S&P 500 and Nasdaq Eye New Highs Amid Market Cautions

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Despite a lack of drama last Friday, the S&P 500 and Nasdaq avoided any significant downturns or ‘bull traps‘ as they closed the week. This resilience could point towards a continued upward trajectory for both indices.

Yet, the appearance of potential reversal signals on Thursday, which did not materialize by the week’s end, introduces a note of caution. An unexpected increase in penny stock activity detected on my breakout scan suggests potential volatility ahead.

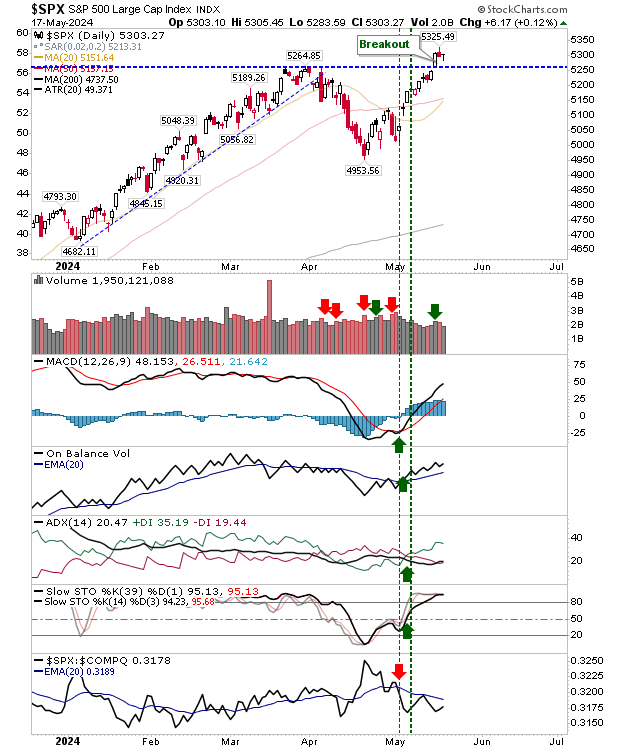

S&P 500: Steady Bullish Signals

While the S&P 500 has been somewhat overshadowed by the Nasdaq’s performance, it still maintains a robust breakout with solidly bullish technicals. Despite a recent drop in buying volume, substantial support levels suggest resilience even if a 10% correction were necessary.

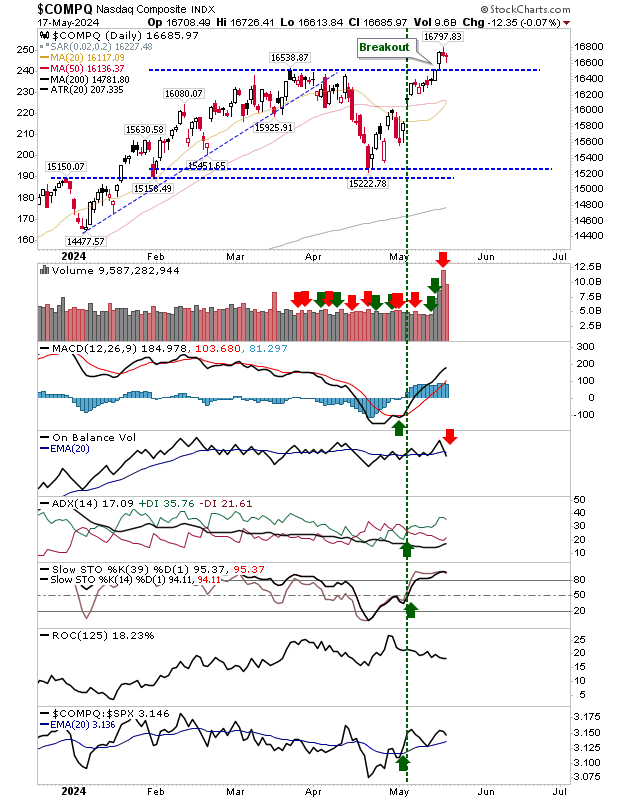

Nasdaq: Leading the Charge

The Nasdaq experienced significant selling pressure last Thursday, triggering a ‘sell‘ signal in the On-Balance-Volume indicator. However, the emergence of a bullish doji by Friday’s close hints at potential gains for the coming week. The index’s performance remains pivotal, outpacing both the S&P 500 and the Russell 2000 (IWM), which it has substantially supported.

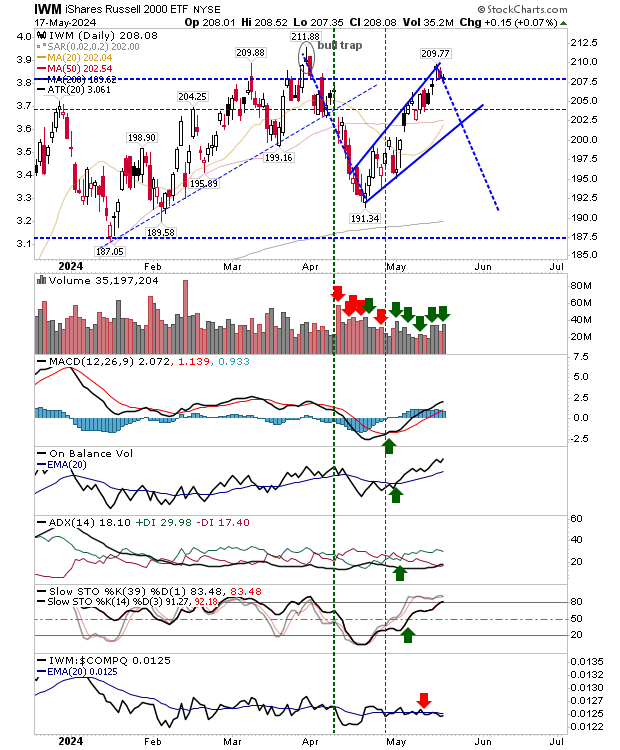

Russell 2000: A Complex Outlook

The Russell 2000’s trajectory has been more complex and challenging to predict. What initially seemed like a ‘bear flag‘ formation unexpectedly transformed, pushing the index beyond typical bearish resistance. While this might hint at a developing bearish wedge, the interpretation remains speculative.

Expectations for the Coming Week

Looking ahead, the positive doji formed by the Nasdaq on Friday sets an optimistic tone for this index, as well as the S&P 500, potentially driving them to new highs. This momentum could be crucial in propelling the Russell 2000 towards its own new highs, distributing the strength across indices as the markets embrace a burgeoning bull trend.

This analysis provides a detailed forecast, preparing investors for potential developments in the coming week as they navigate the complexities of the current market landscape.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.