Q1 2024 Dividend Payments Surge $16B, Reflecting Positive Corporate Outlook

By Daniel M.

April 3, 2024 • Fact checked by Dumb Little Man

During the first quarter of 2024, there was a noticeable improvement in corporate sentiment, suggesting that companies are feeling more positive about the future compared to the previous year.

This shift towards positivity is demonstrated by significant increases in share repurchases and dividend payouts, which are important tactics for delivering value to shareholders.

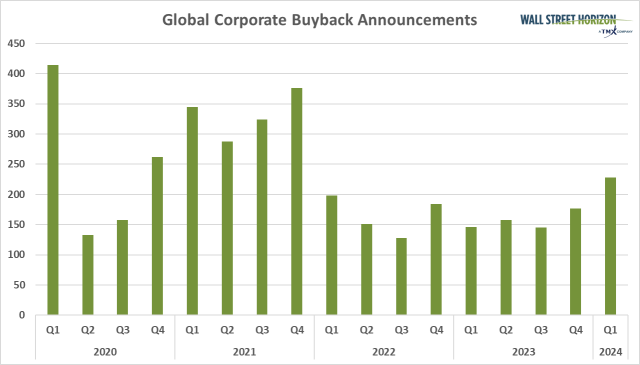

Buyback Announcements Surge

During this period, there was a significant increase in buyback announcements, reaching the highest levels since Q4 2021, with 228 companies announcing repurchase programs.

This signifies a significant turning point, indicating a high level of assurance in the potential for future expansion and financial stability. Buybacks are a useful tool that can indicate both an increase in shareholder value and strong cash flow positions within corporations.

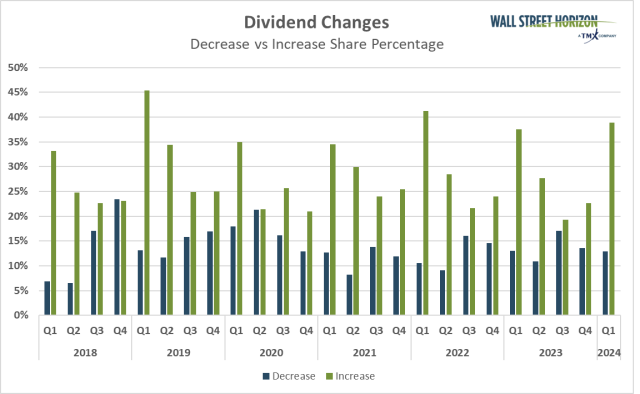

Dividend Increases Reach New Heights

In Q1 2024, dividend activities surged to levels not seen since before 2018, as a staggering 1,639 companies chose to boost their dividends.

This action highlights the positive outlook and financial strength of the corporate sector. Dividends are commonly seen as an indicator of a company’s financial health and potential for future earnings.

Market Outlook: A Cautiously Optimistic Perspective

The broader market outlook remains cautiously optimistic despite the observable uplift in corporate actions.

Given the current economic uncertainties and concerns about interest rates, it would be wise to adopt a cautious approach when it comes to increasing dividends in the coming months.

However, it is anticipated that the larger companies in the S&P 500 will be able to handle these challenges well, suggesting that their ability to bounce back may not be the same for all sectors of the market.

S&P 500 Dividend Dynamics

Examining S&P 500 dividends provides a more detailed perspective. Although there was a slight decline in dividends per share in Q1 2024 compared to the previous quarter, the overall trend is still positive.

This period was marked by major players initiating significant dividends, indicating a strategic shift towards rewarding shareholders in response to changing market conditions.

Conclusion: Navigating Through Opportunities and Risks

With the first quarter of 2024 underway, there are positive signs for the year ahead. Corporate sentiment is strong and there are strategic corporate financial activities that suggest a positive outlook.

Nevertheless, the combination of potential gains and potential losses resulting from current economic uncertainties highlights the need for careful monitoring and thoughtful preparation.

Corporations’ proactive measures regarding buybacks and dividends demonstrate a cautious yet forward-thinking strategy in maneuvering through the complex market landscape.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.