Japanese Stocks Soar to New 52-Week High Amid US Fed Rate Outlook; Yen Makes a Strong Comeback

By Daniel M.

March 21, 2024 • Fact checked by Dumb Little Man

The Japanese stock market rose to a 52-week high on Thursday, boosted by the US Federal Reserve’s reaffirmation of its dovish stance, with three rate cuts expected this year. The Nikkei 225 index rose 2%, closing at 40,815.66, and briefly peaked at 40,823.32.

Economic and Corporate Highlights

The Ministry of Finance reported a considerable reduction in Japan’s trade deficit in February, citing a 7.8% year-over-year growth in exports.

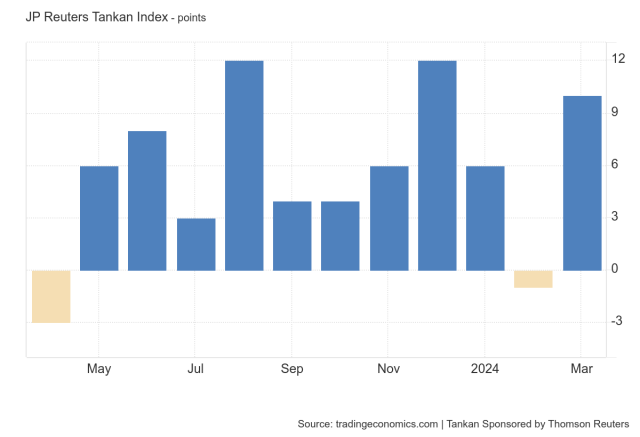

Concurrently, the Reuters Tankan survey reported an increase in business sentiment among large manufacturers to +10 in March, up from -1 in February, boosted by the car, oil refining, and chemical industries.

On the corporate front, Nippon Signal, and Takamatsu Construction had their shares rise by more than 2%, while JCR Pharmaceuticals saw a nearly 1% boost after Nippon Signal announced a higher dividend prediction.

Diverging Paths of the Fed and BOJ

The Federal Reserve’s commitment to easing contrasts with the Bank of Japan’s (BOJ) recent policy change, which included its first rate hike since 2007 and the conclusion of eight years of exceptional stimulus.

However, BOJ Governor Kazuo Ueda maintained that policy would remain substantially accommodative, hinting at another rate hike later this year. This gap has spurred investor confidence, prompting a comeback to the stock market.

Nomura’s chief equity strategist, Yunosuke Ikeda, cited continuous favorable factors such as improved corporate governance, the end of deflation, and shifting fears about China as all supporting Japanese shares.

Currency and Bond Market Movements

The yen rebounded against the dollar, dropping to 150.94 after reaching a four-month high. Market speculation revolves around probable BOJ actions, with forecasts pointing to a gradual tightening approach.

Meanwhile, Japanese Finance Minister Shunichi Suzuki expressed concern over currency swings but stayed silent on involvement. Japanese government bond rates rose little across maturities, reflecting market reaction to the BOJ’s recent policy meeting and uncertainty about future moves.

Final Thoughts

As Japan’s stock market soars and the yen recovers, investors and traders navigate a landscape shaped by the US Federal Reserve and the Bank of Japan’s opposing monetary policies.

While the immediate future seems promising for Japanese equities, the changing scenario necessitates close monitoring of economic indicators, company performance, and global market trends.

As the BOJ considers more policy changes, the interplay of these factors will continue to impact investor sentiment and market trends.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.