Markets Week Ahead: Gold, EUR/USD, GBP/USD, USD/JPY; Key Data Releases

By Daniel M.

May 27, 2024 • Fact checked by Dumb Little Man

The new week will start off slowly, as both the US and UK markets will be closed on Monday. The US observes Memorial Day, while the UK has a bank holiday. Holidays in these financial hubs mean lower trading volume, possibly leading to sluggish price action. However, thin liquidity can sometimes magnify price movements if unexpected news hits the wires, with fewer traders around to absorb buy and sell orders. Caution is warranted for those who still decide to trade on Monday.

As the week progresses, we anticipate a relatively calm period with few high-impact events likely to spark significant volatility. However, the landscape could change on Friday with the release of critical economic indicators. On one side of the Atlantic, Eurozone May CPI figures will be released. On the other side, we’ll get core price consumption expenditure data, the Federal Reserve’s most closely watched inflation gauge.

Eurozone

The European Central Bank is likely to reduce borrowing costs from a record high of 4% at its upcoming June meeting. However, the extent of additional rate cuts will depend on the inflation outlook. The May Flash CPI report will be crucial, offering valuable insights into recent price trends within the regional economy. This data will play a pivotal role in guiding the monetary policy trajectory.

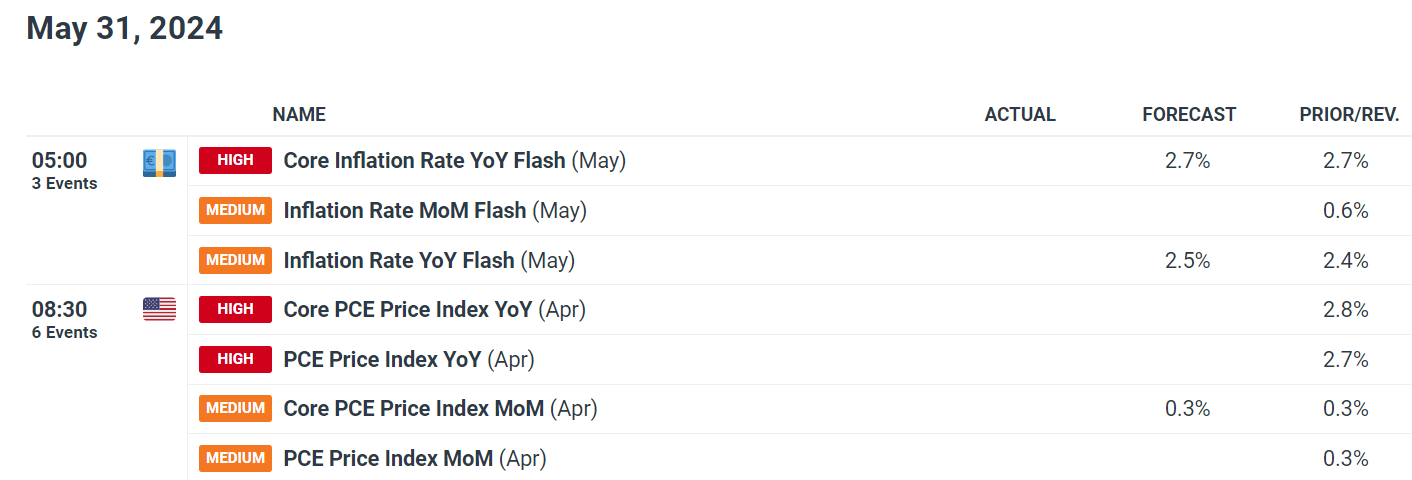

Analysts expect Eurozone inflation to rise to 2.5% y-o-y this month from 2.4% in April, with the core gauge anticipated to remain steady at 2.7%. The slight uptick in the headline metric may not deter the ECB from pulling the trigger next month. However, an upside surprise may prompt the institution to adopt a more cautious approach to future easing. In light of these developments, euro FX pairs may be subject to heightened volatility heading into the weekend.

US

Core PCE deflator data will also be released on Friday. Consensus estimates suggest a 0.3% increase in April, with the annual rate cooling to 2.7% from 2.8%, marking a small but favorable directional move. A downward surprise could reignite optimism that the disinflationary trend, which began in late 2023 but stalled earlier this year, is back on track. This would strengthen the case for the FOMC to pivot to a looser stance in the fall. This should be bearish for the U.S. dollar but positive for stocks and gold.

Conversely, if inflation numbers exceed forecasts, interest rate expectations could shift in a hawkish direction, delaying the Fed’s timeline for initiating rate cuts. In this scenario, November or December could become the new baseline for a potential move by the U.S. central bank. Such a development could propel bond yields and the greenback higher, creating a more challenging environment for equities and precious metals.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.