PRCBroker Review 2024 with Rankings By Dumb Little Man

By Wilbert S

March 3, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 122nd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

PRCBroker Review

Forex brokers play a crucial role in the global financial markets, acting as intermediaries that enable individuals and institutions to buy and sell foreign currencies. In this landscape, PRCBroker emerges as a prominent player with a primary focus on the Forex market. Offering services across multiple regions with limited country restrictions, PRCBroker ensures traders from the EU, Asia, Oceania, Africa, and South America can participate in trading activities seamlessly.

Our detailed review aims to shed light on PRCBroker, highlighting its advantages and areas where it could improve. We delve into the broker’s unique selling propositions, account types, deposit and withdrawal mechanisms, commission structures, and other vital aspects. By integrating expert analysis with real trader experiences, our goal is to provide you with all the information needed to decide if PRCBroker fits your trading requirements.

What is PRCBroker?

PRCBroker is a seasoned entity in the financial markets, boasting over two decades of experience, primarily concentrated on the Forex market. This broker has crafted a service model that is both inclusive and expansive, ensuring traders from diverse regions have the opportunity to engage in trading activities with minimal geographic restrictions. Its footprint spans the EU, Asia, Oceania, Africa, and South America, facilitated by an extensive network of offices.

This brokerage stands out for offering traders direct access to not only the Forex market but also indices, commodities, and precious metals. By leveraging the MetaTrader platform, PRCBroker eliminates the need for trades to be routed through global stock exchanges. This approach simplifies the trading process for its users, providing a seamless and efficient trading experience that caters to a broad array of investment preferences and strategies.

Safety and Security of PRCBroker

After a comprehensive review by Dumb Little Man, it’s clear that PRCBroker prioritizes the safety and security of its clients’ investments. Each branch of PRCBroker adheres to strict regulatory standards, ensuring a secure trading environment. Specifically, the Cyprus branch, operating under Performance Ronnaru Company Ltd, is rigorously supervised by the Cyprus Securities Regulatory Commission (CySEC), highlighting its commitment to regulatory compliance and investor protection.

Furthermore, the division known as Performance Ronnaru Capital Ltd, registered with the number 4788, falls under the jurisdiction of the Vanuatu Financial Services Commission (VFSC). PRCBroker also extends its presence to the British Virgin Islands and Saint Vincent and the Grenadines through local representatives, further solidifying its global footprint and adherence to international regulatory frameworks. As a protective measure for its clients, PRCBroker is a proud member of the Investor Compensation Fund (ICF). This membership guarantees that, in the unlikely event of financial distress or bankruptcy, retail clients’ funds are eligible for reimbursement up to 20,000 euros per trader from the ICF, underscoring PRCBroker’s dedication to client security and financial integrity.

Pros and Cons of PRCBroker

Pros

- Wide range of account options (Standard, ECN, swap-free, MAM, demo)

- Regulated by CySEC

- Protected by ICF, securing up to 20,000 euros per client

- MetaTrader 4 and 5 platforms available

- English language technical support 24/7

- Opportunities for passive income

- No fees for deposits or withdrawals

Cons

- High minimum deposit ($500 for Standard, $50,000 for ECN)

- No cent accounts

- Spreads higher than competitors

- No bonus programs, partner initiatives, or educational resources

Sign-Up Bonus of PRCBroker

As of the current update, PRCBroker does not offer a sign-up bonus for new clients. This approach aligns with their strategy, focusing on providing robust trading tools and secure investment environments rather than promotional incentives. Potential traders should consider the comprehensive services and regulatory protections offered by PRCBroker, rather than looking for initial financial incentives.

Minimum Deposit of PRCBroker

PRCBroker has set its minimum deposit amount at $500. This threshold is designed to cater to traders who are ready to engage seriously in the Forex market and other financial instruments. It reflects PRCBroker’s commitment to offering a trading environment that balances accessibility with the seriousness of investment, ensuring clients are well-positioned to capitalize on the markets from the outset.

PRCBroker Account Types

Our team of experts at Dumb Little Man conducted thorough research and testing on PRCBroker‘s account types. Here’s what they found:

Standard Account

- Ideal for both novice and experienced traders

- Minimum deposit: $500

- Maximum leverage: 1:100

- Spreads start from 1 pip

ECN Account

- Tailored for professional traders in over-the-counter asset trading

- Minimum deposit: $50,000

- Maximum leverage: 1:50

- Variable spreads, starting from 0.1 pips

This structured account offering from PRCBroker is designed to accommodate a wide range of trading strategies and experience levels, ensuring that both new and seasoned traders have the resources they need for effective trading.

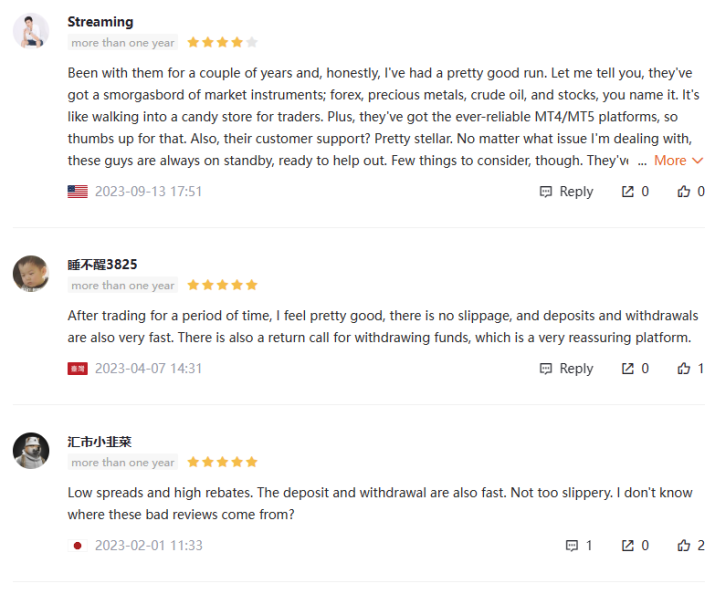

PRCBroker Customer Reviews

Customer reviews for PRCBroker highlight a generally positive experience among its users. Traders have praised the broker for its wide selection of market instruments, including forex, precious metals, crude oil, and stocks, likening it to a “candy store” for trading enthusiasts. The availability of MT4/MT5 platforms is also a significant plus, ensuring a reliable trading experience. Customer support is commended for its responsiveness and efficiency, providing timely assistance for any issues encountered. Additionally, clients appreciate the fast deposit and withdrawal processes, with some noting the absence of slippage and the added reassurance of return calls during withdrawals. The mention of low spreads and high rebates further underscores the broker’s competitive offering. Despite a few detractors, the overarching sentiment among reviewers is one of satisfaction and trust in PRCBroker’s services.

PRCBroker Fees, Spreads, and Commissions

PRCBroker distinguishes itself in the market through its competitive approach to fees, spreads, and commissions. The broker operates on a model of variable spreads, ensuring that traders can benefit from tight pricing that aligns with market conditions. For those using Standard accounts, spreads start from as low as 1 pip, making it accessible for a wide range of trading strategies. On the other hand, ECN accounts enjoy even lower spreads, beginning at just 0.1 pips, catering to the needs of professional traders who require razor-thin margins for their high-volume trades.

An important note for ECN account holders is the presence of an extra trading fee, which is attributed to the specialized order execution method employed by these accounts. This fee structure is transparent, allowing traders to account for costs effectively in their trading plans.

When it comes to non-trading activities, PRCBroker stands out by not imposing any fees on deposits and withdrawals, enhancing the overall value proposition for its clients. However, it’s essential to be aware that while the broker does not charge these fees, the chosen payment systems might apply their own charges according to their regulations. This approach by PRCBroker to fees and commissions underlines its commitment to providing a cost-effective and transparent trading environment for its clients.

Deposit and Withdrawal

A trading professional at Dumb Little Man tested PRCBroker‘s deposit and withdrawal processes, confirming their efficiency and user-friendliness. Withdrawals at PRCBroker initiate upon the company receiving a signed form from the client, either through mail or via a submission in the user’s account. This process ensures a secure and verified transaction pathway for clients’ funds. The options for withdrawal include transferring funds to a card, bank account, or electronic wallet, with the available methods clearly listed in the client’s user account for convenience.

PRCBroker stands out by not imposing any fees on withdrawals, although it advises clients that payment system fees may still apply. It’s crucial for clients to note that they are responsible for covering these external fees, as PRCBroker does not offer compensation for such expenses. Withdrawals are efficiently processed within five business days, contingent on the client having completed the necessary verification steps. Moreover, to proceed with a withdrawal, the free margin in the client’s account must surpass the amount requested, ensuring trades are not adversely affected.

The flexibility extends to currency options, as clients are allowed to withdraw funds in any currency. Should a withdrawal request involve a currency different from the account’s currency, PRCBroker performs the conversion using its internal exchange rate, as determined by its partner bank. This feature adds an extra layer of adaptability for traders managing funds in various currencies, underscoring PRCBroker’s commitment to accommodating its clients’ diverse financial needs.

How to Open a PRCBroker Account

- Navigate to “Customer Service” on PRCBroker and click “Open Trading Account” for standard account options or contact technical support for ECN or MAM accounts.

- Complete the registration form with your personal information including email and phone number.

- Input your passport/ID card number and taxpayer identification number.

- Upload screenshots of your bank card and the required identification documents.

- Attach a photo of a recent utility bill or bank statement as proof of residence.

- Indicate your source of funds with appropriate documentation.

- Review your information for accuracy before submission.

- Submit the form and wait for a confirmation email from PRCBroker.

- Follow the instructions in the confirmation email to finalize your account setup.

PRCBroker Affiliate Program

The PRCBroker Affiliate Program offers an enticing opportunity for partners registered as Introducing Brokers (IBs). These partners benefit from a variety of payout plans, including TU rebates from distribution, trading commissions from referred clients, or a percentage of their deposits. Furthermore, IBs have the potential to earn a share of PRCBroker’s profits from the trades executed by new traders who sign up through their referral links.

To facilitate the management and tracking of referrals, PRCBroker provides its Introducing Brokers with a convenient CRM system. This system allows IBs to monitor the trading and payment activities of their referees in detail. It offers insights into deposit and withdrawal amounts, as well as the volume and number of closed positions. This level of access ensures that IBs are well-informed about their referees’ activities, enabling effective tracking and management of their affiliate earnings.

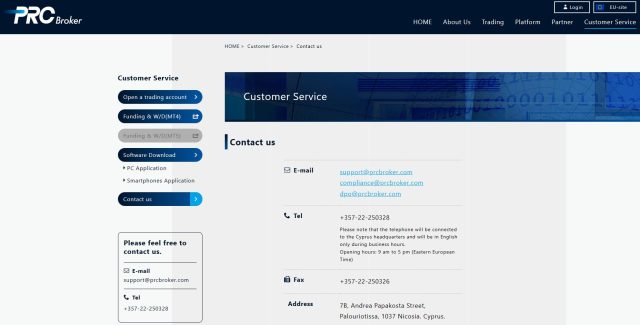

PRCBroker Customer Support

Based on the experience of Dumb Little Man, PRCBroker‘s Customer Support is notably accessible and versatile, catering to the diverse needs of traders. The broker ensures clients can reach out for assistance through multiple channels: a dedicated phone line listed in the contact section, an online chat feature on the website, and via email. This multi-channel approach facilitates prompt and efficient resolution of queries and issues, enhancing the overall trading experience.

In addition to these standard communication methods, PRCBroker goes a step further by offering support in Chinese through Skype and the popular instant messaging app QQ. This inclusion underscores the broker’s commitment to serving a global clientele, ensuring that language barriers do not hinder access to quality customer service.

Advantages and Disadvantages of PRCBroker Customer Support

| Advantages | Disadvantages |

|---|---|

PRCBroker vs Other Brokers

#1. PRCBroker vs AvaTrade

AvaTrade sets itself apart with a strong emphasis on regulatory compliance and a vast array of financial instruments, boasting over 1,250 options for traders. Founded in 2006, AvaTrade has a significant global presence, including offices in Australia, Ireland, the British Virgin Islands, and Japan, catering to more than 300,000 registered customers. In contrast, PRCBroker focuses on offering specialized Forex market services with a significant emphasis on personalized customer support and trading flexibility across various regions.

Verdict: For traders valuing a broad selection of financial instruments and strong regulatory backing, AvaTrade might be the better choice due to its extensive global reach and commitment to client security. However, for those prioritizing Forex trading with dedicated support and a tailored trading experience, PRCBroker could be more appealing.

#2. PRCBroker vs RoboForex

RoboForex, operating since 2009, is recognized for its innovative approach to trading technology and the diversity of trading platforms, including MetaTrader, cTrader, and RTrader. It offers over 12,000 trading options across eight asset classes, catering to a wide spectrum of traders’ needs. PRCBroker, while more focused on the Forex market, prides itself on accessibility and efficient trading through MetaTrader platforms, emphasizing a more concentrated yet highly professional trading environment.

Verdict: For traders looking for technological innovation, a vast array of trading options, and platform diversity, RoboForex emerges as the superior choice. Conversely, PRCBroker is better suited for traders who prefer a focused approach to Forex trading with efficient customer support and trading conditions.

#3. PRCBroker vs FXChoice

FXChoice, established in 2010 and regulated by the International Financial Services Commission of Belize, is known for its dedication to serving both active and passive traders with a focus on integrity and customer-centric services. It offers a mix of classic and professional ECN accounts, aiming at experienced traders with its stringent conditions. PRCBroker, with its comprehensive Forex trading services and variable spreads, caters to a broad audience, offering a blend of account types to suit various trader levels.

Verdict: FXChoice stands out for traders seeking a broker committed to high standards of service and a range of trading instruments tailored for experienced market participants. On the other hand, PRCBroker is preferable for those looking for a variety of Forex-centric trading accounts and supportive customer service, making it a versatile option for both novice and seasoned traders.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you’re passionate about establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor is the ideal choice for top-notch forex, stock, and crypto trading courses. Renowned visionary Ezekiel Chew, known for his contributions to trading institutions and banks, leads Asia Forex Mentor. Personally achieving seven-figure trades, Ezekiel sets himself apart from other educators. Here are the compelling reasons supporting our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers a well-rounded educational program covering stock, crypto, and forex trading. This structured curriculum equips aspiring traders with the knowledge and skills needed to excel in these diverse markets.

Proven Track Record: Asia Forex Mentor’s credibility is solidified by its track record of consistently producing profitable traders in various market sectors. This achievement attests to the effectiveness of their training methods and mentorship.

Expert Mentor: Students benefit from the guidance of an experienced mentor at Asia Forex Mentor, with a remarkable track record in stock, crypto, and forex trading. Ezekiel provides personalized support, enabling students to navigate each market confidently.

Supportive Community: Joining Asia Forex Mentor grants access to a supportive community of like-minded traders pursuing success in stock, crypto, and forex markets. This community encourages collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Trading success requires a strong mindset and disciplined approach. Asia Forex Mentor offers essential psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: Financial markets are dynamic, and Asia Forex Mentor ensures students stay updated with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in numerous success stories where students have transformed their trading careers and achieved financial independence through comprehensive forex, stock, and crypto trading education.

Asia Forex Mentor is the top choice for those seeking the best forex, stock, and crypto trading courses to shape a rewarding career and attain financial prosperity. With its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor equips aspiring traders with the tools and guidance to excel in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: PRCBroker Review

In conclusion, the team of trading experts at Dumb Little Man has conducted a thorough review of PRCBroker, revealing a broker that stands out for its extensive experience and wide range of market instruments. With over two decades in the financial markets, primarily focusing on the Forex market, PRCBroker offers accessibility to traders across various regions with minimal restrictions. The use of MetaTrader platforms and provision of diverse account types, including Standard, ECN, and swap-free accounts, highlight its commitment to catering to different trader needs.

However, potential clients should also weigh certain drawbacks. The high minimum deposit requirements and the lack of cent accounts may deter newer traders with limited capital. Additionally, the absence of ongoing bonus programs and educational resources could be a downside for those looking to enhance their trading skills and knowledge through their broker.

>> Also Read: ATC Brokers Review 2024 with Rankings By Dumb Little Man

PRCBroker Review FAQs

What account types does PRCBroker offer?

PRCBroker provides a variety of account types to cater to different trader needs, including Standard, ECN, swap-free, MAM (Multi-Account Manager), and demo accounts. The Standard account is suitable for both novice and experienced traders with a minimum deposit of $500 and spreads starting from 1 pip. ECN accounts, designed for professional traders, require a higher minimum deposit of $50,000 but offer more competitive spreads starting from 0.1 pips.

Are there any fees for deposits and withdrawals with PRCBroker?

PRCBroker does not charge any fees for depositing or withdrawing funds. However, it’s important to note that while the broker waives its own fees, payment systems used for transactions may impose their own charges. Clients are responsible for covering these external fees, and PRCBroker advises clients to be aware of potential additional costs associated with their chosen payment method.

How does PRCBroker ensure the safety and security of its clients’ funds?

PRCBroker places a high priority on the safety and security of its clients’ investments. All its branches are licensed and operate in compliance with local regulatory standards. For instance, its Cyprus branch is overseen by the Cyprus Securities Regulatory Commission (CySEC), and it is also a member of the Investor Compensation Fund (ICF). This means in the event of financial difficulties, clients are eligible for compensation up to 20,000 euros, providing an added layer of protection for their funds.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.