Traddoo Review with Rankings 2024 By Dumb Little Man

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The expert team at Dumb Little Man, comprising retail traders, financial advisors, and experienced trading professionals, is celebrated for its thorough reviews of proprietary trading firms. They employ a distinctive algorithm and a detailed evaluation method to comprehensively assess each broker. This assessment is based on vital metrics like:

In their analysis of Traddoo, the Dumb Little Man review highlights the firm's strong performance. Traddoo not only meets these critical benchmarks but also demonstrates extensive broker knowledge and addresses a broad range of trader requirements. Consequently, Traddoo is recognized as a significant player in the proprietary trading firm landscape. |

Traddoo Review

Proprietary trading firms play a significant role in the financial markets, offering traders the tools and capital to trade with. These firms, often referred to as ‘prop firms,’ allow individuals to trade the firm’s capital, sharing profits while mitigating individual financial risks. Traddoo stands out in the field of prop trading firms, known for its global reach and exceptional earning potential. Serving over 180 countries internationally, Traddoo offers traders the opportunity to earn up to $400,000 in trading, marking it as a prominent player in the prop trading world.

This article will delve into a comprehensive Traddoo review, crafted with insights from trading experts at Dumb Little Man and augmented with customer reviews. It aims to present a balanced view, highlighting both the advantages and disadvantages of partnering with Traddoo. From bonuses and security features to overall trading experience, this review will equip traders and investors with crucial information. This detailed analysis will also uncover potential drawbacks, empowering readers to make an informed decision about whether Traddoo is the right prop trading firm for their financial aspirations.

What is Traddoo?

Traddoo, a U.S.-registered proprietary trading firm, adheres to the local legal frameworks, ensuring a secure trading environment. This prop trader stands out by offering two distinct account types tailored to traders’ needs: the 1-phase challenge and the 2-phase challenge. These accounts are accessible with a minimum deposit of $99, making it a feasible option for many traders.

Claiming as the most innovative prop firm, the firm operates on a profit split model, which varies between 80/20 and 75/25, depending on the account type and balance. Traders at Traddoo have the flexibility to use popular trading platforms like MetaTrader 4 and MetaTrader 5, widely recognized for their robustness and user-friendly interface. The firm’s portfolio includes over 100 assets, encompassing a diverse range of options such as currencies, cryptocurrencies, stocks, indices, metals, and CFDs.

Leverage options in Traddoo are tailored to the selected financial instrument, with a maximum of 1:30. The firm is progressive in its trading policies, allowing practices like trading news, scalping, hedging, and the use of expert advisors. However, traders should note that weekend trading is not available. In a strategic partnership with Eightcap, Traddoo provides its traders with a raw spread trading account, linking directly to the interbank market. This model is advantageous as it excludes trading fees, with traders only responsible for the spreads and broker’s fees.

Traddoo Pros and Cons

Pros

- Accessible entry, user-friendly platform, choice of two accounts

- Favorable profit sharing, no extra fees

- Flexible trading with no limits on days or strategies

- Diverse financial instruments, reasonable leverage

- Multiple withdrawal options

- Option to remove trading restrictions for a fee

- 24/7 technical support

Cons

- Unavailable in OFAC blacklisted countries

- Support limited to email, live chat, Discord; no phone support

- Lacks structured educational resources; only blog articles available

Safety and Security of Traddoo

The safety and security of Traddoo, a topic of paramount importance to traders, has been extensively researched by Dumb Little Man. Unlike traditional financial institutions, proprietary trading firms like Traddoo are not directly involved in bringing client trades to the interbank market. This critical function is performed by partner brokers, which necessitates a distinct set of regulatory requirements.

For Traddoo, its official U.S. registration serves as a fundamental layer of legitimacy. However, the more significant aspect of security comes from its broker, Eightcap, which is regulated by the Bahamas Securities Commission. Such regulatory oversight ensures that the broker operates with transparency and fulfills its obligations, providing a secure trading environment for Traddoo’s clients.

While Traddoo’s affiliation with a regulated broker like Eightcap offers a layer of security, it’s important to note that non-residents of the Bahamas do not have the same recourse to the regional financial authorities. Nevertheless, the involvement of a regulated broker adds a significant level of reassurance and safety for traders using Traddoo’s platform.

Traddoo Bonuses and Contests

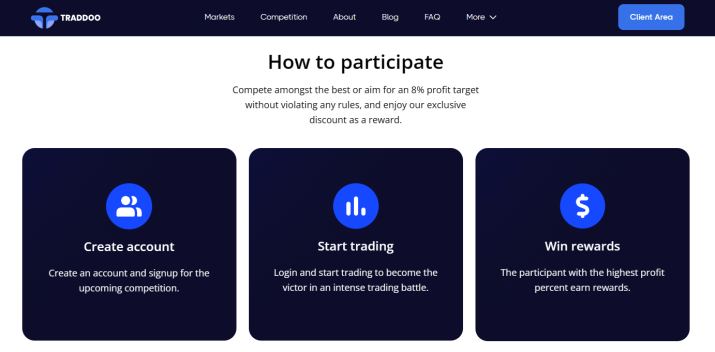

Traddoo offers exciting bonuses and contests for Traddoo clients seeking to test their skills and earn rewards. Participating in these contests is a straightforward process, providing traders an opportunity to compete and achieve specific targets.

To participate, traders must create an account on Traddoo and sign up for the upcoming competition. Once registered, they can start trading, competing against others in what is described as an intense trading battle. The objective is clear: aim for an 8% profit target without breaking any rules, which not only challenges traders’ skills but also offers the potential for an exclusive discount as a reward.

The rewards for successful traders are significant. The top performer, securing first place, will be entitled to a $200k Traddoo two-phase evaluation. This is followed by substantial evaluations for the second to fourth places, with rewards of $100k, $50k, and $25k respectively in Traddoo’s two-phase evaluation. Furthermore, traders who rank from fifth to tenth are not left behind; each will be subject to a $10k Traddoo two-phase evaluation. These incentives add a competitive edge to trading on Traddoo, encouraging traders to excel and reap the benefits of their trading acumen.

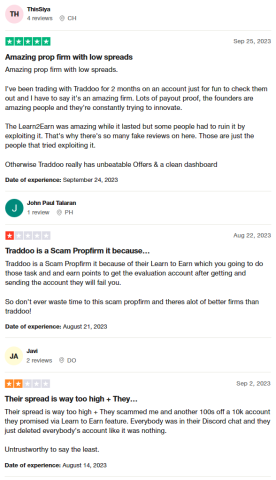

Traddoo Customer Reviews

Traddoo‘s customer feedback on Trustpilot presents a mixed picture, reflected in its 3.3-star rating, which is considered poor. Some customers praise Traddoo as an amazing prop firm with low spreads, highlighting the firm’s innovative approach and the quality of its dashboard. They commend the founders and mention the firm’s efforts in creating unique opportunities like the Learn2Earn program, despite its eventual issues due to exploitation by some users.

On the other hand, there are significant negative reviews raised by other customers, labeling Traddoo as a scam, particularly in relation to the Learn to Earn feature. Complaints include allegations of high spreads and unfulfilled promises, like failing participants in the program after they have completed tasks for evaluation accounts. There are also claims of untrustworthy behavior, with accounts being deleted unexpectedly. This polarity in reviews suggests that while some find value in Traddoo’s offerings, others have had decidedly negative experiences, contributing to its overall mediocre rating on Trustpilot.

Traddoo Commissions and Fees

The fee structure at Traddoo is reflective of common practices in proprietary trading firms. These firms, including Traddoo, generally impose initial fees and charges for additional services. Unlike traditional trading setups, prop firms like Traddoo do not incur trading fees, as they do not directly engage in bringing clients’ trades to the interbank market. This role is fulfilled by their partner brokers, such as Eightcap, who are responsible for spreads and fees.

An important aspect to note is that the spreads and trading fees at Traddoo can differ from those encountered when working directly with brokers. This variance is due to specific agreements prop traders like Traddoo have with brokers, often resulting in more favorable conditions for their clients.

Regarding specific account types, both the 1-phase challenge and the 2-phase challenge accounts at Traddoo feature a minimum spread of $1. Importantly, both these account types come with the advantage of no withdrawal commission, making them financially appealing options for traders who choose to engage with Traddoo. This fee policy is designed to provide a cost-effective trading environment for its partners, aligning with Traddoo’s overall approach to offering accessible trading conditions.

Traddoo Account Types

After thorough research and testing by the team of experts at Dumb Little Man, the following is a clear and organized summary of Traddoo‘s account types:

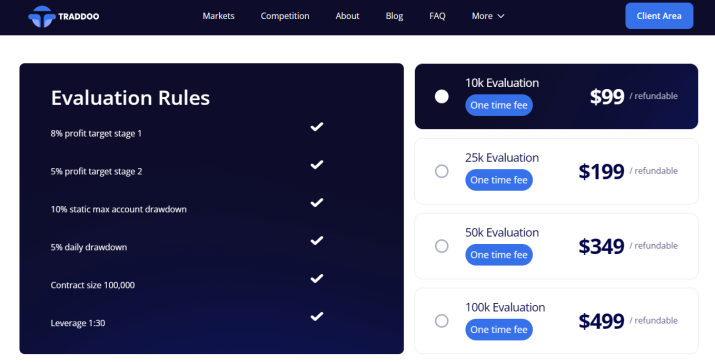

1-Phase Challenge

- Minimum Deposit: $99

- Balance Range: $10,000 to $400,000

- Profit Target: 10%

- Profit Split:

- 75% for balances of $10,000 and $25,000

- 80% for other amounts

2-Phase Challenge

- Minimum Deposit: $99

- Balance Range: $10,000 to $400,000

- Profit Target:

- 10% (Phase 1)

- 5% (Phase 2)

- Profit Split: 80% for all balance amounts

In both account types, traders have the flexibility to hold multiple accounts. However, it’s important to note that an initial fee is required for each account, and undergoing the challenge phase is mandatory for new accounts. This detailed account structure offers traders a range of options, accommodating different preferences and trading strategies.

Opening a Traddoo Account

- Visit Traddoo‘s website and click the “Get Funded” button.

- For 2-phase challenge accounts, stay on the page; for 1-phase accounts, click “Programs” and select 1-Phase Evaluation.

- Review the conditions of your chosen account, select a balance, and click “Get Started MT4” or “Get Started MT5”.

- Choose additional options if needed and click “Add to Cart”.

- In the cart, verify the account conditions, then click “Proceed to Checkout”.

- Enter personal and contact information, including name, country, address, phone, and email.

- Select a payment method such as bank card, crypto wallet, or online transfer, and enter payment details.

- Agree to the terms of service, then click “Place Order” and follow on-screen instructions for payment.

- Complete personal data verification by uploading identification documents, then start trading once verified.

Traddoo Customer Support

Customer support is a crucial aspect for any company, especially in the dynamic world of trading where traders often face issues needing prompt resolution. Traddoo recognizes this necessity and places significant emphasis on providing efficient and responsive support services. According to the experience of Dumb Little Man, Traddoo’s technical support team plays a vital role, particularly since requests for fund withdrawals are processed through them.

Traddoo’s commitment to 24/7 professional assistance ensures that traders can access support at any time, including weekends and nighttime. This around-the-clock availability is essential in maintaining trader confidence and satisfaction. If support fails to meet expectations, traders might seek other firms, underlining the importance of effective customer service in retaining partners. Communication with Traddoo’s support team can be conducted through various channels, including email, live chat, and Discord, offering multiple avenues for traders to seek assistance and guidance.

Advantages and Disadvantages of Traddoo Customer Support

| Advantages | Disadvantages |

|---|---|

|

Traddoo Withdrawal Options

After an in-depth review by a trading professional at Dumb Little Man, the withdrawal options offered by Traddoo are found to be straightforward and efficient. Traders who have registered, paid the initial fee, and successfully navigated the challenge can engage in real trading. Upon completing successful trades, clients earn income, with the profit split standing at 80/20, and 75% for 1-phase challenge accounts with balances ranging from $10,000 to $25,000.

Traddoo allows its traders to submit withdrawal requests once every 30 days. It’s important to note that more frequent withdrawals are not possible. This withdrawal frequency is designed to maintain a structured financial flow for both the trader and the firm. As for the withdrawal channels, Traddoo provides multiple options including Visa or MasterCard bank cards, Coinbase crypto wallet, PayPal, as well as Payoneer, Revolut, and Wise wallets.

To initiate a withdrawal, traders need to contact technical support via email. The processing time for these requests is typically a few days, ensuring traders can access their earnings without undue delay. This system reflects Traddoo’s commitment to providing a seamless and efficient withdrawal process for its traders.

Traddoo Challenge Difficulties

Psychological Pressure

The challenge’s tight deadlines can create significant psychological stress for traders. This stress tends to affect their decision-making skills, potentially leading to poorer trading outcomes. The need to meet the challenge’s criteria within a set time frame can be daunting, particularly for new traders.

Limited Trading Instruments

In some challenges, the range of available trading instruments is restricted. This limitation poses a challenge for traders who specialize in specific markets or assets not covered by Traddoo’s challenge. Such constraints can hinder a trader’s ability to fully leverage their expertise and strategies.

Consistency in Profitability

One of the key challenges is maintaining consistent profitability under the unique conditions of the challenge. The urgency to show profits within the allotted period can compel traders to make hasty decisions or stray from their tested trading strategies, impacting their performance negatively.

Adhering to Strict Risk Management Rules

Traders frequently find it challenging to comply with the rigorous risk management regulations imposed in these challenges. Rules like enforced stop-loss orders and limits on the maximum daily loss can be particularly challenging for those accustomed to a more flexible approach to risk management. This requirement demands a careful balance between aggressive trading tactics and conservative risk control.

How to Pass Traddoo’s Evaluation Process

Passing Traddoo‘s Evaluation Process demands strategic preparation, with a strong emphasis on enrolling in a comprehensive training program. This step is crucial for acquiring the necessary skills and knowledge to navigate the challenges effectively. Particularly for those aiming to succeed in Traddoo’s rigorous evaluation, the right training can make a significant difference in enhancing trading proficiency and strategy.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

When it comes to preparing for Traddoo’s evaluation, Asia Forex Mentor stands out as a highly recommended platform by trading experts at Dumb Little Man. This platform is renowned for its effectiveness in helping thousands of traders pass their respective prop firm’s evaluation programs. Founded by Ezekiel Chew, a recognized forex trading guru with over two decades of experience, Asia Forex Mentor is more than just a training program. It’s a culmination of Chew’s extensive trading experience, brought together in his One Core Program. This program is tailored to train forex traders in making substantial profits from forex trading.

Ezekiel’s journey in establishing Asia Forex Mentor began with requests for trading lessons from friends and soon expanded online. His success and expertise are the cornerstones of the program, which has since become a go-to resource for aspiring and experienced traders alike. The program’s online expansion has allowed it to reach a broader audience, providing valuable insights and strategies to those looking to excel in Traddoo’s evaluation and beyond.

How Could Asia Forex Mentor Help You Pass Traddoo’s Challenge?

Asia Forex Mentor (AFM) stands as a formidable resource for traders aiming to pass Traddoo’s Challenge, backed by several significant accolades that establish its credibility.

- Best Comprehensive Course Offering Award: AFM’s One Core Program received high praise from Investopedia, a leading authority in financial content. The program was lauded as the most comprehensive forex course, indicating its thoroughness and depth in covering forex trading.

- Best Forex Trading Course for Beginners: Benzinga, another reputable site in financial, business, and stocks information, named the One Core Program as the best forex trading course. This recognition highlights the program’s suitability for both beginner and advanced traders, underscoring its broad appeal and effectiveness.

- Best Forex Mentor: The BestOnlineForexBroker website awarded Asia Forex Mentor as the Best Forex Mentor in 2021. This accolade reflects the program’s ability to guide traders towards making significant gains in the forex market.

- Top Forex Trading Course: In a comprehensive review of top forex trading courses, Asia Forex Mentor emerged as a leader due to its effective trading strategies and excellent trading system.

These awards and recognitions are a testament to the quality and effectiveness of the AFM and its One Core Program. The program has consistently exceeded the expectations of its participants, including both advanced and new traders. This track record of success makes Asia Forex Mentor a strong ally for traders preparing to tackle Traddoo’s Challenge.

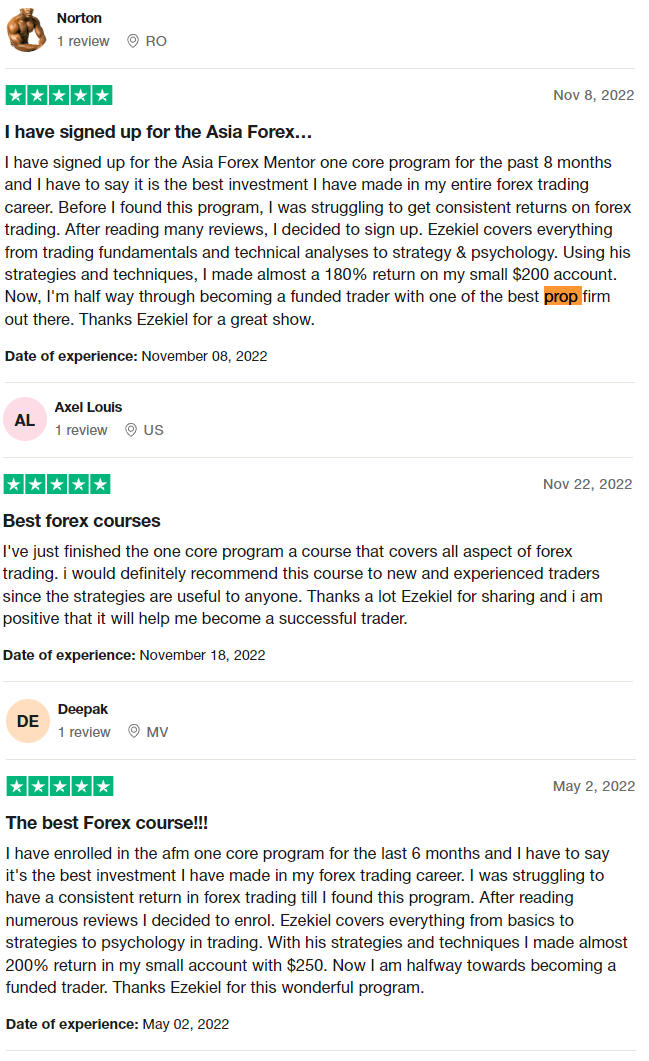

Asia Forex Mentor Members’ Testimonials

Members of the Asia Forex Mentor‘s One Core Program have shared glowing testimonials, emphasizing its transformative impact on their forex trading careers. These traders highlight how the program, led by Ezekiel Chew, has been the best investment they’ve made in their forex journey. Before joining, many were struggling to achieve consistent returns. The comprehensive coverage of topics, from trading fundamentals, technical analyses, to strategy and psychology, is frequently lauded.

Participants have experienced substantial returns, with examples of almost 180% to 200% profits on small accounts. This success has propelled many towards becoming funded traders with reputable prop firms. The testimonials underscore the effectiveness of Ezekiel’s strategies and techniques in helping traders not only improve their trading skills but also progress significantly towards their goal of becoming funded traders. The program is consistently recommended for both new and experienced traders, affirming its versatility and effectiveness in enhancing forex trading proficiency.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Traddoo Review

In conclusion, the team of trading experts at Dumb Little Man has found that Traddoo offers several notable advantages for traders. Its low entry barrier, multiple account options, and fair profit split make it an attractive choice for many. Additionally, the flexibility in trading styles, the availability of diverse financial instruments, and the option to waive certain restrictions add to its appeal.

However, it’s important to be aware of Traddoo’s limitations. The unavailability in OFAC blacklisted countries and the lack of a call center for customer support may be significant drawbacks for some traders. Moreover, the mixed customer reviews and the challenges in its evaluation process suggest that potential traders should proceed with caution and due diligence.

For those considering Traddoo, enrolling in top-notch courses like Asia Forex Mentor could significantly increase the likelihood of passing Traddoo’s evaluation. This training can provide valuable insights and strategies, enhancing one’s trading skills and readiness for the challenges posed by Traddoo.

>> Also Read: Liberty Market Investment Review By Dumb Little Man

Traddoo Review FAQs

Is Traddoo suitable for beginners?

Yes, with its user-friendly platform and varied account options, Traddoo is accessible for beginners.

Are there educational resources available through Traddoo?

Traddoo offers basic educational content, but for more comprehensive learning, external courses like Asia Forex Mentor are recommended.

How does Traddoo handle withdrawals?

Traddoo allows monthly withdrawal requests through various channels like bank cards and e-wallets, processed via email with technical support.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.