Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Price Channels – Quick Video Setup tutorial

A price channel forms as a chart pattern where price action confines itself within two parallel lines. In a price channel, prices move within until the candles price breaks at some point. It may apply to either rising or falling main trend line. Also it applies to a choppy market – with prices that oscillate within the confines of a price channel before eventual price breaks.

Forex traders make efforts to spot patterns that help them figure out price reactions in line with support and resistance over time. A price channel and the main trend line are a golden recipe for a trader to make their next moves.

While the theoretical parts of channel and trend trading appear simple, traders need to go beyond and dig in deeper to build on the concepts and apply them as part of their actual trading. In that regard, we have the pleasure of having Ezekiel Chew take us through the entire trading concept with price channel.

Ezekiel Chew is a Leading traders trainer via Asia Forex Mentor. The purpose of AFM is part of the way to give back to the community from expertise garnered from over two decades of trading and successfully rolling out winning strategies. His journey to making six-figure trades is a take of every ordinary and willing trader who is serious about making it in Forex markets.

Before we dive deeper, it’s worth mentioning here that price channel pattern is a technical analysis in forex trading. Price movements within the price channel show probable predictions and also key transitions such as momentums and attempts to break away from the channels at an extreme point. It’s by zooming into the channel that traders spot higher probable trading setups within the broader picture of either trend continuation or reversals.

Price Channels: What are Price Channels?

With a clear grasp of what channels are on forex charts, we may agree that they are not the best tools to trade on their own. However, a price channel provides a handful of very insightful information to help traders with price action. Traders should especially watch the markets when they go choppy or trade consolidating or sideways fashion.

To kick-off, a price channel is used by traders to locate probable”pivot points” and help predict the zones where prices are most likely to reverse in the trends and within the scopes of support and resistance lines. This notion, however, assumes that the market sentiment remains perfect and also assumes we can plot a fitting channel with 100% accuracy.

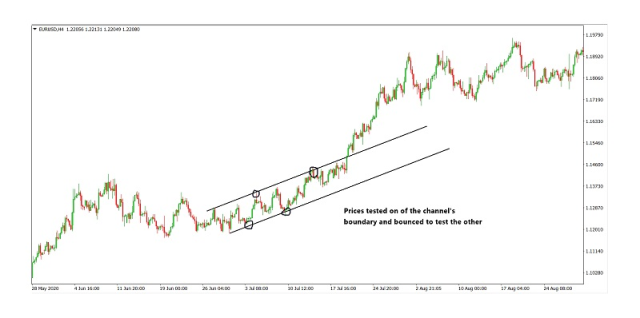

While prices remain trading within a channel, clear reactions are visible when prices hit the roof and the floor of the channel, respectively. Prices are bound to either reverse or break away from the channels when momentum harnesses enough energy to break from the channel. The other portion of insight would mean prices test the extremes of a price channel for two or three times before managing to finally break away.

The second and most significant piece of insight is that price channels are able to predict a pending breakout in terms of the direction and the build-up of momentum towards the latter. Also, as the prices lose momentum, the market shows exhaustion while making pullbacks in a certain direction within a price channel.

Bullish momentum build-up shows when the market scores higher highs within bullish price channel – a probable bullish break away from the confines of a price channel. Also, the opposite applies. Failing momentum shows as the market scores lower low- an impending bearing break-away.

Types of Trading Channels

Price channels in trading fall into 3 key categories. And the three categories arise from the arrangement of the contact points. From a general point of view, a trader requires to connect two lower lows and two higher highs with straight lines to clearly show the channel formations. Therefore, a channel requires 4 points of contact.

Price Channel Patters fall into the following three types:

A channel with an angle facing upwards is an ascending price channel pattern. They apply to a bullish price channel.

Channels with angles that face downwards are better known as descending channels. Some groups of traders refer to the one and two above as the trending channels. And the reason is that the prices generally move in one direction – upwards or downwards generally.

The third category consists of trendlines that are horizontal hence the horizontal channels. Also, some traders refer to them as either trading ranges or rectangles.

How to use Price Channel Pattern

Earlier on, we pointed out that trading channels may be used to trade by providing key information. As such, there are two main ways in which traders use a price channel pattern to trade.

First, traders lookout for opportunities to trade within the channel. Secondly, traders wait and allow sufficient momentums of the markets to break away from the channels.

For the purpose of this article, we’ll be looking deeper into the second category, where traders look for opportunities when prices break away from a price channel. Potential entries with the channel break-away strategy involve traders looking out for the close of a candle with a low or high price for the breakouts.

The best way to position to place the SL or Stop Loss order position is by looking at the vertical distance between the channel borders. Therefore, count the number of pips in between the channel and set your stop loss at half the width of the price channel pattern in pips.

Lastly, place a reasonable take profit position. For the price channel breakout strategy, set the take profit position at the number of pips equal to the width of the channel but projecting towards the direction of the price channel break-in prices.

Pros and Cons of Price Channel Trading Strategy

One huge advantage with price channels in trading is the high rate of their occurrence. And their event is not limited to any time frames at all.

Secondly, price channels feed traders with invaluable information regarding probable turning points as well as the underlying volumes and momentums. The invaluable information helps the traders to build on their analytical prowess and, in turn, assists them target break-away opportunities with the occurrence of well-visible price channels.

The drawback with price channels is that, as much as they help predict the impending occurrence of break-aways, they fail at gauging the strength of a breakout in prices.

Price Channel Trading Strategy Analysis

To lay more emphasis on the knowledge of price channel occurrence, we’ll get into a series of practical backtests to see how far we can gauge the profitability of the strategy with channel breakouts. In finer details, our backtests will take 10 trades running from the date s27 of May in 2021, and we’ll primarily focus on the 4 hours timeframes.

Also, to help us spread our strategic sampling, we’ll test across there key pillars of the markets:

- Forex markets under-representation of EURUSD.

- AAPL will stand in for stock markets

- BTCUSD will cater for the Cryptocurrencies

And to help simplify our backtest conditions, we’ll follow a risk of 1% of account equity for all the three pillar markets.

And here are key definitions to help Definitions:

- For the Average Risk to Reward Ratio = ( The Total risk-reward ratio of all winning trades/ The Total Number of Wins)

- The Profitability (in % gain ) = (Number of Wins X Rewards)- (The Number of Losses X 1) [ Risk which is @ 1%]

Here Below is an image of the application of our backtests for the price channels trading strategy:

Keynote: Our backtest results show the blue and yellow regions on the chart. All blue zones indicate the rewards taken, while the Yellow regions show the risk taken while trading.

And here are the results from the backtests:

- Win rate for EURUSD representing Forex markets) is at40%

- The win rate for AAPL standing in for the Stocks market is ) is 20%

- The win rate for BTCUSD representing the Crypto-assets is at 50%

The results for the average risk to reward ratio for price channels trading strategy are as follows:

- EURUSD (Forex) Risk Reward ratio stands at 1.23

- AAPL (Stocks) Risk Reward ratio stands at 1.7

- BTCUSD (Crypto)Risk Reward ratio stands at 1.07

Lastly, the results on our schedule for the backtests are on the profitability of price channel pattern trading strategy:

- First, EURUSD (Forex) scores a -2.94,

- Second is the AAPL (Stocks), scoring -8.4

- The third is the BTCUSD (Crypto) scoring is 0.37

Best Forex Trading Course

One Core Program is a course in which the lead Trainer – Ezekiel Chew aims to pull you into an inner circle to share over two decades of efforts that culminate into an expertly crafted path to better trading. There are many free materials you can read and get insightful trading content via the Asia Forex Mentor. However, the One Core Program comes to fast-track your progress.

One Core Program is the course that has helped both retail and institutional traders to level up their game at everything they need to know and turn the tables of their trading careers for the better. One Core Program is a balance of many aspects that traders miss in the markets.

Among the outstanding benefits of the One Core Program is the ability to transform all traders – retail or institutional into a mindset of winning traders. Ezekiel dabbed it as Lifestyle trading. And you must not quit your job or hobbies to get to learn and trade onwards successfully. Lifestyle trading only requires as little as 20 minutes daily for you to onboard with the winning habits.

Lastly, one key aspect you’ll come to appreciate is the proven path to success. Ezekiel lays emphasis on the fact that winning in trading is not a cumulative effect of trading in fear and greed while staring at charts all day. Enroll and take on the One Core Program to best grasp the sure bullet to your lifetime of successful and fulfilling trading careers.

Best Forex Brokers

Conclusion: Price Channels

Price channels are market formations that confine price action between two parallel lines. The beauty of price channels is they form on any market time frame, and traders who are well able to read the price action have wide arrays of opportunities with them.

While price channels do not offer standalone trading opportunities, they for a very wonderful ingredient to help analyze price action for firm entry opportunities when combined with another technical indicator. One key aspect through price channels will show clear indications of price break-aways from the channel formation and online with other key components inclusive of the support and resistance zones.

It’s worth noting that price channels are easy to plot – all they require are two parallel lines, and each should connect two highs while the other connects two lows. Also, we’ve highlighted the three types of channels: ascending, descending, and rectangular price channels.

Price channels form in any market chart, be they Crypto, forex, or stocks. And therefore, they enrich the whole trading scenario by offering analytical insights to help traders build on whatever indicators or strategies they are exploring.

While it goes on record from the backtests, a price channel trading strategy has a poor winning rate and a poor risk-reward ratio which also extends to poor profitability. However, it’s a good tool to help you analyze and target entry opportunities via confirmations with another technical indicator.

One good example is the breakout strategy, where traders notice price action’s attempts to trade break-aways from a price channel. However, the entry opportunities require other indicators to gauge the momentum and volumes of trades concurrently.

Lastly, price channels help foreign exchange trading via market analysis that’s more refined- deeper than trend lines. When traders get the main trend lines, they look for opportunities within the upper price channel and lower price channels.

Price Channel Pattern FAQs

How do you draw a price channel?

A price channel exists when prices establish a formation confining its prices in between two adjacent parallel lines. To draw or plot a price channel, traders connect the two higher highs and the two lower lows of the prices with the two parallel lines. Most price charting software provides tools for drawing lines to help show the confines of the price channel formations.

It’s also ideal to approach price channel formation with the probability that they fall into three main categories: up trending, down-trending, or rectangular price channels. Once a trader is able to spot the price channel formation, it’s time to go extra steps to use other indicators that help gauge the market’s volumes and momentums to check the feasibility of opening positions.

What is the Price Channel Trading Strategy?

A price channel strategy arises where traders explore trading opportunities whenever they notice prices trending within any of the three categories of price channels. Whether rising, falling, or consolidating markets, price channel strategies allow traders to trade opportunities as prices remain within the channels or target break-away opportunities.

For price channel breakout opportunities, traders work with the width of the channel to help them estimate reasonable stop loss and profit-taking targets. Ideally, SL is taken to be half the width of the channels. And for a good risk to reward ratio, take profits are set up at a distance equal to the width of the channel but projecting towards the direction of break-away with price action.