What Is Short Sale Restriction – An Expert’s Take 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Short sale restriction has been a confusing topic amongst most newbies; they are often unaware of the market antics and fear that short sale restriction will be a hurdle in their investment profitability.

Incomplete information does more harm than good, so it’s essential to be well aware of the investment markets before you put your precious investment at stake. Are you a new trader looking to short assets for profits? Well, then, this article is essential for you.

We shall discuss everything you need to know about short sale restrictions and how you can begin shorting without putting your investment at risk. We have Ezekiel Chew with us to share his take on the subject.

He is a world-renowned investment mentor and has taught thousands of students worldwide. His skills and experience can help new traders find a smoother path to success. Let’s use his knowledge to our benefit.

What is Short Sale Restriction

Any investment market needs regulations to function correctly and generate reliable results; if inefficient legislation is employed, some parties may incur significant losses due to the wrongs of other groups. An investment market moves in two fashions; the asset can rise or fall.

A rising commodity provides an opportunity for buyers to purchase it and sell it later at a high price. However, a falling market means that asset holders must get rid of their assets before their profit vanishes due to the falling price, but what about traders who don’t have the asset?

Shorting refers to selling an asset before you own it; a trader can set up a shorting contract where they tend to sell an asset for the ongoing price, but the delivery is to be made later.

It allows sellers to benefit in a falling market; a short trader could sell their share for a high price even if it falls in the future. Although it presents a good chance of profit in a falling market, sometimes an assumption may go wrong, and a seller is exposed to unmeasurable risk.

The idea of short sale restriction was first discussed in 1934, but the rule wasn’t bought into action until 1938. The old rule was taken back in 2007. In 2010, the SEC announced a modified short sale restriction, also known as the alternative uptick rule.

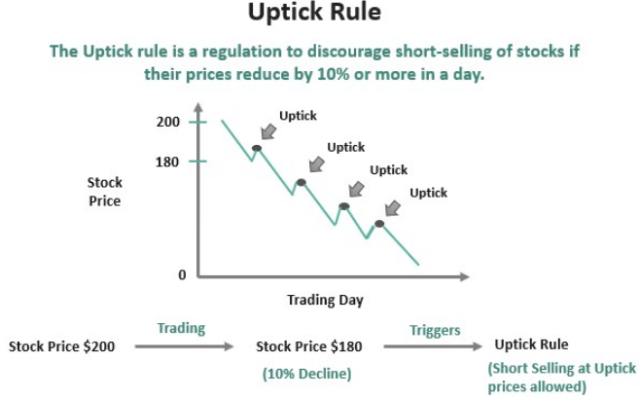

It prevented short sellers from selling a share after more than a 10% drop in the asset’s price. The rule was organized to condemn investors from keeping the price of an asset artificially low. Some investors used their financial strengths to reduce asset prices and short-sell them for profit.

Short Selling Rule with the Securities Exchange Commission Explained

The great depression set the foundational block for the modern short sale rule; during 2009, investors used to influence the stock market and keep share prices considerably low. It allowed them to make significant profits on their trades; once the asset’s price fell, they would buy the share in large quantities and make profits once the share rose.

They repeated the same cycle with various assets, which presented an alarming situation for the SEC. They couldn’t prohibit shorting completely, but they needed to prevent exploitation by investors. Hence, they launched the short sale rule. The SEC designed the rule to prevent sellers from decreasing an asset’s price further.

The rule also meant that sellers must set a shorting price above the current market rate; it was called the uptick/ plus tick rule. The regulation also prevented traders from shorting stock below the ongoing market price; hence, the asset could retain its value and counter the market forces.

In 2010, the SEC modified the uptick rule that called for short sale restriction; the rule measured the asset price change from the last day’s closing. If the price of an asset went down by more than 10% than the last day’s closing, the alternative uptick rule came into action.

A trader could only short-sell an asset if the current best bid is below the short selling price. The same condition applied to the stock and all other investment markets; it protected the organizations and saved buyers from unnecessary losses.

How does Short Sale work

The goal of the SSR is to prevent traders from driving the price of a share any lower after a decline. Setting up the uptick rule makes it improbable for traders to find a short sale, and the order isn’t executed. It prevents the asset’s price from going any lower. Let’s study an example.

For instance, company A has been a sensation in the tech world, and users expected its share price to soar high in the next year. The share kept rising until one day, its quarterly reports were published. They showed a decline in earnings and low growth due to technological changes by other giants.

The New York stock exchange is shaking, and people are selling their shares; it declines sharply from $10 on the previous day to less than $8.3 on the current day. The decline in the price is 105 lower than the previous day’s close; hence, the short sale restriction is triggered.

It means you must short-sell at a price above the current best bid. If the best bid were $8.2, you would have to place a bid higher than $8.2 to short-sell. The order will only be executed if a trader accepts your higher price.

As you might have anticipated, rational traders won’t go for a higher short-selling price for a falling stock. It is challenging for traders to short-sell a particular stock; hence, company A is safeguarded against further declines and gets the space to recover its reputation.

Basic Rules of Short Sale Restrictions in Stocks

Short sale restriction has come in handy for most stocks to prevent sharp declines within a trading period. The SEC has established four distinct rules that dictate how the market moves once the asset’s value falls by more than 10% since its previous closing. The rules are as follows:

- The short sale restriction is imposed on the specific stocks once their trading price drops more than 10% below their previous day’s closing. Some shares may have massive fluctuations within a day, but the SSR isn’t triggered until the difference rises to more than 10% from the previous day’s close.

- Once the asset has SSR governing its short position, the restriction shall last until the market closing of the next day. The SSR may retrigger the upcoming day if the decline stays consistent.

- The SSR rule was primarily focused on the American stock exchange, but the latest developments have also included asset classes from other major markets such as NASDAQ and NYSE.

- The SSR rule is triggered as the conditions are fulfilled; the brokerage firms are responsible for imposing the rule on relevant trades and preventing any short seller from breaching it.

Alternative Uptick Rule – Discussed

The uptick rule was first designed in 1934 and was published by the SEC in 1938. The rule was revoked in 2007, but an alternative version was reproduced in 2010. It was known as the alternative uptick rule (rule 201); it required brokerages and regulating agencies to ensure restrictions on prohibited short selling.

The alternative uptick rule requires short sellers to place trade above the current best bid, meaning the traders can down-tick their short trades for easier execution. The rule allows traders to exit their long positions before short trades are executed. An uptick in price meant buyers would find direct buying cheaper, and shareholders could quickly sell their shares.

The rule helped retain investor confidence in the market by allowing them to withdraw from a falling market. Once an asset price falls below 10% on its last day’s closing, the SSR is triggered, and an alternative uptick rule comes into play. According to SEC directions, the restriction may stay enacted for the current trading activity until the next day’s closing.

Usually, the SSR doesn’t occur in futures trade due to the high volume traded daily; the securities can be down-ticked due to the high number of buyers willing to take a long position that keeps the market stable on average days.

Short Selling Rule – Is it Effective?

We have talked a fair deal about the short sale restriction, and the ultimate question is to determine whether the rule is beneficial. The easiest way to check its efficacy is by measuring whether it satisfies its primary goals. The SSR was bought into action to help two parties- long position investors and declining companies.

The rule meant a declining company wouldn’t have to decline further due to short sellers down-ticking their trades. Uptick selling also meant that long-position traders could easily sell their stock to the best bid and save themselves from losses. The SSR rule is successful on both grounds as it justifies its role in protecting both parties.

However, regular short sellers may often get into unwanted positions due to the SSR rule. It may prevent them from making profitable trades and enjoying their success in the market. The SEC has left few exemptions to the SSR, and it is usually inevitable for a short seller to avoid it.

Traders must educate themselves about market movements and possible changes and know the perfect time for short selling to make good profits reliably. The direct uptick rule is also an essential aspect of the SSR and may come in handy to bring profits.

Best Forex Trading Course

A trading journey is never a bed of roses; it presents an uneven road that trains you to trade in the market. Traders who fail to cope with the market’s fluctuation end up quitting, while others grind through losses to change their fortunes.

The Forex industry has been a preferred choice amongst new traders; it has been an established market exchange and involves the exchange of currency pairs, ETFs, and options. The SEC regulations ensure the investors’ investments are safe and protected.

Most traders often struggle to make a profit, mainly due to a lack of trading education. The right course can help you tune your Forex journey and achieve desirable results. Our choice is the Asia Forex Mentor by Ezekiel Chew.

It is a one-of-a-kind course that takes an ROI-focused training approach to help you make the most of your investments. The course builds on mathematical probability and discusses reliable methods to generate consistent results. It gives you a detailed understanding of the trading market and how technical analysis is done.

The learners have achieved excellent results; some are achieving six figures trade regularly. Ezekiel is a renowned name amongst investor mentors and is rated highly in the industry. He travels worldwide to educate people about the Forex market, its potential, and how they can use it to change their lives.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Short Sale Restriction

Short sale restriction is a less-familiar concept amongst traders, and most are often unaware of it until their short sales can’t be performed due to the rule. The rule helps create market stability and retain investor confidence.

The SSR rule is triggered for assets that fall by more than 10% of the previous day’s close price; the rule stays in action for the current and next day. Short sellers need to uptick short sales to avoid breaching the rule.

SSR is applied to ASE, NYSE, and NASDAQ; exceptions are valid for some asset classes, but stocks and most investment securities are regulated through it. Traders need to educate themselves about market complexities and how they can profit in unexpected conditions.

Short Sale Restriction FAQs

Is a Short Sale Restriction Good?

The restriction is helpful for companies and long-position traders. It was designed to prevent market panic and build investor confidence. The SSR allows traders to exit their long positions in a falling share and prevent losses.

Why is Short Selling not Allowed?

Short selling is a popular technique to earn good returns in a falling market. Traders sell an asset at a higher price, but the delivery is made at a later date when the asset’s price is low. It allows them to make a profit.

Short selling is widely practiced; however, downtick short selling may not be allowed in some cases. When a share declines below 10% of its last day closing, SSR comes into play, and short sellers can’t downtick their trades. It makes it challenging for traders to execute their short sales.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.