What is the Marubozu Candlestick Pattern – Explained By An Expert

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Marubozu candlestick pattern may not very popular, so, it is not used by many fundamental analysts and professional traders. Perhaps, because using it alone may be considered insufficient to predict the future direction of prices. But, when properly studied and identified, it can be beneficial.

In this review, we’ve got Ezekiel Chew; the forex industry expert trader and trainer to share his take on Marubozu Candlestick. We will thoroughly examine the Marubozu candle, its bullish and bearish patterns, how it is used in trading, its advantage, disadvantage as well as how accurate its candlestick patterns can be. We will conclude the review with the best forex trading course.

What is Marubozu Candlestick Pattern

Marubozu is a Japanese candlestick pattern with a body without wick or shadows. The Japanese word ‘Marubozu’ means shaved head, bald head, or ‘close-cropped head’. Ideally, the perfect Marubozu candlestick has no head or tail; that is, no wick on top or bottom of the body but practically, what is mainly observed may be a very small insignificant wick.

The Marubozu candlestick pattern was first used many centuries ago in Japan by rice traders who used it to denote steady price falls or increments throughout the day. It indicated that the price traded strongly in one direction throughout the day or trading session. Within the particular session involved, there was no zigzag movement of the asset’s price.

Today, Marubozu candles are found in trading charts that cuts across various financial markets such as forex, cryptos, stock charts, etc. It may be extremely rare to find Marubozu candlesticks on daily charts and higher timeframes but may be easier to find in a quiet market with very low volatility. It mainly occurs at the beginning of a new trend; be it bullish or bearish and also in the middle of a trend or when the trend is about to reverse.

Basics of Marubozu Candlesticks explained

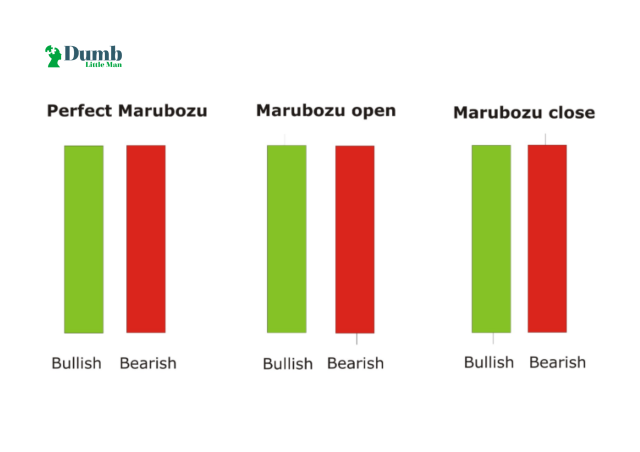

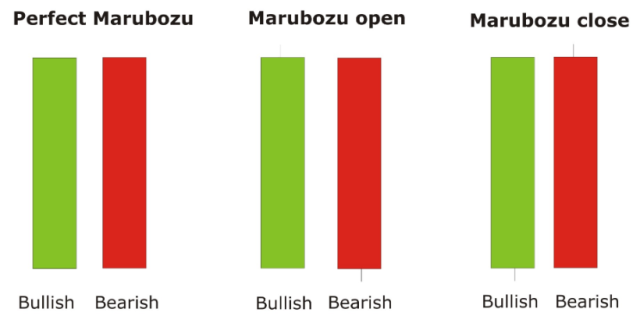

Normally, a candlestick has a rectangular body as well as upper and lower shadows or wicks. But a Marubozu candlestick pattern has little or no wicks. For a candlestick to be classified as a type of Maribozu, one or both wicks must be absent. Generally, there are 3 types of Maribozu candle formation; they are as follows:

Perfect Marubozu

Here, both the opening and closing prices are flat; once the price is opened, it continued increasing or decreasing until the period of the candlestick elapses. There were no price rebounds.

Marubozu open

For this pattern, the opening price is usually flat; without any wicks, while the other side may have a little wick. So, once the price opens, it steadily goes higher or lower until it closes.

Marubozu close

This Marubozu candle pattern has a closing flat while the open has a very short wick or candle. It is the exact opposite of the Marubozu open. It means that within the timeframe, the price may drop a little lower than the opening price but must close at the highest or lowest price.

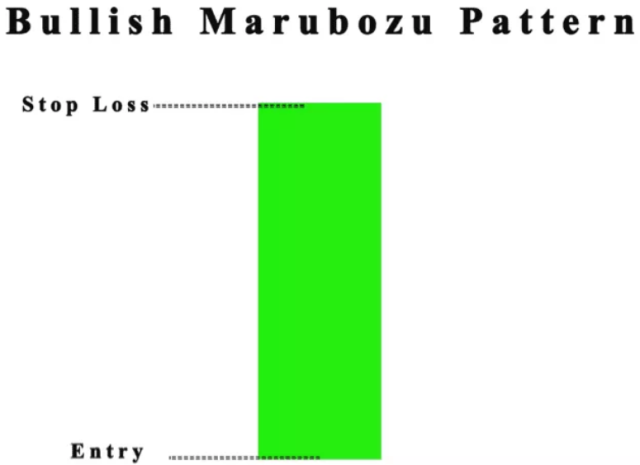

Bullish Marubozu

Just like all candlesticks, the Marubozu candlesticks are either bullish or bearish. They are also colored in the same way; that is, a bullish Marubozu candle is green or white while a bearish Marubozu candle is colored red or black.

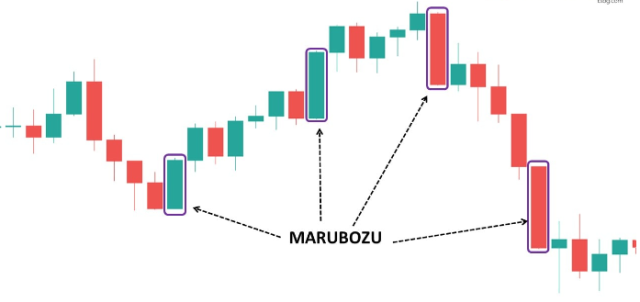

The bullish Marubozu pattern is formed when the price starts low and continues going higher until it reaches the closing price. The market sentiments obviously indicate that buyers controlled the price throughout the day or timeframe represented by the candlestick.

If the bullish Marubozu pattern forms an uptrend, it may indicate that the current trend is a strong trend but if it forms a downtrend, it may indicate a potential trend reversal. But, traders will need more analysis, experience, and good trading skills in order to determine how to place their trades.

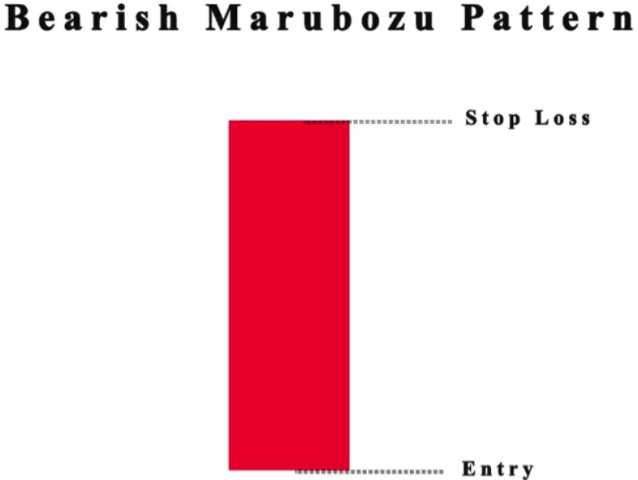

Bearish Marubozu

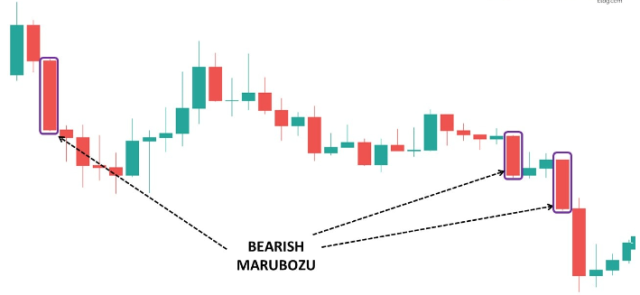

The bearish Marubozu candlestick opens at a higher price, then the price steadily drops until the timeframe closes. The close price is equal to the lowest price within the candlestick or timeframe. It means that selling pressure is high and sellers are in control of the price for the entire trading session.

If the bearish Marubozu candle is formed in a bearish trend, it indicates that the trend is moving strongly in one direction and is likely to continue. But, when it is formed in a bullish trend, it often indicates a sharp sentiment change; meaning that sellers have taken over and a trend reversal is forming.

How to trade with the Marubozu Pattern

If you take a closer look at short-term chart time frames, there is a high chance that you will spot bullish and bearish Marubozu pattern candlesticks as well as other candlestick patterns. It is important to check the trend or earlier candlestick patterns that came before the Marubozu candle. The position and color of the Marubozu matter because it should be viewed as part of a large trend and not in isolation.

Generally, Marubozu candlesticks usually indicate consolidation or reversal but there are no rules. Nothing can be absolutely predicted in the forex or stock charts. For example, if a bullish Marubozu open is formed, it is likely that the trend will continue. So, the trader may open a long position but he will need to use other tools to determine where he will place his stop loss and take profit positions.

Similarly, if a bearish Marubozu open is spotted in a downtrend, it may mean that sellers are still in control. So, the trader may open a short position to ride the trend. It is even better if the bearish Marubozu forms a few candlesticks after the price breaks through a support or bounces off a resistance level.

Advantages of Marubozu Pattern

The Marubozu pattern signals the attitude of the market participants in relation to a given asset. It gives traders information about the action of buyers and sellers participating in the market.

Disadvantages of Marubozu Pattern

One of the major drawbacks of the Marubozu pattern is that it may give false signals. This often leads to losses because when the price goes against the trader’s position, losses are sure to follow.

Creating a strategy based on the Marubozu candlestick alone is not feasible, so the trader must learn to combine other strategies and analytical approaches.

Accuracy of the Marubozu Pattern

Though one of the single candlestick patterns, the Marubozu candle is best considered as part of a series of candlesticks forming a larger pattern or trend. If a Marubozu bearish candlestick is formed in the middle of a downtrend, in most cases, it accurately signifies that the bearish pattern will continue. For a bearish candlestick in the middle of an uptrend, the odds are high that the trend will continue.

When the Marubozu bullish or bearish candlestick appears towards the end of an established trend, it may be that a reversal is setting in. But, it can also be a false signal and the trend will continue. This makes it difficult and less accurate when trading the Marubozu pattern. It is always better to combine it with other trading strategies.

Best Forex Trading Course

The best forex trading course on the internet today is the ‘One core program’ by Ezekiel Chew. It is available on the Asia Forex Mentor website. Ezekiel affirms that the program was designed with the same system that he has been using to train bank workers and institutional traders for several years. This trading system is highly effective as it yields 6-figures per trade for him.

The best part is that prior knowledge of the financial markets or trading experience is not needed. One core program is a comprehensive program that covers everything from scratch to advanced levels of forex trading. You only need to be a committed learner. Ezekiel developed this proprietary trading system after several years of learning, trading, and teaching.

Like all traders, he started by blowing his accounts, but over the years, he developed a highly rewarding system based on mathematical probability. His fortunes changed and he began generating millions of dollars from forex trading. Over the years, he has taught numerous students who are equally millionaires courtesy of the one core program. He is also a renowned speaker at major forex events.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Marubozu Candlestick

Marubozu candlesticks originated in Japan and are formed on candlestick charts when price increment or decrement continues within a chart timeframe. The resulting candlestick will have a body without a shadow or wick. A perfect Marubozu has no wicks at all but a Marubozu open has a little wick stretching from the closing price while the Marubozu close has a short wick stretching from the end where the price opened.

A bullish market is indicated by rising prices, so a bullish Marubozu candle opens at a low point and closes at a higher price. Similarly, bearish Marubozu candles open at a high price and close at a lower price. Trading Marubozu candlesticks depends on its position; if it’s in the midst of a bullish or bearish trend, then it is likely to mean continuity.

Marubozu is generally a continuation pattern and is difficult to find at support or resistance levels.

Marubozu Candlestick FAQs

What does Bullish Marubozu mean?

Bullish Marubozu candles signify that the price of the financial market’s asset started at a lower point and continued rising until it closed out at the highest price within the timeframe of the study. A bullish Marubozu may be observed within an uptrend or sometimes in a downtrend. The only way to differentiate a bullish Marubozu from a bearish one is its color. Bearish candlesticks are usually red or black while bullish candlesticks are green, blue, or white.

Is Marubozu Pattern effective?

The Marubozu is formed with a single candle which may be bullish or bearish. Generally, single Japanese candlestick patterns like Marubozu, hammer, shooting star, doji, etc always need more analysis to confirm their signals. Even double candles like the engulfing pattern also need further analysis and confirmation.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.