Rethinking ‘Sell in May’: A Flawed Investment Strategy

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Investment Psychology and Market Dynamics

The old adage, “Bears sound smart; bulls make money,” captures the essence of market psychology. Fear, a dominant emotion in finance, often overshadows rational investment strategies. Reflecting on my previous analyses:

- During the 2022 Bear Market, I advocated for buying during dips.

- In 2023, amid recession fears, I highlighted positive market data.

- Early 2024 was focused on leveraging the groundwork of the past years.

Key investment principles remain:

- Be bold when others are cautious.

- Buy low, sell high.

- Patience pays off.

Current Market Outlook

Since October 2022, the market has been on an uptrend. Short-sellers have dwindled, and many investors are eager for what seems like easy profits.

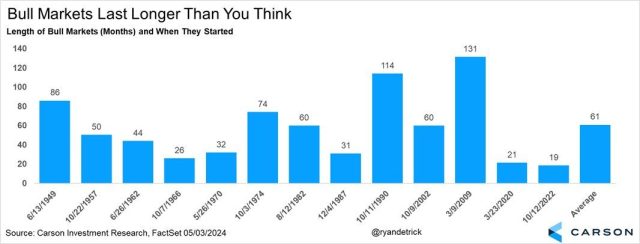

Historically, bull markets average 61 months; we’re currently in month 20.

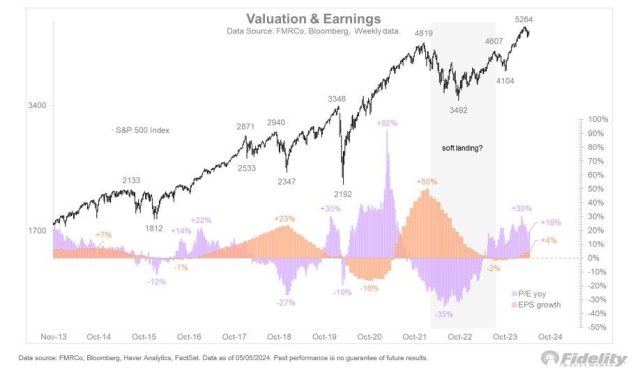

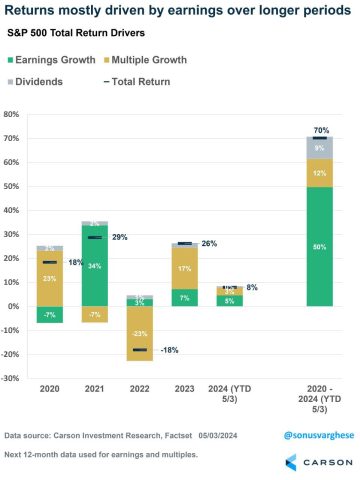

Market valuations are high, though not in bubble territory. The bull market initially sparked by speculative valuation recovery is now increasingly supported by earnings growth.

It’s important to remember that earnings, not speculation, drive long-term market returns.

Debunking ‘Sell in May’

As we approach the end of May, the wisdom of “sell in May and go away” is questionable. Despite the 2022 Bear Market, the May-October period has generally been positive over the last decade.

While May often performs well, September and October are typically weaker. This year, given the electoral volatility, a brief correction might occur. However, the last year of the presidential cycle coupled with the post-bear market recovery phase suggests a positive year-end outlook.

During heightened market enthusiasm, prudence is crucial. With bond markets in their third bear year, they offer a hedge, particularly against unforeseen recessions.

With limited opportunities in U.S. markets, diversifying into other geographies and defensive sectors like utilities could be wise. Effective stock selection remains key for capitalizing on the ongoing uptrend, as demonstrated by tools like InvestingPro+.

In conclusion, while it’s wise to remain vigilant, abandoning the market in May could miss potential gains, especially in a year poised for recovery.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.