Over 150 missiles and drones were fired during the most recent attack

The war between Russia and Ukraine has escalated substantially, with over 150 missiles and drones launched in a recent strike on both countries’ energy infrastructure. This current onslaught has killed at least five people and struck a major dam, causing widespread power disruptions across Ukraine.

The assaults are in response to Ukraine’s actions during the Russian presidential elections, worsening the already tense energy situation in the country and generating concerns about future supply disruptions.

These events could put additional strain on the global oil market, with Russia facing difficulty in sustaining export levels and Ukraine potentially increasing its demand for imported energy resources.

Oil prices ease into the weekend despite strikes in the oil industry

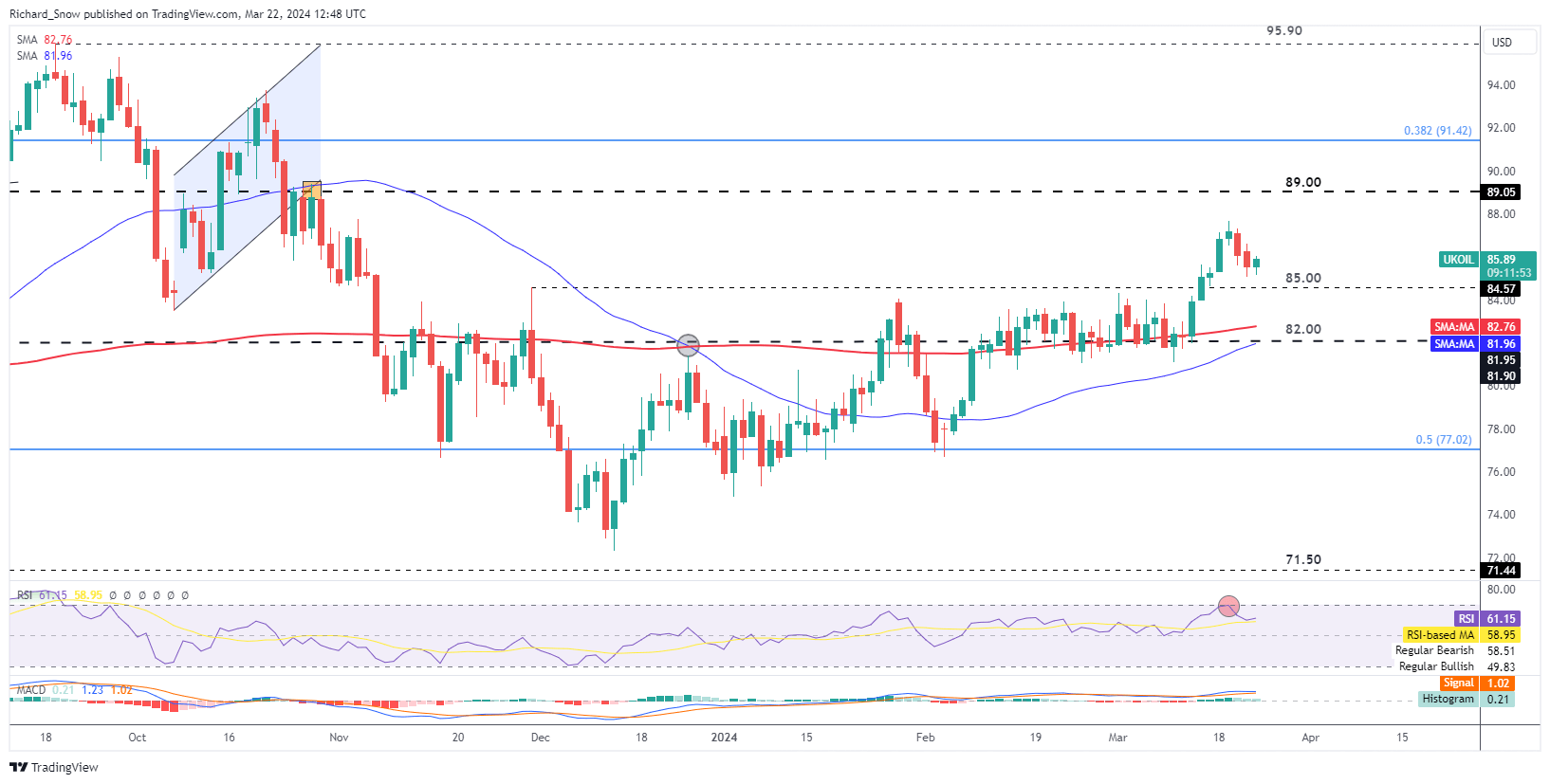

Despite the surge in global tensions, the oil market has remained relatively at ease. Following a brief surge in prices, the market has settled, with oil prices moderating and perhaps retesting the $85 resistance level.

This stability is further supported by a medium-term upsurge over the 200-day SMA, signaling that the conflict’s immediate impact on global oil supplies may be minimized for the time being, thanks in part to OPEC’s ongoing supply curbs.

Brent Crude Oil Daily Chart

IG client sentiment supports a short-term bearish move to continue

US crude (WTI) data is utilized as a proxy for Brent crude oil mood data. Oil-US Crude: Retail trader data shows that 64.54% of traders are net-long, with a long-to-short ratio of 1.82 to 1.

We normally adopt a contrarian perspective on crowd sentiment and the fact that traders are net-long signals that oil prices in the United States may continue to decrease.

However, market sentiment, as measured by IG client data, indicates a pessimistic prognosis for US crude prices, confirming traders’ expectations of additional drops. This view highlights the oil market’s complicated dynamics, which involve balancing geopolitical threats with fundamental supply and demand factors.

The strikes have targeted not only Ukraine’s energy grid but also residential regions, highlighting the conflict’s vast scope. Ukrainian President Volodymyr Zelenskyy has lamented the delay in getting essential military help from Western partners, urging more US-made Patriot air defense systems to repel the strikes.

Meanwhile, the United States has expressed concern that sustained strikes on Russia’s energy infrastructure may spark retaliation and raise global oil prices, complicating the geopolitical environment and the global energy market’s stability.

Final Thoughts

As the crisis goes on, the possibility of future escalation remains a major concern, emphasizing the important junction of geopolitical tensions and international energy markets. Traders and analysts are paying particular attention to these events, which have far-reaching ramifications for oil prices and global energy supply dynamics.