Markets This Week: ECB Rate Decision, US Jobs Data, and Market Movements

By Daniel M.

June 3, 2024 • Fact checked by Dumb Little Man

Navigating Market Volatility: Key Events and Indicators

This week could be marked by significant volatility, highlighted by the European Central Bank (ECB) policy meeting and the US employment report. Traders are eyeing these events as potential catalysts. The ECB is anticipated to reduce interest rates by 25 basis points. A critical question remains: will ECB President Christine Lagarde indicate when the next reduction will occur? Market speculations suggest a possible announcement on September 12, though October 17 appears more likely. Analysts and traders will closely analyze the nuances of the ECB’s post-decision press briefing.

In the US, a series of employment data, including the JOLTS report, ADP employment figures, and initial jobless claims will precede Friday’s comprehensive US Jobs Report. The expectation of US rate cuts has been postponed in recent months as inflation continues to challenge the Federal Reserve. Any signs of weakening in the US employment sector could prompt a reevaluation of upcoming US rate adjustments.

Further, the Bank of Canada will reveal its latest policy decision. Additionally, Australia’s GDP figures are due for release, and the US ISM Services data will be a focal point for market watchers.

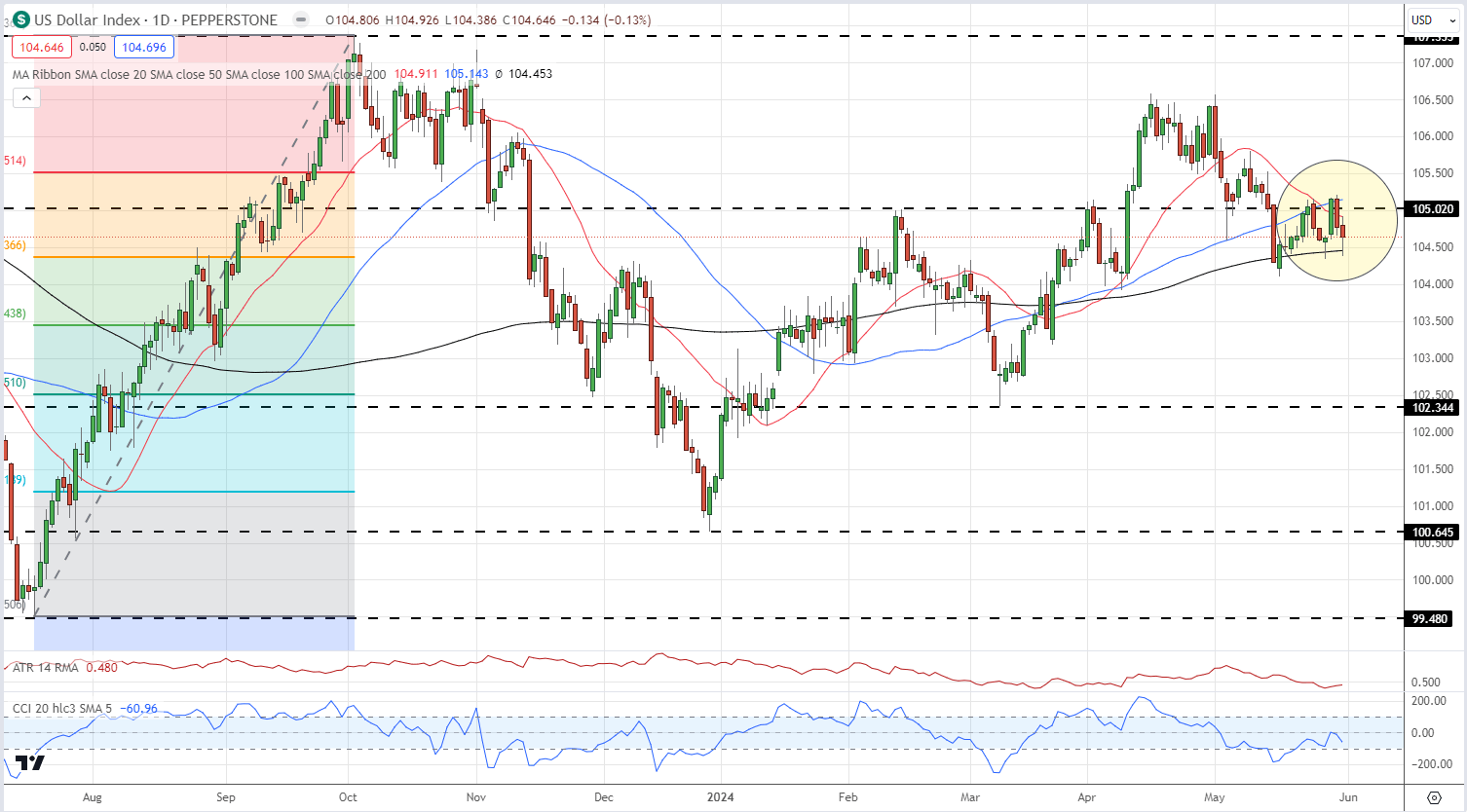

The US Dollar is experiencing downward pressure, now just 20 pips from a two-month low. Technically, the US Dollar Index is challenging the 200-day simple moving average. A decisive dip below this level could push the dollar under the 104.00 mark.

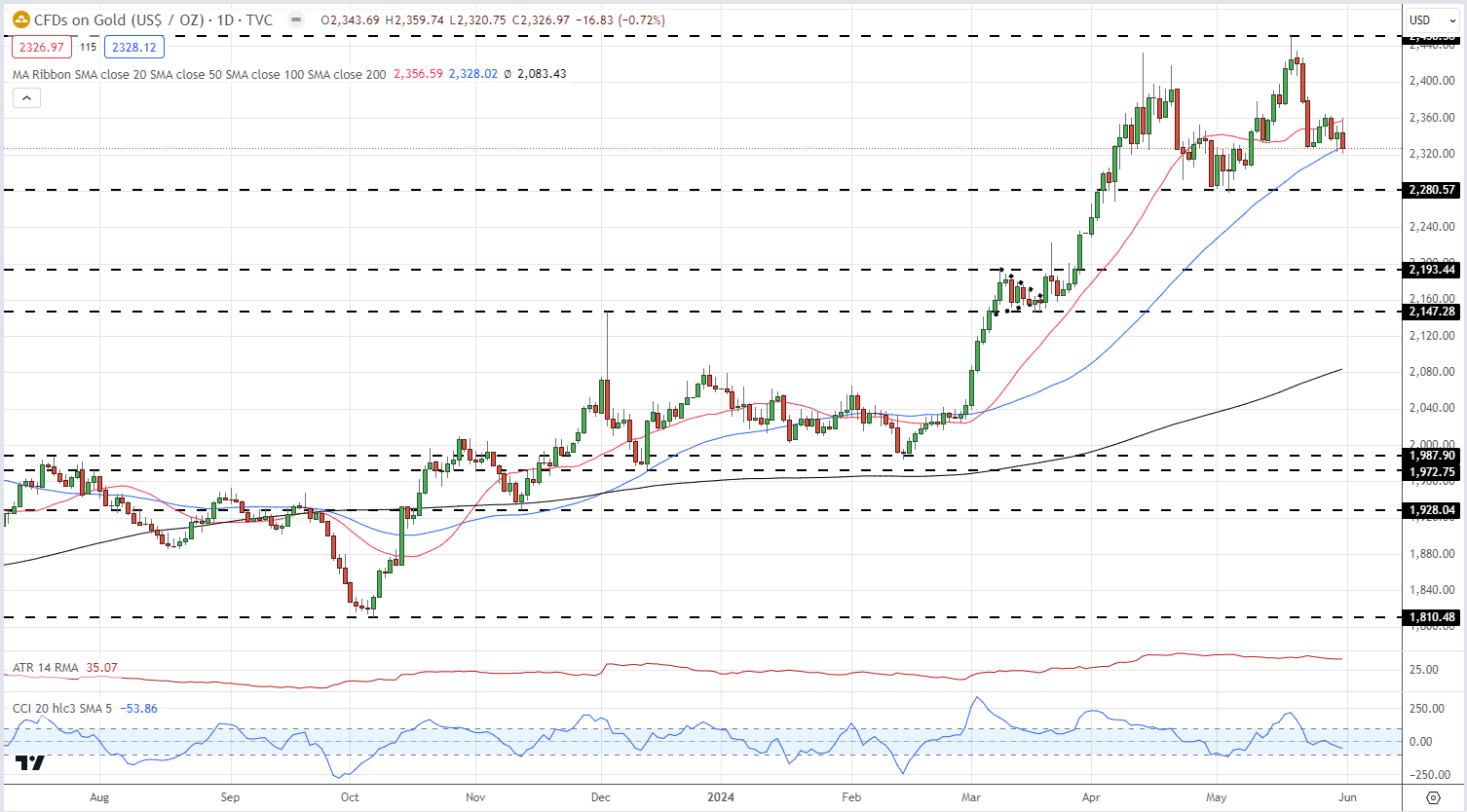

Gold might also face a downward trajectory. Driven by an increase in US Treasury yields and a series of bill and bond issuances, gold could test the $2,280/oz mark. The outcome of Friday’s US NFPs will be crucial in determining gold’s direction.

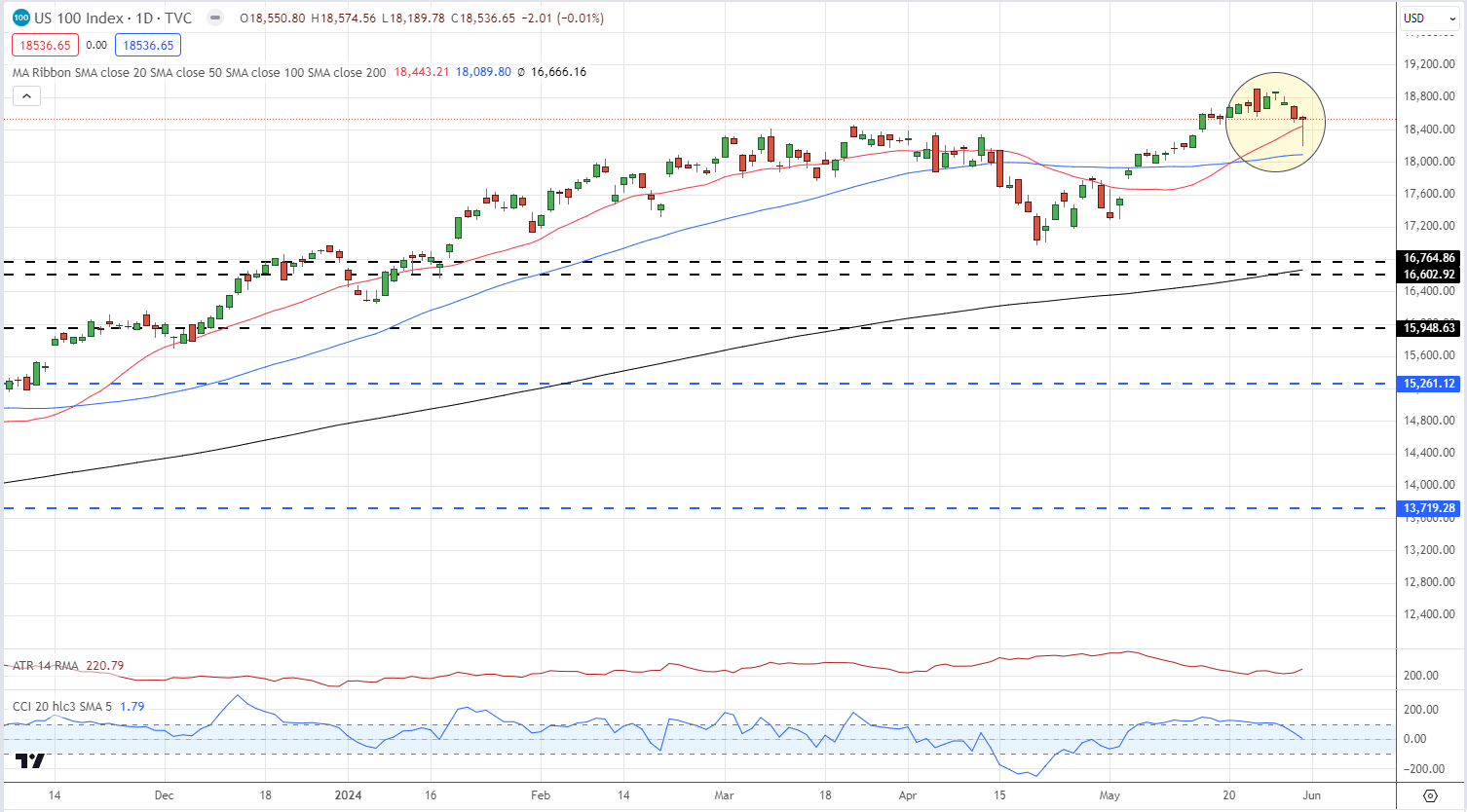

The Nasdaq 100 has shown signs of strain, particularly among the Magnificent Seven members, pulling back from a steep early-week sell-off. Friday’s trading could offer bulls a glimpse of hope for recovery, yet the index’s concentration in a few large-cap firms makes it susceptible to shifts in market sentiment.

This week promises to be a pivotal one for markets, with multiple major economic indicators poised to influence investor strategies and market trends.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.