Pacific Union Review 2025 with Rankings By Dumb Little Man

By Wilbert S

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 114th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

Pacific Union Review

Forex brokers play a crucial role in the world of online trading, offering platforms for trading in foreign currencies and other financial instruments. Pacific Union stands out as a broker that facilitates trading in contracts for difference (CFDs) on a wide array of assets. These include currencies, stocks, bonds, indices, commodities, metals, and exchange-traded funds (ETFs). For newcomers, Pacific Union provides a free demo account with a balance of 100,000 virtual dollars, offering a risk-free environment to practice trading strategies.

This Pacific Union review aims to deliver a comprehensive analysis of the broker, highlighting its key features and potential limitations. We focus on providing vital information about Pacific Union’s account options, deposit and withdrawal processes, commission structures, and more. Our approach combines expert analysis with feedback from actual traders, ensuring you have all the necessary details to consider Pacific Union as your go-to brokerage service provider.

Our balanced review seeks to equip you with insightful data on Pacific Union, enabling you to make an informed decision regarding your trading needs. Whether you are new to trading or an experienced investor, understanding the offerings and how they align with your investment goals is paramount. With Pacific Union, traders have access to a broad spectrum of financial instruments, making it a compelling option for diversifying your trading portfolio.

What is Pacific Union Forex Broker?

Pacific Union is a renowned broker in the online trading industry, offering its clients the opportunity to engage in trading contracts for difference (CFDs) across a diverse range of assets. These assets include currencies, stocks, bonds, indices, commodities, metals, and exchange-traded funds (ETFs). To support new traders, Pacific Union provides a free demo account with a generous $100,000 in virtual dollars, allowing for a risk-free introduction to the world of trading.

The broker offers real accounts that are designed to meet the needs of traders at different levels of experience. There are five types of accounts, each with its unique trading parameters. The minimum deposit required to start trading is just $20, making it accessible to a wide audience. Spreads are floating and start from as low as 0 or 1.3 pips, depending on the account selected. Additionally, traders can leverage up to 1:1000, amplifying their trading potential.

Clients of Pacific Union have the advantage of using MetaTrader 4, MetaTrader 5, and WebTrader trading platforms, which are among the most respected platforms in the trading community. The broker also offers a highly-rated mobile platform, ensuring traders can manage their investments on the go. Beyond active trading, Pacific Union provides avenues for income through a standard referral program and an integrated copy trading service, further enhancing the trading experience for its users.

Safety and Security of Pacific Union

The safety and security of trading with Pacific Union is a paramount concern for both new and experienced traders. After extensive research, including insights from Dumb Little Man, it’s clear that Pacific Union has taken significant steps to ensure its clients’ investments are protected. The company is officially registered in Seychelles and operates under the strict oversight of the local Financial Services Authority (FSA). This regulatory framework demonstrates Pacific Union’s commitment to maintaining a secure and trustworthy trading environment.

Being regulated by the FSA provides traders with a level of assurance regarding the operational standards and financial stability of Pacific Union. The regulatory body enforces stringent guidelines that the broker must adhere to, including those related to financial reporting, client fund segregation, and risk management. This oversight ensures that Pacific Union operates with the highest level of integrity and transparency, offering traders a safe platform for their trading activities.

Pros and Cons of Pacific Union

Pros

- Low entry barrier

- High leverage on various assets

- Cost-effective trading

- Diverse account options

- Comprehensive trading platforms

- Efficient copy trading

- Reliable 24/7 support

Cons

- CFD trading only

- Limited passive income opportunities

- Geographical restrictions

Sign-Up Bonus of Pacific Union

Pacific Union offers an attractive sign-up bonus to welcome new traders. For your initial deposit, you’ll receive a 50% bonus on the first $1000, credited directly to your account. This generous offer is designed to enhance your trading capabilities from the start, providing extra funds to explore the diverse trading opportunities available.

For any deposits made after the initial one, Pacific Union continues to reward its clients with a 20% bonus. This additional bonus applies to subsequent deposits, with the potential to accumulate up to a maximum total of $9,500 in bonus credits. This ongoing bonus structure is crafted to support and encourage traders as they expand their trading activities on the platform.

Minimum Deposit of Pacific Union

The minimum deposit requirement at Pacific Union is notably low, set at just $20. This low threshold ensures that trading is accessible to a broad audience, including beginners and those with limited capital. It highlights Pacific Union’s commitment to inclusivity in the trading world, allowing more individuals to start trading with a minimal financial commitment.

Pacific Union Account Types

After thorough research and testing by our team of experts at Dumb Little Man, we’ve organized the account types offered by Pacific Union into a clear and concise list. These types of PU Prime account are designed to cater to the diverse needs of traders, from beginners to professionals.

Cent Account

- Minimum Deposit: $20

- Spread: Starts at 1.3 pips

- Commissions: None

- Account Currency: USD only

- Maximum Leverage: 1:500

Standard Account

- Minimum Deposit: $50

- Spread: Starts at 1.3 pips

- Commissions: None

- Account Currency: All base currencies

- Maximum Leverage: 1:500

Pro Account

- Minimum Deposit: $50

- Spread: Starts at 1.3 pips

- Commissions: None

- Account Currency: All base currencies

- Maximum Leverage: 1:1000

Prime Account

- Minimum Deposit: $1000

- Spread: Starts at 0 pips

- Commission: $3.50 per lot

- Account Currency: All base currencies

- Maximum Leverage: 1:500

Islamic Account

- Minimum Deposit: $50

- Spread: Starts at 1.3 pips

- Commissions: $0-3.50 per lot

- Account Currency: All base currencies

- Maximum Leverage: 1:500

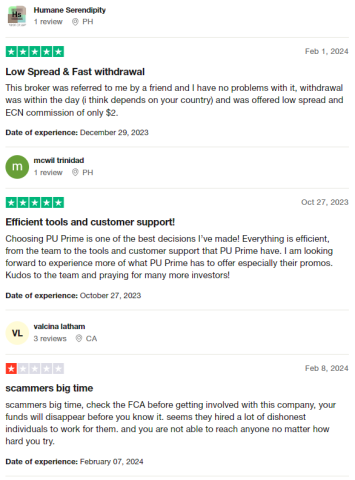

Pacific Union Customer Reviews

Customer reviews of Pacific Union present a mixed picture, with many highlighting the broker’s strengths and a few pointing out areas of concern. Users have praised the low spreads and low ECN commissions, with some noting efficient withdrawal processes that vary by country. The Prime account has been lauded for its efficiency, including the team, tools, and customer support, with customers expressing eagerness to explore further offerings and promotions. However, there are cautionary tales advising potential clients to check regulatory bodies like the FCA before committing, citing experiences of funds disappearing and difficulties in contacting support. This spectrum of feedback underscores the importance of conducting thorough research and considering both positive and negative experiences when choosing a broker.

Pacific Union Fees, Spreads, and Commissions

Pacific Union is known for its competitive fees, spreads, and commissions, catering to a wide range of traders. The broker offers floating spreads, which start from 0 or 1.3 pips, varying according to the account type. This flexibility allows traders to choose an account that best suits their trading style and goals.

For those opting for the Prime account, there’s a trading commission of $3.5 per standard lot, which is competitive within the industry. The Islamic account, designed to comply with Sharia law, also incurs fees but these are floating, ranging from $0 to a maximum of $3.5.

When it comes to withdrawal fees, Pacific Union charges them only for specific channels: Skrill (1%), Neteller (2%), and Faspay (0.5%). Withdrawals through other methods, including Visa or MasterCard bank cards, are free of broker charges. However, it’s important to note that additional fees may be applied by other parties, such as banks, involved in the withdrawal process, which traders should take into account.

Deposit and Withdrawal

After thorough testing by a trading professional at Dumb Little Man, it has been found that Pacific Union provides a seamless deposit and withdrawal process. Traders can start risk-free with a demo account, trading with virtual funds to get accustomed to the platform. However, it’s important to note that while this option is risk-free, it does not yield real profits.

Upon transitioning to a real account, traders can deposit funds and begin trading in earnest, with the potential to earn profits on successful trades. Profits can be withdrawn at any time, offering flexibility and control over financial assets. There’s no limit on the number of withdrawals, and the first withdrawal each month is free of commission. However, a $20 fee is charged for the second and subsequent bank transfer withdrawals within the same month.

The minimum withdrawal amount is set at $40, ensuring that all requests below this threshold are not processed, maintaining a standard for transactions. Withdrawal requests are processed within one business day, providing a quick turnaround for traders looking to access their funds. Although requests made over the weekend are processed the following Monday, this ensures that traders have timely access to their profits.

Traders have multiple options for withdrawing funds, including Visa and MasterCard, bank transfer, Neteller, Skrill, and Faspay. The availability of withdrawal channels may vary based on the trader’s region, offering a tailored experience to meet the needs of Pacific Union’s global clientele. This flexibility in deposit and withdrawal options underscores Pacific Union’s commitment to accommodating traders from various geographic locations.

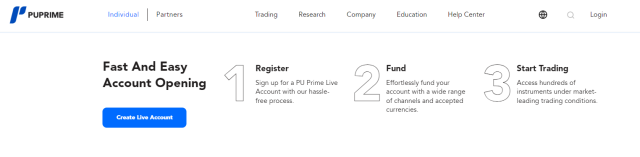

How to Open a Pacific Union Account

- Visit puprime.com and select “Personal” in the upper left corner.

- Choose your preferred language from the upper right corner.

- Click on “Join Now” to begin the account creation process.

- Opt for “Live Account”, enter your country, name, email, and phone number, then click “Submit”.

- Fill in personal details such as salutation, nationality, birth details, and identity document information, then proceed by clicking “Next”.

- Use the “Continue Application” button if you need to pause and resume your registration.

- Wait for document verification to complete for full account access.

- Fund your account via the “Deposit Funds” button and select account conditions.

- Download the trading platform from the “Downloads” section to start trading.

Pacific Union Affiliate Program

The Pacific Union affiliate program offers traders an opportunity to earn extra through a unique referral link. Once registered, traders can share this link via any digital platform or directly with friends and colleagues. When someone clicks on this link and signs up on the broker’s website, they become a referral of the link owner.

For the link owner, each referral who deposits $500 or more brings a $150 bonus. In turn, the referral also benefits, receiving an additional $100 bonus from the broker. This mutual benefit makes the affiliate program especially appealing.

Traders are entitled to one bonus per referral, yet the number of referrals they can invite is unlimited. It’s important to note that the $150 and $100 bonuses may vary by region. Traders can find all relevant details about the affiliate program in their user account, ensuring they have the information needed to maximize their participation in the program.

Pacific Union Customer Support

Based on the experience of Dumb Little Man, Pacific Union’s customer support has been recognized for its robustness and efficiency. The technical support department is multi-lingual and offers consultations 24/5, ensuring that traders can receive assistance whenever needed, although this is limited to weekdays. The broker utilizes standard communication channels, including telephone, email, and LiveChat, to address and resolve queries promptly.

The accessibility of LiveChat is particularly noteworthy, as it is available directly on the website, within the user account, and through the broker’s mobile application. This wide range of options underscores Pacific Union’s commitment to providing comprehensive support to its clients, facilitating a seamless trading experience across different platforms.

Advantages and Disadvantages of Pacific Union Customer Support

Advantages Disadvantages

Support available to non-clients

24/5 availability

Multilingual team

Consultations on trading

Multiple communication channels

No weekend support

Limited instant response options

Pacific Union vs Other Brokers

#1. Pacific Union vs AvaTrade

Pacific Union and AvaTrade both serve a wide clientele but differ significantly in their offerings and regulatory environments. AvaTrade, with its inception in 2006, boasts a robust regulatory framework with registrations in multiple jurisdictions, offering over 1,250 financial instruments. Its global presence is marked by physical locations in Australia, Ireland, the British Virgin Islands, and Japan, catering to a large international clientele with a focus on regulatory compliance. Pacific Union, on the other hand, is known for its competitive spreads, low minimum deposit requirements, and diverse account types, including Islamic accounts.

Verdict: For traders prioritizing regulatory security and a broad range of financial instruments, AvaTrade may be the better choice due to its established regulatory framework and global presence. However, Pacific Union offers more flexibility in account types and lower entry barriers, making it suitable for traders looking for diverse trading options and those starting with smaller capitals.

#2. Pacific Union vs RoboForex

RoboForex stands out with its emphasis on cutting-edge technology and a wide selection of trading platforms, including MetaTrader, cTrader, and RTrader. It offers over 12,000 trading options across eight asset classes, appealing to traders of varying styles and volumes. Pacific Union, while offering a competitive range of assets and platforms, focuses more on accessibility and cost-effectiveness with low spreads and minimal deposit requirements.

Verdict: RoboForex is better suited for traders looking for technological sophistication, a vast array of trading options, and platform diversity. Its tailored solutions cater to a broad spectrum of trading preferences. In contrast, Pacific Union is more favorable for those seeking lower costs of entry and flexibility in trading conditions, especially for beginners and those preferring a streamlined trading experience.

#3. Pacific Union vs FXChoice

FXChoice differentiates itself with a focus on active and passive trading, offering classic and professional ECN accounts geared towards experienced traders. Its regulatory backing by the FSC of Belize and a strong emphasis on business integrity and customer focus are notable. Pacific Union, with its broad asset range and flexible account options, including low minimum deposits, appeals to a diverse trader demographic.

Verdict: For experienced traders focused on active and passive trading strategies, FXChoice may be the preferable option, especially for those seeking specialized ECN accounts with tight market spreads. Pacific Union, however, offers a more versatile trading environment suitable for traders at all levels, including beginners, with its user-friendly account structures and lower financial barriers to entry.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those passionate about forging a successful path in forex trading with the aim of significant financial rewards, Asia Forex Mentor is the top recommendation for comprehensive training in forex, stock, and crypto trading. Ezekiel Chew, recognized for his groundbreaking work with trading institutions and banks, leads the charge at Asia Forex Mentor. Notably, Ezekiel’s ability to consistently secure seven-figure trades distinguishes him from others in the educational sphere. The reasons for our endorsement are compelling:

Comprehensive Curriculum:Asia Forex Mentor delivers a thorough educational suite that spans forex, stock, and crypto trading. This structured program prepares traders to thrive in various markets with essential knowledge and skills.

Proven Track Record: The effectiveness of Asia Forex Mentor is underscored by its history of nurturing traders who achieve profitability in diverse markets. This success attests to the quality of their teaching methods and mentorship.

Expert Mentor: Students at Asia Forex Mentor receive advice and insights from a mentor with a proven record in forex, stock, and crypto trading. Ezekiel’s personalized guidance empowers students to confidently tackle market complexities.

Supportive Community: Membership in Asia Forex Mentor grants access to a community of ambitious traders. This environment promotes collaboration and learning from peers, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to aid traders in emotion management, stress handling, and making informed decisions.

Constant Updates and Resources: With the ever-changing nature of financial markets, Asia Forex Mentor keeps students informed on the latest trends and strategies. Ongoing access to resources ensures traders stay ahead in the game.

Success Stories: Numerous individuals have achieved financial independence through the education received at Asia Forex Mentor, showcasing the program’s capacity to transform trading careers.

Asia Forex Mentor stands out as the definitive choice for anyone seeking an extensive course in forex, stock, and crypto trading. Offering a broad curriculum, expert mentorship, a practical learning approach, and a supportive community, Asia Forex Mentor equips aspiring traders with the tools and guidance necessary to excel as professionals in the financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Pacific Union Review

In conclusion, the team of trading experts at Dumb Little Man has conducted a thorough review of Pacific Union, identifying it as a broker with notable strengths but also areas requiring caution. Pacific Union excels in offering flexible trading conditions, including competitive spreads, low minimum deposit requirements, and a diverse range of account types. These features make it an attractive option for both novice and experienced traders seeking to navigate the forex and CFD markets.

Moreover, Pacific Union’s commitment to customer support and the inclusion of educational resources further enhance its appeal, providing traders with the tools and assistance needed for successful trading endeavors. The broker’s affordable entry point and comprehensive trading platforms are significant advantages that facilitate accessibility and ease of use.

However, potential traders should be aware of the limitations, such as the broker’s focus on CFD trading and the absence of services on weekends. Additionally, the geographical restrictions may impact traders in certain regions. It’s crucial for prospective clients to weigh these considerations alongside the broker’s benefits.

>> Also Read: HugosWay Review 2024 with Rankings By Dumb Little Man

Pacific Union Review FAQs

What is the minimum deposit required to start trading with Pacific Union?

The minimum deposit to open a trading account with Pacific Union is $20. This low entry barrier makes it accessible for traders of all levels to begin trading in forex and CFDs without a significant initial investment.

Does Pacific Union offer educational resources for beginners?

Yes, Pacific Union provides a range of educational resources tailored for beginners. These resources include tutorials, webinars, and articles designed to help new traders understand the basics of forex and CFD trading, as well as develop effective trading strategies.

Can traders from all countries open an account with Pacific Union?

While Pacific Union offers services to a wide global audience, there are restrictions for traders from certain countries, including Australia and Singapore. Prospective clients should check the broker’s website or contact customer support to verify if their country of residence is eligible for Pacific Union’s trading services.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.