Short Analysis on USD/CHF Sentiment Trends

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

USD/CHF Sentiment Overview

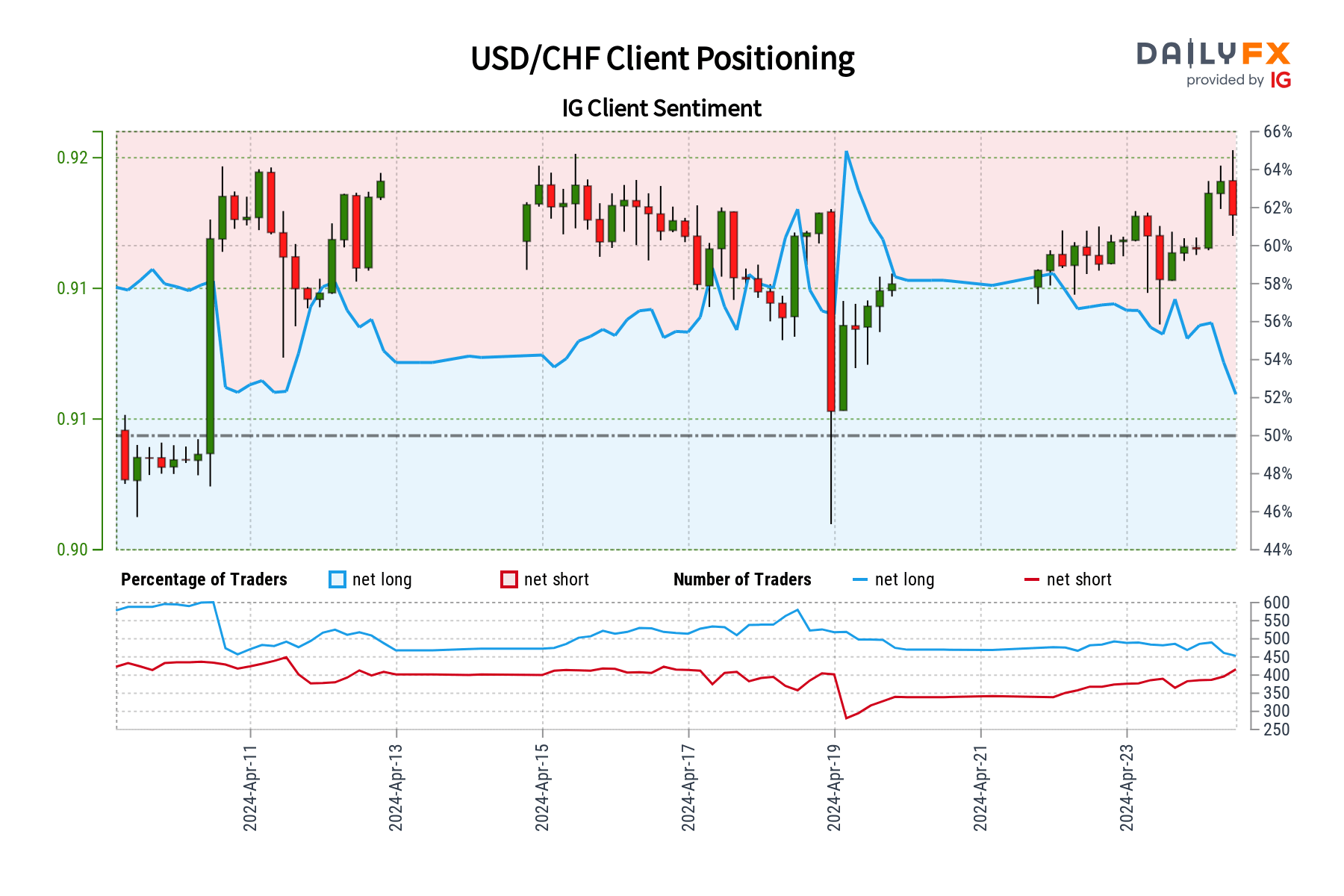

Retail trader data indicates that 51.76% of traders are net-long, with the ratio of long to short traders at 1.07 to 1. This marks the lowest net-long position in USD/CHF since April 10, when the currency pair was near 0.91.

The percentage of traders who are net-long has dropped by 9.82% since yesterday and 16.64% from last week.

Conversely, the number of traders net-short has risen by 8.73% since yesterday and 2.24% from last week.

Market Sentiment and Potential Price Movements

We generally adopt a contrarian stance to crowd sentiment. The prevailing net-long positioning suggests potential for further declines in USD/CHF prices.

However, the recent decrease in net-long positions and the increase in net-short positions indicate a possible reversal in the current price trend, hinting that USD/CHF might start to climb, despite the majority of traders maintaining a net-long stance.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.