SuperFunded Review with Rankings 2025 By Dumb Little Man

By John V

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The proficient finance and trading team at Dumb Little Man conducts thorough evaluations of proprietary trading firms, using a detailed algorithm and stringent criteria. Their focus encompasses crucial aspects like:

|

The role of a “proprietary trading firm” is vital in the financial markets. They lessen the requirement for traders to make sizable deposits at brokerages by enabling individuals to trade with the firm’s money. One major competitor in this market, SuperFunded, concentrates on developing the tactics and abilities of traders.

This post will offer a thorough analysis of SuperFunded. A well-rounded viewpoint will be provided by Dumb Little Man’s trade professionals’ insights and consumer reviews. This strategy makes sure that readers comprehend SuperFunded’s performance and services in a precise and comprehensive way.

What is SuperFunded?

SuperFunded is changing the landscape of proprietary trading firms. It was founded by senior traders from Australia with over 50 years of expertise. Its goal is to provide low-cost trading opportunities, cutting-edge trading technology, and instructional resources to democratize access to the international financial market.

The company serves a wide spectrum of traders with its varied offering of more than 500 financial instruments.

SuperFunded is the first prop firm backed by Broker Venture Capital, partnering with affiliate broker Eightcap, which also provides them with the best trading platforms. This partnership improves the dependability and scope of services provided.

SuperFunded’s evaluation plans, which mimic actual trades without putting money at risk, are good news for new traders. On the other hand, seasoned traders profit from the company’s consistent trading opportunities and reasonable trading targets.

The simplicity of SuperFunded’s approach—a one-step evaluation that is easy to understand, a range of account sizes, and clear rules—makes it appealing. Its strategy and attractive profit-sharing make it a great option for experienced traders looking for funding.

With its low evaluation costs and quick rewards upon verification, the company stands out in the crowded prop trading market and provides a distinct edge.

The firm’s extensive selection of financial instruments includes major stock indices, CFDs, currency pairs, and commodities including precious metals and energy goods. SuperFunded, supported by the PropTradeTech network and able to hold deals over the weekend and overnight, ensures payouts through formal contracts.

Its $200,000 maximum account size is less than some of its rivals, and new traders could find it unsuitable due to the lack of comprehensive teaching materials.

Pros and Cons of SuperFunded

Pros

- No continuous costs to use the platform

- Collaboration with Eightcap

- 80 percent profit divided

- Different account sizes

- Definite, uniform standards

- Options for biweekly payouts

Cons

- Few avenues for consumer service

- Possible customer service delays

- There are no contests or bonuses available.

- Rigorous assessment procedure

- No forums for community support

Safety and Security of SuperFunded

The trustworthy environment that SuperFunded offers traders is paramount in terms of security and safety. Know Your Customer (KYC) methods are widely used in the banking industry by SuperFunded to verify the authenticity of its clients. This method plays a major role in protecting the trading environment and fighting fraud.

Broker Venture Capital’s backing and SuperFunded’s connection to affiliate broker Eightcap bolster the company’s security credentials. These collaborations improve the security of traders’ capital by introducing an additional degree of oversight and accountability.

SuperFunded has collected data regarding its security and safety procedures from Dumb Little Man after conducting a thorough investigation. The company’s commitment to providing its customers with a trustworthy and secure trading platform that offers peace of mind to both novice and experienced traders is evident from this thorough investigation.

SuperFunded Bonuses and Contests

There aren’t any incentives or competitions SuperFunded offers to its traders right now. While these promos may seem good, the company’s main focus is on providing a straightforward and effective trading experience without any additional benefits.

SuperFunded Customer Reviews

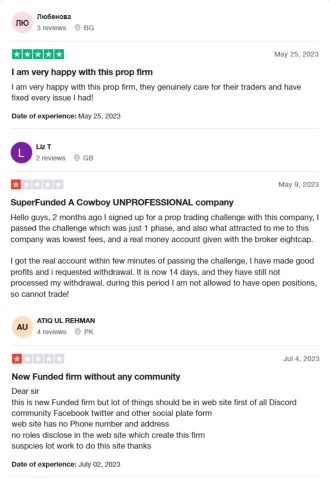

SuperFunded’s Trustpilot rating is now 2.8 stars, indicating a diversity of client experiences. Some people complain about social media sites like Facebook, Twitter, and Discord because they don’t feel like there is a community there.

Not only are there unclear founding principles for the organization on the website, but crucial information like phone numbers and addresses is missing, which raises more questions about openness.

Conversely, other clients report favorable experiences, complimenting the company on its prompt problem-solving and attentiveness to trading requirements. Low fees and the ease of SuperFunded’s one-phase trading challenge have been well-received. Some traders have expressed irritation, nevertheless, as there have been reports of withdrawal processing delays and trading limits during this time.

SuperFunded Commissions and Fees

SuperFunded is unique in the market for proprietary trading firms since it does not charge usage fees on its platform. It is an alternative that many traders can access because of this characteristic. SuperFunded works with Eightcap as its broker to offer the best spreads and commissions in the market.

The goal of this partnership is to replicate actual trading conditions, including the use of Eightcap’s commissions and idealized market circumstances.

For the Standard account, the platform offers competitive trading with a minimum spread of 1 pip. Additionally, SuperFunded provides traders with a remarkable perk that allows them to retain a substantial amount of their profits: an 80% profit split.

This arrangement, which strikes a mix between affordability and the possibility of significant profit, illustrates the company’s commitment to providing its traders with favorable conditions.

SuperFunded Account Types

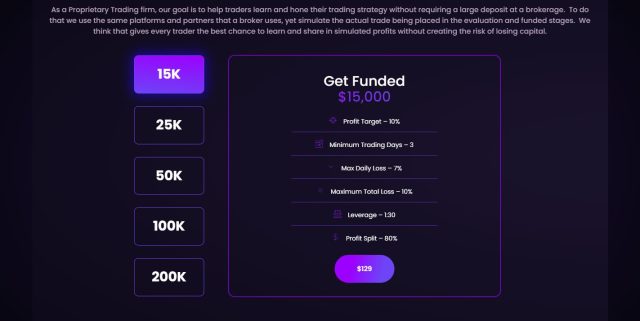

SuperFunded offers several account sizes that fit varied trading demands and any forex trading style while following by the same set of rules, giving traders stability and transparency.

The uniformity of the trading environment across accounts of varying sizes is guaranteed because all of the account sizes below are subject to the same criteria. This consists of a three-day minimum trading day requirement, a 10% profit target, a 7% daily loss ceiling, and a 10% maximum total loss limit.

The accounts additionally include a notable 1:30 leverage and an 80% profit split. Because of the criteria’ stability, traders are allowed to select the size of their account according to their strategy and available finances, all the while knowing that there will be reasonable limitations and substantial profit potential.

- 15K Account – Priced at $129.

- 25K Account – Available for $215.

- 50K Account – Costs $350.

- 100K Account – Set at $700.

- 200K Account – The largest, priced at $1400.

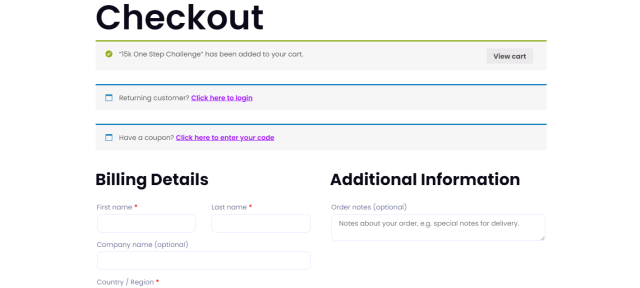

Opening a SuperFunded Account

The procedure of creating an account on SuperFunded is simple. The following eight easy steps will assist you in creating a trading account:

- Go to the SuperFunded website and select the “Get Funded” section.

- Enter your name, address, and billing information.

- Enter your email address and set a password.

- Choose an account size.

- Select the mode of payment.

- Agree to the terms and conditions, evaluation schedule, and privacy policy.

- If needed, include notes in the “Additional Information” section.

- When the setup is finished, begin trading.

SuperFunded Customer Support

The dedicated Contact Us form on SuperFunded’s website and the email address [email protected] serve as the company’s major customer service outlets. Customers will always have a simple and quick way to get support with this strategy.

These channels are designed to provide traders with rapid and beneficial answers to their questions and problems, based on Dumb Little Man’s experience with customer care. This simplified support approach is a manifestation of SuperFunded’s dedication to transparent communication and user satisfaction.

Advantages and Disadvantages of SuperFunded Customer Support

| Advantages | Disadvantages |

|---|---|

|

SuperFunded Withdrawal Options

SuperFunded’s withdrawal options are geared for traders who have moved to live funded status. To be eligible for their first payout, traders must actively trade for at least 30 days, as verified and tested by a Dumb Little Man trading expert. Following this time frame, there is a bi-weekly payout option that opens up regular prospects for earnings withdrawal.

It’s crucial to remember that the goal of the evaluation accounts is to evaluate a trader’s consistency without putting money at risk. Profit withdrawals in the Evaluation phase are therefore not allowed. Trading strategies like this are in line with SuperFunded’s realistic trading objectives like encouraging profitable trading practices by guaranteeing that traders exhibit their abilities in a risk-free setting.

SuperFunded Challenges and Difficulties

The 10% profit target that SuperFunded traders must meet their straightforward trading rules that call for both competence and strategic trading. While there is no set maximum trading period, retail traders also have to follow a three-day minimum trading day requirements, which guarantees consistent market involvement but may be difficult for individuals with less reliable trading habits.

The platform also sets a maximum daily loss limit of 7%, encouraging prudent risk management, yet this may be restrictive for traders inclined towards more aggressive tactics. Furthermore, maintaining the overall trading activity below a 10% total loss threshold is crucial, a rule that helps protect traders’ positions while necessitating vigilant monitoring of their overall trading performance.

How to Pass the SuperFunded Evaluation Process

Navigating the evaluation process of SuperFunded requires a thorough understanding of its rigorous criteria. Facing these challenges can be daunting, especially for those new to the proprietary trading environment. To increase the likelihood of success, gaining proper knowledge and strategic insight is crucial.

A crucial first step in this preparation is to sign up for an extensive training program. These courses offer the fundamental knowledge and methods required to satisfy SuperFunded’s high requirements. Through this training, traders are guaranteed to be both prepared for and confidently pass the evaluation.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Dumb Little Man suggests Asia Forex Mentor as a great resource for traders getting ready for the SuperFunded assessment. Thousands of traders have benefited from it by passing proprietary firm evaluations.

Ezekiel Chew, a well-known and seasoned forex trader, is the creator of this course. With an emphasis on the best forex trading techniques, he created Asia Forex Mentor’s One Core Program. Chew wanted to impart his knowledge, and he began by training acquaintances. This led to the development of an extensive online school for forex traders.

How Could Asia Forex Mentor Help You Pass SuperFunded Challenge?

With multiple noteworthy awards to its credit, Asia Forex Mentor is an extremely reliable resource for traders hoping to clear SuperFunded’s challenge.

Best Comprehensive Course Offering: Asia Forex Mentor’s One Core Program won this award from Investopedia, a leading provider of financial material, for its comprehensive coverage

Best Forex Trading Course for Beginners: The One Core Program, appropriate for both novice and seasoned traders, has been recognized by Benzinga, as a reliable source of financial, business, and stock information.

Best Forex Mentor: Asia Forex Mentor was named the best Forex tutor in 2021 by the website BestOnlineForexBroker. Their support demonstrated how well the method works to assist traders in making big profits from FX trading.

Best Forex Trading Course: Because of its superior trading system and successful trading tactics, Asia Forex Mentor was given the highest ranking in a thorough evaluation conducted by leading forex traders and platforms.

These accolades highlight Asia Forex Mentor’s capacity to go above and beyond for novice and seasoned traders alike, making it an invaluable tool for anyone attempting SuperFunded’s evaluation challenge.

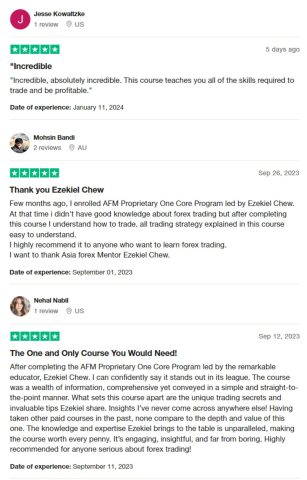

Asia Forex Mentor Members’ Testimonials

Members of Asia Forex Mentor strongly commend the One Core Program, notably for its success in forex trading and preparation for proprietary firm evaluations. They praise its thorough but uncomplicated methodology, which simplifies the understanding of intricate trading methods.

The course instructor, Ezekiel Chew, is well-known for his unique perspectives and trading techniques, which are frequently cited as being unmatched in comparison to other courses. For individuals who are serious about becoming experts in the currency market, the curriculum is highly recommended due to its outstanding educational value.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: SuperFunded Review

The trading specialists at Dumb Little Man conclude by praising SuperFunded’s advantages, which include an enticing 80% profit split, competitive spreads and commissions, and no ongoing fees. It is a good choice for traders looking for a stable platform. They should, however, be aware of the drawbacks, like the limited customer care channels, and possible delays in responses.

Ultimately, those interested in joining SuperFunded, particularly in passing their evaluation, enrolling in top-tier courses like Asia Forex Mentor could greatly boost their chances of success. Ezekiel Chew’s extensive program, Asia Forex Mentor, is well known for its success in educating traders about forex trading and equipping them to handle problems posed by prop firms.

>> Also Read: Bulenox Review with Rankings 2025 By Dumb Little Man

SuperFunded Review FAQs

What is SuperFunded’s relationship with broker venture capital?

While not an ASIC regulated broker, SuperFunded has gained a reputation and financial stability by being the first prop trading company to receive support from broker venture capital.

Can beginners apply for a funded trading account at SuperFunded?

Yes, beginners can apply for a funded trading account, but it’s recommended they learn some trading expertise and experience first, possibly through courses like Asia Forex Mentor.

What are the key benefits of trading with a prop firm like SuperFunded?

It is appealing to both new and seasoned traders due to its main advantages, which include competitive spreads and costs, an 80% profit share, and the ability to access larger cash through a funded trading account.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.