techniques, the corporation uses these fake accounts to collect data on strategies that work and those that don’t. Although most consumer activity does not normally include this, it may also use data from consumer-simulated trades to manage actual fund trading on its own accounts.

Remember that any trading made with the tools offered by Instant Funding uses virtual funds from the account. Traders are mostly paid by the company through registration fees rather than actual trading profits. Clients should read the Terms and Conditions that the Instant Funding program provides for thorough details.

Instant Funding Bonuses and Contests

For traders who enjoy simulated market testing, Instant Funding offers both One-Phase and Two-Phase Challenge Models. The One-Phase strategy has a 3% daily drawdown, a 10% profit target, and no time limits. It is simple to assess. Upon successful completion, traders receive money and receive a 20% gain over a 60-day period, increasing their payment from 80% to 90%.

The Two-Phase strategy poses a greater challenge for traders who want to enhance their risk management and expertise. In order to proceed, traders must adhere to a daily drawdown limit of 5% and fulfill profit targets of 8% and 5%, respectively. This method can raise payout rates to 90% after reaching milestones and has no time constraints.

To avoid account inactivity for both challenges, at least one trade must be made every thirty days. As a result, participation and funding growth continue, supporting the platform’s flexibility and trader growth.

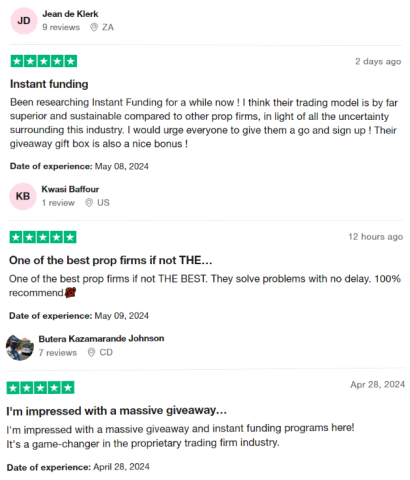

Instant Funding Customer Reviews

Consumers note Instant Funding‘s influence on the proprietary trading business sector and give it praise for its creative giveaway and funding initiatives. Because of its excellent, sustainable trading approach and quick problem-solving, many consider it to be one of the greatest prop firms, if not the best.

Positive comments include suggestions to use their services, with particular appreciation for the gift package that was given as a bonus.

Instant Funding Commissions and Fees

Instant Funding provides a clear pricing structure with no hidden fees, offering account sizes ranging from $1,250 to $80,000, with fees between $79 and $3,460. This transparent model benefits both beginner traders, who may be undercapitalized, and experienced traders through the Challenge programs.

The Instant Funding Affiliate Program enables significant passive income opportunities by inviting contacts to join via an affiliate link. Affiliates receive a 10% commission on first orders and offer a 10% discount to their invitees, with bi-weekly payments and no minimum withdrawal requirement, alongside regular promotions and robust support.

Instant Funding Account Types

For all account types, the following details apply: The profit target is set at 10%, with a baseline profit split of 80% and a scaled profit split of 90%. Accounts can scale up to 100% of the starting balance or up to $1.6 million, with a scale target of 10%. There are no time limits for these accounts. Leverage for currencies is up to 1:100, for commodities up to 1:20, for indices up to 1:20, and for crypto up to 1:2. For swing trading accounts, the leverage is up to 1:30 for currencies, up to 1:8 for commodities, up to 1:10 for indices, and up to 1:1 for crypto.

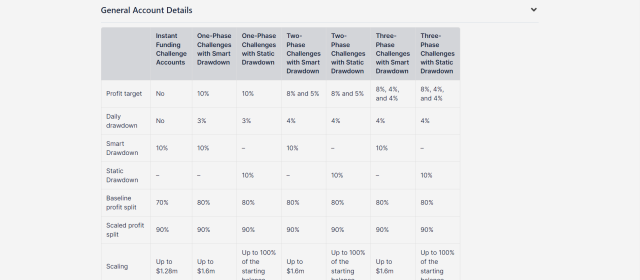

Here are the account types and how they differ with each other:

One-Phase Challenges with Smart Drawdown

- Daily drawdown: 3%

- Smart Drawdown: 10%

One-Phase Challenges with Static Drawdown

- Daily drawdown: 3%

- Static Drawdown: 10%

Two-Phase Challenges with Smart Drawdown

- Profit target: 8% and 5%

- Daily drawdown: 4%

- Smart Drawdown: 10%

Two-Phase Challenges with Static Drawdown

- Profit target: 8% and 5%

- Daily drawdown: 4%

- Static Drawdown: 10%

Three-Phase Challenges with Smart Drawdown

- Profit target: 8%, 4%, and 4%

- Daily drawdown: 4%

- Smart Drawdown: 10%

Three-Phase Challenges with Static Drawdown

- Profit target: 8%, 4%, and 4%

- Daily drawdown: 4%

- Static Drawdown: 10%

Instant Funding Challenge Accounts

- Profit target: None

- Daily drawdown: 10%

- Baseline profit split: 70%

- Scaling: Up to $1.28m

- Minimum trading days: None

Opening an Instant Funding Account

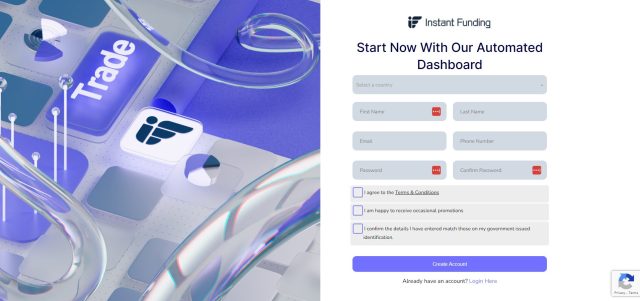

Here are the steps to create an account on Instant Funding:

- Start by going to the Instant Funding website.

- Explore the Smart Drawdown feature to understand how it differs from traditional trailing drawdowns.

- Familiarize yourself with the daily loss calculation. Note that you can remove the Daily Drawdown Limit after your first payout.

- Enter any promotional codes you have during the registration process to take advantage of special offers.

- Check the specific rules for the account type you are interested in on the rules section on the FAQ page of the website.

- Complete the registration form on the website to set up your new trading account. Be sure to input all required fields accurately to avoid delays.

- Verify your identity by uploading the necessary documents as part of the account setup process. This step is crucial for compliance and to secure your account.

- After understanding all terms and completing registration, proceed to fund your account according to the chosen account size.

- You can now begin trading under the conditions set forth by Instant Funding, taking advantage of no time limits and favorable drawdown terms.

Instant Funding Customer Support

In order to guarantee efficient and timely service, Instant Funding provides a variety of customer support options. Their Live Chat feature is open 24/7 and usually answers basic questions on trading regulations in less than a minute. Additionally, users can join the Instant Funding Discord channel to get quick answers to common inquiries.

Contact [email protected] when you have questions regarding purchased accounts; you should expect a response in a day or two. Contact [email protected] when you have inquiries about partnerships or issues with affiliate payouts. In addition, Instant Funding is active on several social media sites, such as LinkedIn, Facebook, YouTube, Instagram, Twitter, and Telegram.

Advantages and Disadvantages of Instant Funding Customer Support

| Advantages | Disadvantages |

|---|---|

|

Instant Funding Withdrawal Options

Instant Funding pays out on the 14th day following your trade, and you can receive payouts every 7 days after that. After the initial payout period, you can access your earnings more frequently thanks to this expedited schedule. As per the rules, make sure all deals are finished before asking for a reward.

Instant Funding only allows withdrawals made using RISE, a platform that streamlines and speeds up the payout procedure. Close all open transactions and make sure the Smart Drawdown has been locked in order to start the withdrawal process. Choose RISE from your automated dashboard, input the appropriate amount, and provide your email address to receive additional instructions.

If a withdrawal request is made during the workweek, it will be handled in 24 hours. On the following business day, requests submitted on weekends or on UK bank holidays are handled. To prevent paying SWIFT costs for any necessary adjustments if the bank data are inaccurate, it is imperative that the transaction’s bank details are entered accurately.

Instant Funding Challenges and Difficulties

Like some others without relaxed trading rules, the strict enforcement of protocols, especially with regard to trade stacking, may present substantial issues for Instant Funding users. Using an aggressive trading approach to scale initial investment dramatically over a short period of time can result in many alerts and finally a flag from the support team, which might lead to account suspension.

This is indicative of a larger trend where trading activity that departs from predetermined standards may result in account restrictions or bans due to the firm’s stringent compliance checks. Traders who want to use high-risk tactics like stacking need to be aware of these rules in order to prevent account closure and loss of earnings.

How to Pass Instant Funding Evaluation Process

A comprehensive training program is required to prepare for the strict Instant Funding evaluation. Participating in such a program allows traders to gain the core information and skills needed to meet Instant Funding’s demanding requirements. Having the necessary resources will significantly increase your chances of passing the evaluation and being hired as a trader by Instant Funding.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is highly recommended by trading experts at Dumb Little Man for those serious about passing the Instant Funding evaluation process. Founded by Ezekiel Chew, a renowned forex trader with two decades of experience, Asia Forex Mentor has successfully guided thousands of traders through proprietary firm evaluations.

Ezekiel Chew, who also leads the Golden Eye Group, created the One Core Program specifically to teach traders effective forex trading strategies. His platform started from humble beginnings, offering lessons to close friends, and has since expanded to a comprehensive online training program. Chew’s track record in forex trading and his dedication to education make Asia Forex Mentor a top choice for traders aiming to succeed in Monevis’s challenging evaluation.

How Could Asia Forex Mentor Help You Pass Instant Funding Challenge?

Asia Forex Mentor is ideally equipped to assist traders in navigating Instant Funding‘s evaluation process, owing to its renowned training programs and established reputation within the trading community. Here are the main reasons why this platform stands out:

- Awarded Most Comprehensive Course: Asia Forex Mentor’s One Core Program was the best comprehensive forex training, according to Investopedia. This award illustrates how comprehensive the forex trading training is, covering everything you need to succeed.

- Recognized for Excellence in Forex Education: Benzinga, a financial news and research firm, voted the One Core Program the best forex trading training for beginners. This prize proves the program can aid new and seasoned traders, making it ideal for Monevis challengers.

- Best Forex Mentor: The platform got BestOnlineForexBroker’s 2021 Forex Mentor award. Their award illustrates how well they coach and how much purchasers can profit on the currency market with their aid.

- Top-Ranked Forex Trading Course: Experts reviewed many forex trading schools and chose Asia Forex Mentor for its best trading methods and systems. This ensures traders learn from the best and employ proven trading tactics.

Asia Forex Mentor Members’ Testimonials

The AFM OneCore Program is known for its thorough forex trading teaching. Starting with the basics and progressing to professional approaches, it can assist beginners without financial experience. The course’s breadth, clarity, and practical application of techniques through live trading videos boost students’ confidence in real-world trading scenarios.

Participants like the curriculum because it delivers unique trade perspectives and ideas. Clear, engaging, and instructional training material distinguishes it from other trading courses. Overall, the program is highly recommended for anyone interested in a Forex trading career due to its value and comprehensiveness.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Instant Funding Review

Instant Funding is ideal for traders seeking flexible funding, transparent trading conditions, and a simple account scaling process. These features attract new and seasoned traders looking to enhance their trading potential and financial gain. To avoid funded account suspension, potential users must follow the firm’s severe compliance and trading guidelines.

Top-tier training programs are necessary for traders who aim to succeed in Instant Funding’s rigorous environment. The AFM One Core program can equip traders with the necessary skills and strategies to navigate the platform’s unique challenges effectively. This not only enhances a trader’s ability to leverage Instant Funding’s offerings but also mitigates risks associated with strict protocols.

Instant Funding Review FAQs

How do I know I’m going to get paid my profits?

Unlike other prop firms, Instant Funding works solely with regulated and insured brokers and liquidity providers to guarantee the availability of funds for payout to our successful forex traders globally. They aim to support consistent traders and offer them the best possible conditions to enhance their consistency and profitability.

Can I retry my Instant Funding account?

If a trader fails to pass the challenge, they will have the option to reset their evaluation at a discounted price. If you lose Instant Funding accounts, you will be presented with a retry button to restart at a discounted rate. This button is available on the dashboard and will apply the discount at checkout automatically. However, please note that program and reset prices are subject to change.

How do I make sure my account Instant Funding account is secure?

At the Instant Funding prop firm, securing your account password is your responsibility, as the company does not manage password security. If necessary, use the Investor password, which can be changed every 30 days by contacting the support team. If your password is compromised, contact the team for a change that’s possible once every 30 days to gain instant account access.

RECOMMENDED TRADING COURSE REVIEW VISIT #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try!