17 Most Important Stock Trading Software [2024]!

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Thanks to the explosion of online trading in the late 1990s, people everywhere can try their hand at stock trading to gain a profit almost instantly. You’ve probably heard the stories and come across videos of people online who earn thousands of dollars every single day from trading stocks. You probably hope to become one of them. Despite those success stories, stock trading is neither easy nor a guaranteed way to make money. It takes plenty of research, patience, and a dash of luck to gain a significant profit. There are always inherent risks involved in this form of investing. Traders should only ever invest an amount of money they can afford to lose. Fortunately, just as technology continues to transform businesses, industries, and entire economies, it is also transforming stock trading. Trading technologies such as stock trading software are helping investors make smarter decisions.

What Is Stock Trading Software?

Stock trading software is a series of programs that assist in the trading of stocks and currencies. They guide traders through various stock markets and provide the tools necessary to make well-informed stock-picking decisions. These programs offer features for fundamental and technical analysis. Many of them show real-time data and teach you how to react to any fluctuations in the market. Some of them have charting features that allow traders to visualize stock information better. Other advantages include news coverage, backtesting, and advanced AI that scouts for profitable trading opportunities. Regardless of whether you are new to the stock market, a long-term investor or an experienced day trader, stock trading software can help improve your investing strategy.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Here are Stock Trading Software For Traders

There are plenty of stock trading software for traders to choose from. Each of them offers a range of advanced tools that improve the buying and selling decisions of stock traders regardless of their expertise. If you are looking to trade stocks, try the following stock trading software.

1. Trade Ideas

Image from Trade Ideas

Trade Ideas is an important stock trading software for any trader, but especially for day traders. It offers an impressive arsenal of sophisticated trading tools that have the ability to drastically improve trading strategies. Moreover, this trading platform is widely regarded to be one of the most advanced and trustworthy available to both amateur and professional traders.

Pros

Trade Ideas is considered to be one of, if not the best stock trading software around for good reason. It is hands down the best day trading software available. This platform is the most advanced day trading option for stock prediction and trade signals.

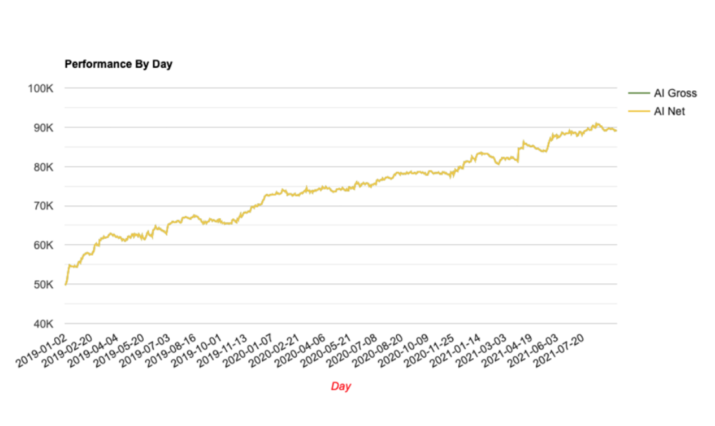

Image from Trade Ideas

It leads the industry in terms of artificial intelligence. The platform’s AI, named Holly, is capable of suggesting trade opportunities that are potentially profitable. It scans for sudden spikes in mentions of particular stocks on social media so traders know the latest trends. Holly uses three algorithms that are constantly learning how to improve. In addition, active traders who grow tired of choosing their own stocks or want to take a break can switch into a fully automatic portfolio managed by Holly. Trade Ideas is one of very few trading platforms with the flexibility for AI-automated trading.

Their leading AI technology makes Trade Ideas the best stock trading software for day trading. Their AI can provide helpful trading signals for auto-trading. These trade signals are based on millions of backtests on numerous trading strategies. They are particularly useful for day trading because it scans and analyzes millions of trading ideas daily. The AI-generated signals can help anyone make a profit from day trading.

Beginners and experienced traders alike will benefit from the education and support on the Trade Ideas platform. They offer comprehensive resources to help new investors succeed in the stock market. These resources range from a live training class, introductory lessons, and the option for 1-on-1 lessons. On top of educational resources, Trade Ideas offers advanced tools for perfecting trading strategies. Through their Simulated Trading feature, investors can learn how to trade with the help of market experts. They can simulate various strategies without the risk of losing real money.

Other incredible features include point-and-click backtesting capabilities, a superb scanner system, risk assessment, and more.

Cons

Trade Ideas is one of the pricier trading platforms on this list, but you get what you pay for. In this case, you’re paying for the best stock trading software available.

| Broker | Best For | More Details |

|---|---|---|

| Scanning Platform

| securely through Trade Ideas website |

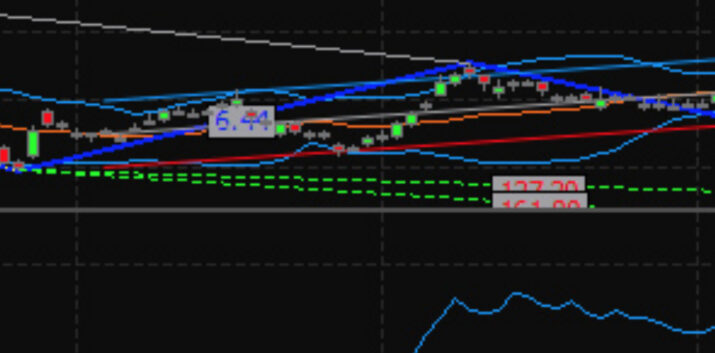

2. TrendSpider

Image from TrendSpider

TrendSpider is a stock charting software with a state-of-the-art AI. In terms of technical analysis using charts, there are few trading platforms that can compete with TrendSpider.

Pros

TrendSpider is one of the best stock trading software programs for technical analysis using charts. This stock charting software is one of the few trading platforms capable of automating chart analysis. The software is also available as a mobile app.

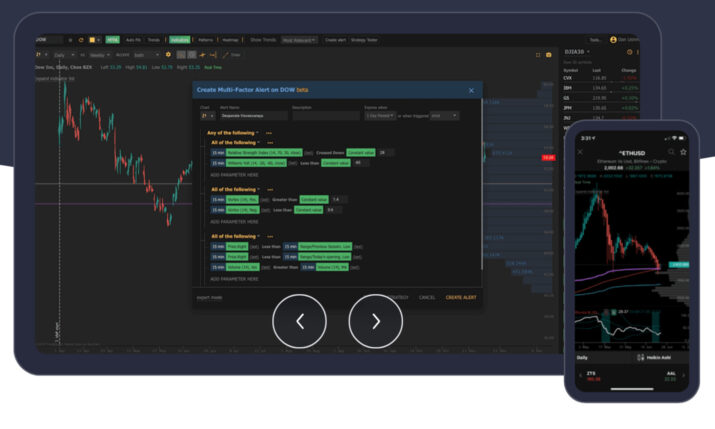

Image from TrendSpider

Its AI uses complex algorithms to automate technical analysis and present it to traders through charts. These algorithms backtest thousands of trades to identify those most relevant to the trader. An advanced trader will greatly benefit from the technical analysis indicators offered by TrendSpider.

This allows active traders and day traders to visualize the patterns occurring in regards to a specific stock. TrendSpider offers cutting-edge automated technical analysis tools to help traders analyze the market.

As a day trading software, users will benefit from the automated trendline and candlestick detection. Their AI recognizes patterns that can be especially useful for day traders. This technical analysis software can also automate multi-frame analysis, allowing those interested in day trading to view trendlines across multiple time-frames on the same chart.

All of these features combined can save trades and investors a tremendous amount of time from analyzing the market. Moreover, its backtesting of automated trendlines along with its cutting-edge pattern recognition makes TrendSpider one of the best technical analysis software available.

Cons

Unlike other platforms, TrendSpider has no feature that connects you to other traders for support or advice. Another downfall is the absence of automated trading.

| Broker | Best For | More Details |

|---|---|---|

| Tool for Charting and Analyzing

| securely through Trendspider website |

3. Benzinga Pro

Image from Benzinga Pro

Although it is not traditionally a trading software, Benzinga Pro has become a powerful market analysis software. Benzinga Pro is a streaming platform for financial news.

Pros

Experienced traders understand the importance of financial news and its impact on trading systems. Benzinga Pro is specifically designed to inform traders and investors of news that could affect the stock market. This makes it an extremely powerful day trading software.

Image from Benzinga Pro

Benzinga Pro is arguably the most important financial news resource for anyone interesting in day trading, active trading, or a long-term investment. Staying on top of financial news is one of the best research tools for active traders.

On top of access to historical data such as earnings, Securities and Exchange Commission filings, and other corporate news that could potentially impact the value of a stock, Benzinga Pro offers real-time data on companies.

As a research tool, it offers news data feeds with features such as keyword search, custom filters, sentiment indicators, and more.

Traders can use the Movers tool to view real-time market data of the biggest losers and gainers. This allows day traders to take advantage of the top market movers and make trades accordingly.

There is also a very useful Signals tool that alerts users instantly of any sharp price fluctuations or other large trades occurring in real-time. Traders can customize their signals through filters.

Benzinga Pro includes a great stock screener as well. Using the stock screener, you can search for stocks using a wide array of technical criteria. Filtering according to these technical indicators will allow you to find the most suitable stocks for your trading style and goal.

Cons

Although Benzinga Pro is hands down the best news and research tool for traders, it is limited to equities news.

| Broker | Best For | More Details |

|---|---|---|

| Stock Screener Platform

| securely through Benzinga website |

4. Stock Rover

Image from Stock Rover

Stock Rover is one of the best stock trading software programs for analysis and research. Many of its most useful features are available to traders for free. It also offers broker integration which enables portfolio management.

Pros

As a free trading software, Stock Rover is absolutely stacked. For traders on a budget, this is a great free stock trading software to try.

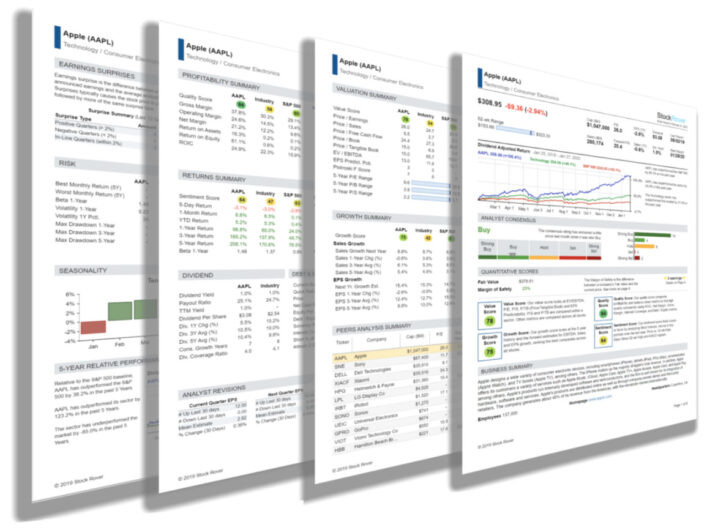

Image from Stock Rover

As a research and analysis tool, Stock Rover excels with its stock research reports. These reports cover real-time data as well as historical data.

Its stock screener is one of the best on the market. Its market scanning criteria are based on the strategies of Warren Buffett. It screens data points from a huge financial database, which gives traders the advantage of a full picture. Knowing the history of a company and its past performance is crucial when making trade decisions. Moreover, traders can take advantage of the historical data to backtest their strategies.

Another advantage of using Stock Rover as your stock trading software is the ability to connect to your brokerage platform. Liking to your brokerage account unlocks the portfolio management feature. In addition to managing your portfolio, the software can create reports based on your performance. This results in one of the most comprehensive stock trading software programs.

Other useful features include the ability to view market news, comparing strategies to gurus, and charting options.

Cons

Although many of its features are available for free, its true potential can only be unleashed with the premium version. Moreover, day traders will not benefit as much from this stock trading software as long-term investors. Its charting abilities are also not up to par with other stock trading software options. Stock Rover offers no market data on global exchanges.

| Broker | Best For | More Details |

|---|---|---|

Best Investment Research Platform on the Web

| securely through Stock Rover website |

5. TradingView

Image from TradingView

TradingView is one of the most popular stock trading software. It also offers many of its most useful features for free.

Pros

There are numerous benefits to using TradingView as your stock trading platform. It’s one of the only online stock trading software that grants access to global stock, cryptocurrencies, Forex, and CFD trading. It’s also available as a mobile app for more convenient trading.

Image from TradingView

TradingView is a good choice for any trade hoping to make money trading stocks in Forex and cryptocurrency markets. Moreover, it’s one of the only trading software that offers CFD trading.

It also boasts a strong trading community where traders can turn to more experienced traders for feedback and advice. There are plenty of groups to join depending on your trading strategy and stock interests. This is a great opportunity to learn from other investors and experts in the market. It offers one of the largest social networks for investors and traders.

There are plenty of technical indicators and chart styles to choose which allows for a more custom technical analysis. Some of the most useful features include a point and figure option as well as candlestick patterns recognition. TradingView also offers a multi-timeframe analysis feature in its charts which is very useful for a well-informed trading strategy. These technical analysis tools can be very useful for informing trades and the performance of a particular stock.

This stock trading platform truly shines in terms of its user-friendly interface. The features are incredibly easy and intuitive to figure out. This makes TradingView a great option for beginners who are just learning how to trade stocks.

In terms of screening, TradingView offers a variety of both fundamental and technical criteria for users to filter stocks with. This ensures that only the most suitable stocks are brought to the trader’s attention. It provides a strong technical analysis using hundreds of pre-built indicators and thousands more that were built by the community.

Other helpful features include news feeds, backtesting, and more.

Cons

Although TradingView is a great free trading software, most of its best features are locked for premium subscribers. Moreover, this software does not cover stock options trading. While it includes news feeds to its platform, users can’t customize the data feeds and the news is not in real-time.

| Broker | Best For | More Details |

|---|---|---|

| securely through TradingView website |

6. TC2000

Image from TC2000

TC2000 is a stock trading software that specializes in charting and screening. It offers many cutting-edge and advanced features despite being an industry veteran. Although it offers a free version, most of its best features are saved for those who pay for the premium service.

Pros

As a trading software, TC2000 shows off its experience with its many useful features. North American traders who like to visualize market data will find this platform very useful. It is also available as a mobile app. TC2000 is a great option for any traders looking to trade ETFs or mutual funds.

Image from TC2000

Where TC2000 beats its competitors is in its charting options. There are various stock and option charts. The plot option charts are particularly useful for visualizing the different data of a stock such as its last trade data or bid/ask data. This allows traders to visually see their trade positions. There is also a feature to add your favourite stocks to a watchlist and add notes. There are plenty of technical indicators for users to choose from and customize their charts. Traders can also draw trendlines on their charts to better visualize trends and patterns. This allows for a more personalized technical analysis of the market.

TC2000 offers a very user-friendly interface. Beginners will have no trouble learning how to use this to software and trade stocks in no time. While there is no community to support you in your stock trading endeavours, there is a help desk available on the website.

Another useful feature is access to some of the most important market index watchlists conveniently on the platform. These include the SP-500, Nasdaq 100, NYSE, TSX, and others.

One of its most helpful features is the ability to trade multi-leg strategies from charts. This tool allows traders to visually see the direction of their strategies. It’s also a useful tool for analyzing the risk and reward of a particular trade.

Cons

TC2000 is only available in North America and it exclusively tracks stocks in American and Canadian exchanges. Another downfall is the absence of a social option. There is no community for new traders to turn to when they need advice or feedback on their strategies. Lastly, it lacks a backtesting feature which is very useful for analysis.

7. TradeStation

Image from TradeStation

TradeStation is a trading software with stock analysis capabilities. Though they used to focus on higher net-worth active traders, they’ve recently opened up the platform to less-experienced traders. They are a very reliable choice for traders.

Pros

As a trading platform, TradeStation offers its users real-time market data, faster trade execution, and a reliable platform. There are no account minimums for their highest premium accounts and no commission on stock and EFT trades. They also provide an option to trade in cryptocurrency. As a software, its features seemed to be designed for active traders.

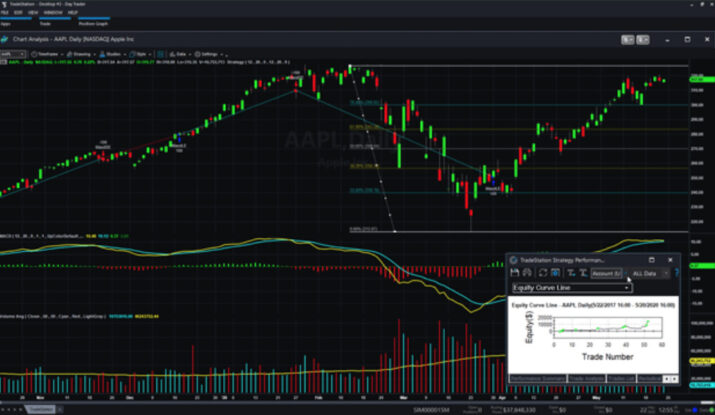

Image from TradeStation

TradeStation offers features such as technical analysis, charting, backtesting, and automation. This platform allows traders to carry out one-click trades and analyze the market using various charting options. There is also a great screening tool that can scan thousands of stocks using over a hundred technical and fundamental indicators. Their automation is also not bad. Traders can create, test, and automate their trading strategies using TradeStation‘s automation technology. The option to backtest the trading strategy against a huge database of historical data is also very useful.

Cons

Traders may struggle to use TradeStation at first because its interface is not the most intuitive or user-friendly. There is definitely a steep learning curve. Its highly technical features can also be confusing unless you’re an experienced trader. Moreover, there are hidden trading costs such as surcharges that many traders may find annoying.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through TradeStation website |

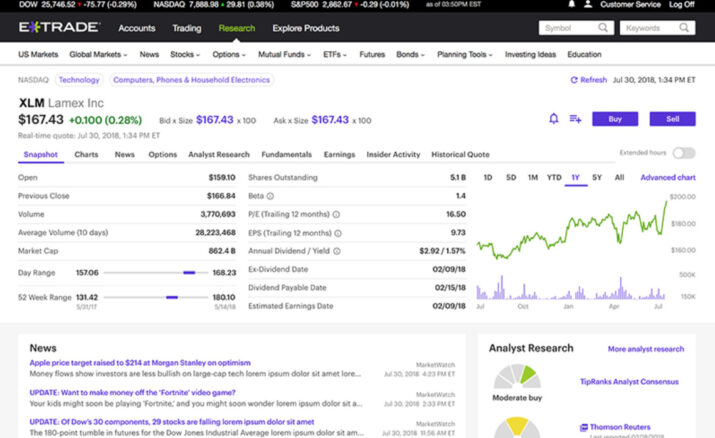

8. E*Trade

Image from E*Trade

E*Trade is a one-stop-shop platform for buying, selling, researching, and trading. Users can participate in stocks, options, ETFs, mutual funds, bonds, and CFD trading. It is one of the best mobile apps for stock trading available to investors.

Pros

E*Trade is a great stock trading software for anyone new to the stock market. It allows traders to easily make trades on the go. Traders can choose from the regular E*Trade app or the Power E*Trade version which provides greater analysis tools.

Image from E*Trade

One of its biggest draws for investors is its ease of use. Both versions of the app are extremely well-designed. Users can also use the desktop version of the software which is equally as user-friendly.

The Power E*Trade version is one of the few stock trading software programs that engage in paper trading using real-time data. This allows traders to test out their strategies and see how they would play out without losing actual money. This simulation offers amazing practice and experience for new traders risk-free.

Cons

One of the biggest cons of this platform is its tiered commission schedule. They charge more per trade for less frequent traders. There is also no option to trade in global markets.

| Broker | Best For | More Details |

|---|---|---|

Range Platform | securely through E*Trade website |

9. Finviz

Image from Finviz

Finviz is a stock screener program with trading capabilities. It’s one of the best free screeners available for traders.

Pros

One of the best things about Finviz is that it’s free for the most part. Traders can use the software to find the most suitable stocks for them using the wide selection of criteria.

Image from Finviz

Finviz is also a beginner-friendly software. Its interface is incredibly easy to figure out in spite of all the features it offers. The filters make it easy to screen stocks and the design of the stock screener overall is very user-friendly. As a free research tool, traders should definitely try Finviz. In addition to scanning for fundamental data metrics, it can also scan for other technical indicators. The platform provides a lot of technical and fundamental information on stocks. Users can research the performance history of a particular stock. They can also read market-related news curated by Finviz. However, one of its most useful features is backtesting. The ability to test your strategy on past data to determine its success is a great advantage for traders.

Cons

Those using the free version of Finviz will encounter plenty of ads. This could be annoying to a lot of traders. Moreover, despite the many features it provides on the free version, its best ones require a paid subscription to unlock.

10. Portfolio123

Image from Portfolio123

Portfolio123 is a great free stock trading software available to traders. It currently only supports American and Canadian stocks.

Pros

As a research tool, Portfolio123 allows its investors to trade stocks and EFTs. It offers several useful features such as backtesting, stock screens, and a ranking system.

Image from Portfolio123

One of the biggest benefits of using Portfolio123 is its large library of data for backtesting. This allows users to analyze their strategy against years and years of data. This can be very useful for creating a strategy that works in today’s market. It also offers a charting feature. This allows traders to visualize information about their trades. The charts provide additional statistics, rankings, technical as well as fundamental data. You can even visualize various prices on one chart using its multi-chart feature. On top of the usual charting options, traders will find it useful to compare their trades to historical specific data. Another useful charting option is the integrated ranking systems which allow traders to compare the performance of a stock to other data. There is also a handy feature to add notes which can be a useful self-analysis tool.

Cons

One downfall of Portfolio123 is the way it allocates picks without considering its size.

11. VectorVest 7

Image from VectorVest 7

VectorVest 7 is a trading software that offers numerous benefits to traders and investors. While there are plenty of better options out there, it’s not a bad choice for those looking for a simple platform.

Pros

This software is designed to simplify stock trading, and to that end, it succeeds. It provides numerous benefits to traders and investors beyond simplification, such as strong technical analysis, stock screening, and ratings. It promotes the Value, Safety, and Timing system of trading.

Image from VectorVest 7

Traders who are looking for a simplified software for trading should look no further than VectorVest 7. It simplifies buy and sell signals, stock valuation, among other aspects of stock trading. It simplifies stocks from various global stock exchanges such as the U.S., Canada, Australia, UK, and other European countries. In comparison to its competitors, its dashboard is very easy to use and understand.

Another benefit of VectorVest 7 is the way it scans stocks based on its VST system. As a result, it only recommends trades based on these useful criteria. Though this strategy is simple compared to others, it can be very effective.

The software features a variety of tools such as trendlines, Gann & Fibonacci graphs, and more.

Cons

Though VectorVest 7 does offer a rankings system, there is no information on how it is calculated. Therefore, it’s impossible for traders to confirm whether it’s actually effective or not. There is also no news or social features. Therefore, traders need to turn elsewhere to get advice or learn from other traders.

12. NinjaTrader

Image from NinjaTrader

NinjaTrader is a very popular software used by traders. This is the go-to choice for a lot of active traders. Many of its features are also available to users for free, but its most useful ones are saved for premium subscribers.

Pros

NinjaTrader is a great platform for traders who appreciate technical tools. It offers a wide array of features that traders can use to analyze their strategy and performance. It offers access to stocks, futures, Forex, and CFD trading.

Image from NinjaTrader

NinjaTrader beats a lot of its competition when it comes to custom charting. Traders can customize almost every single aspect on their chart including the colours, fonts, spacing, and layout. In terms of chart types, the selection is vast. Users can choose between point and figure, candlesticks, time-based, volume, range, Renko, and more charts. In addition, you can use the charts to visualize your strategies. You can also partially automate your strategy using the point and click option.

One of the benefits of NinjaTrader is its large ecosystem. Users have the option to connect this platform to thousands of other apps or customize the experience further through the many add-ons.

Beginners will find a lot of the guides, educational videos, and webinars useful. Once they’re more confident about their trading knowledge, they can practice their strategy using the practice NinjaTrader simulation. This allows traders to hone their strategy before risking real money.

In addition to these analysis features, NinjaTrader offers plenty of resources for research. This provides traders with the real-time economic data they need to make informed trades.

Cons

The best features of NinjaTrader are not available to free users. Moreover, there is no app for this software.

13. eSignal

Image from eSignal

eSignal is another highly technical stock trading software. Though more experienced investors will benefit from this platform, beginners might become overwhelmed with its interface.

Pros

eSignal is a software that specializes in technical analysis through charting and screening. Traders can use this platform to analyze stocks, futures, and Forex trading. It also offers broker integration allowing traders to analyze, buy, and sell stocks right from the platform.

Image from eSignal

One of the strengths of eSignal is its charting system. It offers high-quality charting analysis that covers all global stock exchanges. This makes it a valuable tool for traders looking to buy and sell in international markets. The charts have a very intuitive interface that makes it easy for traders to analyze their trades.

It does an excellent job of scanning and screening markets in real-time. This can be a useful tool for anyone hoping to get into day trading.

Cons

eSignal lacks when it comes to customization. Though the charts are of good quality, users have no option to customize them. Moreover, there are not as many criteria for scanning and screening stocks in comparison to other software on this list. Therefore, it does not filter through stocks in the same way that other platforms would. Lastly, there is no news or social feature. Real-time market news is incredibly important for traders to make the most accurate and informed choices. Since there is no social option, traders must turn to other sources for advice and guidance.

14. MetaStock

Image from MetaStock

MetaStock is a stock trading software that’s been around for over 30 years. As an industry veteran, you can expect a lot of great features ad tools from this platform.

Pros

MetaStock is a great software in many regards. It offers features such as a backtesting system, technical chart analysis, real-time data from news feeds, and more. It is a very useful tool for traders to have.

Image from MetaStock

Out of all of its features, its backtesting system is probably the best one. They use something they refer to as “expert advisors” to analyze patterns and teach traders how to make a profit from trades. These stock market system programs or “expert advisors” differentiate MetaStock from their competitors.

There is also a helpful forecast function on MetaStock that traders can use to predict the future trend of their stocks. This Forecaster option allows the trader to predict the future performance of stocks and thus, equips them with an advantage over other traders. Though it may not be perfect, the forecast tool is still very useful.

Another great feature on MetaStock is access to real-time financial news. This allows investors to stay up to date with what the performance of the companies they’ve invested in. It’s also handy for making current and informed trading decisions.

In terms of charting, MetaStock offers an abundance of tools for charting and drawing. There are also a variety of charts for traders to choose from such as point and figure and market profile charts.

Cons

In terms of broker integration, the software does not offer as many options as some competitors. It is also not available on mobile.

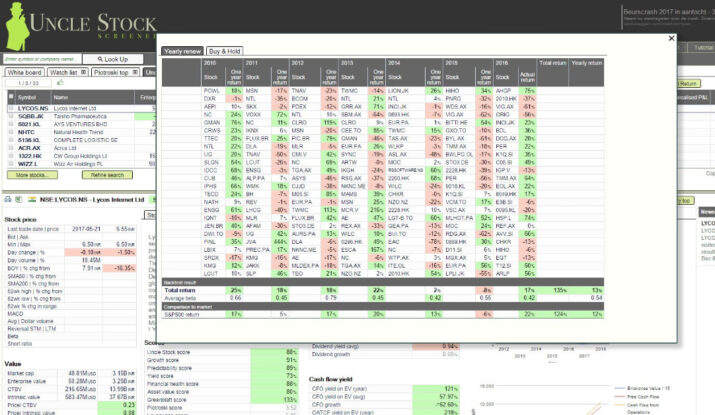

15. Unclestock

Image from Unclestock

Unclestock is a screener with a vast amount of data o both American and European stocks. Therefore, traders who are looking to participate in either of those markets might want to consider this platform.

Pros

As a trading software, one of Unclestock‘s strengths lies in its extensive coverage of global stocks. This is a great option for traders who have a strategy and don’t require any help formulating one.

Image from Unclestock

Its greatest strength lies in its stock coverage. With over 77,000 stocks worldwide, Unclestock is perfect for traders who want to cast the widest net possible when fishing for profitable trades. In addition to these impressive stock numbers, it boasts 3000 metrics to sort them with. This allows traders to narrow their search down to the most suitable possible stocks for them.

In terms of charting, Unclestock offers basic graphs for all of its metrics. Users can compare several data points in one chart.

One of its most beneficial tools for traders is its ranking system. They score stocks according to clearly defined metrics. This can help traders decide quickly whether or not a stock is profitable.

Unclestock also offers a really useful backtesting feature that is integrated into its powerful screener. Its screener is unassuming at first glance, but it’s an incredible tool with endless options for parameters. This allows traders to finely filter their results.

Cons

Some traders may find the user interface confusing. Moreover, its layout is not the most modern and can seem too dense at times.

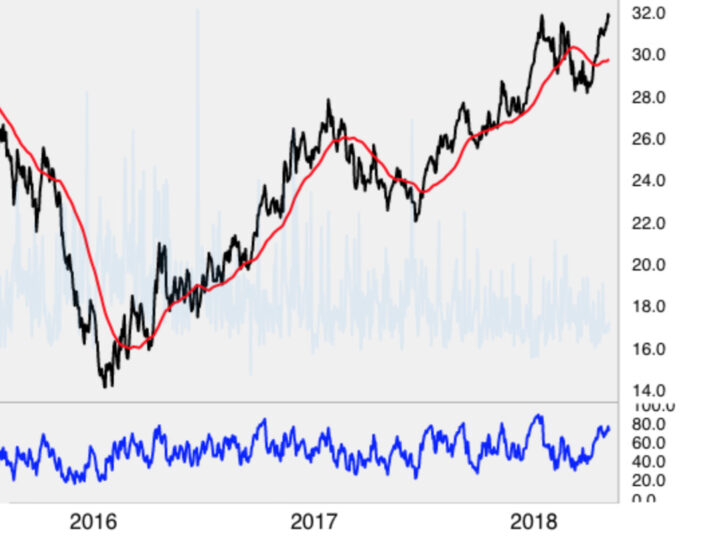

16. Optuma

Image from Optuma

Optuma is a great charting platform designed more for professional traders. It offers high-quality technical analysis charting tools such as relative rotation graphs.

Pros

Intended more for professional analysts and traders, this platform is highly technical. Its library of analysis charts is more extensive than most software. It’s also a great resource for retail investors.

Image from Optuma

This platform is specifically designed to provide the best technical analysis charts in the market. As a result, users will enjoy a massive selection of indicators and drawing tools. In addition, there are endless options for chart types such as bar, line, candlestick, point and figure, as well as more rare charts like relative rotational graphs.

Optuma offers a great backtesting system designed by expert market technicians.

In terms of news, there is an option to link it to Bloomberg, but those without a subscription are out of luck.

Cons

It’s the most expensive option, but this is likely because the software is geared towards professionals.

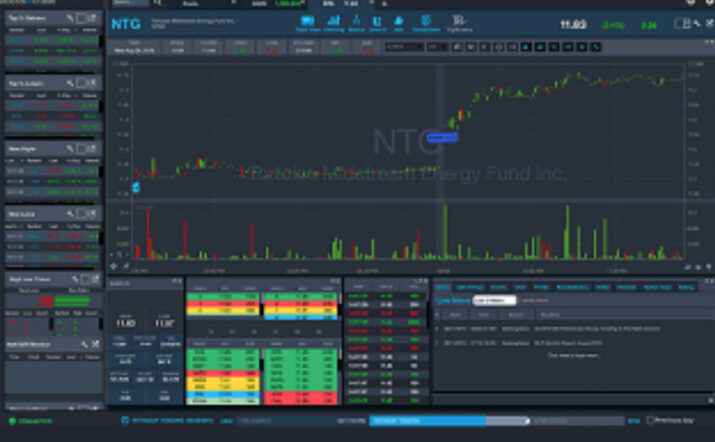

17. StocksToTrade

Image from StocksToTrade

StocksToTrade is a stock trading platform with charting, technical analysis, and screener capabilities. Its intention is to help traders do their analysis and trading on the same platform.

Pros

StocksToTrade is particularly useful for trading low-priced stocks and penny stocks. It is one of very few platforms that offer this option.

Image from StocksToTrade

In addition to appealing to traders who are interested in trading low-priced stocks and penny stocks, it also appeals to those who prefer a highly visual screener.

In terms of charting, StocksToTrade offers high-quality charts with good customization options. This makes them ideal for traders who need a custom technical analysis. They offer chart options such as candlestick, line charts, and more.

The screener is a lot more visual than most of its competitors. This allows traders o easily keep track of the criteria they selected.

Cons

The software is a bit pricey compared to its competitors.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion

With so many options promising the most sophisticated trading tools, it can be difficult for traders and investors to choose the right trading software for them.

Best Stock Trading Software Overall

Regardless of your experience and goals, the best stock trading software overall is Trade Ideas. It is the most comprehensive trading platform on the market. It provides countless resources and support to ensure the trader’s success. Moreover, other stock trading software platforms don’t even come close to the capabilities of its AI, Holly. Its backtested trade signals make this platform particularly perfect for day trading. Trade Ideas also offers a broker integration feature, which allows you to link to platforms such as Interactive Brokers, to make this platform even more comprehensive. As a result, Trade Ideas is our choice for the best overall stock trading software because it offers investors all the tools necessary to succeed in the stock market.

| Broker | Best For | More Details |

|---|---|---|

| Scanning Platform

| securely through Trade Ideas website |

Best Free Stock Market Analysis Software

Stock Rover is one of the best free stock trading software for market analysis. It offers detailed and useful reports that traders can use to optimize their strategy. In addition, they have one of the best stock screeners to filter through thousands of stocks. This market scanning feature helps active traders and long-term investors find the most suitable stocks according to the criteria they set. However, one of their best market analysis tools is the option to analyze your portfolio’s performance.

| Broker | Best For | More Details |

|---|---|---|

Best Investment Research Platform on the Web

| securely through Stock Rover website |

Best Stock Trading Platform For Complete Beginners

Trade Ideas is perfect for beginner traders due to its wealth of educational resources and community support. New traders will highly benefit from the webinars and educational videos. They can also turn to the huge community of traders on Trade Ideas for advice regarding their strategy. Afterwards, they can practice this strategy using the trade simulation without risking real money. This helps beginner traders gain the knowledge and confidence they need to succeed in the stock market.

Best Stock Trading Software For Technical Analysis

Optuma is undoubtedly the best option for technical analysis, and its price certainly reflects that. However, this software is aimed specifically at professional analysts and traders. Unless you have years of experience trading, it may be difficult to navigate. Beginners should definitely consider another option. Furthermore, unless your profits from trading are in the thousands, the price of this highly technical software is not worth it.

In terms of automated technical analysis software, TrendSpider is by far the best option. Its AI is capable of automatically recognizing patterns, trendlines, and thus, chart analysis. The software allows traders to recognize trends they might have otherwise been unaware of and thus, enables them to make a better-informed trade.

Best Stock Market Prediction Software

In terms of the best stock market prediction software, Trade Ideas reigns supreme over other stock trading software options. Their leading-edge AI, Holly, is capable of identifying the most profitable trade opportunities. Using three algorithms that are continuously learning how to analyze trade strategies better, Trade Ideas provides day traders with extremely useful signals. These day trading signals are based on millions of backtests daily and are capable of outperforming indexes such as the S&P 500. Therefore, Trade Ideas is the best day stock market prediction software as well as the best day trading software available to traders.

How To Choose The Right Trading Platform For You

Choosing the right platform can be overwhelming when you have an abundance of great options. You can narrow down your list of options based on your experience level as a trader, what kind of stocks you would like to trade, and in which markets. Consider also factors such as customer service and support when weighing options. Usability is another huge factor. Choose an application programming interface that is user-friendly especially if you are inexperienced. If you are new to trading, options such as Trade Ideas with plenty of educational resources and community support would be ideal to help you ease into trading. Other considerations would be the kind of research tools the software provides such as real-time news feed. Moreover, if you need to trade on the go, eliminate any options without a mobile app. You should also research cost factors such as trading costs, account minimums, and other fees that could minimize your profit as a trader.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.