Megaphone Pattern – A Complete Expert’s Guide 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Traders love chart patterns, and for a good reason. They’re easy to spot, offer clear trading implications, and can be found in all time frames. No matter the pattern type, investors know entry and exit points. One of the most widely followed patterns is the Megaphone pattern which can be bullish and bearish.

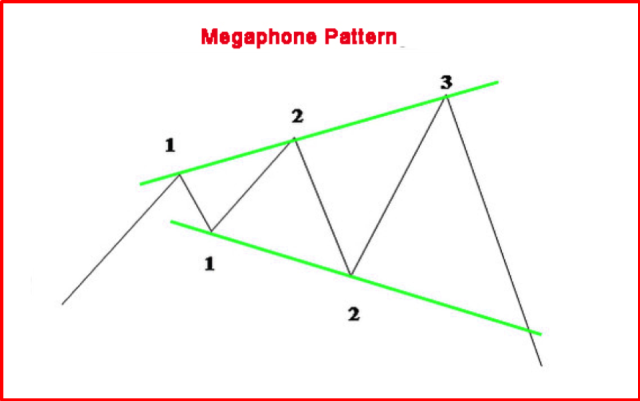

The megaphone pattern is not a new name in the industry. It’s one of the most commonly cited chart patterns by traders and investors across different time frames to read on the market. The pattern looks like a widening and converging price formation that resembles a megaphone, which is where it got its name. It happens when the market is in continuous bullish pressure but starts to face dwindling buying momentum.

To explain the Megaphone pattern in depth, we’ve got Ezekiel Chew. He is renowned worldwide for his financial know-how and has trained not just retail traders but professionals from prominent financial institutions. In addition, Ezekiel is the founder and CEO of Asia Forex Mentor, where he imparts his knowledge of the financial markets to help people achieve financial freedom.

The purpose of this review is to highlight the advantages and feasibility of the megaphone pattern. Furthermore, it put forward the elements of the megaphone, bullish and bearish patterns, its trading opportunities, and more.

What is Megaphone Pattern

The Megaphone Pattern is a behavioral design pattern that allows an object to broadcast events to multiple observers. It is generally formed during high market volatility when traders lack confidence in the market direction. It includes a minimum of two higher highs and two lower lows.

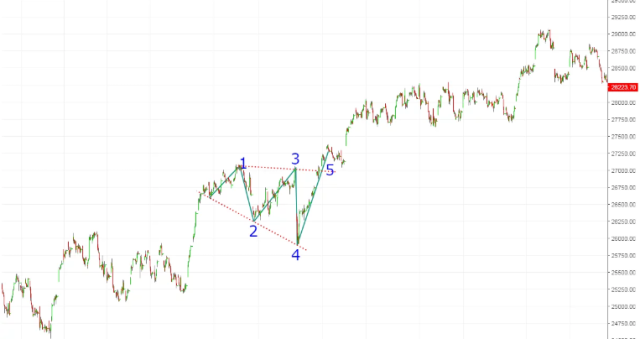

Traders use these patterns to provide signals to buy or sell a stock depending on the market’s direction when it is approaching either end of its range. Because this pattern normally becomes visible at the top or bottom of the market, it is most useful in long-term trends. However, traders find this pattern extremely useful when it takes shape daily or weekly.

Although the pattern provides many opportunities for profitable trades, it’s important to know when it has failed so you can avoid those situations. However, as with any other technical indicator or pattern for successful outcomes, all data must be cross-checked from several sources.

Combining a multidisciplinary approach for finding entry and exit points is a surefire method to make stock market profits.

3 Elements of Megaphone Pattern

The formation of megaphone patterns is not unique, and many variables distinguish one pattern from another. The megaphone pattern consists of the following three elements:

#1. Intrinsic Behavior

The pattern is birthed from the continuous tussle between bears and bulls to gain control over the asset. After the bulls drive prices higher and a pattern gets formed, the bears take over and influence prices to decline, resulting in lower lows. In the end, the bearish pressure subsides, and the bulls make a final push to levels above the previous highs, thus completing the pattern.

#2. Volume

The easiest way to identify this pattern is by looking at the volume. When there’s a Megaphone Top, the volume will increase along with prices. So a sudden rise in volume is usually a good sign that the pattern exists.

#3. Price Targets

The target price is what the pattern suggests as the prospective price move. In other words, traders see it as if the pattern’s target price will cover their losses after commissions are deducted.

A rule of thumb is that the target price should be higher than five percent. However, the current price needs to be considered if the trade is going well.

Bullish or Bearish Pattern Explained

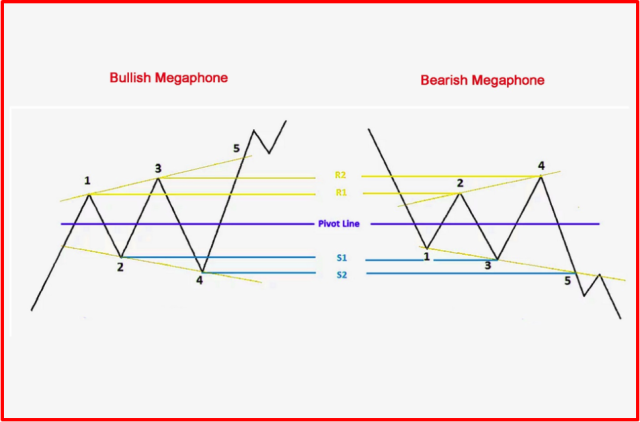

The pattern can get displayed as a bullish or bearish megaphone chart pattern.

A bullish phase starts when the price goes up a channel, while a bearish phase starts if it goes down the channel. Therefore, investors must watch how prices react at lower and upper channels to make investment decisions.

The essential thing to notice is whether the trend forms outside the megaphone.

Trading Opportunities of Megaphone Pattern

Megaphone patterns are popular among investors because they offer less opportunity for trading, making them ideal for swing trades, breakout trades, and failed transactions. So let’s look at the different opportunities this pattern provides.

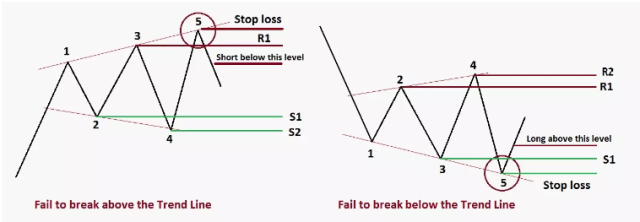

Failures

Though it sounds confusing, the pattern can be used even if it doesn’t work perfectly. But for this method to succeed, the pattern must first get confirmed correctly. But how can you identify a failure swing? The fifth swing is the point when a trendline break may be seen.

If we assume a bull market is in place, the pattern develops, and if the price does not break the upper trend line, investors will be short if it moves below the third swing high.

However, circumstances are similar if a market is bearish but fails to penetrate the lower trend line. Thus, investors prefer a long position when the price closes over the third swing high.

Breakout Trades

The breakout is verified if the price breaches the trend line following the fifth swing and moves away from the pattern.

Breakouts can take place in either a positive or negative direction. Breakouts of a bullish and bearish nature can happen due to the market’s circumstances and the pattern’s position on the chart.

After a steadily increasing market, the pattern for reversal is created at the top when the prices close lower than the trend line. In this instance, it signals that there may be a change in direction coming soon.

A continuation pattern is identified when the price closes above the higher trend line and attains new highs in the chart. Investors who want to make a trade based on the price closing away from the pattern don’t need to predict the direction to verify a breakout.

Swing Trades

This is a geometrical pattern that has been observed following Fibonacci levels. However, it is impossible to analyze the Fibonacci levels without considering Pivot lines.

Making it clear that the pattern’s pivot line will be hard and fast, as well as support and resistance lines, to assist you in interpreting the pattern.

Resistance points one and two can be used for your trades if you’re a trader that prefers long positions. On the other hand, support points one and two will act as support if you take a short position. When there is a breakout, it can be difficult to find the target because the best exit is not always easy to locate.

There is an option for investors to create an exit point by estimating the interval between two trend lines from the breaking point. If the price goes down to sixty percent of that Redline, they can make a profit.

Broadening Formation – What is it

The megaphone pattern, also called the broadening formation, begins when market risks are high and sustained over time.

Pattern formation is greatly influenced by political developments, like elections. In simpler terms, any type of uncertainty will have some hand in shaping the megaphone stock pattern.

In the case of an election, when a new individual is elected to office, his policies have the potential to influence national events and market performance.

This is one of the market’s driving forces and has a bullish and bearish dynamic due to the political situation.

Several factors are at play, but one of the most important is earnings season. This balance directly impacts a stock’s future value, and investors generally become more optimistic when outcomes are positive or pessimistic following negative results. These reactions influence pattern formation.

As a result of their ability to show major trend lines, technical analysis plays a big role in making it possible for day and swing traders to take advantage of volatility in broadening formations.

Best Forex Trading Course

Ezekiel Chew is a highly acclaimed Forex trader, coach, and founder of Asia’s largest Forex education company – Asia Forex Mentor. Over a decade of trading experience, he has helped thousands of people worldwide achieve financial freedom through Forex trading.

His core program is designed to take beginners from zero to hero, teaching them everything they need to know about Forex trading in a concise and structured manner. The program covers everything from the basics of technical analysis to advanced risk management techniques and is backed by mathematical probability and years of trading experience.

To date, Ezekiel has trained students from around the world, including bankers and traders from some of the biggest financial institutions in the world. His methods have been proven to work in any market condition and have helped his students make millions of dollars in profits.

If you’re serious about learning how to trade Forex, there is no better teacher than Ezekiel Chew. With his experience, knowledge, and passion for teaching, he will help you achieve your financial goals and change your life for the better. So, what are you waiting for? Enroll in the ‘AFM PROPRIETARY ONE CORE PROGRAM’ now and kickstart your trading career.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Megaphone Pattern

Traders benefit from patterns since they allow them to predict the price trend. When volatility decreases, the Megaphone pattern can be a useful reference point for investors in determining the direction.

When the price of a pattern breaks out, it confirms that the trend is continuing, and if it signals dismissal, there is a possibility for reversal. Because of this, traders must be very careful in starting a trade to take advantage of the many trading possibilities.

Long-term traders can benefit from megaphone patterns as an indicator to secure investments, but it works best for swing and day traders.

The megaphone stock pattern, which resembles a triangle, is a widening pattern that can indicate future price movements. Just like any other trade, binary options trading requires you to be informed and learn about the various patterns and their meanings.

The most successful way to learn how to trade is by practicing with a demo account. This allows you to draw trend lines, make connections between dots, and locate various patterns — which are all important aspects of trading.

However, the standard recommendation still applies as the megaphone pattern is one of a few that can help achieve the best results. However, you still need to combine the patterns that verify the data to make the most out of it.

Megaphone Pattern FAQs

Is Megaphone Pattern Bullish or Bearish?

The megaphone pattern is both bullish and bearish.

What is a Megaphone Pattern in Trading?

The pattern is usually created during market turbulence when investors are unsure about which direction the market will move next.

How do you trade Megaphone Patterns?

Trades are completed in the course of a Megaphone breakout pattern’s development.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.