Market Outlook: Key Trades Ahead of CPI Release

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

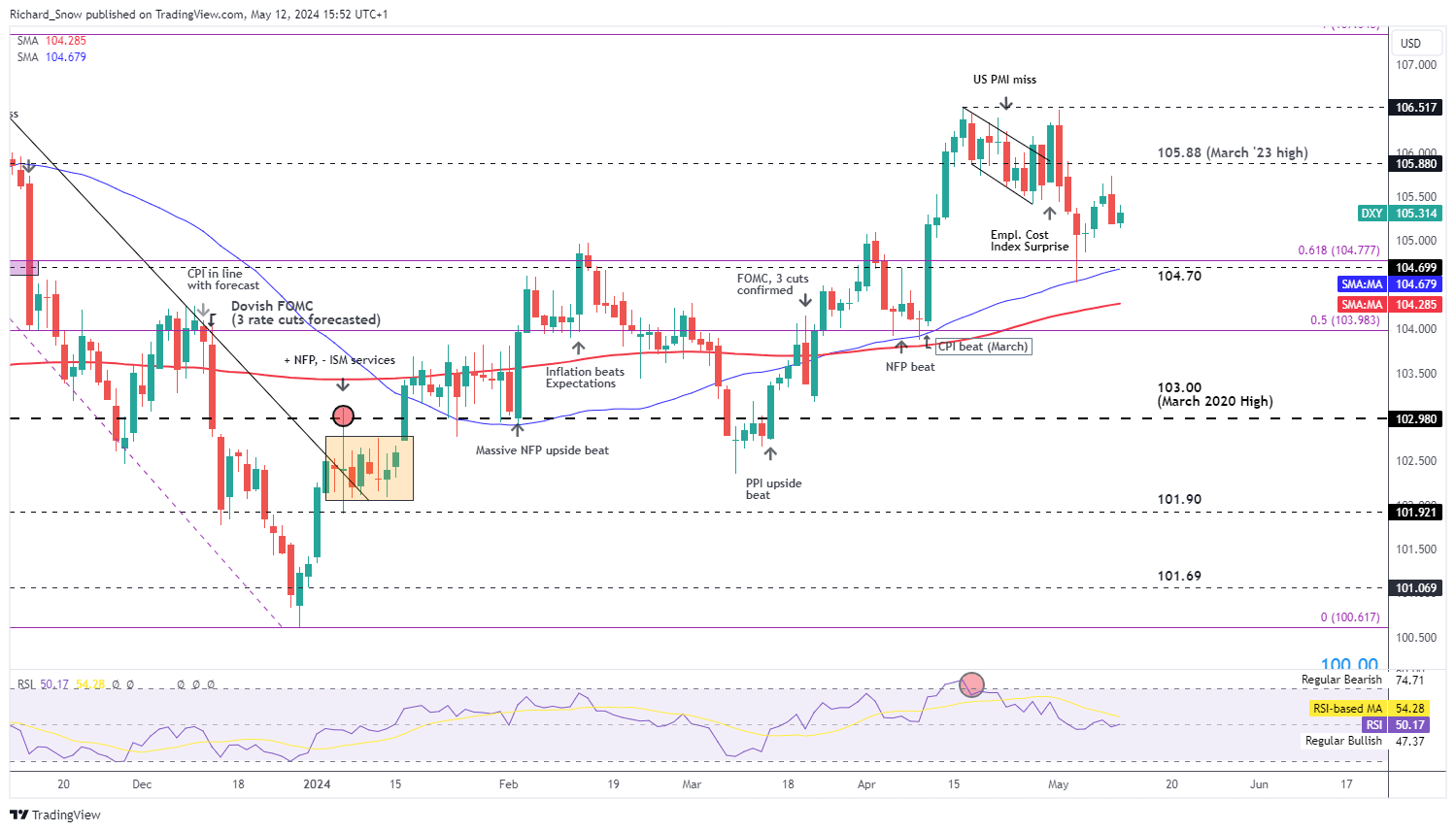

Directional Catalysts for the US Dollar

The US dollar showed uncertainty last week, swayed by fresh data including initial jobless claims. Upcoming US CPI data on Wednesday could significantly influence the dollar, especially if it deviates from expectations. Historical data indicates that high inflation rates tend to drive interest rates and the dollar upwards, as shown in March when the core CPI rose by 0.4% for three consecutive months. The upcoming report could be crucial if the inflation rate drops to 0.2% or lower.

US labor market trends also contribute to the dollar’s trajectory. Recent data including a disappointing NFP and high jobless claims have capped potential gains for the dollar. A higher CPI could offset these effects, but a lower CPI aligned with recent weak job data could further depress the dollar.

US Dollar Basket (DXY) Daily Chart

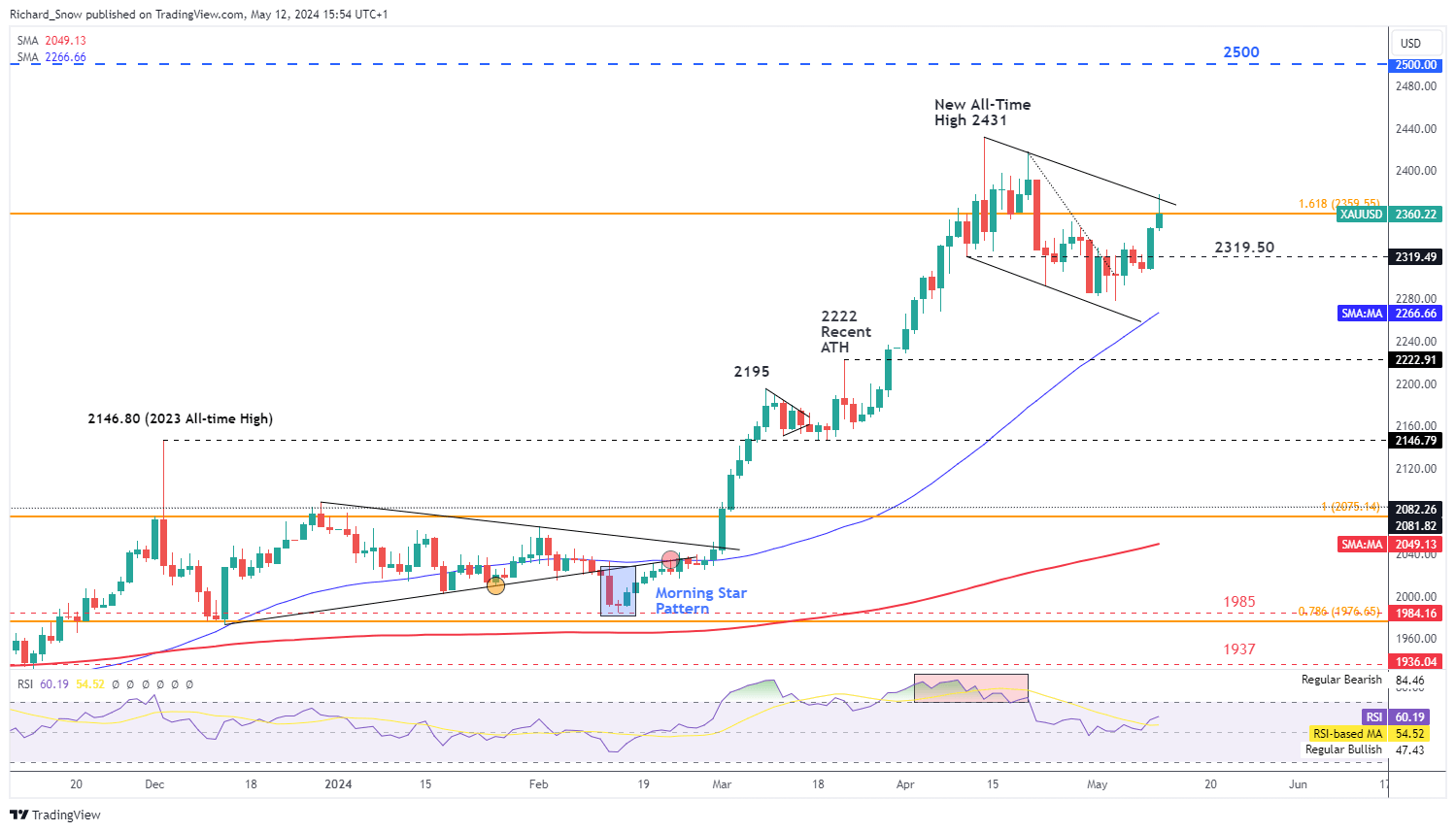

Gold Eyes Inflation Data for Movement Gold experienced a surge late last week, reversing from earlier declines. Despite failing to breach trendline resistance, gold ended the week on a high note, reacting to shifts in the US Treasury yields, interest rate forecasts, and dollar strength. A lower-than-expected CPI could boost gold prices, potentially retesting record highs.

Gold (XAU/USD) Daily Chart

Technical and Fundamental Forecasts

- The dollar’s recent recovery is supported by modest increases in bond yields, with further gains possible if CPI exceeds expectations. Conversely, both gold and silver showed strength after recent US jobless claims indicated a softening labor market.

Sterling Outlook Amid Economic Indicators

- The British Pound might gain from recent positive economic news, though potential rate cuts by the Bank of England next month could impact its strength.

Euro’s Stability Tested by US Data

- The euro has managed to hold its ground, largely due to weaknesses in other currencies. However, the upcoming US CPI data could challenge the euro’s resilience.

This summary provides investors with insights into potential market movements, driven by upcoming US economic data, impacting key currency pairs and commodities.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.