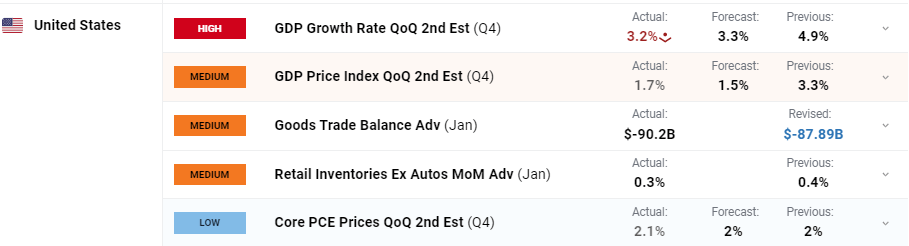

According to the most recent economic update, the United States economy performed well in the fourth quarter of 2023, expanding by 3.2%. This result, reported in the second estimate, fell slightly short of market expectations of a 3.3% increase but still showed strong growth, albeit at a slower rate than the 4.9% growth witnessed in the previous quarter.

The US Bureau of Economic Analysis ascribed this expansion to considerable gains in consumer spending, exports, government spending at all levels, and investments in both the non-residential and residential sectors. However, these positive contributions were partially offset by a decrease in private inventory investment and a rise in imports, with the latter acting as a drag on GDP calculations.

Source: via DailyFX

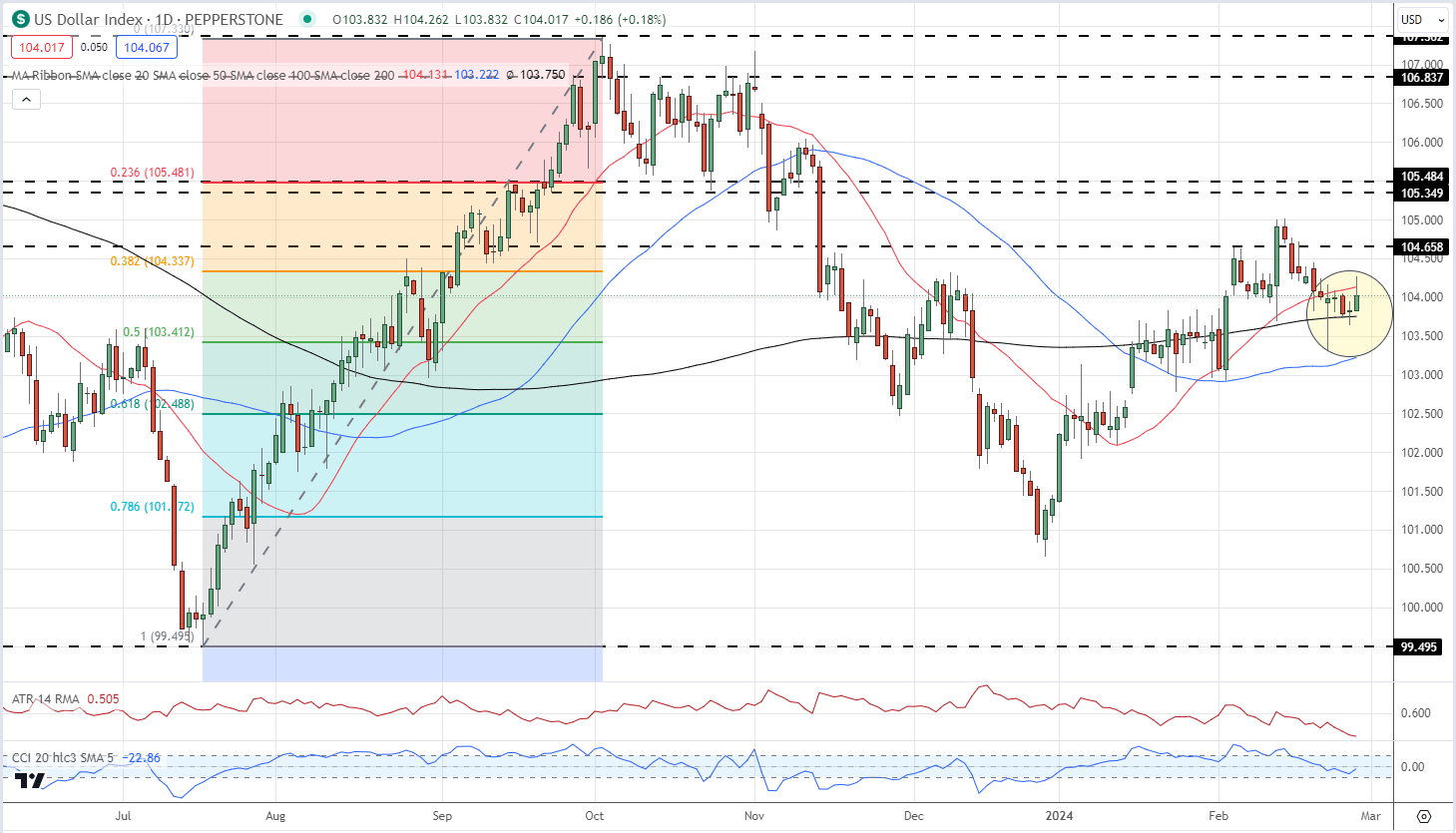

Following this news, the US dollar fell a little, indicating a stable market response. Earlier in the day, the dollar increased, helped by technical support, particularly the 200-day simple moving average. This backdrop establishes the tone for traders’ expectations of the approaching US. Personal Consumption Expenditures (PCE), a key inflationary metric recommended by the Federal Reserve, sheds light on future monetary policy decisions.

US DOLLAR INDEX DAILY CHART

Source: via DailyFX

Gold prices rose slightly in response to the GDP news, but they remained inside a narrow trading range, reflecting a cautious market tone. Resistance and support levels were regularly monitored, with key levels set at just under $2,044/oz and $2,025/oz, extending down to $2,010/oz. This tiny increase in gold demonstrates the difficult balance between economic strength and current volatility in global financial markets.

GOLD PRICE DAILY CHART

Source: via DailyFX

Retail trader data shows a positive sentiment among traders, with 62.45% of them net-long in the market. This position highlights a long-to-short ratio of 1.66 to one, showing a strong anticipation of rising market prices. The data show a dramatic movement in trader mood, with the number of traders holding net-long positions rising by 8.38% from the previous day and 0.70% higher than the values recorded last week. In contrast, the number of traders taking net-short positions has fallen by 10.27% since yesterday, and is 10.22% lower than last week’s figures.

Final Thoughts

The U.S. economy’s Q4 performance and its implications for monetary policy remain a focus for traders, with small swings in the US dollar and gold prices reflecting the intricate interplay between economic strength, inflation fears, and policy actions. As the market anticipates additional economic data, the relationship between the US dollar, gold, and the broader financial markets will remain a primary focus.