Japanese Yen Forecast Update: USD/JPY, GBP/JPY, EUR/JPY

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

JAPANESE YEN OVERVIEW

The Japanese services PPI spiked in April, marking the most significant increase since March 2015. This rise of 2.8% year-over-year surpassed the expected 2.3%, highlighting potential shifts in Japan’s monetary policy as the Bank of Japan aims to solidify customer inflation.

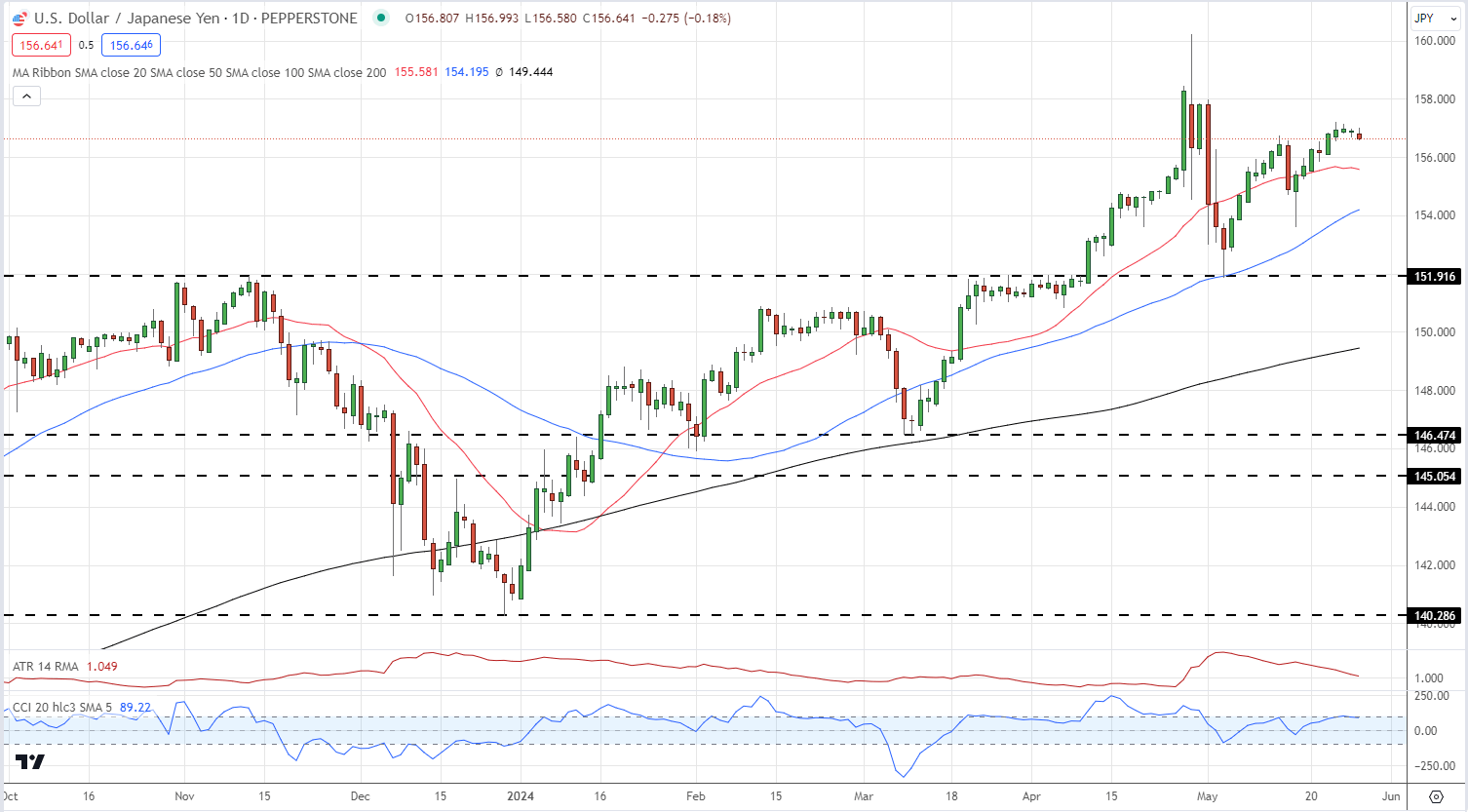

USD/JPY Analysis

The USD/JPY pair has been displaying a pattern of higher lows since December, though the trend of higher highs has stalled, potentially due to fears of official intervention. For the USD/JPY to decline, it would need to break below the 20-day and 50-day SMAs, positioned at 155.58 and 154.20 respectively. Any upward movement could face resistance at 158.00 and the recent spike high of 160.21.

USD/JPY Daily Price Chart

Retail trader data indicates a contrarian view might be appropriate, as 26.27% of traders are net-long, but the short-to-long ratio stands at 2.81 to 1. The current net-short positioning suggests USD/JPY could continue to rise.

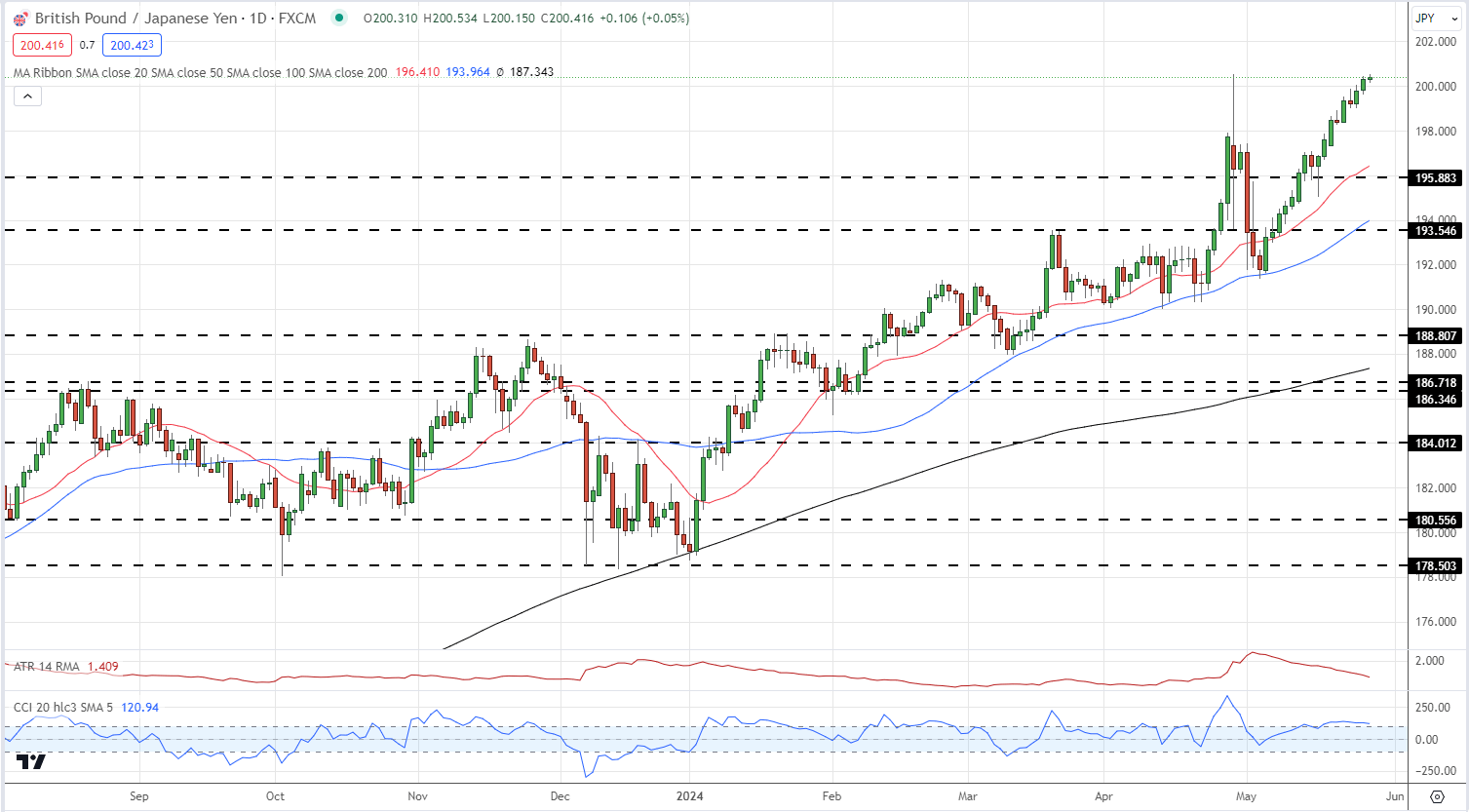

GBP/JPY Outlook

Sterling’s strength continues to propel GBP/JPY higher, fueled by delayed expectations for UK rate cuts. This shift in monetary policy sentiment has pushed GBP/JPY towards the 200 level, nearing highs last seen in August 2008. Further strength could see the pair testing 202 and 205 levels.

GBP/JPY Daily Price Chart

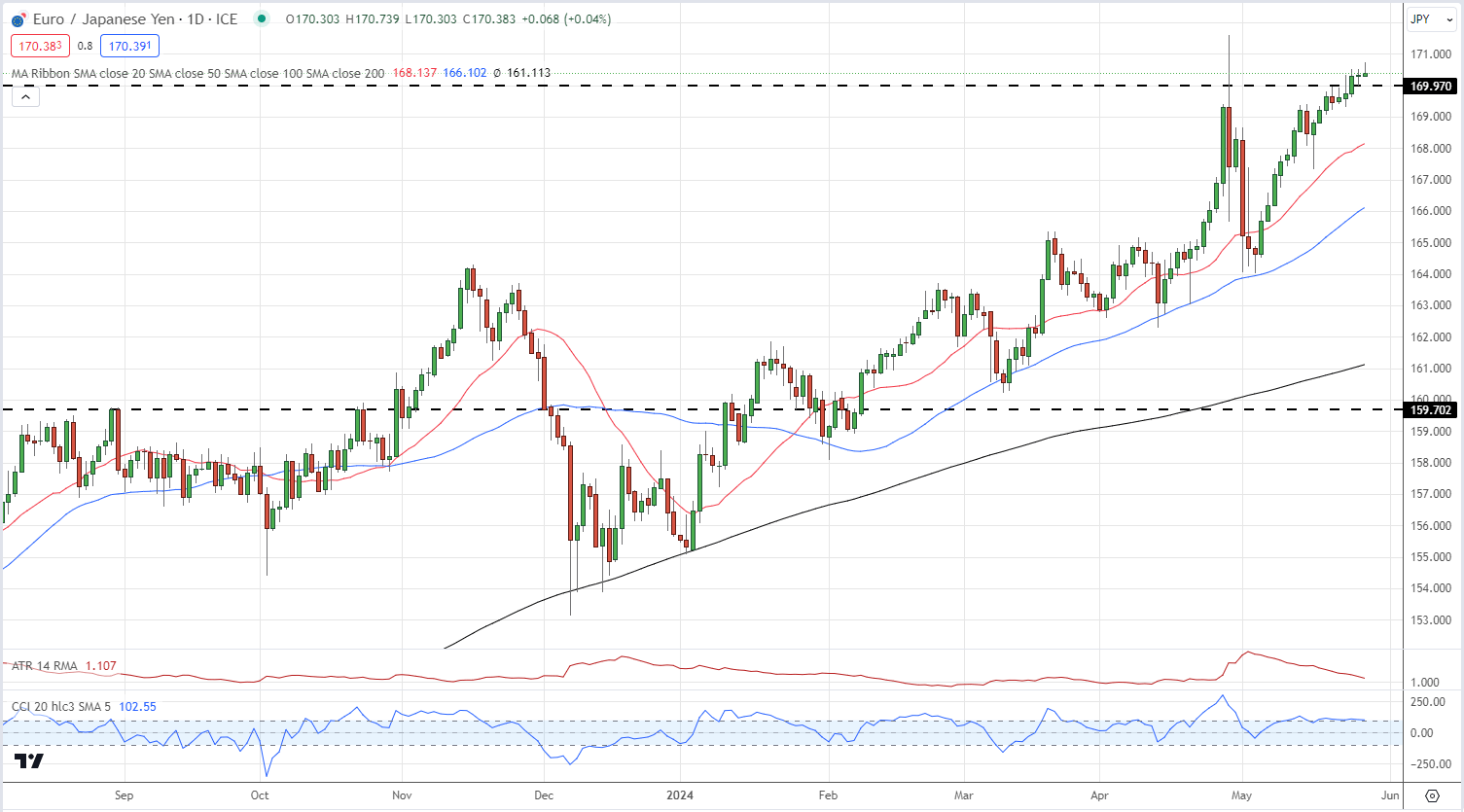

EUR/JPY Projections

The EUR/JPY pair’s trajectory is somewhat mirroring that of GBP/JPY, although influenced by differing economic policies. The European Central Bank is anticipated to cut rates by 25 basis points soon, which might limit the pair’s upward momentum.

EUR/JPY Daily Price Chart

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.