Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

It’s becoming increasingly difficult to locate a broker that charges no commission these days. If you’ve been in the forex market for some time, you may be perplexed as to why your broker doesn’t charge a fee after each transaction.

When it’s all said and done, it is a business and needs revenue to keep it going. How do forex brokers make their money? What is the nature of the forex broker’s business model? In comes “spread”.

To explain the concept of spread in forex we’ve got Ezekiel Chew. He is a world-class trader who makes upwards of six figures in each trade. He has also trained many traders from around the world ranging from retail traders to large banks and institutions.

In this review, you will learn exactly what is spread, how it affects profits, how to find the best spread, and more. So, if you are ready, let’s dive straight in.

What is Spread in Forex

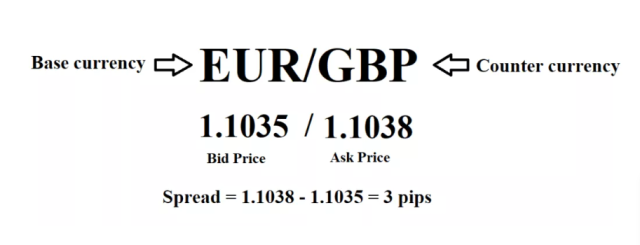

Each currency pair consists of two prices from the perspective of your forex broker. The bid price (price on the left) is the selling price for the currency. Buying price for base currency (price on the right) is known as the asking rate.

There’s a difference between the bid price and ask prices. This is known as the spread, and it reflects a change in price.

The trades you make are not charged. Instead, this cost is added to the purchase and sale prices of the trading instrument you choose. Since they run a business and must obtain money in some manner, no one can fault them for it.

Your broker may earn money in two ways using this method. They make a profit by selling you currency pairs at a higher price than they bought them for. Also, they make money by purchasing your currency at a lower price than they would sell it for. The spread is the difference between these two prices.

If it appears complicated, consider the following scenario:

To make money, a used automobile dealer must purchase your old vehicle for a lower price than the selling price. So, if your automobile is worth $10,000, the dealer’s best offer to you would be $9,999. To better understand the spread, it is the difference between the two prices.

Often brokers may say their services are free. This is far from the truth. Granted, there are no additional transaction costs, but you will still be charged a fee. It’s just hidden.

How does Spread affect Profit in Forex

Consider spread to be the cost of buying or selling a trading instrument. You should aim to keep it as low as you can by selecting a broker who offers minimal spread. As a result, you’ll be able to cut your forex market trading expenses and make greater profits each time you take a trade.

Spreads are usually tiny pip-wise. While it appears little to the naked eye, many traders understand that a big spread might swiftly reduce their profits when trading in big quantities. As a result, you’ll need to trade forex using a broker who offers a small spread. There are plenty of these on the internet.

Volatility may also expand the spread. It’s possible that the currency pair will become costlier to trade, but there’s also a greater payoff if you do things right. During times of extreme market volatility times, when many Forex traders are attracted, you get a better risk/reward ratio.

However, if things go against you, you could also incur greater losses.

How to Calculate Spread in Forex

It is quick and easy to calculate spread. All you need to know is the pip value and the total lots you’re trading. Some forex market trading platforms may calculate for you making things a lot easier, but keep in mind the figure may be difficult to view.

Here’s a scenario:

Consider the case of trading EUR/USD. The bid price is 1.34790 and the asking price is 1.34771, thus if you buy and immediately sell the position, you’ll lose 1.9 pips.

A pip is a small unit of value that’s used to express price differences in currencies, particularly those with distinct exchange rates. To summarize quickly, a pip is equal to 0.0001 in the majority of currency pairs. It is 0.01 in specific currency pairs. If the currency has three or five decimals, the final digit is known as a pipette

The total cost of the forex spread is calculated by multiplying the cost per pip by the number of lots.

Forex spread costs are a fixed amount, meaning it rises at a steady rate as the number of lots traded increases. Assuming a spread of 1.9 pips and trading five mini lots (50,000 units), the cost of the transaction would be $9.5.

Again, simply said, this is a very simple procedure. You need not worry about calculating rates or anything because often a trading platform would take care of all of that for you.

What is the Best Spread in Forex

The forex spread is often different from a broker, and it is typically small. The EUR/USD pair has a spread of about 1 to 3 pips and is what most traders go for. For some currency pairs, the spread could fall as low as 0.

Sure, you want to avoid trading forex with large spreads such as some that can have up to 12 pip spreads, as this will severely impact your profits. During volatile markets, the spread widens dramatically, so be on the lookout for it.

Some seasoned traders prefer a forex trading platform with “raw” forex spreads. The spread may go down to 0 pips and is provided directly to the trader by the broker’s liquidity supplier.

This is a good strategy to ensure that your broker can’t make the spread any wider. Even so, because different brokers have diverse liquidity suppliers, the forex spread may differ between brokers. At least, you reduce the spread with raw forex spreads.

So, if you want to minimize your spread, it’s critical to go with a broker with access to deep liquidity access through providers offering competitive spreads. Such simple adjustments can make a significant impact in reducing spread.

Regardless, consider a few more elements while selecting your brokers like the speed of execution, latency, and slippage (order fulfilled at a different price from the requested price).

On the upside when it comes to offering what we mentioned above, finding a Forex broker isn’t difficult. Forex traders are increasing each day, which implies a big market for forex brokers.

The majority of them will try and entice you to register retail investor accounts with them since the market continues to become even more competitive. You should choose a broker who provides all that we’ve mentioned above, regardless of how attractive the offer is.

Why do Forex Spreads Widen at 10 pm

When the spread increases outside of typical ranges, it may indicate increased market volatility or a lack of liquidity, which can be induced by trading forex activity occurring out-of-hours.

Granted, Forex is not centralized and operates 24 hours a day, the infrastructure must be switched across the world to keep it operational. New York, London, and Tokyo are the major sites. The time indicated here is GMT.

London opens from 8 a.m. to 4 p.m., while New York City opens at 1 p.m. and shuts at 10 p.m. Sydney opens from 10 p.m.-6 a.m., while Tokyo’s business hours are 12 a.m.-8 a.m.

Apart from the Sydney-to-New York transition, financial centers have similar operational hours. The New York session ends at 10 p.m while the Sydney session is just getting started, resulting in limited liquidity and wider spreads. The spread generally stays this way till the Tokyo market opens.

Forex Spread Calculator

The foreign exchange market always fluctuates. The value of currencies, as well as the spreads, can shift rapidly resulting in losing money rapidly. When the spread fluctuates, it may be difficult to use the calculator when you are day trading.

Fortunately, you don’t need to be a math genius to compute the spread. Most platforms have a spread calculator that will tell you the spread and other information.

The interface is different across platforms, so learning the layout might take some time. After a while, though, it should be second nature. You should be able to exchange with ease.

When do you Pay the Spread in Forex

When you make a market order using your broker, you “pay” the spread. You will place the orders with your broker, who then charges the spread cost when they submit them.

Your broker is paid whether you turn a profit or loss in a position, as long as you open and close a trade. That may appear selfish, but they’re in business to make money, not bank on the trades you take.

Best Forex Trading Course

The best trading course is the One Core Program offered by the lead trainer cum mentor from Asia Forex Mentor – Ezekiel Chew. With a decade of experience trading forex, commodities, indices, and crypto-assets, He arises as a towering example of how you can move from zero to six figures!

Ezekiel Chew and through the One Core Program will forever transform the way you trade. If you want to bank six figures and move away from trading where you glare at screens all day long, explore this course. Do you want to trade the lifestyle way? Living your life and taking your hobbies more seriously, all that while trading like a pro? One Core Program is for you.

By exploring the One Core Program, you will appreciate the winning approach that Ezekiel refers to as the PPE approach. PPE stands for pre-planned trading, and it’s a model where you never chase markets. It’s almost like waiting for the markets to come to your favor.

One most unbeatable note with PPE is that you only need a few trades that fill into your ROI. And you achieve that, the professional way Ezekiel guides you. Plain simple, few killer trades that you hit with mathematically proven strategies, and all of that is away from trading emotionally and staring at screens all day long!

Last but not least. You may feel like there’s no time to get into a class or commit long hours to yet another course. One Core Program suits you perfectly. Ezekiel will only require your commitment of twenty minutes daily – to transform your income for life.

Best Forex Brokers

Conclusion: Spread in Forex

The spread in forex is a minor fee that comes with each currency pair trade. When you look at the price displayed for a currency pair, you’ll see there’s a difference between the buy and sell price; this is the spread, also known as the bid/ask spread.

They don’t charge you any money for each trade you execute. Instead, the fee is incorporated into the purchase and sell prices of the currency pair that you are interested in. Because they offer a service and need to make money someplace, no one can blame them for this.

A spread, which is the distance between two prices, may be as low as one pip. It’s typically tiny, with pips being a typical measurement. While it appears to be little to the average person, many traders are aware that a significant spread might result in losing money rapidly if they trade in significant quantities. You are better off dealing with a broker that offers competitive prices.

Spread in Forex FAQs

What is a good spread in forex?

The spread is generally quite small, depending on the broker. The EUR/USD currency pair has a spread of 2 to 3 pips, which is where most traders concentrate. It’s the same story for other major currency pairs; some have spreads as low as 0.

Even so, because brokers have diverse liquidity sources, the spread may vary from one to the next. Raw spreads at least minimize spread and remove one variable.

It is critical to choose a broker who has adequate liquidity access via reputable providers with very competitive spreads. This minor modification will go a long way toward lowering your spread.