The economic calendar is relatively light this week, with only a few notable dates ahead. The week is mostly quiet until Thursday when Eurozone PMI data is released, and it remains subdued until key economic indicators such as U.S. PCE and Eurozone inflation figures emerge at the month's end.

Federal Reserve officials have consistently expressed a cautious stance on lowering interest rates, advocating the necessity to maintain higher rates to steer inflation towards the 2% goal.

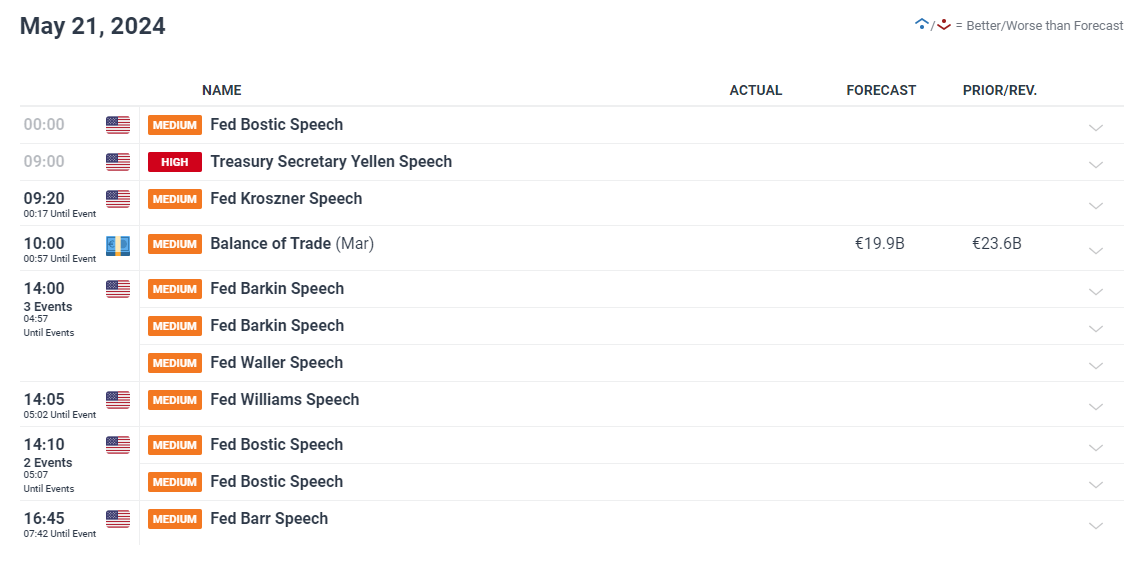

This afternoon, remarks are anticipated from Fed Governor Christopher Waller and New York Fed President John Williams. Notably, Williams had suggested in April that an interest rate increase might be necessary if inflation failed to decline. However, since a lower-than-expected CPI reading in April, the narrative has shifted from the timing of a potential rate hike to discussions on when it might be appropriate to reduce rates later in the year.

EUR/USD: A Quiet Search for Direction

Currently, EUR/USD is showing a slight downward trend after rejecting higher levels at channel resistance. The quieter market conditions this week might allow the dollar to recapture some strength, as forex markets generally favor higher-yielding currencies when volatility is low.

Although nearing overbought territory recently, the pair pulled back before crossing into that range. A similar pattern occurred in March, leading to a prolonged downtrend. Key levels to watch include the top of the ascending channel for resistance and, for support, the channel's lower boundary, the psychological 1.0800 mark, and the 200-day simple moving average.

A significant market mover for EUR/USD could appear later next week with the release of U.S. PCE data and inflation figures from Germany and the Eurozone.