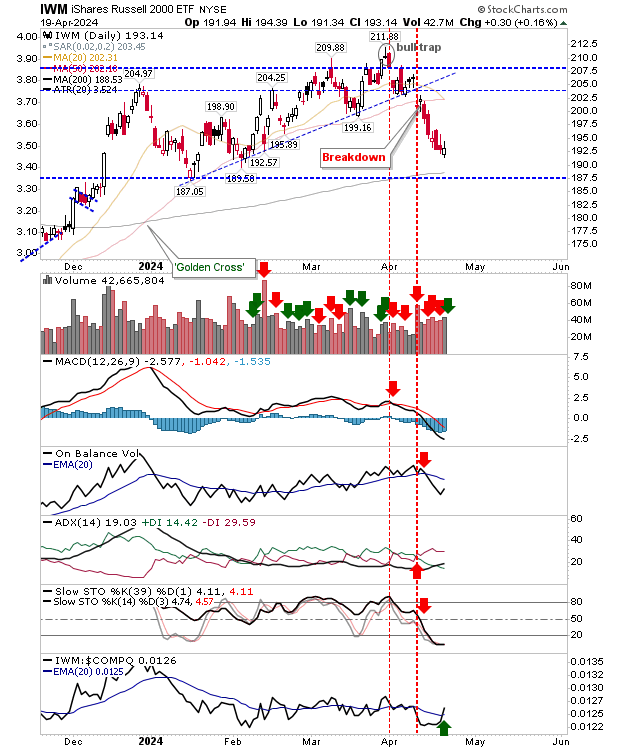

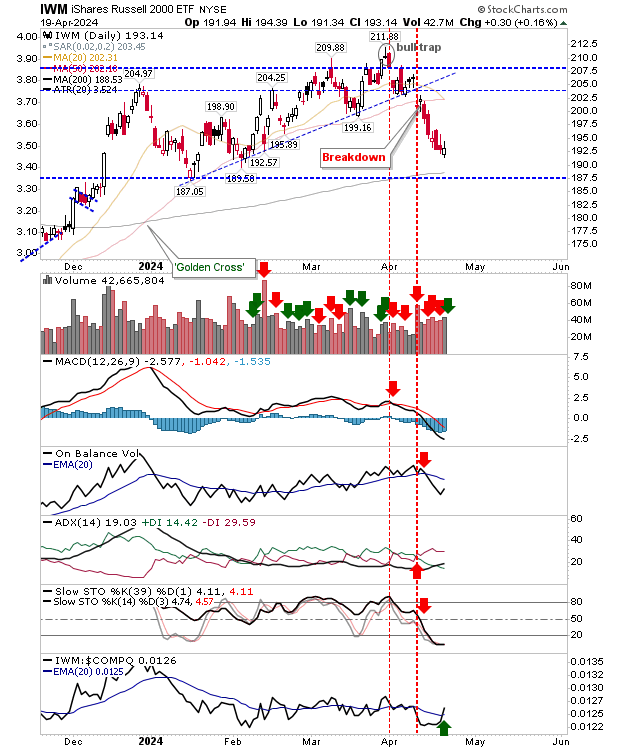

Potential Rally for Russell 2000

The Russell 2000 (IWM) continues to diverge from the S&P 500 and Nasdaq. If it reaches its 200-day moving average (MA) via a bullish reversal candlestick, it may present a solid trading opportunity. A rally, supported by a tight stop, could be sufficient.

S&P 500 Struggles Without Support

The S&P 500 finds little relief in current Fibonacci retracement levels, with the 200-day MA far off. However, it has still managed a surge in performance relative to the Nasdaq.

Nasdaq Faces Downward Pressure

The Nasdaq has deepened its losses, reporting a 2% decline. The 15,150 support level might offer a break, but only if there’s a strong bid early in the week.

Despite a challenging environment, the Russell 2000’s stability might open up a trading opportunity. For the S&P 500 and Nasdaq, a strategic candlestick pattern could be the key to sparking interest in small-cap trades, setting the stage for new trading ranges in these leading indexes.