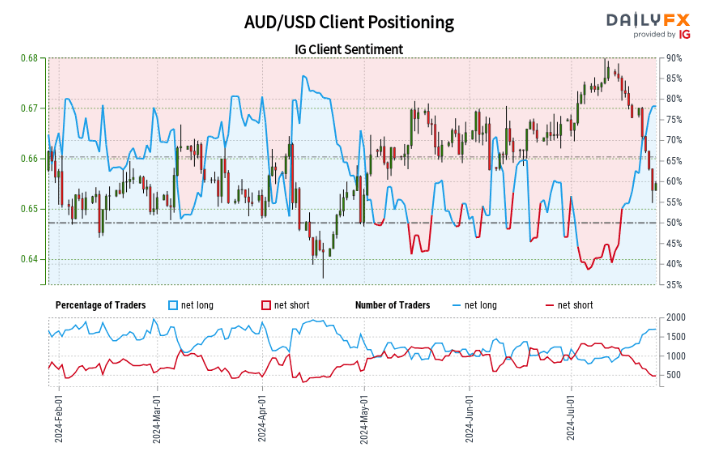

AUD/USD Sentiment:

Retail trader data reveals that 78.72% of traders are net-long, with a ratio of 3.70 long traders for every short trader. The number of net-long traders has increased by 5.45% since yesterday and 34.21% since last week. Conversely, net-short traders have decreased by 14.05% since yesterday and 49.63% since last week.

Adopting a contrarian view to crowd sentiment, the dominance of net-long traders suggests AUD/USD prices may continue to fall. The rise in net-long positions on both daily and weekly scales reinforces this bearish outlook for AUD/USD.

GBP/USD Sentiment:

Retail trader data shows that 37.63% of traders are net-long, with a ratio of 1.66 short traders for every long trader. Net-long traders have increased by 2.27% since yesterday and 9.89% since last week. Net-short traders have decreased by 8.01% since yesterday and 11.81% since last week.

While a contrarian view to crowd sentiment suggests GBP/USD prices may continue to rise due to the majority being net-short, recent changes in sentiment indicate a potential downward reversal in the current GBP/USD price trend.

USD/JPY Sentiment:

Retail trader data indicates that 41.56% of traders are net-long, with a ratio of 1.41 short traders for every long trader. Net-long traders have increased by 4.29% since yesterday and 8.00% since last week. Net-short traders have decreased by 7.01% since yesterday and 16.85% since last week.

Although a contrarian view to crowd sentiment suggests USD/JPY prices may continue to rise due to the majority being net-short, recent changes in sentiment warn of a potential downward reversal in the current USD/JPY price trend.