Saracen Markets Review 2025 with Rankings by Dumb Little Man

By John V

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 149th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Saracen Markets as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Saracen Markets Review

As go-betweens for traders and the currency market, “forex brokers” are essential to the trading community. In addition to a range of trading tools and resources, they provide platforms for buying and selling currencies. Traders who want to reduce risks and increase profits must choose a trustworthy broker.

With a physical location in Dubai, United Arab Emirates, Saracen Markets is an offshore forex broker registered in Saint Vincent and the Grenadines. This broker, which was established in 2018, offers extremely high trading leverage on a constrained selection of trading instruments. This review provides an in-depth analysis of Saracen Markets by utilizing the findings and experiences of experts.

What is Saracen Markets?

With a physical headquarters in Dubai, United Arab Emirates, Saracen Markets is an offshore forex broker registered in Saint Vincent and the Grenadines. The broker was founded in 2018 and offers extremely high trading leverage on a constrained selection of trading instruments.

The broker does not accept traders from the US, Canada, or any EU or EEA member state. Nonetheless, Saracen Markets is well-established throughout Southeast Asia and the Middle East. For dealers in Malaysia, Indonesia, Vietnam, and Thailand, it facilitates local payment methods, making account funding easy.

With a concentration on approximately 25 currency pairs and gold and silver CFDs, Saracen Markets provides a narrow range of trading instruments. In comparison to most other forex brokers, this selection is more limited. It might still be appropriate, nevertheless, for traders who work mostly with large currency pairs.

MetaTrader 4 (MT4) is used for all trading on Saracen Markets. For use on any computer, MT4 is accessible as a web version and as a platform that can be downloaded for Windows and Mac systems.

In short, because of its partial Arabic website and support for local payment methods, Saracen Markets primarily serves merchants in the Middle East and South-East Asia.

Its small assortment of trading instruments, which might not satisfy the demands of traders seeking a wider variety of assets, is its primary disadvantage. In order to give a fair evaluation of Saracen Markets, this study is founded on the opinions and observations of experts.

Safety and Security of Saracen Markets

The Saracen Markets Group of companies owns and runs Saracen Markets. Among the companies in this group is SARACEN MARKETS (PTY) LTD, a South African business with registration number 2013/120134/07. Eighty Strand Street, Cape Town, Western Cape 8001, South Africa is the company’s registered address. It is noteworthy that SARACEN MARKETS (PTY) LTD holds a Financial Sector Conduct Authority (FSCA) license under FSP license number 44806.

With the registration number 26306 BC 2021, SARACEN INC., an additional entity, is incorporated as an international business company in St. Vincent & the Grenadines. Suite 305, Griffith Corporate Centre, P.O. Box 1510 Beachmont, Kingstown, VC0120 St. Vincent & Grenadines is the address of its registered office. This arrangement suggests a presence across multiple jurisdictions with the goal of expanding its market reach.

Although the FSCA regulates the South African corporation and offers some monitoring, it is crucial to remember that SARACEN INC in St. Vincent & the Grenadines operates in a less regulated setting. The overall sense of safety and security that traders perceive might be affected by this dual structure.

Pros and Cons of Saracen Markets

Pros

- Ultra-high leverage

- Low minimum deposit

- Multiple account types

- Transparent commission structure

- Fast execution times

- Wide range of payment options

Cons

- Limited trading instruments

- No service for US/EU clients

- Occasional connection issues

- Limited educational resources

- Mixed customer reviews

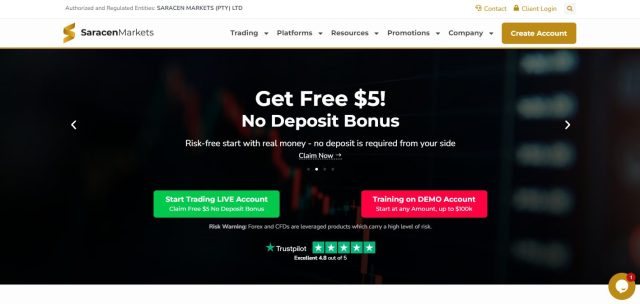

Sign-Up Bonus of Saracen Markets

Start your forex trading journey in Saracen Markets with an alluring $5 free account with Saracen Markets. These free funds are available for trading by new clients without requiring a deposit. It’s easy to register, and you keep all profits made. As a result, traders can explore the market without taking on any financial risk.

With the $5 free account, there’s no danger involved because there’s no concern about losing your money. Trading is profitable from the beginning since you keep all profits made. The simple registration process allows traders to get started right away.

Saracen Markets provides a 30% deposit incentive on new deposits up to a maximum bonus sum of $600, in addition to the free account. Every deposit is eligible for this bonus, with a $10 minimum required. Users must create a new bonus account in the client area, put money into it, and then use the bonus.

The client’s account receives an automatic credit of the 30% deposit incentive, which can be utilized for opening positions and covering losses in floating positions. This promotion offers significant value for new users in Malaysia, Thailand, and Vietnam and is offered to dealers in these territories.

In general, Saracen Markets wants to improve the trading experience and possible profitability of new traders by offering them both a big deposit bonus and a risk-free starting bonus.

Minimum Deposit of Saracen Markets

Saracen Markets provides a $10 minimum deposit for pro and VIP accounts, making it an accessible entrance point for traders. Due to the minimal deposit requirement, novice traders can begin trading forex without having to make a substantial financial investment.

Both account types have a $10 minimum deposit, so it’s simple for consumers to select the one that best meets their trading requirements. This strategy guarantees that Saracen Markets’ features and tools are accessible to traders at all skill levels.

Saracen Markets hopes to draw in a diverse group of traders, from novices to seasoned pros, by maintaining a low minimum investment. In the cutthroat forex market, this tactic improves the broker’s accessibility and attractiveness.

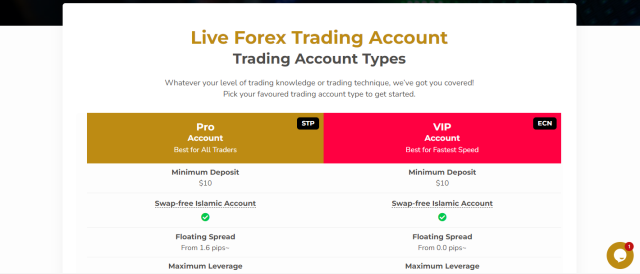

Saracen Markets Account Types

Two separate account types are available from Saracen Markets, each intended to meet certain trading requirements. After conducting extensive investigation, our team of professionals at Dumb Little Man tested these accounts and compiled the following data. The types of accounts are as follows:

Pro Account

- STP

- Best for All Traders

- Minimum Deposit: $10

- Swap-free Islamic Account

- Floating Spread: From 1.6 pips~

- Maximum Leverage: 1:2000

- Account Currency: USD

- Execution Type: Market Execution

- Minimum Order Volume: 0.01

- Minimum Step Volume: 0.01

- Minimum Margin: 1

- Maximum Order Volume: 200

- Margin Call: 50%

- Commission: $0

- Trading Instrument: Forex, Commodities & Indices

- Maximum Position: 200

- Stop Out Level: 20%

- Expert Advisor: Available

VIP Account

- Best for Fastest Speed

- Minimum Deposit: $10

- Swap-free Islamic Account

- Floating Spread: From 0.0 pips~

- Maximum Leverage: 1:500

- Account Currency: USD

- Execution Type: Market Execution

- Minimum Order Volume: 0.01

- Minimum Step Volume: 0.01

- Minimum Margin: 0.25

- Maximum Order Volume: 200

- Margin Call: 50%

- Commission: $5 / Lot

- Trading Instrument: Forex, CMDTY, Indices, Equities & Crypto

- Maximum Position: 200

- Stop Out Level: 30%

- Expert Advisor: Available

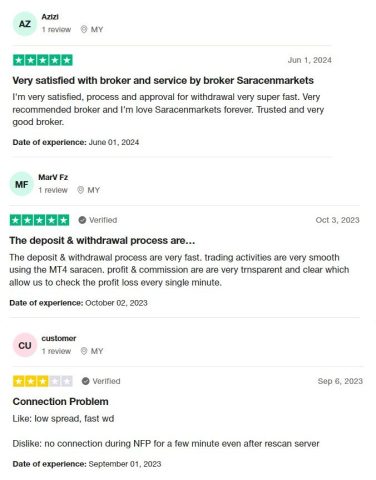

Saracen Markets Customer Reviews

Reviews for Saracen Markets have been mixed, with the majority of comments being favorable. Numerous users praise MT4’s quick deposit and withdrawal processes as well as its seamless trading environment.

Clients emphasize how the clear profit and commission structure makes it simple to monitor their financial activity. However, during busy occasions like the NFP, some customers have reported connection problems that momentarily impact trading. All things considered, Saracen Markets is regarded as a reputable broker with potential for increased connection stability.

Saracen Markets Fees, Spreads, and Commissions

Competitive fee structures are available at Saracen Markets, catering to a variety of trader types. The Pro Account is a desirable choice for traders looking for low-cost trading because it offers floating spreads starting at 1.6 pips and no commission fees.

The VIP Account offers floating spreads as low as 0.0 pips for traders who need faster execution, but there is a $5 lot cost. This account is designed for traders that value efficiency and quickness above all else.

Market execution is a feature of both account types that guarantees orders are filled at the cheapest pricing. The price structure is transparent, and commission policies are unambiguous, making it easier for traders to understand their costs up front and making trading at Saracen Markets more predictable.

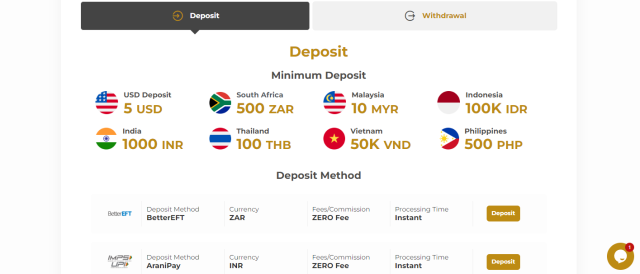

Deposit and Withdrawal

To accommodate traders from various regions, Saracen Markets offers a range of deposit and withdrawal methods. This data was acquired following extensive testing by a Dumb Little Man trading expert.

For both pro and VIP accounts, Saracen Markets has a $10 minimum deposit requirement. Several local currencies, such as USD (minimum $5), ZAR (500 ZAR), MYR (10 MYR), IDR (100K IDR), INR (1000 INR), THB (100 THB), VND (50K VND), and PHP (500 PHP), can be used for funding.

The majority of deposit options, including PaymentAsia, AraniPay, WalaoPay, BetterEFT, and SurePay, have no fees and quick processing. B2BinPAY, on the other hand, charges a 2% fee and its processing time is blockchain-dependent. Processing periods for local depositors differ.

The minimum withdrawal amount from Saracen Markets is $10 USD, $500 ZAR, $50 MYR, 1000 INR, 100 THB, 50K VND, or 200 PHP. BetterEFT, AraniPay, WalaoPay, PaymentAsia, SurePay, B2BinPAY, and Local Depositor are among the withdrawal options. With the exception of Local Depositor, which is dependent on the local depositor, the majority of methods offer ZERO fees and processing times of up to 24 hours.

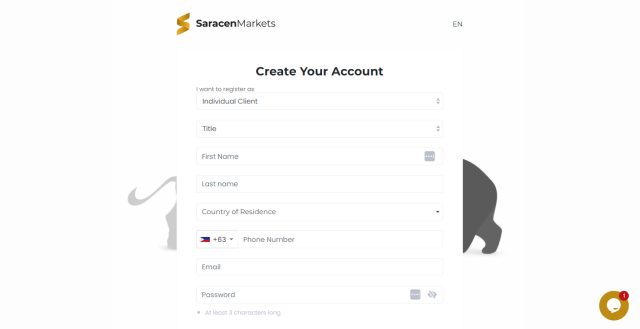

How to Open a Saracen Markets Account

Saracen Markets offers a simple account opening process that will begin you trading right away. Simply complete these steps to open an account and begin trading.

- Visit their website by clicking here.

- Click “Create an account” on the upper right side.

- Choose if you want to register as an Individual Client, or as a Corporate Client.

- Supply important information, such as Name, and your country of residence.

- Put in your phone number and email address for verification.

- Choose a strong an secure password, then solve the captcha.

- Agree with the Privacy Policy, AML Policy, and Risk Disclosures, then agree and consent to their Customer Agreement.

- Continue, then open your email address to verify your account.

- You can now start trading with Saracen Markets, after completing your first deposit!

Saracen Markets Affiliate Program

Customers can make money by encouraging their friends to trade on the platform through Saracen Markets‘ profitable “Refer a Friend” affiliate program. Regardless of whether their friends win or lose, this scheme guarantees that clients will always receive commissions from their friends’ transactions.

Upon registration, every client is immediately registered in the Affiliate Program. To get involved, just select the PARTNER option. The fee structure is simple: users of Pro Accounts receive $2 every lot, while users of ECN Accounts receive $0.2 per lot. It should be noted that commission amounts for cryptocurrency pairs differ.

It is simple for users to keep track of who among their friends has signed up and how much money they have made from recommendations. Transparency and ease of tracking affiliate profits are ensured by the dashboard, which displays the trade volume and associated rewards from each buddy referred.

Introducing friends to Saracen Markets has many advantages: spreads as low as 0.0 pips, leverage as high as 1:2000, quick execution beginning at 160 ms, a variety of deposit methods, trade protection on negative balances, and deposit alternatives for both fiat and cryptocurrency.

Saracen Markets also guarantees accurate trading with five decimal places for every account and quick withdrawals, enabling customers to take advantage of their winnings in a matter of hours.

Saracen Markets Customer Support

Comprehensive customer support services are provided by Saracen Markets, and they are open from Monday through Sunday, 24/7. This guarantees that traders will always have support available to them, improving their trading experience.

SARACEN MARKETS (PTY) LTD’s headquarters are located at 80 Strand Street, Cape Town, Western Cape 8001, South Africa. Support can be reached via email at [email protected]. As the staff at Dumb Little Man has seen, their customer service representatives are renowned for their promptness and effectiveness.

Saracen Markets provides live chat assistance as well as a thorough FAQs section in addition to direct support. With the help of these tools, traders can more easily fix problems quickly and carry on with their trading activities without interruption. They also offer real-time assistance and rapid responses to frequently asked queries.

Advantages and Disadvantages of Saracen Markets Customer Support

| Advantages | Disadvantages |

|---|---|

Saracen Markets vs Other Brokers

#1 Saracen Markets vs AvaTrade

With a $10 minimum deposit requirement, Saracen Markets provides leverage up to 1:2000. With a focus on the Middle East and South-East Asia, it offers a restricted selection of trading instruments, such as Forex, Commodities, and Indices, via the MetaTrader 4 (MT4) platform. As opposed to this, AvaTrade is governed by several jurisdictions—though not by the FCA—and provides leverage of up to 1:400, depending on the location. AvaTrade offers a wider range of trading products, including Forex, stocks, commodities, cryptocurrencies, and indices, with a minimum deposit of 100 units of the base currency. With the exception of the United States, AvaTrade services a global clientele and offers a variety of platforms for both human and automated trading.

Verdict: AvaTrade offers a more secure and adaptable trading environment than other brokers because of its extensive regulatory control, greater selection of trading instruments, and numerous trading platforms.

#2 Saracen Markets vs RoboForex

With a minimum deposit of $10, Saracen Markets is a platform offering leverage up to 1:2000. It targets clients in the Middle East and South-East Asia and provides a restricted range of trading instruments, including as Forex, Commodities, and Indices, via the MetaTrader 4 (MT4) platform. Conversely, RoboForex is a globally known platform that provides leverage up to 1:2000; nevertheless, it does not disclose any precise regulatory information. RoboForex provides a large selection of trading instruments, including Forex, stocks, commodities, and indices, with varying minimum deposits. It offers several cutting-edge trading platforms, including as MT4, MT5, cTrader, and R Stock Trader, to a global clientele.

Verdict: RoboForex provides a more thorough trading experience than other brokers because of its sophisticated trading platforms, greater selection of trading products, and stronger market awareness.

#3 Saracen Markets vs FXChoice

With a minimal minimum investment of $10, Saracen Markets offers leverage up to 1:2000. Its trading products consist only of Forex, Commodities, and Indices, and it uses the MetaTrader 4 (MT4) platform to mainly service traders in the Middle East and South-East Asia. On the other hand, FXChoice does not disclose its regulatory status and provides leverage up to 1:200. Forex and commodity CFDs are among the trading instruments offered by FXChoice, and the minimum deposit varies. With support for both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, FXChoice caters to a global clientele.

Verdict: FXChoice is superior since it offers traders more flexibility and options thanks to its MT4 and MT5 platforms, which are available for both emerging market currencies and a wider variety of trading instruments.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor is the finest option for the best forex, stock, and cryptocurrency trading education if you are serious about starting a profitable career in forex trading and hope to make significant financial advantages.

Asia Forex Mentor is spearheaded by Ezekiel Chew, who is widely recognized for being the visionary behind banks and trading organizations. Ezekiel stands out from other instructors in this industry that he routinely closes seven-figure deals. The following strong arguments support our recommendation:

Extensive Curriculum: Stock, cryptocurrency, and forex trading are all covered in Asia Forex Mentor’s comprehensive educational program. This well-designed program gives budding traders the information and abilities they need to succeed in these varied marketplaces.

Proven Track Record: Asia Forex Mentor has a strong track record of creating consistently profitable traders in a variety of market areas, which solidifies its trustworthiness. This accomplishment is evidence of the potency of their mentoring and training programs.

Expert Mentor: Students at Asia Forex Mentor receive the direction and wisdom of an accomplished mentor who has shown exceptional performance in the stock, cryptocurrency, and forex markets. With the individualized assistance that Ezekiel offers, students may confidently negotiate the complexities of each market.

Friendly Community: By signing up with Asia Forex Mentor, you may connect with other traders who share your goals of success in the forex, stock, and cryptocurrency markets. The learning process is improved overall because of the community’s promotion of cooperation, idea exchange, and peer education.

Focus on Psychology and Discipline: A disciplined approach and a strong attitude are essential for trading success. In order to assist traders control their emotions, cope with stress, and make logical judgments when trading, Asia Forex Mentor offers essential psychological training.

Regular Updates and Resources: Because the financial markets are always changing, Asia Forex Mentor makes sure that students are aware of the newest approaches, tactics, and market insights. Traders stay ahead of the curve because they have constant access to vital materials.

Success Stories: Asia Forex Mentor is proud of the many examples in which its students have used its extensive instruction in forex, stocks, and cryptocurrencies to alter their trading careers and become financially independent.

In conclusion, Asia Forex Mentor stands out as the top option for anyone looking for the greatest stock, forex, and cryptocurrency trading training to launch a lucrative career. With its extensive curriculum, knowledgeable mentors, hands-on approach, and encouraging community, Asia Forex Mentor offers the resources and direction needed to shape prospective traders into established experts in a variety of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: NSFX Review 2024 with Rankings by Dumb Little Man

Conclusion: Saracen Markets Review

Based on the in-depth research conducted by Dumb Little Man’s trading specialists, Saracen Markets presents a number of alluring advantages for traders. The extremely high leverage of up to 1:2000, which can greatly increase trading potential, is one of the most notable advantages. A wide spectrum of traders can also access the broker because of its low minimum deposit requirement of just $10. The MetaTrader 4 platform’s accessibility guarantees consumers a dependable and comfortable trading environment.

It’s crucial to be aware of a few disadvantages connected to Saracen Markets, nevertheless. Only Forex, commodities, and indices are available for trading, which might not satisfy the demands of traders seeking a wider assortment. Moreover, some users may find Saracen Markets less accessible as it does not permit traders from the EU or the US. Although there are several enticing benefits offered by Saracen Markets, traders should balance these against the risks associated with dealing with an unlicensed broker.

>> Also Read: Nash Markets Review 2024 with Rankings by Dumb Little Man

Saracen Markets Review FAQs

What trading instruments are available on Saracen Markets?

With a restricted selection of trading instruments, Saracen Markets specializes in Forex, commodities, and indices. About 25 currency pairs and CFDs on gold and silver are included in this selection. While traders who are only interested in these instruments could find this appealing, there aren’t many possibilities for those looking for a wider variety of assets. Mobile trading and more trading options are also also available.

Is Saracen Markets a regulated forex broker?

It is regulated; Saracen Markets is an offshore FX broker. Its physical office is located in Dubai, United Arab Emirates, and it is registered in Saint Vincent and the Grenadines. Traders should be aware that unlike Saracen Markets, trading with unregulated trading can carry greater risks.

What is the significance of Griffith Corporate Centre for Saracen Markets?

Located at Suite 305, Griffith Corporate Centre, Saracen Markets is an International Business Company that was incorporated in St. Vincent and the Grenadines. This address serves as a base for the broker’s global activities and is typical for many offshore businesses.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.