Markets Rebound: Dow, Nasdaq 100, and DAX Recover

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

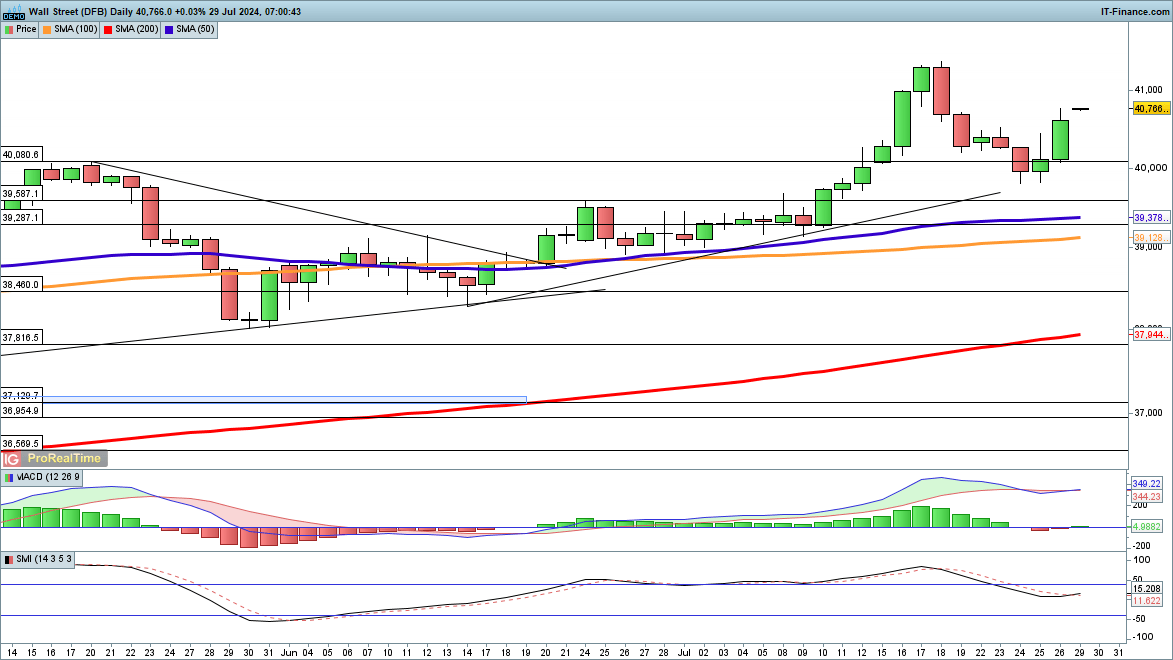

Dow Climbs Higher

The Dow staged a robust recovery last week, surging back above 40,000 after a dip from its record high in July. It opened higher at the start of this week and is now on track to test the July high at 41,390. Breaking this level would signal new record highs.

A reversal below 40,000 would invalidate this outlook.

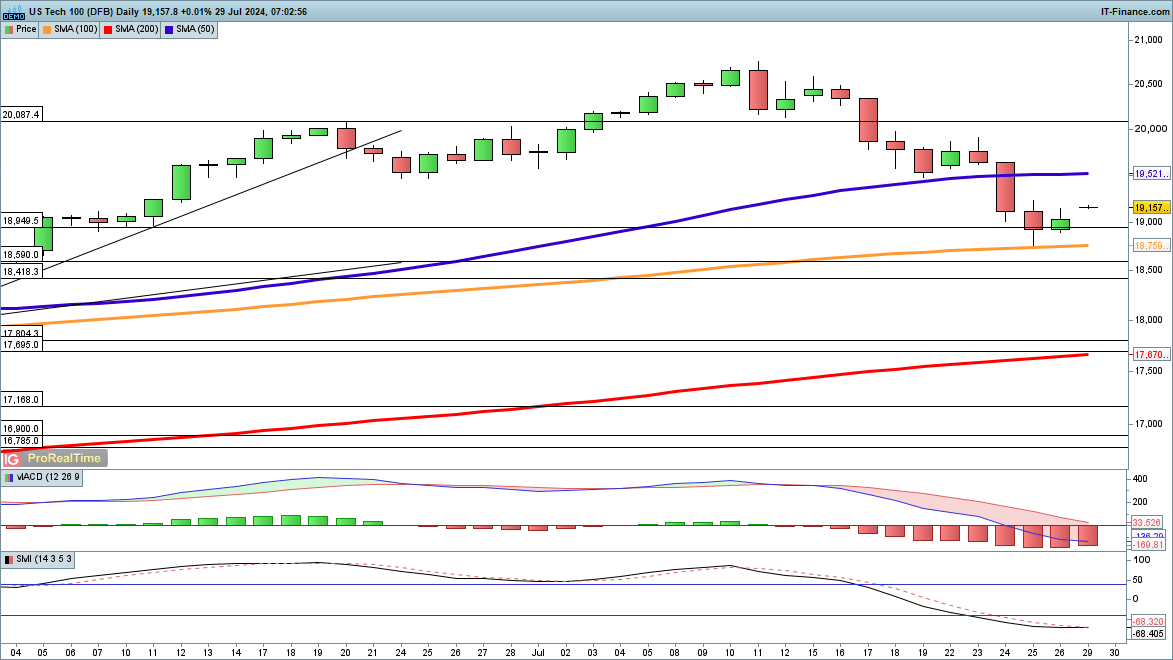

Nasdaq 100 Bounces from Recent Low

The Nasdaq 100 halted its decline at the 100-day simple moving average (SMA) last week and has climbed back above 19,000. With several major tech companies reporting earnings this week, further gains might be challenging. However, a low seems to have been established for now. Additional gains and a close above the 50-day SMA would bolster the bullish perspective.

Sellers will aim for a reversal below the 18,800 level this week and then below the 100-day SMA, undermining the higher low thesis.

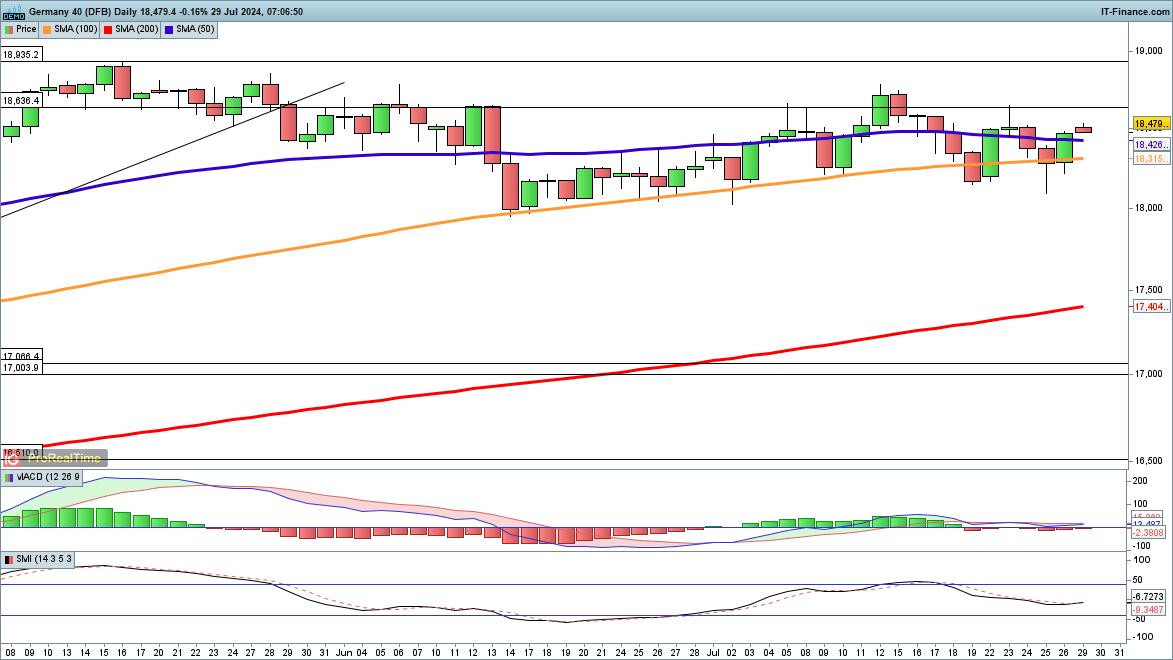

DAX at Upper Range

The DAX has not mirrored the sharp recoveries of its US counterparts but has also sidestepped their severe losses. It continues to avoid a decisive close below its 100-day SMA, which has acted as trendline support since mid-June. The index rebounded on Friday and is now poised to test previous resistance at 18,600. Beyond this lies the mid-July high at 18,786.

Sellers are looking for a firm close below the 100-day SMA, followed by a drop through 18,000, to break the support zone of the past six weeks.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.