TMS Brokers Review 2025 with Rankings By Dumb Little Man

By Wilbert S

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.2 1.5/5 | 143rd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies TMS Brokers as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

TMS Brokers Review

Forex brokers play a crucial role in facilitating currency trading for both individual and institutional investors. They provide access to the Forex market, offering platforms where traders can buy and sell currency pairs.

TMS Brokers is a Forex and CFD broker known for its diverse trading options, including currency pairs, stocks, CFDs on stocks, indices, commodities, and cryptocurrencies. This review aims to deliver a thorough assessment of TMS Brokers, highlighting its unique features and potential drawbacks.

Our objective is to provide essential insights into TMS Brokers, covering aspects such as account options, deposit and withdrawal processes, commission structures, and other critical details. By combining expert analysis with actual trader experiences, we aim to help you make an informed decision about whether TMS Brokers is the right brokerage service for you.

What is TMS Brokers?

TMS Brokers is a Forex and CFD broker based in Poland, offering a broad range of trading options, including currency pairs, stocks, indices, commodities, and cryptocurrencies. The broker stands out with spreads starting from 0 pips and no trading fees, making it a cost-effective choice for traders. The platforms available include MetaTrader 5 (MT5) and TMS Brokers’ proprietary OANDA platform, catering to different trading preferences.

TMS Brokers also provides a free demo account with virtual €50,000 for users to practice trading without financial risk. The broker does not charge withdrawal fees or account maintenance fees, enhancing its appeal. Furthermore, TMS Brokers supports multiple deposit and withdrawal methods, including credit cards, bank transfers, and PayPal.

Regulated by the Polish Financial Supervision Authority (KNF), TMS Brokers ensures client fund security through segregated accounts and participation in the Polish Compensation Scheme, which covers client funds up to €22,000. The broker also offers negative balance protection, preventing traders from losing more than their account balance.

For those interested in education, TMS Brokers offers various resources, including eBooks, webinars, and an economic calendar to assist traders of all levels in enhancing their skills and market knowledge. The broker’s mobile app, available on both iOS and Android, allows traders to access markets, analyze trends, and execute trades on the go.

Safety and Security of TMS Brokers

TMS Brokers is registered in Warsaw and its activities are supervised by The Polish Financial Supervision Authority (KNF), ensuring that it operates within strict regulatory standards. This supervision by a reputable authority helps to enhance the broker’s credibility and trustworthiness, providing traders with an additional layer of security.

Pros and Cons of TMS Brokers

Pros

- No trading fees

- Spreads from 0 pips

- MetaTrader 5 (MT5) platform

- Proprietary mobile app

- Free demo account

- Multiple deposit methods

- Regulated by KNF

- Negative balance protection

Cons

- Limited account types

- Customer support hours

- No Islamic accounts

- Lack of transparency on costs

- No bonuses or promotions

Sign-Up Bonus of TMS Brokers

As of now, TMS Brokers does not offer a sign-up bonus to new clients. This absence of promotional incentives is in line with many regulated brokers who prioritize transparent trading conditions over marketing gimmicks.

Minimum Deposit of TMS Brokers

TMS Brokers offers a highly accessible entry point with a minimum deposit amount starting from $0. This flexible deposit policy makes it easier for new traders to start trading without a significant initial investment, appealing to both beginners and those cautious about committing large sums upfront.

TMS Brokers Account Types

Demo Account

- Identical to the Standard account

- Traders work with virtual €50,000

- Allows practice without financial risk

Standard Account

- No minimum deposit requirements

- Floating spread from 0 pips

- No trading fees

- Maximum leverage is 1:20

- No restrictions on trading strategies and methods

Pro Account

- Requires compliance with trading volume and activity requirements

- Maximum leverage is 1:200

- Additional conditions differ from the Standard account

TMS Brokers Customer Reviews

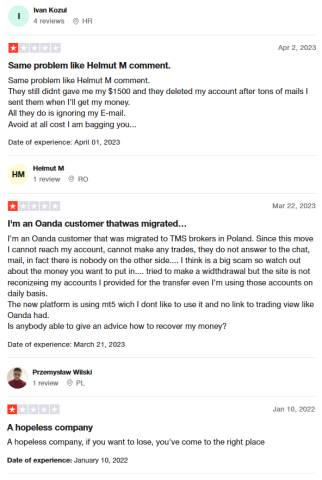

TMS Brokers has received several negative customer reviews that highlight issues with their service. Customers have reported problems such as unreturned funds, account deletions, and lack of communication from customer support. Users migrated from OANDA to TMS Brokers in Poland have faced difficulties accessing their accounts and making withdrawals, leading to suspicions of fraudulent activity. Additionally, some customers have expressed dissatisfaction with the MT5 platform and the lack of integration with TradingView. These complaints suggest that potential traders should approach TMS Brokers with caution.

TMS Brokers Fees, Spreads, and Commissions

TMS Brokers offers highly competitive trading conditions with floating spreads starting from 0 pips. This low-spread structure makes trading costs minimal for users. Additionally, TMS Brokers charges no trading fees, ensuring that traders’ overall expenses are kept objectively low. This fee structure is especially beneficial for those engaging in high-frequency trading or large-volume trades.

Furthermore, TMS Brokers does not impose any fees for deposits, although there might be costs associated with currency conversion if deposits are made in non-Euro currencies. Withdrawal fees are generally not charged, but a €20 fee applies to withdrawals below €100.

This cost-effective fee model, combined with no commissions on most trades, makes TMS Brokers an attractive option for traders looking to minimize their trading costs while enjoying a broad range of trading instruments.

Deposit and Withdrawal

TMS Brokers provides a straightforward process for deposits and withdrawals, allowing traders to manage their funds efficiently. When trading on a live account, traders execute real trades and can earn actual profits, unlike a demo account where transactions are conducted with virtual money.

Withdrawals can be made at any time by submitting a request through the user account on the broker’s website. Traders can withdraw their funds in full or partially, with all broker’s fees clearly stated in advance, ensuring transparency.

Currently, withdrawals are available to bank accounts, Visa, Mastercard, and through Trustly, providing multiple options for accessing funds. It is important to note that third-party institutions involved in the transaction may charge their own fees, over which the broker has no control.

This information was thoroughly tested and confirmed by a trading professional at Dumb Little Man, ensuring its accuracy and reliability for potential and current traders

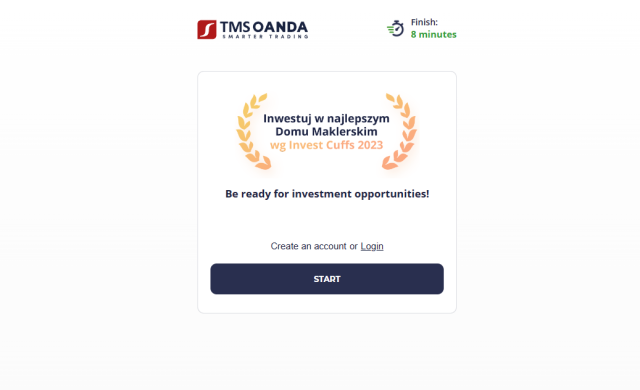

How to Open a TMS Brokers Account

- Visit the TMS Brokers website and click the “DEMO” button.

- Fill in your name, email, and phone number, agree to the terms of service, and click the “OPEN DEMO ACCOUNT” button.

- Check your email for a message with a confirmation link and follow the instructions to activate your demo account.

- To open a live account, click the appropriate button on the main page and provide detailed personal information, including your registration address.

- Follow the on-screen instructions to upload photos of your ID documents for identity verification.

- Once your identity is verified, log into your account and proceed to make a deposit.

- Go to the corresponding section in your user account to fund your account using your preferred payment method.

- Download the OANDA TMS Brokers or MetaTrader 5 platform from the broker’s website.

- Install the platform on your device, enter your registration details, and start trading.

TMS Brokers Affiliate Program

TMS Brokers offers an affiliate program that allows individuals to earn money by inviting new users to the platform. Each client of the broker receives a unique referral link which they can share across the internet. When a new trader visits the broker’s website using this link and starts trading, the affiliate earns a fixed bonus for each referee.

Legal entities can also benefit from the affiliate program. They receive ready-made marketing and trading mechanisms that can be seamlessly integrated into their existing businesses. Additionally, these companies enjoy specific advantages for their personal accounts, making the affiliate program an attractive option for businesses looking to expand their offerings and increase revenue streams.

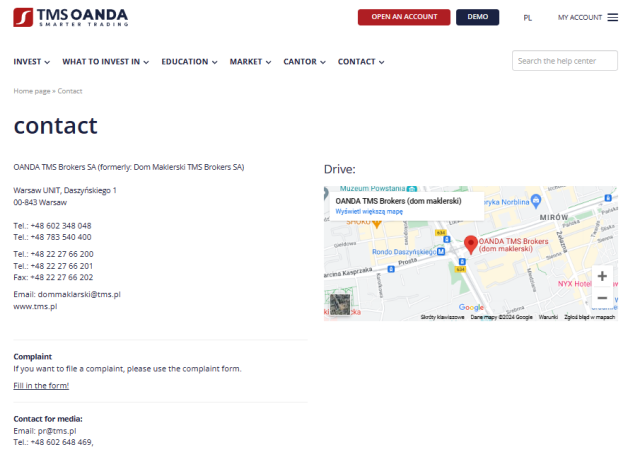

TMS Brokers Customer Support

TMS Brokers provides multiple communication methods to ensure effective customer support. Clients can reach out via telephone or email for direct assistance with their trading needs. This offers a straightforward way for traders to get in touch with the broker’s support team quickly.

Additionally, TMS Brokers maintains active profiles on Facebook, X (formerly Twitter), and LinkedIn. These social media platforms allow users to contact the broker’s technical support team and stay updated on the latest news and announcements. This multi-channel approach enhances accessibility and convenience for clients.

A live chat feature is also available on the bottom right corner of the broker’s website and within the user account portal. This feature enables users to get instant responses to their queries, improving the overall customer support experience. This information was gathered from Dumb Little Man’s thorough evaluation of TMS Brokers’ customer service options.

Advantages and Disadvantages of TMS Brokers Customer Support

| Advantages | Disadvantages |

|---|---|

TMS Brokers vs Other Brokers

#1. TMS Brokers vs AvaTrade

AvaTrade is superior to TMS Brokers due to its global regulation, diverse trading platforms (including MT4, MT5, and AvaTradeGO), and extensive customer support network. While TMS Brokers offers lower trading costs with no minimum deposit, AvaTrade’s broad regulatory compliance and advanced platform options make it a more robust choice for traders.

Verdict: AvaTrade is the better option due to its global regulation, diverse trading platforms, and extensive customer support. TMS Brokers offers lower costs but lacks the regulatory diversity and platform variety of AvaTrade.

#2. TMS Brokers vs RoboForex

RoboForex outshines TMS Brokers with its wide range of trading platforms (MT4, MT5, cTrader, RTrader), lower minimum deposit of $10, and 24/7 customer support. Despite TMS Brokers’ advantage of no trading fees and lower spreads, RoboForex provides better flexibility and accessibility for various trading styles and volumes.

Verdict: RoboForex is the better option due to its wider range of trading platforms, lower minimum deposit, and 24/7 customer support. TMS Brokers has lower trading costs, but RoboForex’s platform diversity and support availability are superior.

#3. TMS Brokers vs FXChoice

FXChoice is preferable over TMS Brokers due to its established regulation by the IFSC of Belize, robust trading platforms (MT4, MT5), and customer loyalty programs. Although TMS Brokers offers lower trading costs with no minimum deposit, FXChoice’s comprehensive regulatory framework and supportive trading conditions offer greater value and reliability.

Verdict: AvaTrade is the better option due to its global regulation, diverse trading platforms, and extensive customer support. TMS Brokers offers lower costs but lacks the regulatory diversity and platform variety of AvaTrade.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you are passionate about building a successful career in forex trading and aim to achieve significant financial returns, Asia Forex Mentor is the ideal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned for his influence in trading institutions and banks, leads Asia Forex Mentor. Personally, Ezekiel consistently executes seven-figure trades, a notable distinction setting him apart from other educators in the field. Here are the compelling reasons for our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers a well-rounded educational program covering stock, crypto, and forex trading. This curriculum equips aspiring traders with the essential knowledge and skills to excel in diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is reinforced by its impressive history of producing consistently profitable traders across various market sectors. This success highlights the effectiveness of their training methodologies and mentorship.

Expert Mentor: At Asia Forex Mentor, students gain insights from an experienced mentor who has achieved remarkable success in stock, crypto, and forex trading. Ezekiel Chew provides personalized support, helping students navigate market complexities with confidence.

Supportive Community: Joining Asia Forex Mentor grants access to a community of like-minded traders striving for success in the stock, crypto, and forex markets. This community encourages collaboration, idea-sharing, and peer learning, enhancing the overall educational experience.

Emphasis on Discipline and Psychology: Trading success requires a strong mindset and disciplined approach. Asia Forex Mentor offers psychological training to help traders manage emotions, handle stress, and make rational trading decisions.

Constant Updates and Resources: The dynamic nature of financial markets means traders must stay informed. Asia Forex Mentor ensures students are updated with the latest trends, strategies, and market insights, providing continuous access to valuable resources.

Success Stories: Asia Forex Mentor celebrates numerous success stories where students have transformed their trading careers and achieved financial independence through comprehensive forex, stock, and crypto trading education.

Asia Forex Mentor stands out as the premier choice for those seeking the best forex, stock, and crypto trading course to build a rewarding career and achieve financial prosperity. With its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor offers the tools and guidance necessary to turn aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: StarTrader Review 2024 with Rankings By Dumb Little Man

Conclusion: TMS Brokers Review

The team of trading experts at Dumb Little Man concludes that TMS Brokers offers a robust trading experience with several key advantages. The broker provides competitive spreads starting from 0 pips and no trading fees, which can significantly reduce trading costs for clients. Additionally, the availability of both MetaTrader 5 (MT5) and a proprietary platform caters to diverse trading preferences. The lack of a minimum deposit requirement further enhances its accessibility for new traders.

However, potential traders should be aware of some drawbacks. Customer support is not available on weekends, which may be inconvenient for those needing assistance outside of regular business hours. Additionally, there have been reports of issues with account access and fund withdrawals, which could pose significant concerns for users. The lack of transparency regarding certain costs and the limited variety of account types are other areas that may need improvement.

TMS Brokers Review FAQs

What trading platforms does TMS Brokers offer?

TMS Brokers provides traders with access to the MetaTrader 5 (MT5) platform and their proprietary OANDA TMS Brokers platform. MT5 is popular for its advanced trading tools, multiple charting options, and user-friendly interface. The proprietary platform also offers robust features, including customizable dashboards and real-time market data.

Are there any fees for depositing or withdrawing funds with TMS Brokers?

TMS Brokers does not charge any fees for deposits, but there may be costs associated with currency conversion if deposits are made in non-Euro currencies. Withdrawal fees are generally not imposed by TMS Brokers, but a €20 fee applies to withdrawals below €100. It is important to note that third-party institutions involved in the transaction may charge their own fees, which are beyond the broker’s control.

What types of accounts are available at TMS Brokers?

TMS Brokers offers three main types of accounts: Demo, Standard, and Pro. The Demo Account allows traders to practice with virtual €50,000. The Standard Account has no minimum deposit requirements, spreads starting from 0 pips, and no trading fees, with a maximum leverage of 1:20. The Pro Account requires compliance with trading volume and activity requirements, offers a maximum leverage of 1:200, and has additional conditions compared to the Standard Account.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.