S&P 500 Gapped Lower, Led by APPLE, TESLA, and AMD

The S&P 500 and Nasdaq faced notable declines, influenced significantly by performance dips in leading tech companies such as Apple, Tesla, and AMD. Apple’s recent $2 billion fine for anti-trust breaches and a substantial sales drop in China added to the negative sentiment, with its shares plunging and Tesla also facing setbacks due to reduced sales in China and a factory fire.

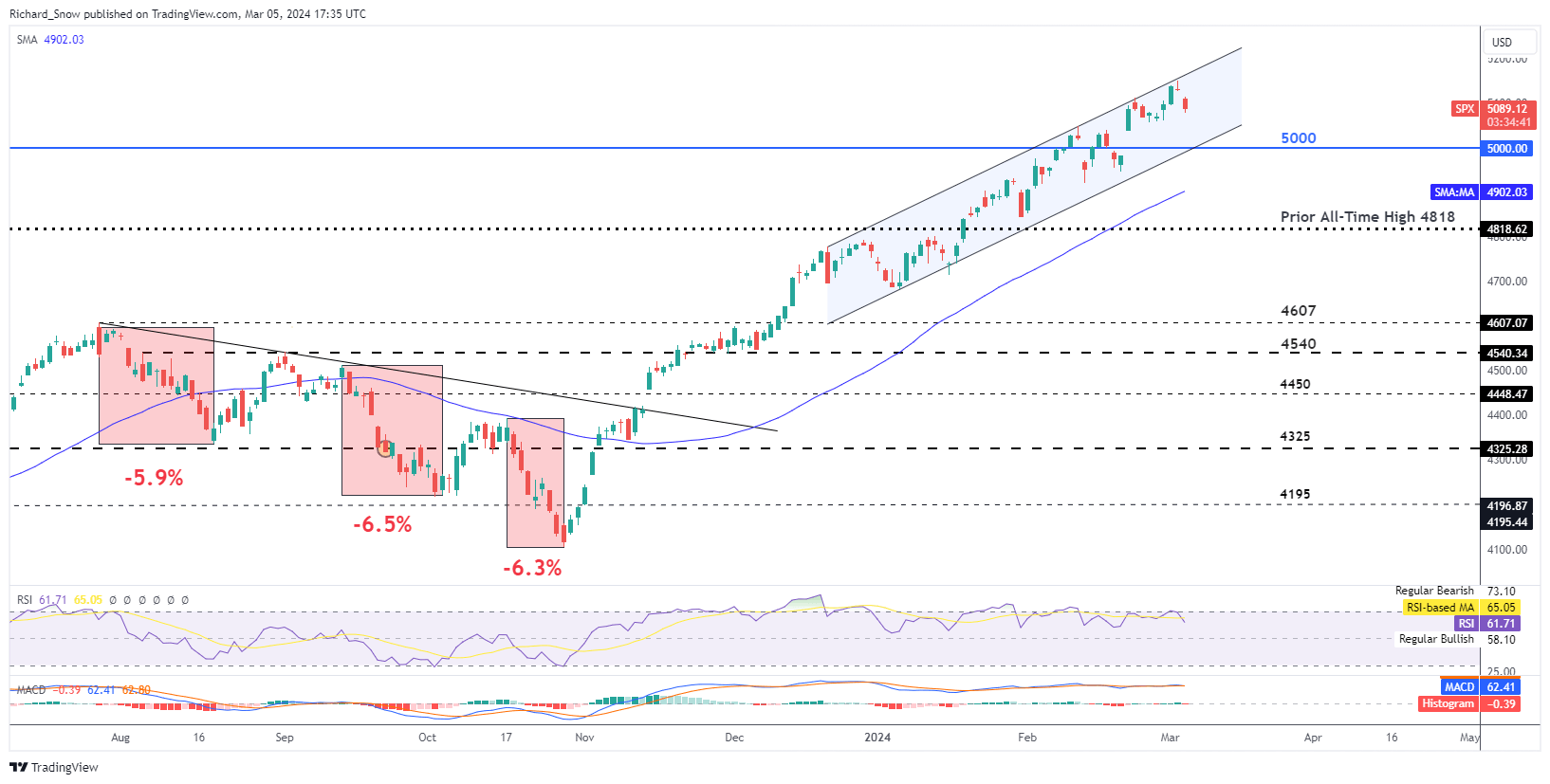

The overall tech sector’s downturn, including a 1% drop in Alphabet’s shares amid AI race concerns, pressured the indices. Despite this, the anticipation of multiple rate hikes this year had previously buoyed stocks, supported by the AI mania and the demand for advanced computer chips. However, the negative news from key tech players led to a pullback in the S&P 500, gapping lower at the open, and testing channel resistance once more.

S&P 500 Daily Chart

Massive Sales Drop Adds to Negative Sentiment After Apple Fined $2 Billion

Apple’s stock gapped lower, following a 24% sales drop in China, contrasting with competitor Huawei’s rising popularity. This downturn was exacerbated by concerns over weakening iPhone sales and the company’s fines related to its treatment of Spotify on the Apple Store. The downward trend led to Apple’s shares breaching prior support levels, indicating a potential slowdown in the decline as market reactions cool off.

Tesla Sinks After the EV Maker Experienced Poor Chinese Sales, Factory Fire

Tesla, too, reported poor sales in China, marking its lowest sales month since December 2022. The EV maker’s challenges were compounded by a suspected arson attack at its German plant, likely leading to significant financial losses. Tesla’s stock fell about 4% on Tuesday, adding to a 7% decline on Monday, with the next support level in sight but room for further bearish movement suggested by technical indicators.

The NASDAQ Sees Notable Gap Lower, Surpassing Prior Support Zone

The Nasdaq also saw a notable gap lower, failing to find support at the 18,100 level, indicating potential for further declines toward the 50-day SMA. Despite the downturn, Nvidia’s flat trading amid the general declines suggests some investors might see the pullback as an opportunity to take profits, given the positive outlook for Q1 2024.

Final Thoughts

This turbulent period for major tech stocks sends a clear signal to traders about the heightened volatility and potential risks in the market, especially within the tech sector. Investors are advised to stay informed and possibly reassess their portfolios in light of these developments.