Market Downturn: Dow and Nikkei Drop, Nasdaq Limits Losses

By Daniel M.

May 30, 2024 • Fact checked by Dumb Little Man

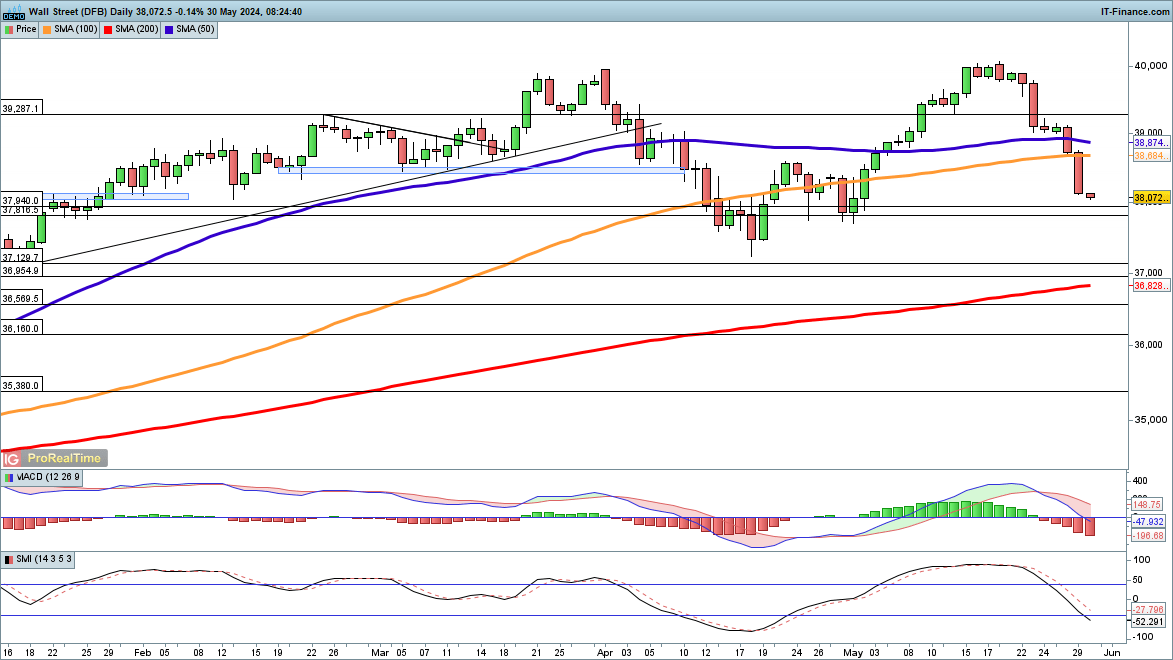

Dow’s Gains Erased in May

The index has relinquished the gains acquired since the start of the month, plunging 2000 points within two weeks. This shift has altered the market outlook from short-term bullish to near-term cautious.

Support might emerge around 37,000 and 37,850—levels where buyers previously entered. If the Dow closes below its mid-April low, it might challenge the 200-day SMA for the first time since November. A rebound above 38,500 could indicate a potential low point has been established.

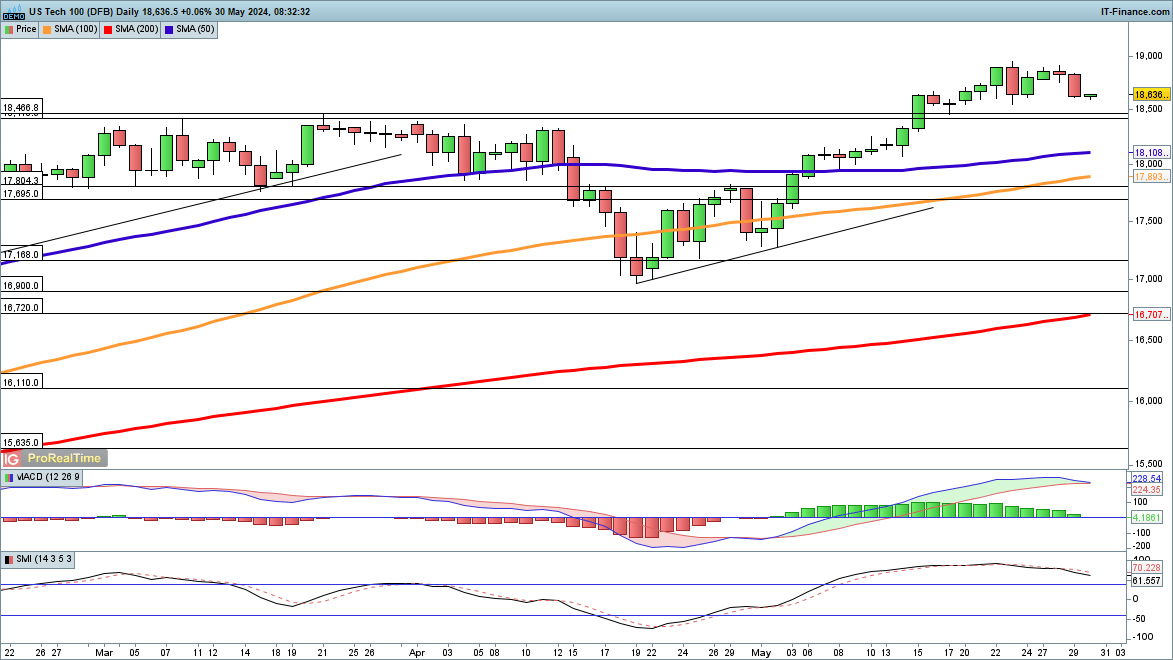

Nasdaq 100 Withstands Major Losses

Thanks to robust performance in tech sectors, the Nasdaq 100 has avoided the significant downturns impacting the Dow.

Remaining close to its recent peaks, a breakout above 18,800 could signal the beginning of an ascent towards 19,000. Conversely, a fall below 18,400 would push the index beneath its early year highs, potentially testing the 50-day SMA.

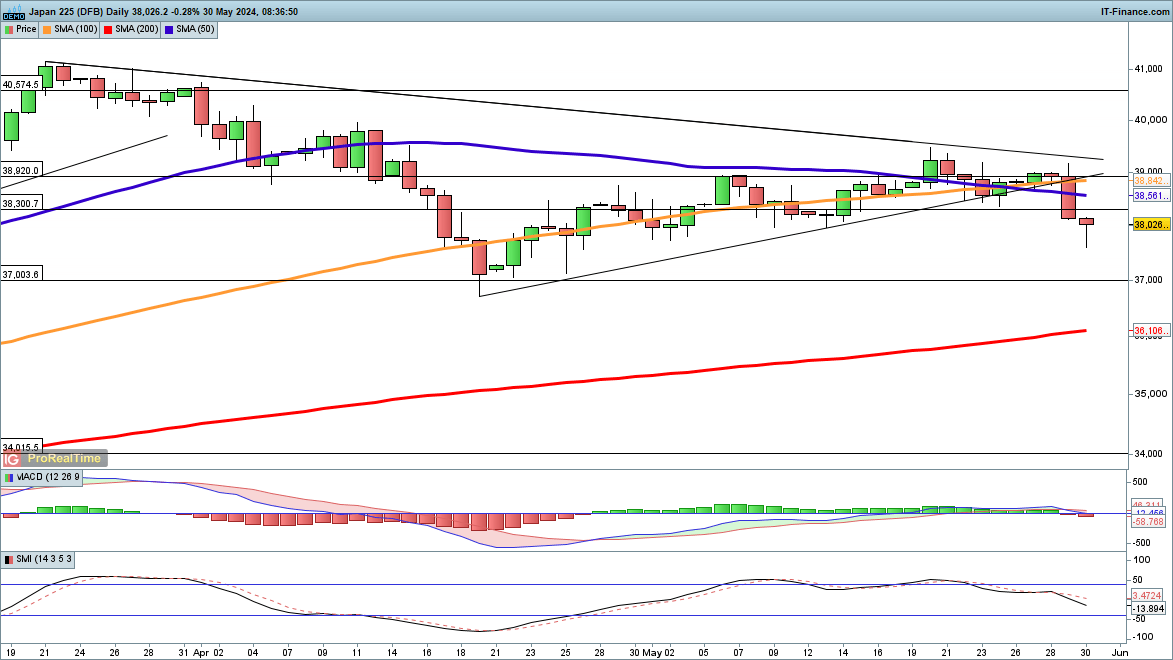

Nikkei Faces Pressure

During Wednesday’s trading, the Nikkei endured substantial losses, dropping below its trendline support since April and hitting a three-week low. Thursday’s session continued this decline, touching a one-month nadir.

If the index can reclaim the 38,300 mark, it may indicate some stabilization. Otherwise, further drops could revisit the mid-April lows near 37,000.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.