Market Sentiment: FTSE 100, S&P 500 & Nikkei 225 Rising

By Daniel M.

July 30, 2024 • Fact checked by Dumb Little Man

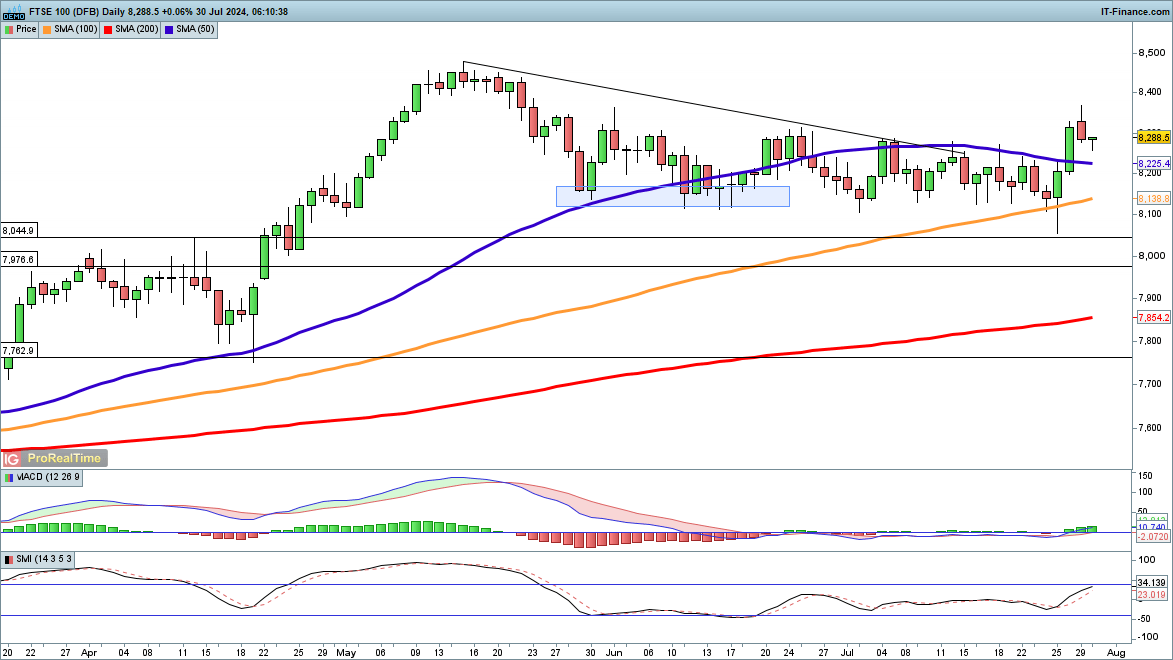

FTSE 100 Breakout Persists

At the end of last week, the FTSE 100 staged an impressive breakout from the range that had dominated since late May. The price surged through the 50-day simple moving average (SMA), reaching a two-month high after hitting a three-month low on Thursday.

While it stalled yesterday, it has resumed its upward movement and appears on course to revisit the May highs. A close below 8200 would negate this outlook.

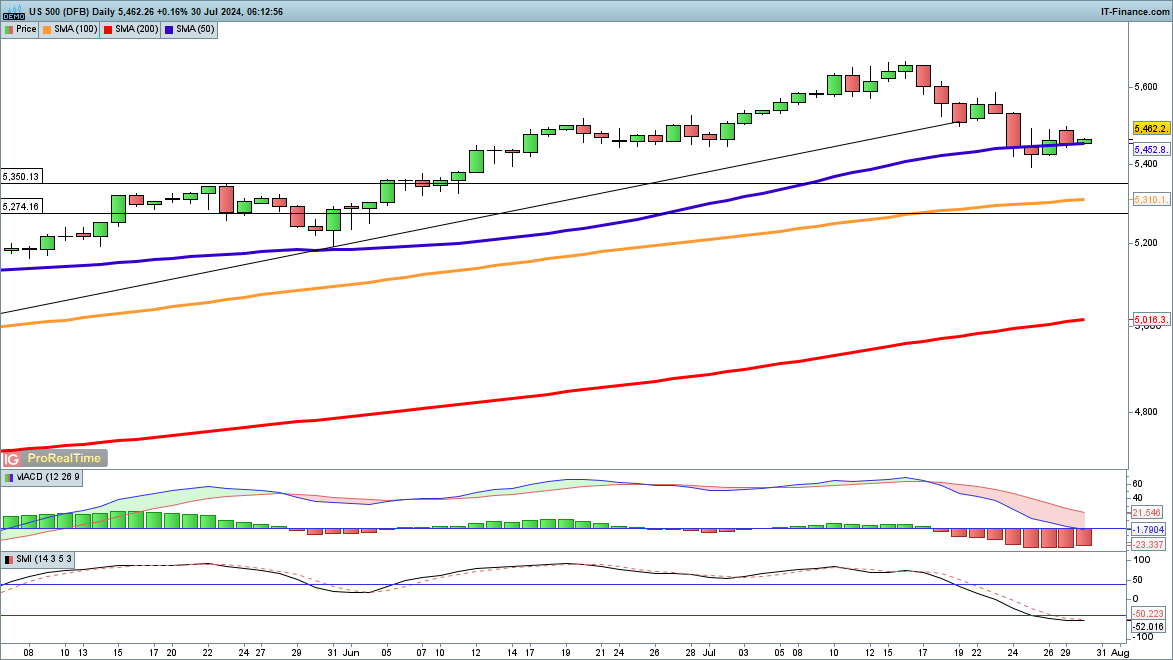

S&P 500 Forms Higher Low

The S&P 500 continues to form a higher low, having rallied back above the 50-day SMA after falling to 5400 last week. A close above 5500 would strengthen the bullish perspective and set the index on a path to target the July highs. Despite the recent volatility, this appears to be a typical pullback.

A reversal below 5400 is required for sellers to regain control.

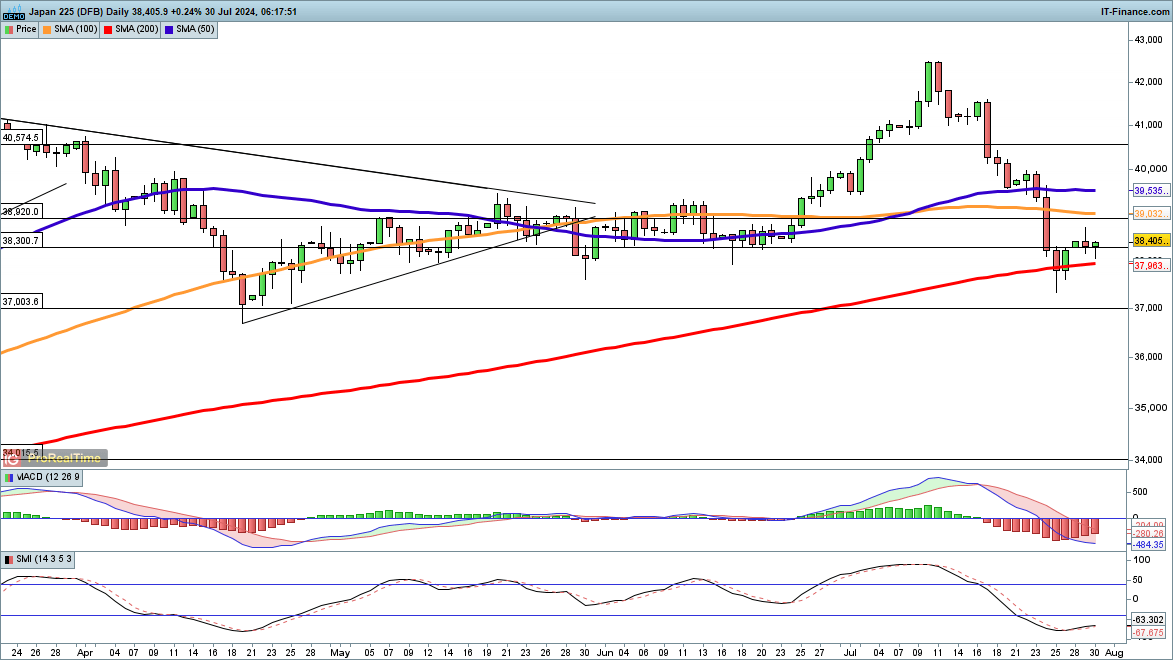

Nikkei 225 Moves Higher

The Nikkei 225’s significant drop has paused for now, after briefly dipping below the 200-day SMA last week. Although it showed little change on Monday, it gained overnight and moved back above the 38,300 level, which marked support in June. Further gains could target the 100-day and 50-day SMAs, and then the 40,000 level.

Sellers will look for a close below the 200-day SMA and a move below 37,500 to pave the way for more downside.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.