Pound Nears Two-Month High Against USD

The British Pound maintained its position near two-month highs against the US Dollar on Tuesday, with all eyes on the upcoming inflation report from the UK set for release on Wednesday. If the Consumer Price Index (CPI) data for April aligns with market expectations, it could significantly influence the Pound’s value. Analysts predict the headline inflation rate to decrease to an annualized 2.1% from March’s 3.2%, while the core rate—excluding volatile food and fuel prices—is expected to drop to 3.6% from 4.2%.

Market sentiment suggests that UK interest rates might soon decrease from their current highs, with potential adjustments as early as June, although August remains the more likely option. Inflation figures that meet expectations are likely to support this outlook.

The Bank of England’s upcoming rate decision on June 20 will be closely watched, especially as it will be based on the May CPI figures available just a day prior. Any unexpected drop in the April inflation could bolster confidence that a rate cut could occur in June, potentially impacting the Pound’s strength.

Moreover, the day will also see the release of the Federal Reserve’s May 1 policy meeting minutes. Given the frequency of recent Fed communications and upcoming speeches, these minutes might not significantly impact market movements.

The Pound’s steady climb against the Dollar since April has been supported by positive economic news from the UK and a broader increase in risk appetite. However, comparisons of monetary policies still give the US Dollar an edge, with American interest rates expected to remain high.

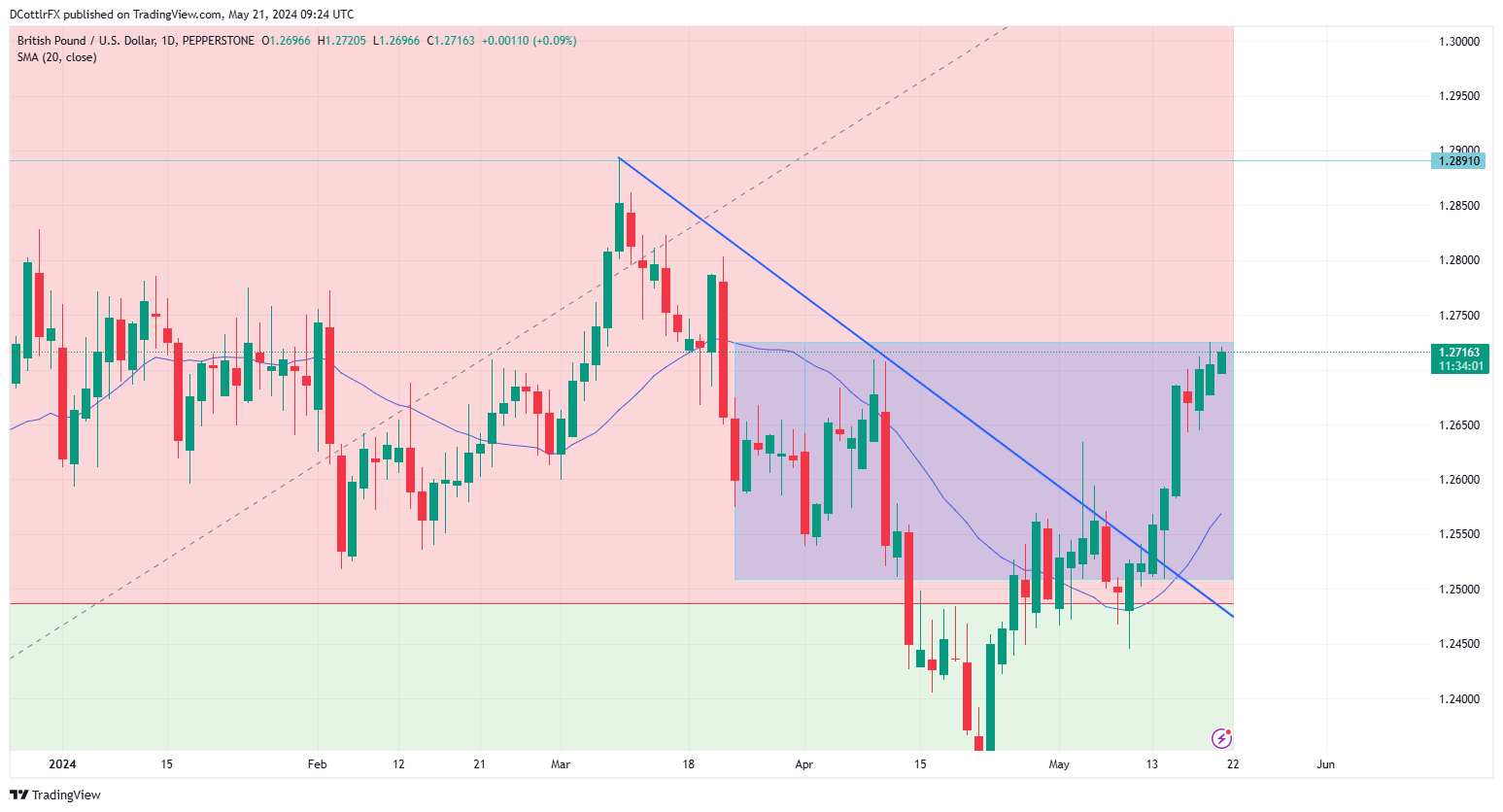

GBP/USD Overextended?

Despite recent gains, there’s concern that the Pound may be reaching an overly strong position.

Since late April, the Pound has surged nearly five US cents, surpassing the downtrend line that began on March 7. Bulls are now approaching the March 20 peak of 1.27884. Surmounting this could bring the 1.28 psychological resistance into focus.

Interestingly, despite the sharp rise in GBP/USD, the Relative Strength Index (RSI) does not indicate overbuying, remaining well below the critical 70.00 level. However, the rally seems overstretched, and IG’s data indicates that most traders are currently bearish. This sentiment suggests that any further gains might be challenging to achieve and could involve significant pauses.