NFP Analysis: Signs of US Job Market Weakening?

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

May Non-Farm Payrolls Indicate Slowing Growth

As the key event of the week unfolds, expectations for the non-farm payroll (NFP) suggest a modest improvement from last month’s underwhelming performance. April’s job figures notably fell short of forecasts, marking a clear signal of labor market softening after enduring months of tight monetary policy.

With the release of May’s NFP data later today, it’s crucial to monitor any revisions to last month’s figures which could alter market perspectives.

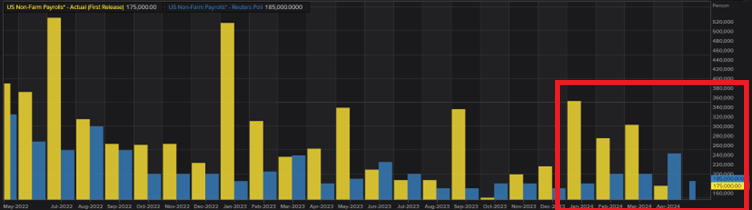

Analysts anticipate the addition of 185,000 jobs in May, a figure that lags behind March’s 315,000 but shows a slight recovery from April. The unemployment rate is projected to hold steady at 3.9%.

Current Trends Suggest Weaker Job Growth

This week’s labor statistics hint at a potential downturn, with forecasts suggesting the actual figure might fall at the lower end of the 185,000 estimate, with potential outcomes ranging widely from 120,000 to 258,000 jobs. Market participants are especially alert to significant deviations from these forecasts due to their implications for interest rates and the broader economic landscape.

Disappointing private payroll figures and a reduction in job openings to just above 8 million suggest a cooling demand for labor. Meanwhile, a slight increase in job quits indicates some worker confidence in securing alternative employment, contrasting with the cautious hiring stance reflected in recent data from the National Federation of Independent Business (NFIB).

NFIB Percentage of Firms Planning to Increase Employment img.3

At the macroeconomic level, the narrative of ‘US exceptionalism’ is fading, with US GDP growth for Q1 adjusted downward to a mere 1.3% after initial estimates of 2.6%. This revision, along with subdued manufacturing PMI and inflation rates, suggests a broader economic slowdown, despite continued expansion in the services sector.

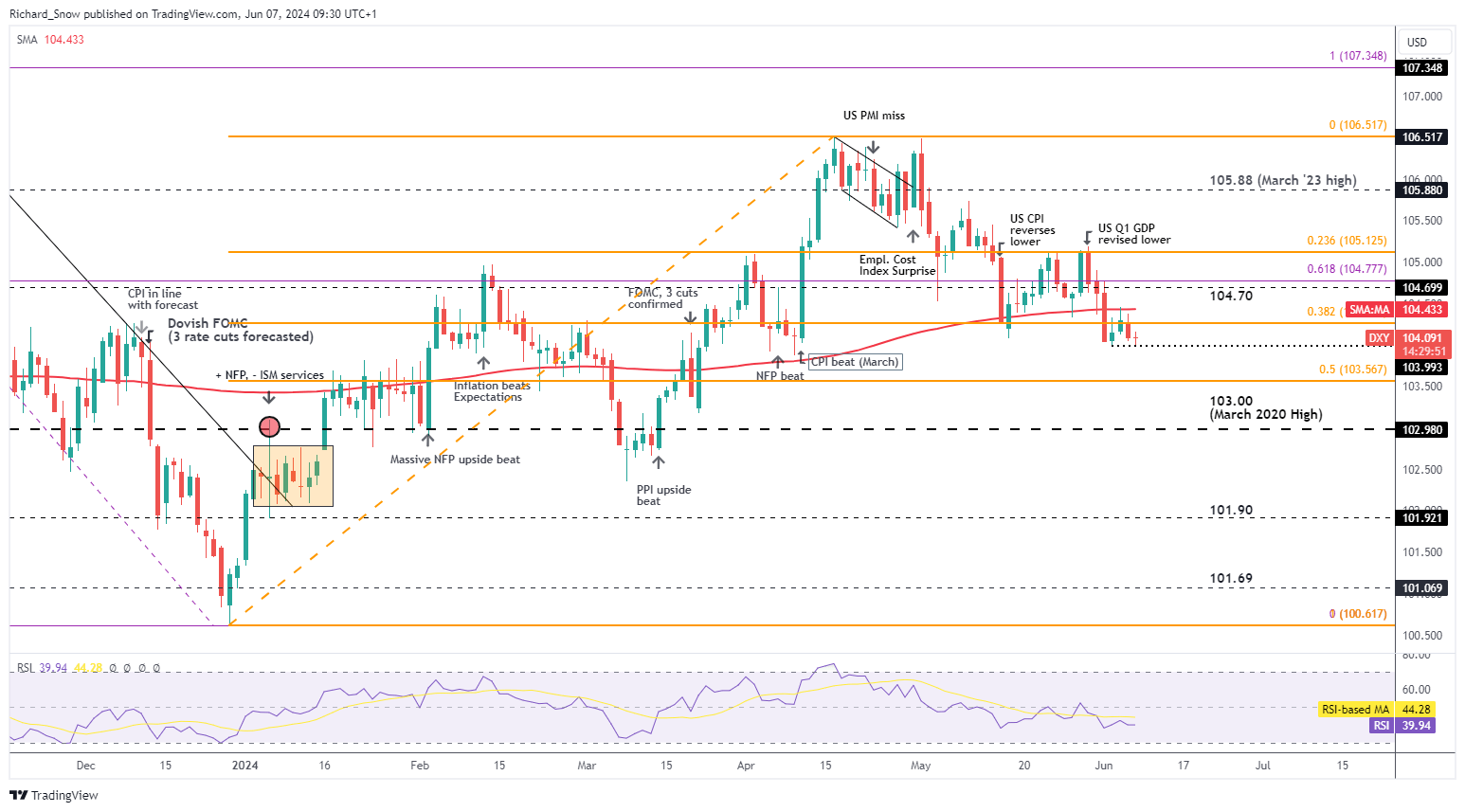

US Dollar Outlook Pre-NFP: Key Levels to Watch

The US dollar started weakly this week, further pressured by a hawkish ECB rate decision that strengthened the euro. As NFP data approaches, the focus sharpens on this week’s low at 104.00 on the US dollar index, heavily influenced by EUR/USD dynamics.

A miss in NFP results or an unemployment rate above 4% could push the index towards the next support level at 103.00, although any rapid declines might be tempered by persistent inflationary pressures. Conversely, a significant positive surprise in NFP numbers could challenge the upper resistance levels at 104.43 and 104.70.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.