Moneta Markets Review: Is it Best for Scalpers in 2025?

By Wilbert S

January 5, 2025 • Fact checked by Dumb Little Man

Vantage International Group Limited (VIG) owns Moneta Markets, which has been in operation since 2009 and holds several regulatory licenses. Moneta Markets is a relatively new company, having been established in 2018 in the Cayman Islands and is regulated by the Cayman Islands Monetary Authority (CIMA). Traders and investors can have faster and more flexible access to global markets with Moneta Markets. With over 70,000 client accounts and an average monthly trading volume of more than $100 billion, it is fair to say that the company provides the greatest services to its customers.

It’s ideal for scalpers, those people who acquire big amounts of popular things and resale them for a profit. Scalpers can trade more than 300 currencies, commodities, indices, and stock CFDs on Moneta markets STP and ECN account, with spreads starting at 0.0 pips. In short, Moneta Markets’ level of openness and regulation is sufficient for a scalper to feel safe and secure while depositing funds.

In this article, we go over how the Moneta market works, as well as its features and benefits. We also compare this trading platform to others to help you make an informed selection. Let us examine the Moneta market in greater detail.

Moneta Markets Review: What Is Moneta Markets?

Moneta Markets was established in 2020 as a global CFD and forex broker. Moneta Markets’ proprietary trading platform offers over 300 instruments. Moneta markets web platform and mobile platform are unique. It allows you to trade on a key financial instrument, such as Forex trading, stock and CFDs trading, indices, commodities, plus cryptocurrencies.

The Cayman Islands Monetary Authority (CIMA) has authorized and regulated Vantage International Group Limited, trading as Moneta Markets, under the Securities Investment Business Law (SIBL). Moneta Markets has more than a decade of experience as a worldwide financial markets specialist, with an average monthly trading volume of more than $100 billion. Professional Indemnity Insurance is in place at Moneta Markets, and it protects the work of our representatives, employees, and other authorized representatives.

Moneta markets have a lot of leverage, better trading tools, as well as a simple web interface. Moneta markets offer advanced tools for you, If you are experienced traders you can now use these tools which you need to begin investing, thanks to the launch of MT4 and MT5. The broker’s mobile app is also a useful tool that allows you convenient trading at any time and from anywhere.

CFDs are sophisticated instruments that carry a high risk of losing money rapidly due to their leverage. When trading CFDs with their company, all providers have a percentage of retail investor accounts that lose money. When trading retail CFD accounts with this service, 74-89 percent of retail traders’ accounts lose money. You should think about whether you know how CFD trading works and whether you can afford to risk losing all of your money.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

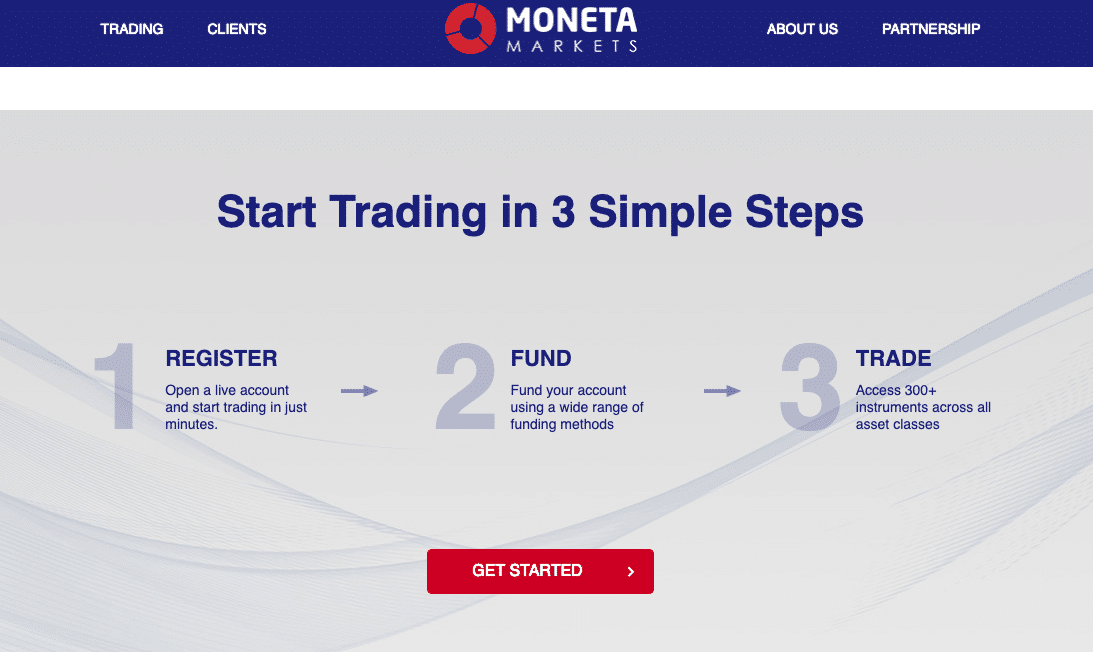

How does Moneta Markets work?

To start a trading account with Moneta Markets, you must first register on the Moneta markets website. Its next step is to install the trading platform of your preference after you’ve received your username and password through email. Then submit your identification documents for your account validation, and make a deposit. On its trading platforms, you may get extensive instructions. As part of Moneta Markets’ onboarding and standard KYC identification checks, you will be required to provide some essential papers to establish your identity. These checks are regular procedures at this platform, and they enable the company to create a secure financial environment for its 70,000 clients.

To open a live trading account with Moneta Markets, go to the top right corner of any page and click the white ‘Demo’ button. Complete the application, supply the needed papers for verification of identity, and your new account information will be emailed to you after it has been approved. The online application for a live Moneta Markets trading account is quick and simple to complete, taking only a few minutes on average. If your country of residency qualifies for online verification, your account will be quickly activated, and you will be able to deposit cash to begin trading. Your account will be set up for financing and live trading within 24 hours if you are required to manually submit the relevant proof of identity papers.

Moneta markets offer you both Live trading STP and ECN accounts. It will allow you to make a small number of trades. Which Depends on the account you open, and this may differ. You can trade a maximum of varies using this Market. As a result of its STP execution, you may expect tighter spreads and greater transparency in the price which you pay to execute your trades. Margin requirements vary by instrument, as they do by other brokers.

| Broker | Best For | More Details |

|---|---|---|

| Scalpers

| securely through Moneta Markets website |

What are the Features of the Moneta Markets platform?

Moneta Markets offers the following features

Excellent Trading Platform:

Moneta Markets traders can use’ MT4, MT5, and WebTrader platforms, and clients can move fluidly between them for optimal ease.

Streamlined Onboarding Process

Moneta Markets’ registration process is exceptionally quick and easy. The forex brokers WebTrader platform enables clients to register an account in just five minutes and includes capabilities like deposits and withdrawals.

A Vast Range of Trader Research and Education Resources

The online portal includes a wide range of trader research and education tools. These tools can be used to analyze market sentiment and to track economic data. Video tutorials are also available to users. Market Buzz and Featured Ideas (Trading Central), two of WebTrader’s few tools, are not integrated and simply connect to an external link. Similarly, its Economic Calendar is open to the public.

Securities

To ensure optimum protection, Moneta Markets keeps client funds in a segregated bank account with NAB (National Australia Bank). Negative balance protection is also available for clients’ accounts, ensuring that negative balances are not the consequence of trade fraud. The MetaTrader App comes with two-factor authentication and standard SSL encryption. All of this adds up to ensure the protection of your assets.

Trading Forex and CFDs carries a high level of risk and can result in the loss of all of your invested funds. You should not invest more money than you can afford to lose, and you should be aware of the hazards involved. For some investors, trading leveraged products is not a good idea. Please evaluate your level of experience, investment objectives, and obtain independent financial advice if necessary before trading.

Customer service

Moneta Markets offers multilingual help via phone, email ([email protected]), and live chat channels at the lower right corner of the website 24 hours a day, 5 days a week. The customer service team has received high praise from users across all platforms. This attests to their professionalism and quick response time when dealing with client issues.

Moneta Markets Pricing and Plan?

On Moneta Markets platforms, there are three major account types, and charges vary according to the one you choose. ECN account and STP are among the available account types. The STP has no commissions, whilst the ECN trading accounts have a commission but a tighter spread, starting at 0.0 pips across all majors.

Demo account and Islamic trading account are also available through Moneta Markets. As a newbie, the trial account is an excellent way to experiment with the market and acquire a sense of what trading is all about. However, the trial account will expire in 30 days, but you will have accumulated valuable expertise by then.

If you deposit $500-$1000 into your Moneta Markets account, you will receive a 50% bonus, with an extra 10% bonus for deposits exceeding $1,000.

Each month, you are allowed one free bank transfer withdrawal; any further withdrawals will be charged 20 units of your account currency.

| Broker | Best For | More Details |

|---|---|---|

| Scalpers

| securely through Moneta Markets website |

Who is Moneta Markets Best For?

Moneta Market is excellent for traders who depend on studying before spending their money on financial products. The broker’s research assistance is fairly thorough, and it includes technical analysis, web TV, client sentiment, as well as the most recent financial news. As a trader, you can use the broker’s research tools to aid in their decision-making process.

Expert traders looking to invest in a wide selection of instruments on margin will benefit from the broker. Moneta Markets provides investors with access to over 300 products and up to 500:1 leverage, allowing them to diversify their portfolio. In addition, the broker’s powerful trading platform is ideal for experienced traders. The platform, which was designed from the ground up, has complex capabilities like fund management plus technical charting, as well as research on over 35,000 tradable assets.

Thus we can say it is Best For:

- Beginners, intermediates, and advanced traders are all welcome.

- Scalpers, swing traders, and long-term traders.

- For Traders in search of an all-in-one trading platform.

- Also best for Islamic traders who are Looking for a swap-free platform.

Moneta Markets Pros and Cons

Pros

- Various financial tools are available.

- Offers excellent instructional and analytical tools

- Low spreads that are quite competitive

- Offers 50% bonus on deposits of $500 or more on a live Moneta markets account

Cons

- Clients in the United States are unable to use this service.

- It’s possible that offshore regulators won’t be able to provide appropriate protection.

Moneta Markets User Experience

Moneta Markets provides its users with a positive overall experience. The broker’s modern MT4 and MT5 platforms ensure that users are fully informed about the most recent market movements and can make more informed investment decisions as a result.

Traders can also benefit from the broker’s extensive charting tools and technical indicators, which allow them to assess the performance of various instruments. The all-in-one platform also improves the customer experience by eliminating the need for consumers to hunt across the world for information.

Most significantly, the broker has placed a premium on developing and distributing relevant educational materials with clients, such as technical analysis, web TV, client sentiment, and the most recent financial news. Furthermore, incorporated risk management capabilities help customers specify stop-loss, take-profit, and limit order thresholds. These features ensure that users do not experience any significant losses while trading and the presence of negative balance protection ensures that traders do not need to worry about their account balances falling into the negative.

Moneta Markets not only takes considerable precautions to provide a smooth and consistent trading experience, but it also provides excellent customer service. Between Monday and Friday, representatives are accessible 24 hours a day. The support team can be reached by phone, via email, through live chat, and from web forms. In addition, the company’s website includes a comprehensive FAQ area. The broker’s entire customer service is nothing short of outstanding.

Moneta Markets vs Competitors

1. Moneta Markets vs Avatrade

In our side-by-side comparison of Moneta Markets vs AvaTrade, we make it easy for you to evaluate which one is best for you. The final selection on which broker to trade with should, like everything else, be based on what and how you want to trade.

- Moneta Markets requires a minimum deposit of $50, whereas AvaTrade requires a minimum deposit of $100

- Moneta Markets makes it possible for traders to trade up to 300 financial products, whereas AvaTrade has about 1,250 on its trading platform.

- Moneta Markets has 300 stocks, whereas AvaTrade has 1,000 stocks to trade.

- Inactivity fees are not charged by Moneta Markets or AvaTrade

- A micro account allows traders to trade on the Forex market with a little amount of money. This is the greatest option for risk-averse traders who want to focus on foreign exchange currency. Beginners typically utilize this.

- Those at Moneta Markets do not have access to Micro accounts, however, clients at AvaTrade do.

- Both Moneta Markets and AvaTrade provide clients with Standard account and Demo account.

- Both Moneta Markets and AvaTrade provide Islamic accounts to their customers.

- Moneta Markets and AvaTrade both provide phone and email support. Moneta Markets provides live chat assistance, although AvaTrade does not.

- Moneta Markets and AvaTrade both have minimum deposit options and educational resources.

This is especially beneficial for newcomers and those looking to enhance their trading abilities. This is a huge benefit for Moneta Markets and AvaTrade because it demonstrates that they care about their clients.

| Broker | Best For | More Details |

|---|---|---|

| Scalpers

| securely through Moneta Markets website |

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

2. Moneta Markets vs FXCC

- FXCC is the brand name of FX Central Clearing Ltd, a Cyprus-based forex and CFD broker. The company was launched in 2010 and has since established itself as a prominent competitor in the sector, holding CySEC and FCA licenses. The Vanuatu Financial Services Commission supervises Moneta Markets (VFSC).

- Moneta Markets is a regulated forex and CFD trader with its own web platform. FXCC is an MT4 trading broker that is highly regulated and trustworthy.

- Moneta Market gives a 50% bonus on deposit fees, whilst FXCC does not.

- The minimum deposit for Moneta marketplace is $50, whereas the minimum deposit for FXCC is $0.

- FXCC uses the trusted MetaTrader 4 platform, which is available as a download or as an online solution, to trade FX, indices, silver, and gold. While the Moneta market trades Forex and CFD trading, indices, stocks, commodities, and cryptocurrencies.

- FXCC and Moneta Markets provide multilingual customer service via phone, email, and live chat 24 hours a day, 7 days a week. By clicking on the chat logo in the lower right-hand corner of the website, you can access the live chat service.

- FXCC is a good low-cost broker for traders using the MT4 platform to trade forex, metals, indices, and commodities. Currently, the number of platforms available is limited.

| Broker | Best For | More Details |

|---|---|---|

| Scalpers

| securely through Moneta Markets website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Is Moneta Markets really the Best for Scalpers?

Basically, Moneta Markets is a simple trading broker that has established a considerable niche in a short period of time. It is a market-maker platform. Despite the fact that the broker has only been functioning for a few months, it has already made a name for itself in the market. The broker’s MT4, MT5, plus WebTrader platforms offer several unique features that are meant to help traders get the most out of their trading. Furthermore, the broker provides clear access to a diverse set of financial instruments.

All consumer accounts are isolated from corporate accounts, which adds an added layer of protection to the attraction for investors. Although Moneta Markets now has only one license, this will be expected to change, as the company expands. The brand’s overall goal is to add value throughout the investment process, from enrollment and onboarding to funding and final trading decision-making. Moneta Markets is focused on getting clients for investment success by including beneficial tools, favorable features, and helpful instructional materials.

Moneta Markets is a forex and CFD broker with offices all over the world. It has cheap forex as well as non-trading fees, which is a bonus. The account opening and deposit or withdrawal processes are both quick and easy, and most of them are free. However, there are certain disadvantages. Moneta Markets’ product offering is confined to FX, CFDs, and cryptos. We also discovered that stock CFD costs are exorbitant. Finally, there is no provision for investment protection. Please feel free to try Moneta Markets, since you will be able to open an account in less than a day and there will be no inactivity fees.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Moneta Markets FAQs

Is Moneta Markets Safe and Legit?

This broker is a subsidiary of Vantage International Group LTD, which has been in business since 2009 and employs over 70,000 traders. It handles more than 1.5 million trades per month, totaling more than $100 billion in value. Given its parent business, Moneta Markets appears to be a legitimate brokerage, even though it is a newer functioning subsidiary that launched in late 2019.

It is safe to trade with Moneta Markets. We strongly propose that you verify two factors to determine whether a brokerage is safe:

- how you will be protected if anything really goes wrong

- What is the broker’s background?

Vantage Global Limited, which is licensed by the Vanuatu Financial Services Commission, is where all Moneta Markets clients are onboarded.

Negative balance protection is offered by Moneta Markets. You will be protected if the amount in your account falls below zero. Moneta Markets is a relatively newbie online trading platform. The longer a broker has been in business, the more evidence we have that it has safely survived prior financial crises.

The question of whether or not a financial service such as Moneta Markets is safe and legitimate is a valid one. After all, you confide your cash and investments to Moneta Markets. It’s also a fairly popular question, and we’ve been asked it several times. Keep in mind that almost all of the brokers are regulated by at least one top-tier authority. In this sense, Moneta Markets is, without a doubt, legitimate. There are also additional variables to consider when evaluating Moneta Markets’ safety, such as if it is listed on any exchange, whether it offers two-factor authentication, whether it discloses its financial results transparently, and so on.

Are Moneta Markets Regulated?

Vantage Group, which includes Moneta Markets, is regulated by numerous authorities throughout the world, including the top-tier Australian Securities and Investments Commission (ASIC). The Vanuatu Financial Services Commission (VFSC) supervises Moneta Markets.

What are trading platforms?

WebTrader

The broker’s web platform is an all-in-one solution that allows you to manage your account and trade all from the same place. Traders can make quick deposits and withdrawals using the built-in Client Portal. All of the capabilities you’ll need for agile trading are available on the dashboard, including:

- There are six different chart kinds and nine different time ranges to choose from.

- Order Module with a Real-Time Calculator that is easy to use

- With 45+ built-in indicators and sketching tools, precision charting is simple.

- Stop Loss or Take Profit levels are simultaneously presented in pips, currency, and dollar value.

- Once you’ve registered for an account, you can access WebTrader directly from your browser.

MT4 and MT5

The MT4 and MT5 platforms were also recently released by the broker. These include dozens of advanced charting capabilities, automated trading services, and built-in support, as well as market-leading trading tools. This easy-to-use desktop and mobile trading system, aimed at active forex traders, will fulfill the needs of the majority of users. They provide an alternative to Moneta Markets’ proprietary web-based solution that is more extensive and downloadable.

| Broker | Best For | More Details |

|---|---|---|

| Scalpers

| securely through Moneta Markets website |

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.