Sage FX Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1/5 | 150th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of retail traders, financial consultants, and trading specialists, conducts thorough reviews of brokerage firms. They use a specialized algorithm to assess brokers based on uniform criteria like:

Customer opinions are also incorporated into the final evaluation. We combine expert viewpoints with user experiences to provide a well-rounded outlook, minimizing individual biases for an unbiased review of the broker. After this rigorous evaluation, Sage FX emerged as a credible option for those looking for a reliable financial broker. While the platform performs well on many fronts, it's important to note that there are specific drawbacks. Potential users are advised to read the article carefully to understand these limitations fully. |

Sage FX Review

Forex brokers serve as intermediaries between traders and the foreign exchange market, providing platforms and tools necessary for trading currencies. They offer various services, such as market access, educational resources, and customer support, to help traders navigate the complexities of forex trading. Selecting a reliable broker is crucial for success in the forex market, as it ensures transparency, security, and efficient trade execution.

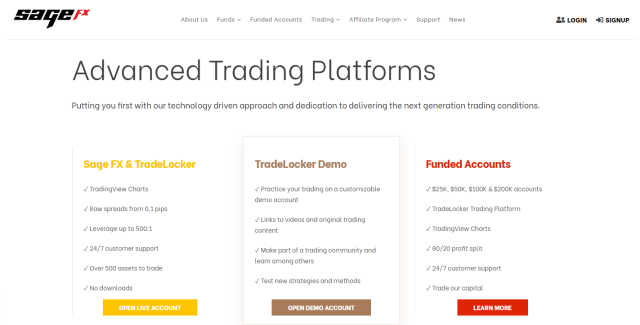

Sage FX is a multi-asset brokerage firm based in Saint Vincent and the Grenadines, offering an intuitive trading platform and 24/7 customer support. Known for its STP (Straight Through Processing) execution model, Sage FX ensures that trades are directly routed to the market without dealing desk intervention, providing competitive trading conditions with minimal slippage and tight spreads starting from 0.1 pips on its PRO account. Sage FX supports various financial instruments, including forex, cryptocurrencies, indices, metals, and commodities.

In this detailed review, we aim to provide an exhaustive evaluation of Sage FX, emphasizing its unique selling propositions and potential drawbacks. Our objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. Our balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Sage FX as your preferred brokerage service provider.

What is Sage FX?

Sage FX is a multi-asset brokerage firm that offers a user-friendly platform for trading various financial instruments, including forex, cryptocurrencies, indices, metals, and commodities. Known for its STP (Straight Through Processing) execution model, Sage FX ensures trades are executed directly in the market, providing transparency and minimizing potential conflicts of interest.

The broker provides a variety of account types to cater to different trading needs, including Standard, PRO, and VAR accounts, each offering competitive spreads and varying commission structures. With a low minimum deposit requirement of just $10, Sage FX makes it accessible for new traders to start trading with minimal financial commitment.

Safety and Security of Sage FX

Sage FX places a high emphasis on the safety and security of its traders, implementing robust measures to protect client funds and data. According to thorough research conducted by Dumb Little Man, Sage FX uses advanced encryption technology to secure transactions and personal information, ensuring that traders' data is kept confidential and safe from cyber threats.

Additionally, Sage FX operates with a segregated accounts policy, which means that client funds are kept separate from the company’s operational funds. This practice ensures that traders' money is protected even if the company faces financial difficulties, providing an extra layer of security and trust.

Another key aspect of Sage FX's security measures is its comprehensive risk management system. This includes real-time monitoring and automated alerts to prevent unauthorized access and fraudulent activities. The broker also employs multi-factor authentication to add an extra step of verification for account logins, making it harder for unauthorized users to gain access.

Despite not being regulated by a major financial authority, Sage FX compensates for this by maintaining high standards of operational transparency and customer support. The broker offers 24/7 multi-lingual support to assist traders with any security concerns, ensuring that help is available at all times.

Pros and Cons of Sage FX

Pros

- User-friendly platform

- High leverage up to 1:500

- Competitive spreads

- No deposit or withdrawal fees

- 24/7 customer support

- Multiple account types

Cons

- Not regulated by major authorities

- Limited educational resources

- No Islamic account option

- Lack of standalone trading tools

Sign-Up Bonus of Sage FX

Sage FX does not currently offer a sign-up bonus for new traders. This approach aligns with industry trends where some brokers are moving away from such incentives due to regulatory and ethical considerations.

Instead of focusing on bonuses, Sage FX prioritizes providing a superior trading experience with competitive spreads, advanced technology, and robust customer support. This focus ensures that traders receive genuine value through quality service rather than temporary promotions.

Minimum Deposit of Sage FX

Sage FX offers a low minimum deposit requirement of just $10, making it accessible for traders of all levels. This minimal financial commitment allows new traders to start their trading journey without a significant upfront investment, which is especially appealing for those just beginning in the forex market.

Sage FX Account Types

Sage FX provides several trading account types designed to meet various trading needs. Our team at Dumb Little Man has tested these accounts and found the following details:

Standard Account

- Perfect for beginners with smaller deposits

- Minimum deposit requirement is only $10

- Offers competitive spreads starting from 1.2 pips

- Ideal for those wanting to start trading with minimal investment

PRO Account

- Geared towards traders with larger deposits

- Minimum deposit is set at $500

- Features tighter spreads starting from 0.1 pips

- Includes a commission per trade, suitable for experienced traders looking for better pricing

VAR Account

- Best for traders preferring a commission-free setup

- Offers spreads similar to the Standard Account

- Provides flexibility without additional commission costs

- Suitable for those who want more trading options without paying commissions

Islamic Account

- Designed for traders following Sharia law

- No swap fees to ensure compliance with Islamic finance principles

- Provides interest-free trading conditions

- An ethical option for traders looking for swap-free trading solutions

Sage FX Customer Reviews

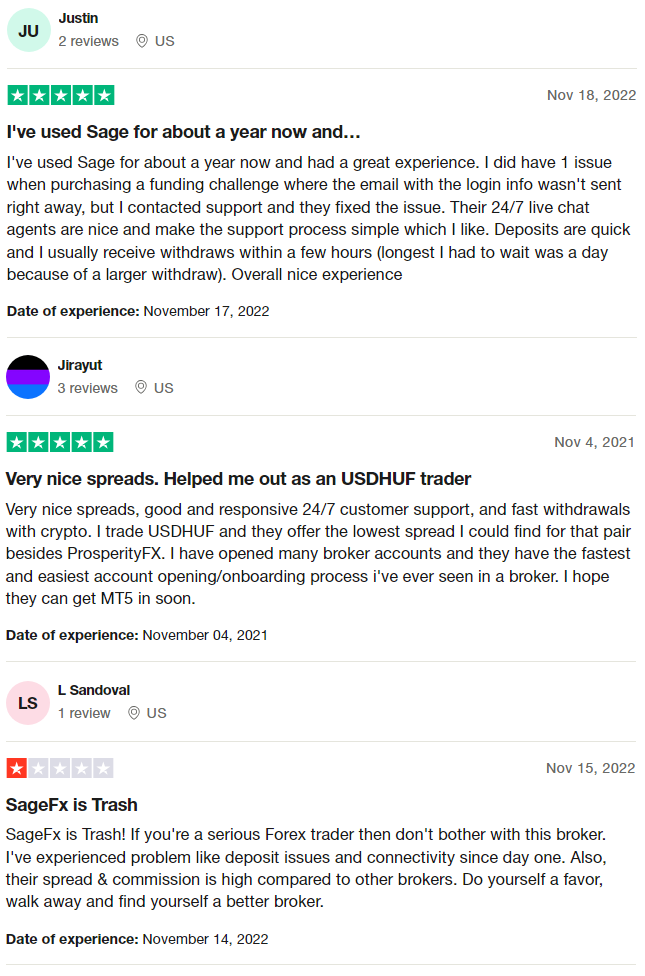

Sage FX receives mixed reviews from its users. Many traders appreciate the fast and responsive 24/7 customer support, noting that issues are quickly resolved, and withdrawals are processed swiftly, often within a few hours. Users also commend the broker for its competitive spreads and efficient account opening process. However, some traders have reported problems such as deposit issues and connectivity problems, and feel that spreads and commissions are higher compared to other brokers. These varying experiences highlight the broker's strengths in customer service and transaction speed, while also pointing out areas needing improvement.

Sage FX Fees, Spreads, and Commissions

Sage FX offers competitive trading conditions with a focus on keeping costs transparent and manageable for traders. The spreads at Sage FX vary by account type, with the PRO account offering tight spreads starting from 0.1 pips, making it ideal for traders looking for low-cost trading opportunities. The Standard and VAR accounts have slightly higher spreads, but they remain competitive in the market.

When it comes to commissions, Sage FX charges a low round-turn commission of $8 on the PRO and Standard accounts, which is in line with industry standards. The VAR account, however, is designed to be commission-free, appealing to traders who prefer to avoid per-trade costs. This variety allows traders to choose the account type that best suits their trading style and budget.

Deposit and Withdrawal

Sage FX offers a streamlined process for both deposits and withdrawals, ensuring that traders can manage their funds with ease. According to a trading professional at Dumb Little Man, deposits are processed quickly, with various methods including cryptocurrencies, credit/debit cards, and e-wallets. This range of options provides flexibility and convenience for traders, catering to different preferences and needs.

Withdrawals at Sage FX are equally efficient, typically processed within a few hours, though larger transactions might take up to a day. The absence of withdrawal fees, apart from third-party charges, makes it a cost-effective choice for traders. This quick turnaround and low cost in handling transactions add to the overall positive trading experience.

How to Open a Sage FX Account

- Visit the official Sage FX website and locate the registration form.

- Enter your basic contact details such as name, email, and phone number.

- Click the “Sign Up” button to proceed with the registration process.

- Fill out a detailed form with additional information like your address and postal code.

- Create a secure password for your account to ensure your information is protected.

- Verify your email address by clicking on the confirmation link sent to your inbox.

- Provide necessary identification documents to complete the KYC (Know Your Customer) process.

- Wait for your documents to be verified by the Sage FX team.

- Once verified, log in to your new account and start trading with Sage FX.

Sage FX Affiliate Program

Sage FX offers a comprehensive affiliate program designed to help partners earn significant commissions by referring new clients to the platform. Affiliates benefit from generous commission structures that reward them based on the trading activity of their referred clients, making it an attractive option for those looking to monetize their network.

The program provides affiliates with professional marketing materials and support, ensuring they have the tools needed to effectively promote Sage FX. With real-time tracking and detailed reporting, affiliates can easily monitor their referrals and commissions, maintaining transparency and efficiency in the partnership.

Sage FX Customer Support

Sage FX offers 24/7 customer support, ensuring that traders can get assistance whenever they need it. This continuous availability is especially beneficial for traders across different time zones, providing reliable support at any hour. Our team at Dumb Little Man found the live chat feature particularly effective, with prompt and helpful responses that resolved issues quickly.

In addition to live chat, Sage FX provides email support for more detailed inquiries. The customer service team is known for their professional and courteous approach, making the support process straightforward and user-friendly. This level of service helps build trust and reliability among traders, enhancing their overall experience with Sage FX.

Advantages and Disadvantages of Sage FX Customer Support

| Advantages | Disadvantages |

|---|---|

Sage FX vs Other Brokers

#1. Sage FX vs AvaTrade

Sage FX and AvaTrade are both prominent brokers in the forex trading space, but they cater to different types of traders. Sage FX is known for its high leverage up to 1:500 and quick, no-fee withdrawals, making it a good choice for traders who want flexibility and cost-effective transactions. In contrast, AvaTrade offers a broader range of trading instruments and extensive educational resources, appealing to both beginners and experienced traders looking for a more comprehensive trading environment. AvaTrade is also highly regulated, providing an added layer of security and trust for its users.

Verdict: AvaTrade is the better option for traders seeking a well-rounded, secure, and educational trading experience due to its regulatory status and extensive resources. Sage FX is ideal for those who prioritize high leverage and fast transactions with lower fees.

#2. Sage FX vs RoboForex

Sage FX and RoboForex offer different strengths in their trading services. Sage FX stands out for its user-friendly platform and 24/7 customer support, catering to traders who need constant access to support and a straightforward trading interface. RoboForex, on the other hand, excels with its wide range of account types and advanced trading tools, including access to MetaTrader 5. RoboForex also provides better research and educational materials, making it more suitable for traders who rely heavily on analytical tools and educational content.

Verdict: RoboForex is the better choice for traders who value advanced trading tools and comprehensive educational materials. Sage FX is more suitable for those who prioritize user-friendly platforms and constant customer support.

#3. Sage FX vs FXChoice

Sage FX and FXChoice both offer competitive trading conditions, but they have distinct differences. Sage FX is noted for its high leverage options and fast, fee-free withdrawals, making it attractive to traders looking for high-risk, high-reward opportunities. FXChoice provides a more regulated environment and supports MetaTrader 4 and 5, appealing to traders who value platform flexibility and regulatory assurance. FXChoice also has better customer service channels, including phone support, which is not available with Sage FX.

Verdict: FXChoice is better for traders who need platform flexibility, regulatory assurance, and comprehensive customer support. Sage FX is ideal for those seeking high leverage and efficient, low-cost transactions.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're eager to build a successful career in forex trading and aim for significant financial gains, Asia Forex Mentor is the ideal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, known for his influence on trading institutions and banks, leads Asia Forex Mentor. Notably, Ezekiel regularly achieves seven-figure trades, setting him apart from other educators. Here are the compelling reasons for our recommendation:

Comprehensive Curriculum: Asia Forex Mentor provides a thorough educational program covering stock, crypto, and forex trading. This structured curriculum equips aspiring traders with the essential knowledge, trading strategy, and skills to excel in these markets.

Proven Track Record: Asia Forex Mentor's credibility is solidified by its impressive track record of producing consistently profitable traders across various market sectors, showcasing the effectiveness of their training and mentorship.

Expert Mentor: Students at Asia Forex Mentor benefit from the expertise of a mentor who has achieved notable success in stock, crypto, and forex trading. Ezekiel offers personalized support, helping students navigate market complexities confidently.

Supportive Community: Joining Asia Forex Mentor grants access to a supportive community of like-minded traders aiming for success in stock, crypto, and forex markets. This community promotes collaboration, idea-sharing, and peer learning.

Emphasis on Discipline and Psychology: Success in trading requires a strong mindset and disciplined approach. Asia Forex Mentor offers crucial psychological training to help traders manage emotions, handle stress, and make rational decisions.

Constant Updates and Resources: Recognizing the dynamic nature of financial markets, Asia Forex Mentor ensures students stay updated with the latest trends, strategies, and market insights, providing continuous access to valuable resources.

Success Stories: Asia Forex Mentor proudly showcases numerous success stories where students have transformed their trading careers and achieved financial independence through their comprehensive trading education.

Asia Forex Mentor stands as the premier choice for those seeking the best forex, stock, and crypto trading course. With its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the essential tools and guidance to turn aspiring traders into accomplished professionals in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Sage FX Review

Based on the analysis conducted by the team of trading experts at Dumb Little Man, Sage FX emerges as a noteworthy platform for both new and experienced traders. The user-friendly interface and diverse range of trading tools make it an attractive option for those looking to engage in online trading.

However, it's important to be aware of some potential drawbacks. While Sage FX offers competitive spreads and a wide variety of assets, users have reported occasional issues with customer service response times.

>> Also Read: PaxForex Review 2024 with Rankings By Dumb Little Man

Sage FX Review FAQs

Is Sage FX suitable for beginners?

Yes, Sage FX is suitable for beginners due to its user-friendly interface and educational resources. The platform offers a variety of tutorials and guides that can help new traders understand the basics of online trading and navigate the system effectively.

What types of assets can I trade on Sage FX?

On Sage FX, you can trade a wide variety of assets, including forex, cryptocurrencies, stocks, and commodities. This diversity allows traders to build a well-rounded portfolio and take advantage of different market opportunities.

How is Sage FX's customer service?

While Sage FX generally provides a range of customer support options, some users have reported delays in response times. It's recommended to use their live chat feature for more immediate assistance, and to check their FAQ section for quick answers to common issues.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.